Kaiser Permanente Medicare Advantage 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Kaiser Permanente was the fifth-largest provider of Medicare Advantage plans in 2021

Its also the largest not-for-profit health maintenance organization in the U.S. Kaiser uses an integrated care model, which means that members can get all their care in one place and all the providers are connected.

Although Kaiser gets top marks, its plans are only available in eight states and Washington, D.C., and the company only offers HMO plans. Heres what you should know about Kaiser Permanente Medicare Advantage.

Where Can I Find Help With These Decisions

You will find plenty of information on the Medicare.gov website, including the Part D plan finder, where you can input the drugs you take and see which plan gives you the best and most economical coverage. The toll-free 1-800-MEDICARE number can also assist you.

Perhaps the best resources, however, are the federally funded State Health Insurance Assistance Programs, where trained volunteers can help consumers assess both Medicare and drug plans.

These programs are unbiased and dont have a pecuniary interest in your decision making, said David Lipschutz, the associate director of the Center for Medicare Advocacy. But their appointments tend to fill up quickly at this time of year, and the annual open enrollment period ends on Dec. 7. Dont delay.

- Give this articleGive this articleGive this article

What Is The Biggest Disadvantage Of Medicare Advantage

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Don’t Miss: Does Medicare Cover Life Alert Cost

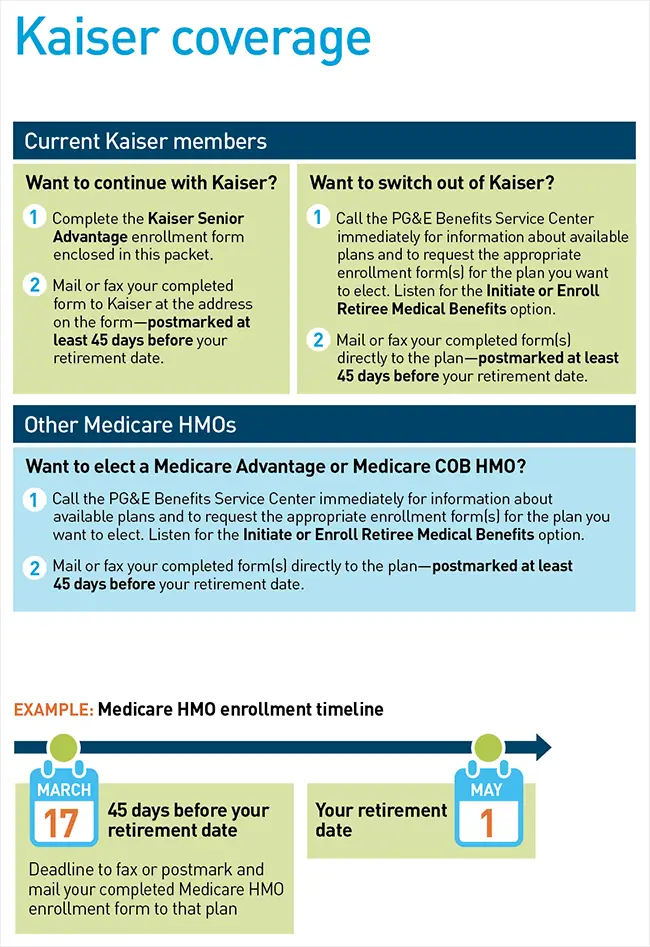

Pers Kaiser Permanente Senior Advantage

Get more. More control, convenience, and quality with a plan that goes beyond Original Medicare. With care under one roof, online health management tools, worldwide emergency coverage, and comprehensive care that builds in wellness programs and supportive services to promote your total health, Kaiser Permanentes Medicare Senior Advantage plan offers comprehensive care and coverage.

Is Kaiser A 5 Star Plan

Medicare Advantage Enrollment | Kaiser Permanente

Every year, Medicare evaluates plans based on a 5-star rating system. For 2021, Kaiser Permanente received the following Overall Star Rating from Medicare.

Does Kaiser Take Health Plan of San Joaquin? Thank you for choosing Kaiser Permanente as your health care provider through Health Plan of San Joaquin. Health Plan of San Joaquin works with the State of California to help you get the health care you need. Kaiser Permanente is your health care provider through Health Plan of San Joaquin.

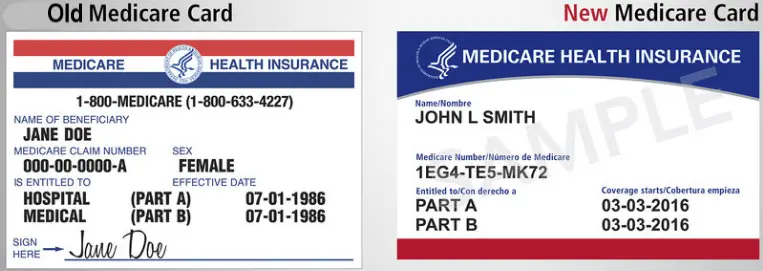

What are Medicare Advantage plans?

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage .

How many Medicare members does Kaiser have? Kaiser Permanente provides care to more than 1.7 million Medicare members in 8 states and the District of Columbia. Kaiser Permanente is proud to provide the highest quality health care and service, which is what our Medicare members expect and deserve, said Phil Madvig, MD, interim chief medical officer.

Also Check: How Do You Apply For Medicare Part B Online

Is Medicare Advantage Cheaper Than Medicare

The costs of providing benefits to enrollees in private Medicare Advantage plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

What Do Kaiser Medicare Advantage Plans Offer

Medicare Advantage plans help with savings by using networks of healthcare resources. By doing so, these plans cover many of the out-of-pocket expenses not covered by Original Medicare. Many Medicare Advantage plans also offer benefits that go far beyond what you get with Original Medicare, and Kaiser Permanente’s Medicare Advantage plans are one such example. Hereâs what these plans have to offer, according to Kaiser Permanenteâs official website.

Don’t Miss: Does Medicare Advantage Cover Part B

Things To Keep In Mind About Kaiser Medicare Advantage

- Some services limited to Kaiser facilities: Kaiser limits some of its Medicare Advantage services to treatments received at Kaiser Permanente medical facilities. For example, if you want to schedule appointments through the Kaiser app, the appointment will have to be at a Kaiser-affiliated clinic or hospital.

- Telehealth available at Kaiser’s discretion: Telehealth may not be available depending on your location or other factors. In fact, it is difficult to know exactly how often patients can access them. Kaiser states that telehealth care can be used when appropriate and available.1 This means that you may or may not be able to use telehealth regularly, even if you have a plan that offers it as a standard benefit.

- Mostly HMO plans: The majority of Medicare Advantage providers offer a wide range of plan types, including HMO, PPO, and PFFS. Kaiser offers only HMO plans . Patients will have to get care within their local network to have their treatment covered .

- Limited availability: While many Medicare Advantage providers boast widespread availability across the country, Kaiser Part C plans are only available in eight states and the District of Columbia.

Extra Perks And Benefits

Advantage Plus is one of the best ways to get extra benefits with your Kaiser Medicare Advantage plan. It provides varying degrees of dental, hearing, and vision coverage in one insurance plan. Kaiser offers a few other extra perks and benefits worth noting:

- OTC benefit: With some Kaiser plans, you can get common over-the-counter products like vitamins and cold medicine at no extra cost. You simply need to place an order through Kaiser’s online catalog of products. Kaiser offers a quarterly allowance on OTC products that varies by plan.

- Fitness benefit: The Kaiser Silver& Fit Healthy Aging and Exercise Program includes access to free or discounted services at local gyms and some types of home exercise equipment.

- Home meal delivery: Certain plans allow seniors to get meals delivered directly to their homes after a hospital visit involving serious medical conditions like heart failure. Though this applies in limited situations only, it is a great feature that is included at no extra cost.

Did You Know? Almost all Kaiser plans come with prescription drug coverage, which means that you won’t have to spend more on a stand-alone Part D plan.

Like most Medicare Advantage providers, Kaiser offers these benefits only with certain plans. You will need to review the plans available in your area to see which benefits they offer. You can either apply online through Kaiser’s website or reach out to a Kaiser agent by phone.

Recommended Reading: Does Medicare Cover Breast Prosthesis

Data Collection And Verification

Our data was collected from third-party rating agencies, official government websites and databases, and directly from companies via websites, media contacts, and existing partnerships. Our sources include: AM Best, the National Committee for Quality Assurance , J.D. Power, and the Centers for Medicare and Medicaid Services .

Data was verified to ensure data integrity and accuracy by cross-referencing the records and citation corresponding to each data point with our primary sources.

Kaiser Permanente Medicare Advantage Plan Options

Kaiser Permanente offers three levels of its Medicare Advantage HMO Plans Senior Advantage Core, Senior Advantage Silver, and Senior Advantage Gold. Since these are HMOs, you enjoy cost savings as compared to other more expensive plan types, such as PFFS and PPOs. However, you will need to choose a primary care physician, and youll have to stay in-network to receive coverage. Members of an HMO typically must get a referral from their PCP to visit a specialist.

All three of Kaisers HMO options have prescription drug coverage, no annual deductible, and free primary doctor and telehealth visits. Monthly premiums for the Silver and Gold plans are lower in 2022 compared to 2021.

Compare your 2022 Kaiser Permanente Medicare Advantage plan options:

| Plan name |

|---|

*Based on pricing in Denver, CO

Read Also: When Do You Start Medicare Coverage

Medical Benefits Under Kaiser Medicare Advantage Plans

Before we begin, itâs important to know that Kaiser Permanente is not available in all states. Even in the states where Kaiser operates, Medicare Advantage plans may not be available in your zip code, so investigate this upfront. Plan benefits may also vary by your location. Here are the states in which Kaiser offers Medicare Advantage plans:

- Washington D.C.

There are several different types of Medicare Advantage plans, and the model of care offered by Kaiser is a Health Maintenance Organization style plan. With HMO plans, you will typically need to choose a primary care provider withiin the organization. You will need authorizations from your primary care provider in order to see specialists or to get certain tests, according to the official U.S. government website for Medicare.

One of the benefits of Kaiserâs HMO-style Medicare Advantage plans is that they bring all the medical services you might need into one simple plan. With Original Medicare, there is separate coverage for hospital care , medical services , and drug coverage . With Kaiser Medicare Advantage, youâll get comprehensive healthcare coverage bundled into one unified plan.

Another benefit of Kaiser Medicare Advantage is the cost savings. An annual deductible is the amount of money you must pay out-of-pocket before insurance starts to pay your medical bills. With Kaiser Medicare Advantage plans, the annual deductible for outpatient services is zero for most plans.

So Many Sometimes Confusing Options

But part of what makes it so tricky to decide is that there are so many options. While 40 counties in the U.S. have no Medicare Advantage plans, nearly 2,200 counties have at least 21 plans from which to choose. And close to 1,000 counties have between 1 and 20 plans, Kaiser reports.

Among Medicare Advantage plans, at least 97% offer some extra benefits, like vision, fitness, hearing, dental or telehealth, that are beyond what traditional Medicare allowed, Kaiser Family Foundation reported often for no additional premium, with the trade-off of more restrictive provider networks and greater use of cost management tools, such as prior authorization.

Per The New York Times, Medicare Advantage may appear cheaper, because many plans charge low or no monthly premiums beyond the basic premium Medicare beneficiaries pay. Unlike traditional Medicare, Advantage plans also cap out-of-pocket expenses. Next year, youll pay no more than $8,300 in in-network expenses, excluding drugs or $12,450 with the kind of plan that permits you to also use out-of-network providers at higher costs. Not all plans allow that.

The big downside, the article says, is preauthorization for some services, providers and medicines. If the plan says no, you pay it yourself or skip it. According to the Office of the Inspector General, about 75% of appeals succeed, but most people dont appeal.

You May Like: Does Medicare Pay For Stelara

What Do Kaiser Permanente Medicare Advantage Plans Cover

Also called Medicare Part C, Medicare Advantage Plans combine Part A and B benefits with various extra services. Part B benefits are subject to the annual deductible and copays. Medicare-covered services apply toward your out of pocket max. Kaiser Permanente Medicare Advantage Plans also include these services not typically covered by Medicare:

- Prescription drug coverage

When Does Medicare Pay For Cataract Surgery

Medicare Advantage plans like the Kaiser Senior Advantage plan may impose some of their own conditions for cataract surgery. These conditions may include certain requirements to determine coverage eligibility, network restrictions and more.

But looking at the Original Medicare terms and conditions can serve as a baseline for what you might be able to expect from a Medicare Advantage plan like Kaiser Senior Advantage.

Under Original Medicare, coverage includes any exams related to the procedure, the removal of the cataract, the insertion of a basic lens implant and one set of eyeglasses or contact lenses following the procedure.

Original Medicare beneficiaries are responsible for a 20% coinsurance payment for cataract surgery once the Medicare Part B annual deductible has been satisfied. Another 20% coinsurance payment applies for the post-operative eyeglasses or contact lenses.

Medicare requires the surgery to be medically necessary and performed at a Medicare-approved facility by a doctor who accepts Medicare assignment or participates in Medicare. The supplier of the eyeglasses or contact lenses must also be enrolled in Medicare.

Medicare only covers a basic set of artificial lenses. If a more advanced type of lens is implanted, it may not be eligible for coverage.

Also Check: Does Medicare Pay For Wheelchair Ramps

Kaiser Permanente Medicare Advantage Plans Reviews And Ratings

Kaiser Permanente isnt just a health insurance company its one of the largest managed care organizations in the United States with its own network of hospitals and medical providers. Your plan premiums directly fund the hospitals and medical offices, so there should be no issues with unexpected bills or denial of coverage for care that you receive within its network.

Trusted ratings and reviews can help you understand how an insurers plans stack up against the competition. See how Medicare, A.M. Best, the Better Business Bureau and more rate Blue Cross Blue Shield Medicare plans.

Is Kaiser Hmo A Good Plan

Kaiser Permanente has frequently been named as one of the best health insurance providers in the country. Rankings on both HealthCare.gov and Medicare.gov give plans 4 to 5 stars, which is consistently higher than many other major insurance companies.

Why should I choose Kaiser? You get the care and services you need under one roof At most of our facilities, you can take care of several health care needs in one visit. You can see your doctor, get a lab test or X-ray, and pick up your medications all without leaving the building.

What kind of reputation does Kaiser Permanente have?

Kaiser Permanente honored for innovative, high-quality patient care and service. Six Kaiser Permanente hospitals have been recognized among the worlds best hospitals by Newsweek magazine.

How much does a Kaiser doctor make? How much does a Physician make at Kaiser Permanente in the United States? Average Kaiser Permanente Physician yearly pay in the United States is approximately $246,457, which is 15% above the national average.

You May Like: Does Medicare Pay For Home Care Services

What Are The Pros And Cons Of Medicare Advantage Vs Original Medicare

Original Medicare doesn’t cover all your medical expenses, while Advantage plans have cost-sharing requirements but then cap your out-of-pocket costs. Plus, you have low premiums and the simplicity of all-in-one coverage. But there can be hidden risks to Advantage plans, especially for those with major health issues.

Does Kaiser Senior Advantage Cover Cataract Surgery

- Kaiser Senior Advantage plans do cover cataract surgery. All Medicare Advantage plans cover cataract surgery, and some Kaiser Medicare plans may cover extra vision benefits such as prescription glasses, eye exams and more.

Cataracts are a symptom of aging, and more than half of adults over the age of 80 are either living with cataracts or have had surgery to correct them.

Fortunately, Medicare Part B provides coverage for cataract surgery. But what about a Medicare Advantage plan like Kaiser Senior Advantage?

All Medicare Advantage plans including Kaiser Senior Advantage Medicare plans are required to cover all of the same services and items that are covered by Original Medicare . And because Original Medicare covers cataract surgery, so too do all Medicare Advantage plans including Kaiser Senior Advantage plans.

Also Check: How To Get A Wheelchair From Medicare

Available Medicare Advantage Plans

Kaiser Permanente offers HMO Medicare Advantage plans. Many plans offer dental, vision and hearing benefits, and worldwide emergency care. Kaiser doesn’t offer any stand-alone Medicare prescription drug plans.

Plan availability may vary by county. Plan offerings may include the following types:

A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

Special needs plans, or SNPs, restrict membership to people with certain diseases or characteristics. Hence, the benefits, network and drug formularies are tailored to the needs of those members. Kaiser Permanente offers one type of SNP:

-

Dual-Eligible SNP: For people who are entitled to Medicare and who also qualify for assistance from a state Medicaid program.

Audits Reveal Millions In Medicare Advantage Overcharges

- Fred Schulte and Holly HackerKaiser Health News

Newly released federal audits reveal widespread overcharges and other errors in payments to Medicare Advantage health plans for seniors, with some plans overbilling the government more than $1,000 per patient a year on average.

Summaries of the 90 audits, which examined billings from 2011 through 2013 and are the most recent reviews completed, were obtained exclusively by KHN through a three-year Freedom of Information Act lawsuit, which was settled in late September.

The governments audits uncovered about $12 million in net overpayments for the care of 18,090 patients sampled, though the actual losses to taxpayers are likely much higher. Medicare Advantage, a fast-growing alternative to original Medicare, is run primarily by major insurance companies.

Officials at the Centers for Medicare & Medicaid Services have said they intend to extrapolate the payment error rates from those samples across the total membership of each plan and recoup an estimated $650 million as a result.

But after nearly a decade, that has yet to happen. CMS was set to unveil a final extrapolation rule Nov. 1 but put that decision off until February.

Doolittle said CMS appears to be carrying water for the insurance industry, which is making money hand over fist off Medicare Advantage. From the outside, it seems pretty smelly, he said.

CMS paid the remaining plans too little on average, anywhere from $8 to $773 per patient.

You May Like: When Can I Change My Medicare Prescription Drug Plan