Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

How Is The Delivery System Organized And How Are Providers Paid

Physician education and workforce: Most medical schools are public. Median tuition fees in 2019 were $39,153 in public medical schools and $62,529 in private schools. Most students graduate with medical debt averaging $200,000 , an amount that includes pre-medical education.21 Several federal debt-reduction, loan-forgiveness, and scholarship programs are offered many target trainees for placement in underserved regions. Providers practicing in designated Health Professional Shortage Areas are eligible for a Medicare physician bonus payment.

Primary care: Roughly one-third of all professionally active doctors are primary care physicians, a category that encompasses specialists in family medicine, general practice, internal medicine, pediatrics, and, according to some, geriatrics. Approximately half of primary care doctors were in physician-owned practices in 2018 more commonly, these are general internists rather than family practitioners.22

Primary care physicians are paid through a combination of methods, including negotiated fees , capitation , and administratively set fees . The majority of primary care practice revenues come from fee-for-service payments.23 Since 2012, Medicare has been experimenting with alternative payment models for primary care and specialist providers.

Providers bill insurers by coding the services rendered. There are thousands of codes, making this process time-consuming providers typically hire coding and billing staff.

How Is Medicare Financed

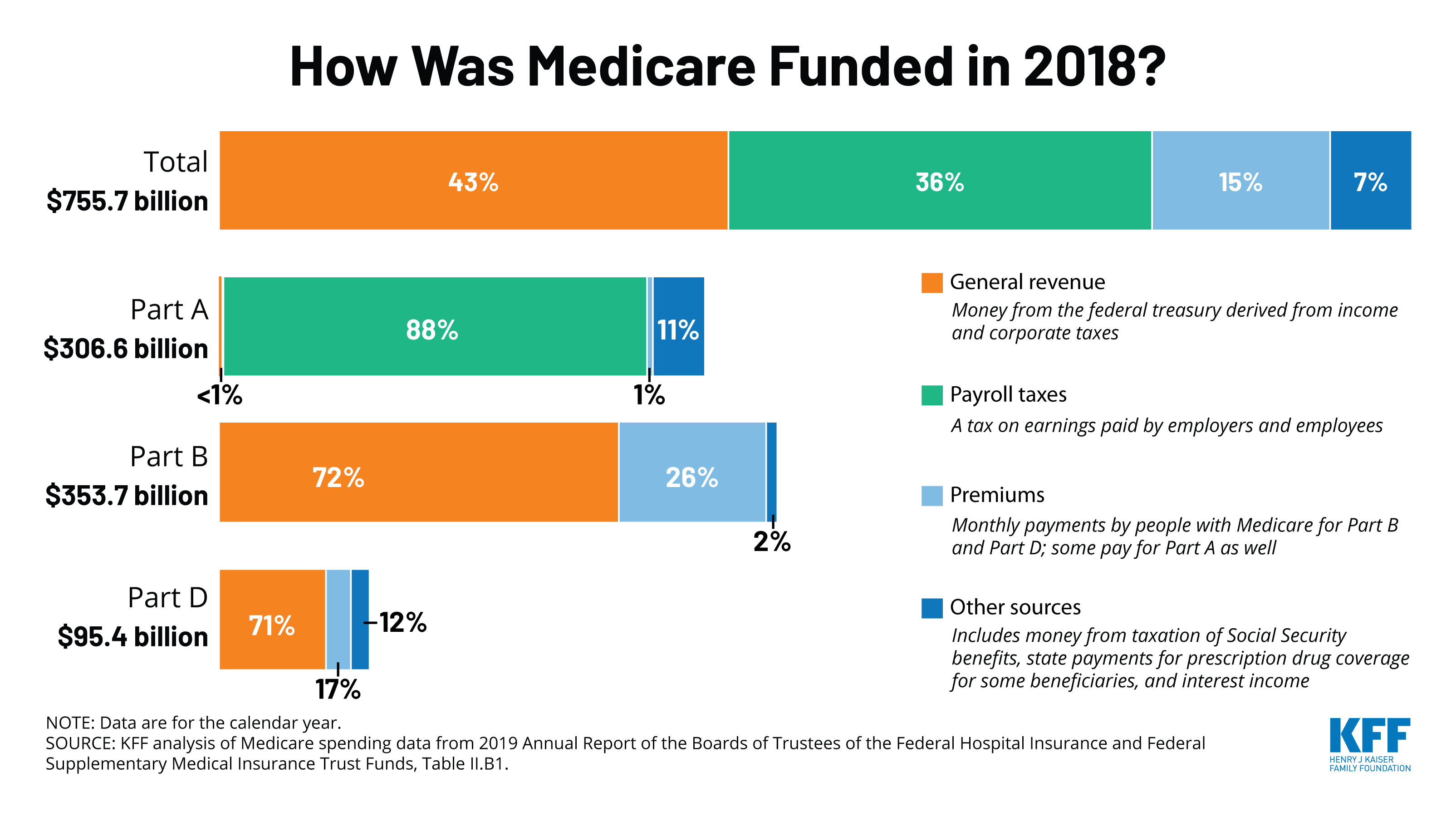

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

Read Also: How Much Does Medicare Cover For Home Health Care

Judge Blocks Portions Of Centers For Medicare And Medicaid Services Vaccine Mandate

On November 5, 2021, the federal Centers for Medicare and Medicare Services issued an emergency regulation requiring that many types of health care facilities and providers that receive Medicare or Medicaid funds ensure that their staff, contractors, and volunteers receive at least their first COVID-19 vaccine dose by December 6, 2021 and be fully vaccinated by January 4, 2022. The vaccination requirements apply to 15 categories of Medicare and Medicaid-certified provider and supplier types that are regulated under the Medicare/Medicaid health and safety standards known as Conditions of Participation , Conditions for Coverage , or Requirements, including hospitals, ambulatory surgery centers, community mental health centers, end-stage renal disease facilities, home health agencies, hospices, and rehabilitation agencies, among others. The Rule does not provide an alternative for periodic testing in lieu of vaccination, but does still require reasonable accommodation for religious, medical, and disability reasons.

The Biden administration is likely to pursue an appeal to the Supreme Court. While that process is underway, facilities subject to the Regulations are urged to confirm with counsel the status of the interim final rule in their jurisdiction and plan accordingly for the rapidly approaching first vaccination deadline.

How Medicare Is Funded

Medicare is funded by two trust funds that can only be used for the program. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits.

Medicare’s supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Medicare Part D benefits, and program administration expenses. The standard monthly premium set by the CMS for 2021 for Medicare Part B is $148.50, although that number increases for higher-income earners. Premiums for Medicare Part D, which covers prescription drugs, will average $33 per month in 2022, up from $31.47 in 2021.

Benefit payments made by Medicare cover the following services:

- Home healthcare

- Physician payments

- Hospital inpatient services

- Medicare Advantage Plans, also known as Part C Plans, which are offered by Medicare-approved private companies

- Other services

The CARES Act expands Medicare’s ability to cover treatment and services for those affected by COVID-19 including:

- Providing more flexibility for Medicare to cover telehealth services

Also Check: Is Xolair Covered By Medicare Part B

Disproportionate Share Hospital Payments

Medicaid is not exactly known for being generous when it comes to paying for health care. According to the American Hospital Association, hospitals are paid only 87 cents for every dollar spent by the hospital to treat people on Medicaid.

Hospitals that care for more people on Medicaid or for people that are uninsured, in the end, are reimbursed far less than facilities that operate in areas where there are more people covered by private insurance. Between 2000 and 2018, at least 85 rural hospitals closed their doors to inpatient care due to low reimbursement rates and other financial concerns.

To even out the playing field, Disproportionate Share Hospital payments came into effect. Additional federal funds are given to the states to divide amongst eligible hospitals that see a disproportionate number of people with little to no insurance. The idea was to decrease the financial burden to those facilities so that they could continue to provide care to individuals with low incomes.

Different formulas are used to calculate federal DSH funding for each state. These formulas take into account the prior year’s DSH allotment, inflation, and the number of inpatient hospitalizations for people on Medicaid or who are uninsured. DSH payments cannot exceed 12% of the state’s total Medicaid medical assistance expenditures for any given year.

Overview Of Medicare Spending

Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2017, 30 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services. In 2018, Medicare spending totaled $605 billion, accounting for 15 percent of the federal budget .

Figure 1: Medicare as a Share of the Federal Budget, 2018

Don’t Miss: Will Medicare Pay For Handicap Bathroom

Hospital Insurance Trust Fund

How is it funded?

- Payroll taxes paid by most employees, employers, and people who are self-employed

- Other sources, like these:

- Income taxes paid on Social Security benefits

- Interest earned on the trust fund investments

- Medicare Part A premiums from people who aren’t eligible for premium-free Part A

What does it pay for?

- Medicare Part A benefits , like inpatient hospital care,skilled nursing facility care,home health care, andhospicecare

- Medicare Program administration, like costs for paying benefits, collecting Medicare taxes, and fighting fraud and abuse

Can You Have Both

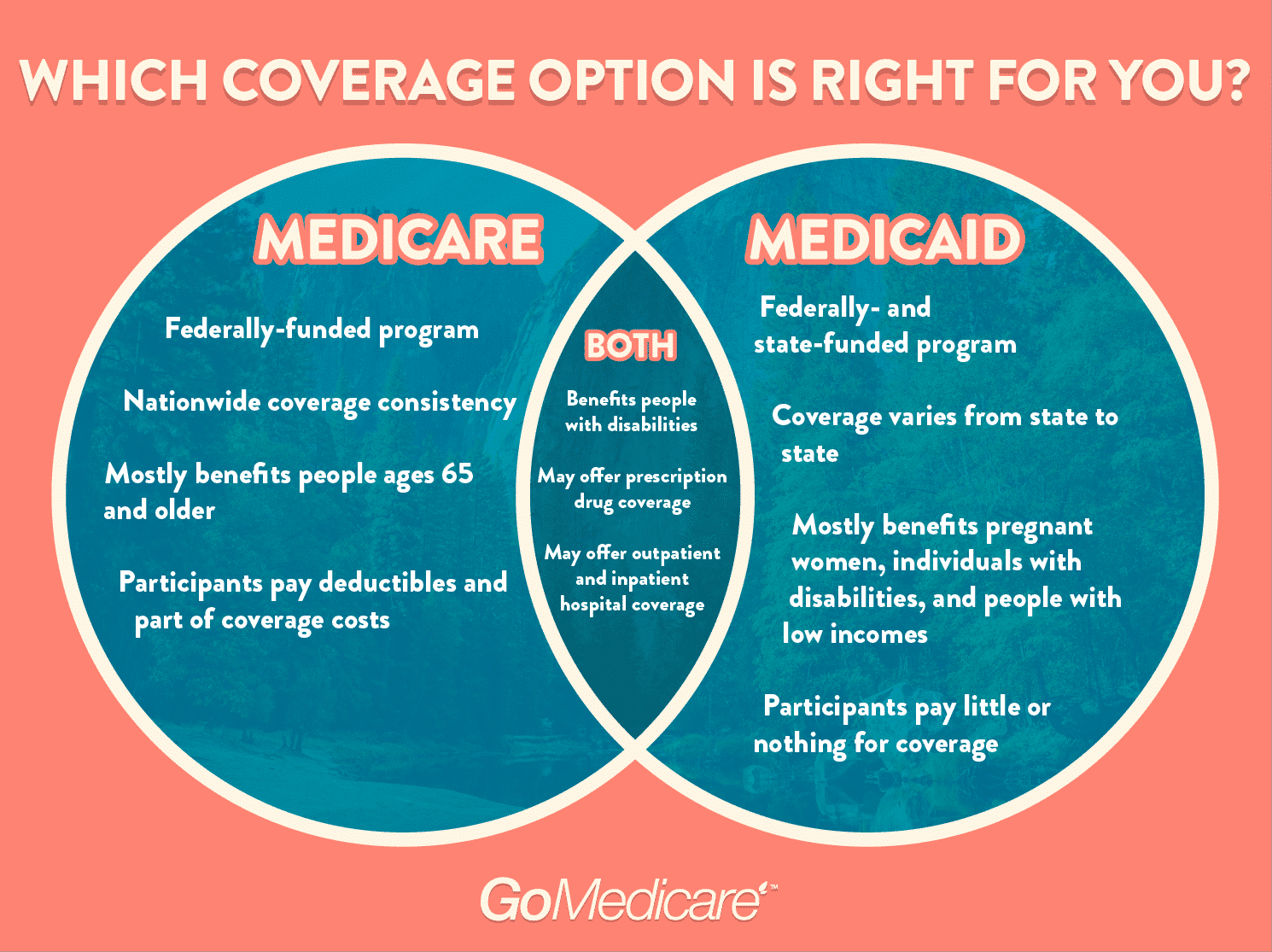

People who qualify for both Medicare and Medicaid are considered dual eligible. In this case, you may have original Medicare or a Medicare Advantage plan , and Medicare will cover your prescription drugs under Part D.

Medicaid may also cover other care and drugs that Medicare doesnt, so having both will probably cover most of your healthcare costs.

Also Check: Can You Sign Up For Medicare Part B Anytime

Medicare Part D Costs

The Part D premium varies depending on the plan you choose, which can be affected by your location and the company selling the plan. If youre late enrolling in your Part D plan, this premium may be higher.

The Part D deductible also differs depending on which plan you enroll in. The maximum deductible amount that any Part D plan can charge you is $435 in 2020.

The Part D copayment and coinsurance amounts depend entirely on the drugs you are taking within your drug plans formulary. All plans have a formulary, which is a grouping of all the medications the plan covers.

What Does Medicare Cover

Medicare comes in four different parts, each responsible for covering different health care costs:

-

Medicare Part A covers inpatient medical services and supplies. Think of it as hospital insurance.

-

Medicare Part B covers outpatient medical services and supplies. Think of it as doctor insurance.

-

Medicare Part C is a private alternative to Original Medicare. It must cover everything Medicare Part A and Medicare Part B covers, but most plans â known as Medicare Advantage plans â cover additional services, including vision, dental, hearing and prescription drug coverage.

-

Medicare Part D is prescription drug coverage beneficiaries purchase through federally approved private health care insurers.

Your specific coverage varies depending on what route you go. The big choice Medicare beneficiaries face is whether to opt for Original Medicare and purchase a Medicare Part D plan or to enroll in Original Medicare and purchase a Medicare Part C plan to serve as their primary coverage.

Our partner Via Benefits can help you compare and purchase Medicare plans in your area.

Don’t Miss: Can You Apply For Medicare After 65

Debt Crisis Creating Pressure For Medicaid Cuts

Puerto Ricos ability to sustain its Medicaid program is also affected by its ongoing fiscal crisis and bankruptcy proceedings. In 2016 Congress enacted the Puerto Rico Oversight, Management, and Economic Stability Act , which established the Financial Oversight and Management Board to oversee Puerto Ricos finances and restructuring of its debt. The FOMB and Puerto Ricos government develop five-year fiscal plans, which the FOMB then certifies, that serve as blueprints for annual budgets and long-term economic projections.

Over the past three years, the fiscal plans have assumed deep cuts in Medicaid. Most recently on March 15 of this year, the FOMB rejected the governors March 11 proposed plan because it didnt include what the FOMB regarded as sufficiently large cuts to meet fiscal goals. In a March 27 letter to the FOMB submitting a revised fiscal plan, the governor declined to include the full Medicaid cuts the board had outlined because they would require major reductions in coverage. The letter stated, Absent a dramatic reduction in the number of lives participating in the program total program expenditures cannot be reasonably expected to be lower than the revised expenditures indicated in the revised plan. The governors revised plan continues to assume additional federal funds beyond this year, which the FOMB does not include in its projections.

Medicares History: Key Takeaways

Discussion about a national health insurance system for Americans goes all the way back to the days of President Teddy Roosevelt, whose platform included health insurance when he ran for president in 1912. But the idea for a national health plan didnt gain steam until it was pushed by U.S. President Harry S Truman.

You May Like: Can I Get Medicare At Age 62

Medicaid Spending In California

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Medicaid spending in California |

California’sMedicaid program provides medical insurance to groups of low-income people and individuals with disabilities. Medicaid is a nationwide program jointly funded by the federal government and the states. Medicaid eligibility, benefits, and administration are managed by the states within federal guidelines. A program related to Medicaid is the Children’s Health Insurance Program , which covers low-income children above the poverty line and is sometimes operated in conjunction with a state’s Medicaid program. Medicaid is a separate program from Medicare, which provides health coverage for the elderly.

This page provides information about Medicaid in California, including eligibility limits, total spending and spending details, and CHIP. Each section provides a general overview before detailing the state-specific data.

HIGHLIGHTS

Medicare And Medicaid Coverage Explained

By Bethany K. Laurence, Attorney

Medicare and Medicaid are very different. Medicaid is a federal program for low-income, financially needy people, set up by the federal government and administered differently in each state.

Medicare was created to deal with the high medical costs that older citizens face relative to the rest of the population — especially troublesome given their reduced earning power. However, eligibility for Medicare is not tied to individual need. Rather, it is an entitlement program you are entitled to it because you or your spouse paid for it through Social Security taxes.

Although you may qualify for and receive coverage from both Medicare and Medicaid, you must meet separate eligibility requirements for each program being eligible for one program does not necessarily mean you are eligible for the other. If you qualify for both, Medicaid will pay for most Medicare Part A and B premiums, deductibles, and copayments.

The information below provides the basics of each program.

Don’t Miss: Should I Get Medicare Supplemental Insurance

More From The New Road To Retirement:

Here’s a look at more retirement news.

Basic Medicare consists of Part A and Part B . There also is Part D, which is prescription drug coverage. About 44% of beneficiaries choose to get those benefits through an Advantage Plan , an option offered by private insurance companies that may include limited coverage for dental, vision and hearing.

In simple terms, it’s the Part A trust fund that is facing a shortfall beginning in 2026, according to the latest trustees report. Unless Congress intervenes before then, the fund would only be able to pay roughly 91% of claims under Part A beginning that year.

That trust fund gets most of its revenue from dedicated taxes paid by employees and employers.

Generally, workers pay 1.45% via payroll tax withholdings . Employers also contribute 1.45% on behalf of each worker. Self-employed individuals essentially pay both the employer and employee share.

The expansion of benefits under Part B would have no direct impact on the solvency challenges facing the Part A hospital insurance trust fund.Tricia NeumanExecutive director for the Kaiser Family Foundation’s program on Medicare policy

“The expansion of benefits under Part B would have no direct impact on the solvency challenges facing the Part A hospital insurance trust fund,” said Tricia Neuman, executive director for the Kaiser Family Foundation’s program on Medicare policy.

What Does Medicaid Cover

Broadly, Medicaid covers major medical expenses, but specific services and prescription drug coverage varies by state. Each state, however, is required by the federal government to cover the following care in order to receive funding:

-

Inpatient and outpatient hospital services

-

Early and Periodic Screening, Diagnostic and Treatment Services

-

Nursing facility care

-

Certified pediatric and family Nurse practitioner care

-

Freestanding Birth Center services

-

Transportation to medical care

-

Tobacco cessation counseling for pregnant women

Optional covered services include prescription drug, physical therapy, occupational therapy and dental, vision or hearing insurance.

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

Basis Of Eligibility And Maintenance Assistance Status

Medicaid does not provide medical assistance for all poor persons. Under the broadest provisions of the Federal statute, Medicaid does not provide health care services even for very poor persons unless they are in one of the following designated groups. Low income is only one test for Medicaid eligibility for those within these groups their resources also are tested against threshold levels .

States generally have broad discretion in determining which groups their Medicaid programs will cover and the financial criteria for Medicaid eligibility. To be eligible for Federal funds, however, States are required to provide Medicaid coverage for certain individuals who receive federally assisted income-maintenance payments, as well as for related groups not receiving cash payments. In addition to their Medicaid programs, most States have additional State-only programs to provide medical assistance for specified poor persons who do not qualify for Medicaid. Federal funds are not provided for State-only programs. The following enumerates the mandatory Medicaid categorically needy eligibility groups for which Federal matching funds are provided:

To Meet Residents Needs Puerto Rico Medicaid Needs Significant Improvement

Maintaining the status quo is not sufficient. Puerto Rico needs to raise its very low provider payment rates that are inducing more health care professionals to leave for the mainland. It also needs to cover necessary health services and treatments that it fails to cover now, such as life-saving drugs to address Hepatitis C, and to address the effects of other changes that are causing some people to lose Medicaid eligibility despite having quite low incomes. To do so, it needs additional federal funding.

You May Like: Does Kelsey Seybold Accept Medicare