Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Do I Have To Enroll In Medicare Part B

What if you have other medical coverage, like an employers plan? Do you still have to sign up for Part B?

You can choose to delay Part B enrollment, as some people do when theyre covered under an employers or union-based health insurance plan. However, when that coverage ends, be aware that if you dont sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty.

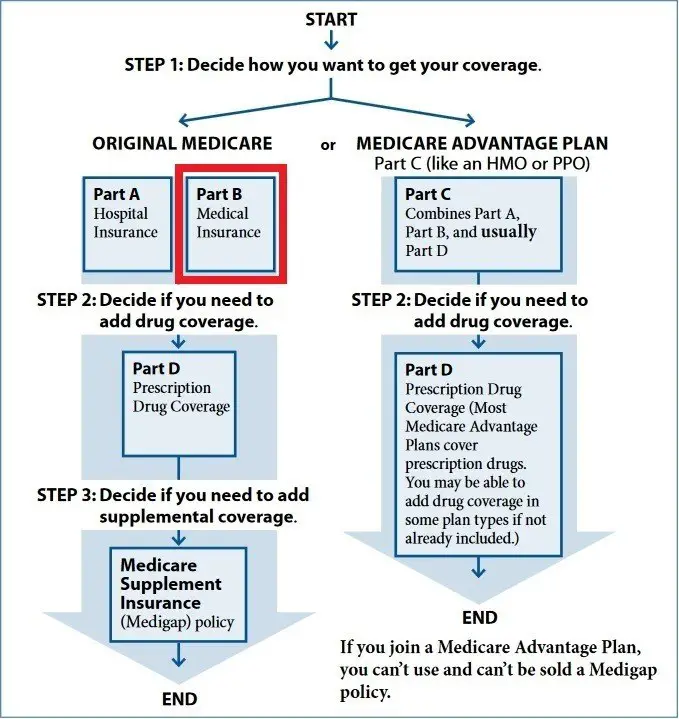

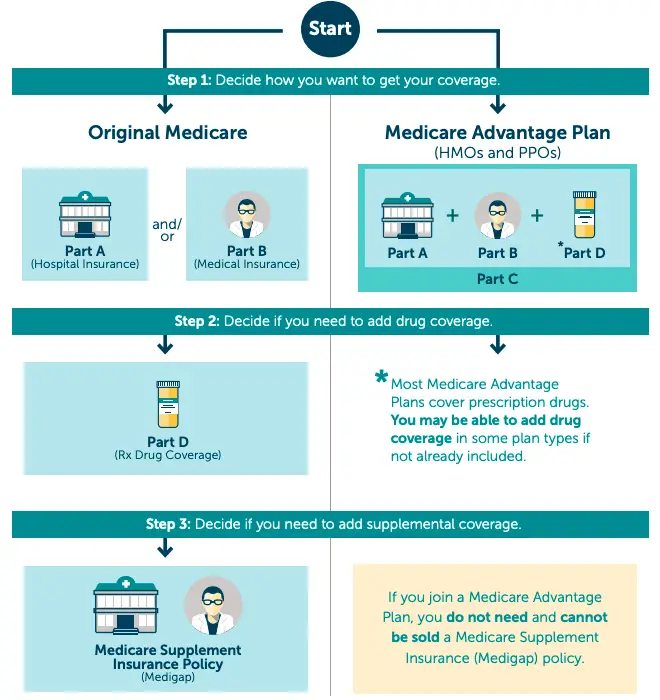

Heres one reason you might want to sign up for Medicare Part B. Suppose you decide youd like to buy a Medicare Supplement insurance plan. Or, you want to enroll in a Medicare Advantage plan. Both of these types of coverage require you to be enrolled in both Medicare Part A and Part B.

If you stay with Original Medicare and decide to sign up for a stand-alone Medicare Part D prescription drug plan, you need to be enrolled in Medicare Part A and/or Part B.

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, youll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

Do you want to learn more about those Medicare coverage options we mentioned? Start comparing plans right away by typing your zip code where indicated on this page and clicking the button.

New To Medicare?

Consider Your Other Costs

Out-of-pocket costs can quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Recommended Reading: What Medicare Do You Get At 65

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part B covers the following preventive care services:

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Does Medicare Advantage Cost More Than Medicare

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

Don’t Miss: Who Can Get Medicare Part D

Can I Enroll In Medicare Part B At Any Time

To enroll in Medicare Part B you must have a valid enrollment period.When you first become eligible for Medicare, you are given an Initial Enrollment Period. If you do not enroll during this time, you must wait until the General Enrollment Period to enroll in coverage. The only exception to this is if you qualify for a Special Enrollment Period.

If you qualify for a Special Enrollment Period, this means that you receive an individualized time to enroll in Medicare Part B without penalty based on a special circumstance. It is essential to utilize these opportunities if you have the chance. If you do not have a Special Enrollment Period, you may be required to pay a Medicare Part D late enrollment penalty.

Does Medicare Advantage Cover A Hepatitis B Vaccine

If you get your Medicare benefits through a Medicare Advantage plan, you are generally covered for the hepatitis B vaccines the same way as described for Medicare Part B above. Medicare Advantage plans include all of the benefits of Original Medicare, Part B these plans may also include other benefits such as prescription drug benefits, routine hearing care, or wellness programs. Medicare Advantage plans are offered by private insurance companies that contract with Medicare, so plan options, availability, and costs may vary by location.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Read Also: Can You Get Medicaid With Medicare

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors services, outpatient care, and other medical services that Part A doesnt cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you dont sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the Medicare & You handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

Thecategories of medical treatment and services listed below are not covered byMedicare. However, the non-covered services listed below do not necessarilyapply to HMO or other Medicare Advantage plan coverage. Many Medicare Advantageplans include some coverage for these medical services even though Medicareitself does not cover them.

How Do You Enroll In A Medicare Advantage Plan

If you want to enroll in a Medicare Advantage plan, you must:

- Be eligible for Medicare

- Be enrolled in both Medicare Part A and Medicare Part B

- Live within the plans service area

- Not have end-stage renal disease

Want more information about enrollment? Visit Medicare Part C Eligibility and Enrollment Information

Also Check: Does Medicare Pay For Mobility Scooters

What Does Medicare Part B Cost

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnât enroll in Part B.

| Medicare Part B monthly premium in 2022 | |

| You pay | |

| $578.30 | $750,000 or more |

The annual deductible for Medicare Part B is $233 in 2022. Youâll generally need to pay this deductible before Medicare starts paying its share for covered services. The deductible doesnât apply to all Part B services.

Which Companies Offer Part B Premium Reduction

Humana Medicare Advantage options include the give-back feature on some plans. In some areas, Cigna may also have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas.

Further, there are likely more companies offering this type of policy than just the ones weve mentioned. Also, consider the plan ratings before you enroll.

Also Check: What Does Medicare Supplement Cost

Don’t Miss: Do I Need An Appointment To Sign Up For Medicare

How Parts B And D Work Together

Medicare Parts B and D pay for medications you receive in the ambulatory setting but they wont pay towards the same prescription. You can only turn to one part of Medicare or the other. However, you may be able to use them both for drugs you receive in a hospital setting.

Medications you receive in the hospital when you are admitted as an inpatient will be covered by your Part A deductible. It is important to understand what happens when you are evaluated in the emergency room and sent home or are placed under observation, even if you stay overnight in the hospital. In this case, you can turn to Parts B and D to pay for your drugs.

When you are placed under observation, Part B will still pay for the medications reviewed above. If you receive IV medications, these will generally be covered. However, you may also receive oral medications during your observation stay that are not on the Part B list of approved medications. In this case, you will be billed for each pill administered by the hospital.

Send copies of your hospital bills to your Part D plan for reimbursement. Unfortunately, if you receive a medication that is on your Part D formulary, your plan may not pay for it.

Read Also: Can I Get Medicare At Age 62

About Half Of All Medicare Advantage Enrollees Would Incur Higher Costs Than Beneficiaries In Traditional Medicare For A 7

Medicare Advantage plans have the flexibility to modify cost sharing for most services, subject to limitations. Total Medicare Advantage cost sharing for Part A and B services cannot exceed cost sharing for those services in traditional Medicare on an actuarially equivalent basis. Further, Medicare Advantage plans may not charge enrollees higher cost sharing than under traditional Medicare for certain specific services, including chemotherapy, skilled nursing facility care, and renal dialysis services.

Medicare Advantage plans also have the flexibility to reduce cost sharing for Part A and B benefits, and may use rebate dollars to do so. According to MedPAC, in 2022, about 43 percent of rebate dollars were used to lower cost sharing for Medicare services.

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,556 in 2022 with no copayments until day 60 of an inpatient stay .

Recommended Reading: Does Medicare Pay For Maintenance Chiropractic Care

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A âpremium-free,â but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

This information is not a complete description of benefits. Contact the plan for more information.

Are Medicare Part B Give Back Plans Cheaper Than Other Medicare Plans

Providers that waive Part B may have lower premiums than other Medicare Advantage programs, as compared to the other. In some situations, Medicare Part B grant back plan costs may differ from Original Medicare combined with Medicare Supplement plans.

Costs of doctor appointments or medical services are typically far higher for patients out-of-network. Consider the high deductible plans, which offer lower costs than the standard Medicare Advantage plans, and are less costly than Medicare Part D Giveback plans if you’ve made no claim.

Recommended Reading: Does Medicare Cover Naturopathic Doctors

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act changed Medicare Advantage plans several times. Almost all of these changes were related to the health insurance market as well. The ACA has reopened the Medicare donut hole, but it does not mean prescriptions for drugs have no limits.

Beneficiaries had to pay some of these expenses. The Medicare plan has a new policy which allows insurers across the country not to charge plan members more for services besides chemotherapy. It may affect the cost of your plans as well.

Are Medicare Deductibles Based On Calendar Year

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. Once you meet it, your plan will pay all or part of your costs for the remainder of the year, but then your deductible resets on January 1.

Dont Miss: Does Medicare Cover Me Overseas

Also Check: Does Aarp Medicare Complete Cover Cataract Surgery

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

How Do You Choose A Medicare Advantage Plan

Its important to compare the benefits between your current coverage and the different types of Medicare Advantage plans . Be sure that you understand the additional benefits and any benefits that you may lose.

You may want to consider:

- If you can change your current doctors

- If your medications are covered under the plans formulary

- The monthly premium

- The cost of coverage. This could include annual deductible, copays, and coinsurance.

- What additional services are offered

- Any treatments you need that arent covered by the plan

Don’t Miss: Does Medicare Cover Shingrix Cost

What Types Of Medicare Advantage Plans Are Available

There are various kinds of Medicare Advantage plans, such as HMO, PPO, and Private Fee-for-Service plans. HMOs and PPOs each have certain characteristics, whether they are part of a Medicare plan or part of a regular health plan.

For example, an HMO plan typically comes with lower costs but requires you to see providers within a network and get referrals before you see a specialist. A PPO plan typically costs more, but offers more flexible options for seeing providers and may not require any referrals to see specialists.

Medicare Supplement Additional Coverage

How can you supplement your original Medicare coverage? Medicare supplement plans enhance original Medicare by offering additional coverage.

Let’s unpack the benefits. First, we need to look at original Medicare, also known as Medicare Parts A and B. Medicare Part A helps cover costs associated with hospital care, and Medicare Part B helps cover costs for things like doctor visits and outpatient procedures. Original Medicare only covers a portion of costs associated with hospital stays and doctor visits. In fact, sometimes it doesn’t cover them at all.

So, why consider additional coverage? Original Medicare may not provide all of the benefits you need. That’s where a Medicare supplement plan can help. For example, if you travel, a Medicare supplement plan could pay for care abroad. Under original Medicare, you’re still responsible for a percentage of your medical costs. But Medicare supplement plans can help pay for the part of your bills that aren’t covered.

Finding the coverage that fits you is a key part of navigating Medicare. Keep in mind, Medicare supplement plans might not include everything, but they give you more options to find the coverage that best matches your goals.

Got more questions? Learn more at AetnaMedicare.com.

Why?

Don’t Miss: Do I Need Pip If I Have Medicare