Does Medicare Cover Hearing Aids

En español | Original Medicare does not cover hearing aids.

It might cover a physician-ordered hearing test or treatment of a hearing-related medical condition, but Medicare will not pay for devices to improve hearing or exams to fit them. You are responsible for 100 percent of these costs.

The average price of a pair of digital hearing aids is about $1,500, according to the National Institutes of Health. High-end devices can be as much as $5,000.

The same holds true if you have a Medicare Supplement plan. These plans, also known as Medigap, generally have no hearing-aid coverage.

But if you have a Medicare Advantage plan from a private insurance company, it might cover some of the cost of hearing aids. Check with your plan provider.

If youre a veteran, you have another route to take in searching for help to pay for hearing aids: the Department of Veterans Affairs . If you qualify for VA health benefits, you may qualify for hearing testing and paid-in-full hearing aids.

Hearing Aid Foundations May Offer Assistance

Some major hearing aid companies, like Miracle-Ear and Starkey, have established foundations to provide hearing aids to people who need them but may not be able to afford them. You can visit the Miracle-Ear Foundation and Starkey Hearing Foundation websites to fill out an application and see if you qualify for assistance from them.

How To Get A Hearing Aid From Medicaid

A prescription from a competent medical physician is required if you want to receive your hearing aid and have it funded by Medicaid.

Examine your insurance card carefully and contact the number on the back for information on the finest audiologist in your area. They will also be able to give you a list of doctors that accept Medicare and answer any extra questions you may have.

You May Like: Can You Have Kaiser And Medicare

Additional Resources For Help With Hearing Aids

If you have Medicare and need help paying for a hearing aid, there are some programs that might be able to offer some assistance.

- Foundation for Sight and Sound provides hearing aids to individuals with limited financial resources. Visit their website for more information about the program.

- If youre a veteran, you may be eligible for financial help for your hearing aids through the U.S. Department of Veterans Affairs.

- Some local organizations such as the Lions Club International may also be able to help people with hearing problems. Reach out to your local branch to find out if you qualify for assistance.

- Medicaid may cover hearing aids in the following states:

- AK, CA, CT, D.C., FL, GA, HI, IN, KS, KY, ME, MD, MA, MT, NE, NH, NJ, NM, ND, OH, OR, RI, SD, TX, VT, WI, WY

Why Doesn’t Medicare Cover Hearing Aids

Original Medicare, and even many private insurance companies, elect not to cover hearing aids due to their cost. In Medicare’s case, federal law prevents Medicare from covering hearing aids. That could change in the future, though. Several pieces of legislation introduced in 20213, including the Medicare Hearing Aid Coverage Act of 2021, would expand Medicare to cover hearing aids if passed.

Don’t Miss: How Many Mastectomy Bras Are Covered By Medicare

How Much Are Hearing Aids

Hearing aids can range widely in cost depending on the type and the features involved, and, unfortunately, out-of-pocket costs can be high.

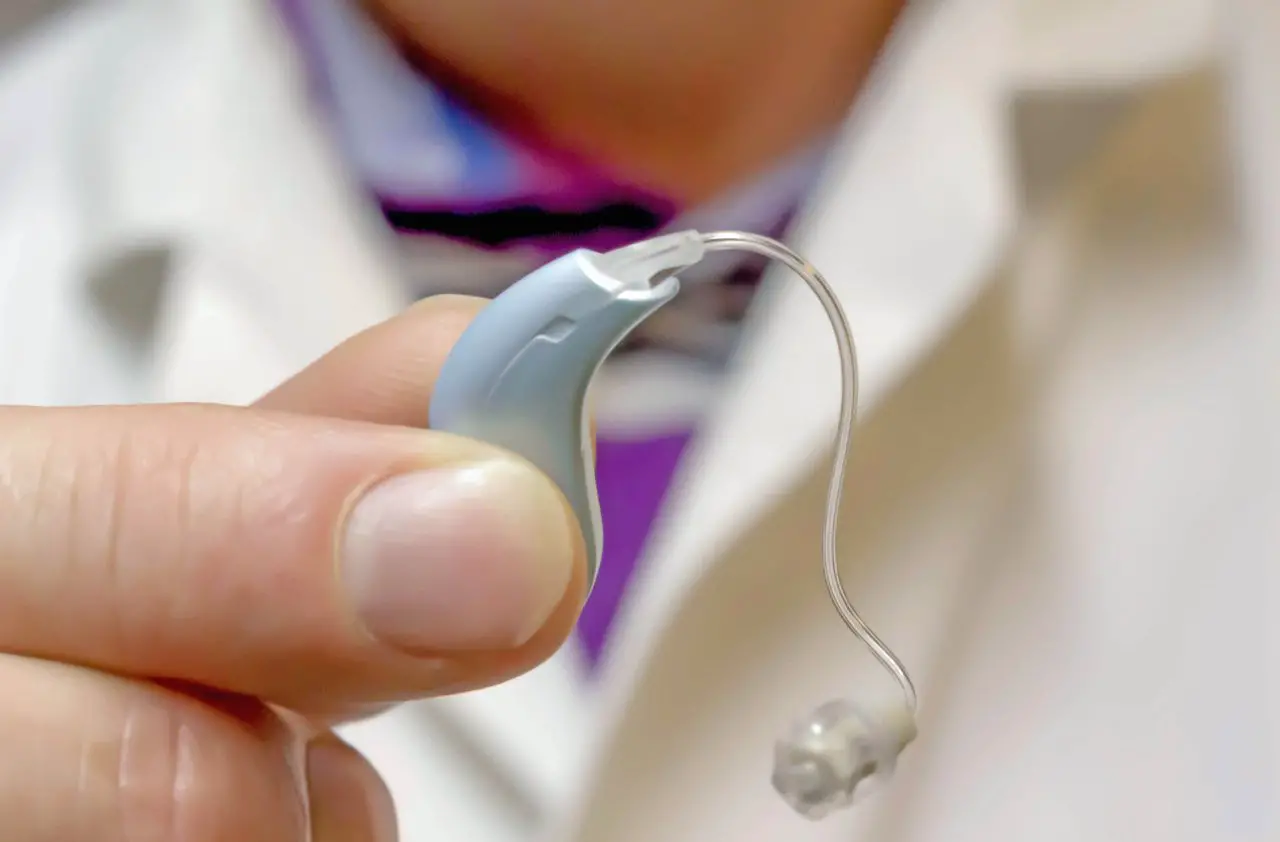

One hearing aid option is a behind-the-ear variety another is one that sits completely in the ear canal and is molded to fit the inside of your ear. Special hearing aid features, which can add to the cost, might include rechargeable batteries, wireless connectivity, wind noise reduction and even remote controls.

The price of just one hearing aid could be as much as $2,400, according to a 2015 report from the Presidents Council of Advisors on Science and Technology.9 Most people end up needing a hearing aid for each ear, which would bring your out-of-pocket cost to nearly $5,000.

What Social Benefits Are Likely To Come From Having Enhanced Access To Hearing Benefits That Result In Improved Hearing

Hearing loss is associated with social isolation and depression. Hearing is about your connection to other people. People may be surrounded by others, such as friends, family, but conversation is difficult to follow and even fatiguing, so they become isolated, even in the presence of others. Moreover, people with hearing loss may be reluctant to engage in activities where good hearing is requiredconcerts, theaters, movies, restaurants, physical activitiesso they may start withdrawing from social aspects of life, causing or exacerbating depression. Beyond social engagement, some people may still be working, and not being able to hear can affect how they do their jobs. Many people don’t realize how many areas of life are affected by the ability to hear.

Moreover, hearing loss doesn’t just affect the individual. It also affects the way people around him or her engage in communication. It’s a communication barrier that goes two ways. Breakdowns in conversation can cause frustration on both sides. I think the pandemic has isolated people further. Masking, for example, makes it harder to use visual clues and can muffle speech while some standard communications platforms, such as telephones and video conferencing, have their own barriers. For example, some video conference platforms have captioning but require the host to activate it. If you have a hearing loss, and you are social distancing, you might be more isolated than ever.

You May Like: Who Do You Call To Sign Up For Medicare

How Does Original Medicare Cover Hearing Aids

In short, Original Medicare doesnt cover hearing aids. Neither do most Medigap plans. You’ll likely have to pay out-of-pocket for hearing aids, fittings for the devices and routine hearing exams with this coverage.

While routine hearing exams aren’t covered, Original Medicare may cover more comprehensive exams when certain requirements are met. Medicare Part B provides 80% coverage for a diagnostic hearing and balance exam that your doctor or health care provider orders to see if you need medical treatment for example, to determine appropriate surgical treatment of a hearing deficit.

»MORE:What is Medicare, and what does it cover?

If you are eligible for coverage, youll be responsible for 20% of the Medicare-approved cost of the exam, plus your deductible if you havent already met it. Additionally, if your hearing exam is done at a hospital, your hospital copay also applies. If you have a Medigap plan, it might cover these coinsurance costs.

How Significant A Change Is This When It Comes To Hearing Has Traditional Medicare Covered Anything

Nothing on the hearing aid side has been covered since the inception of Medicare in 1965. In fact, anything related to hearing aids is a statutory exclusion under current Medicare. Hearing wasn’t really considered part of health careit was an afterthought. Also, at the time it made sense not to include hearing aids because the technology was nascent, and not terribly advanced. The older technology wasn’t really suited for all types of hearing loss. Today, however, modern hearing technology can address a wide range of hearing losses in individuals. Traditional Medicare covers a hearing test if it’s ordered by a physician as part of a medical evaluation, but it does not cover hearing aids. If this legislation passes, Medicare will finally catch up to the technology and the thinking about the health impacts of hearing loss, both on the individual and from a public health perspective. It is very much a big deal. Age-related hearing loss is a major issue for millions of Americans, and Medicare access to hearing aids and hearing care services would make a tremendous difference for them.

Don’t Miss: Do Medicare Advantage Plans Include Part B

How Does Medicare Part B Cover Hearing Aids And Hearing Care

Medicare Part B may cover care for a hearing related medical condition or diagnostic hearing tests to help a doctor assess a hearing problem.

You may feel that hearing aids are medically necessary, but Medicare Part B does not cover most people’s cost. However, Part B does cover cochlear implants and bone-anchoring hearing aids because Medicare classifies them as prosthetic devices rather than hearing aids.

These hearing systems are surgically implanted devices that work differently than standard hearing aids. A BAHA is anchored to a bone in the skull. Rather than simply amplifying sound, it sends vibrations directly to the inner ear and bypasses the middle and outer ear. In comparison, a surgically placed cochlear implant stimulates the auditory nerve through electrodes.

These devices can help people with middle ear or ear canal problems that prevent sound waves from reaching the inner ear. For people with this hearing loss problem, traditional hearing aids may not work as effectively.

What Is A Hearing Aid Discount Program

A hearing aid discount program buys hearing aids from manufacturers in bulk. They are usually discounted, but as the saying goes: you get what you pay for.

If you sign up for a discount program youâre sacrificing the gold standard and best practices of hearing healthcare. These programs dictate how many appointments you can have and what kind of appointment you can have.

They donât provide real-ear verification measures or booth testing in noise to check the performance of your hearing devices.

You donât have a lot of choices when it comes to manufacturers and you donât get to test drive different hearing aids. You also wonât be able to get unlimited follow-ups to fine-tune your hearing aid fitting which is a necessity for a lot of people.

Sometimes with these discounted hearing aid programs, you donât even get to choose the highest level of technology offered by a particular manufacturer – even if you want to pay extra.

Itâs incredibly important that you take all these factors into account if youâre considering switching to a Medicare Advantage plan, whether you need hearing aids now or in the future. The cost of the devices isn’t just about the device itself. It’s the experience and knowledge of the provider who is perfecting your hearing aid fitting just for you.

We want to help you make an informed decision and help ensure that you have the best care for your hearing. If you have questions, please give us a call at 646-2471.

Also Check: Does Plan N Cover Medicare Deductible

Finding A Medicare Advantage Plan That Covers Hearing Aids

Seniors who need coverage for hearing care, including testing and hearing aids, should begin by contacting their Medicare Advantage provider to determine whether its covered under their existing plan. If not, their insurer can generally suggest a more suitable plan that offers the coverage they need. However, seniors who want to switch plans may need to wait until the general enrollment period to make the change. That occurs every year from October 15 to December 7.

If a senior is already working with an audiologist or other hearing care provider, its a good idea to ask the provider which Medicare Advantage plans are accepted at that clinic. Medicare Advantage plans generally only cover care at in-network providers, so selecting a plan that is already accepted can help guarantee that theres no need to find a new health care provider.

Best Hearing Aids On The Market

Your doctor may recommend one hearing aid brand over another, and we recommend listening to your doctors opinion. However, we can tell you that some of the most highly-rated hearing aid brands are Resound, Phonak, Starkey, Widex, and Oticon.

If youre getting coverage for your hearing aid from a Medicare Advantage plan, be careful. Your plan may require that you select from specific Medicare hearing aids. You should also consider that some hearing aid companies will offer trial periods.

Don’t Miss: What Brand Of Diabetic Supplies Are Covered By Medicare

Medicare Hearing Aid Coverage Act Of 2017

In the past few years, legislation has been introduced in Congress to expand Medicare coverage to hearing aids. This includes the Medicare Hearing Aid Coverage Act of 2017 and the Seniors Have Eyes, Ears, and Teeth Act. The latter would also provide Medicare beneficiaries with coverage for vision and dental care.

In late 2019, a pair of lawmakers introduced the Medicare Hearing Act of 2019 in the House of Representatives. The bill would allow Medicare to cover hearing aids for people with severe to profound hearing loss.

Medicare would pay for one pair of hearing aids every five years, but it wouldnt pay for over-the-counter hearing aids. The hearing aids would also need to be deemed necessary by a qualified audiologist or physician.

Its difficult to say if and exactly when in the future beneficiaries will be able to take advantage of expanded benefits for hearing. The goal of the legislations listed above is to make costly elements of healthcare more affordable for seniors and disabled individuals. Well keep this page up-to-date with the latest information about the status of these legislations.

Early Intervention And Schools

Your child can get hearing services through early intervention, or EI, and schools. The Individuals with Disabilities Education Act, or IDEA, is the law that requires hearing services in schools. The Rehabilitation Act is another law that may help your child. Under this law, your child will have a Section 504 plan . These laws say that the school must give your child the hearing services she needs. These laws do not, however, make schools pay for hearing aids.

Recommended Reading: How Do I Know What Medicare Plan To Choose

Hearing Aid Coverage With Medicare In 2022

Regretfully, in 2022, Medicare still does not provide coverage for hearing aids and in most cases hearing exams so you can expect to pay for these expenses completely out-of-pocket. So if you are enrolled in Medicare Part A and Part B and you need help with hearing tests and hearing aid expenses, youll need to look for additional or alternative health insurance coverage.

Medicare typically doesnt cover hearing exams and hearing aids, but there are ways to access them. For example, if your doctor orders the hearing exam in conjunction with a medical condition like an ear infection, then Medicare Part B will cover the cost. But if you have Medicare and want to receive coverage for a hearing aid, youll need additional insurance.

Costs Of Hearing Aids

Hearing aids are expensive. Thankfully, there are now over-the-counter devices you can buy cheaply, if you have mild hearing loss. However, it is still recommended that you see an audiologist to determine if these will help long term.

Hearing aid costs can range from $1000 $4000. The costs can explain why many seniors are unable to afford hearing devices.

Don’t Miss: How Old Do You Have To Be For Medicare

Which Medicare Plans Should You Select If You Know You Need Hearing Aids

You should select a Medicare Advantage plan available in your area that includes extra benefits for hearing if you know you need hearing aids. If you dont have hearing aids yet, but you anticipate needing them based on your family history, you should consider MA plans with hearing aid benefits.

If you are already working with a professional for your hearing and hearing aids, its a good idea to check with your provider to see which MA plans include them in their network.

If you already have a MA plan with hearing aid benefits, consider making an appointment with their in-network audiologist to conduct a screening or exam to determine if you have hearing loss and whether or not it could be helped by hearing aids.

Search for plans here. You will input your zip code to begin the search for Medicare plans that are offered in your area.

- Select Medicare Advantage plans to find plans with hearing aid coverage.

- Take the time to compare plan benefits and providers.

- Contact the plan to discuss details

- Review the EOC document that is associated with each plan. You can find this by clicking on Plan Details, then scrolling to find the EOC. One more click, and you should be able to view the EOC. Refer to the table of contents to find the details about hearing benefits.

Medicare Advantage Plans Provide The Best Overall Hearing Benefits

Unlike Original Medicare, most Medicare Advantage plans cover hearing aids and exams.

- Hearing aids are covered by 88% of Medicare Advantage plans.

- Hearing exams are covered by 97% of Medicare Advantage plans.

Medicare Advantage plans, also known as Medicare Part C, are more like traditional insurance, and they combine multiple categories of coverage, including medical, hospital, prescription drugs and add-on benefits for hearing, dental and vision. As a result, they offer more robust support for hearing health.

Keep in mind that hearing benefits vary widely with Medicare Advantage plans, and partial coverage could still leave you with high out-of-pocket costs.

On average, Medicare Advantage enrollees still pay about 79% of the cost of a hearing aid. That means it would cost you about $1,817 for a $2,300 hearing aid.

Plans may also have coverage specifics about audiologist appointments. For example, 57% of Medicare Advantage enrollees need preauthorization for a routine hearing exam. Check your policy for details on benefits and restrictions.

Best Medicare Advantage plans for hearing aids

- Typical hearing aid cost: $375 to $2,075

- Options for virtual hearing care and devices shipped to your home

Also Check: Is Medicare My Primary Or Secondary Insurance

Proactive Steps To Get Help With Hearing Aid Costs

Patients do not have to be passive about their hearing needs. Information is available online and through healthcare providers, as well as hearing aid companies, that can guide you in finding help. Private insurance companies offer a spectrum of plans that cover varying benefits, many at affordable prices. For veterans, a good place to start would be the local VA Office. Regardless of which Medicare Plan you choose, the insurance policy will list the number of a representative to call 24 hours a day. This person will be able to check the specific plan and outline in detail what it will cover. There will also be advice as to what specialized policies can be added to help cover specific needs.