Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 AHIP. . The State of Medicare Supplement Coverage: Trends in Enrollment and Demographics. https://www.ahip.org/wp-content/uploads/AHIP_IB-Medicare-Supp-Cvg-Report.pdf.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

Medicare Supplement Plan G Vs Plan F

Medicare Supplement Plan G 2022 is the most popular Plan among new enrollees .

Plan F held both of those titles for many years, as the best selling and most comprehensive Medicare Plan. It still holds a vast lead over any other plan in terms of total market share. Plan F currently has 49% of the Medigap market, with Plan G and Plan N lagging far behind.

However, as of 2020, Plan F are closed to newly-eligible Medicare recipients.

Only those eligible for Medicare Part A prior to January 1, 2020 can enroll in Plan F.

Comparing Medicare Supplement Plan G Coverage Chart

Humana: Best Coverage For Medicare Part D Plan

The availability of Part D plans can vary depending on where you live. If youre concerned about getting a plan near you, consider Humana.

Humana has a wide coverage network in most states, and you can even schedule 30-day prescription deliveries to your door. This is useful if you live in 2 different states throughout the year and you dont want to worry about running over your quarterly limits while youre out of your home state.

If you dont currently take any prescription medications but you still want to maintain Part D coverage just in case, Humana might be the best Medicare Part D 2021 option for you. Humana offers affordable value plans that cover more than 3,500 prescription drugs for less than $20 a month. Youll also enjoy even more benefits with preferred cost sharing when you shop at participating Humana-approved pharmacies.

Humana Part D plans are accepted at many national chains including Sams Club, Walmart and Walgreens.

Online Quote Option

Read Also: Will Medicare Pay For Cialis

Why Should I Compare Medicare Supplement Plans

Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

For example, every Plan G policy provides the same benefits, but two insurers may charge you very different prices for a Plan G policy.

Comparing plan prices from multiple insurance carriers helps ensure that you get a competitive rate for the plan you want.

Medicare beneficiaries can enroll in any available Medigap plan, regardless of its popularity. Despite this, is it helpful to review the options and reasons why hundreds of thousands or even millions of people choose one plan over another.

Spousal Income Counts Against You

Those IRMAAs also arent just based on your own income. For example, if you have retired but your spouse is still working and your joint tax return shows modified adjusted gross income of $176,000 or higher, you would be subject to IRMAAs.

This is why its so important for people to begin educating themselves about Medicare a few years before they become eligible for it at age 65, Roberts said.

Think about it if you knew this at age 60, you might be able to consult with your financial advisor and do some planning to try to keep your modified adjusted gross household income below those thresholds, she said.

Recommended Reading: How Do I Qualify For Medicare Low Income Subsidy

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

- No. States Available: Enter zip code to find out

- Providers In Network: Not disclosed

The company offers multiple plans, a comprehensive website that is user-friendly, and customer discounts.

-

Comparison charts for different plans

-

Customer reviews on the plan information page

-

Multi-step process to pay online

-

No app for Medicare Supplement insurance

In business since 1909, Mutual of Omaha offers high quality, in-depth information through the company website. The website is simple, uncluttered, and includes a comparison checklist showing who each plan is best for, with the option to include further coverage . Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company.

However, the company only offers three plans . To get price estimates, you need to include information on your gender, date of birth, and ZIP code. You can contact them online or over the phone for a personalized quote, but the company does not offer a mobile app for its Medigap customers. Mutual of Omaha is ranked by AM Best at A++ for financial health.

What Is The Typical Cost Of A Medicare Supplement Plan G

Costs for Medicare Supplement Plans vary widely depending on your age, gender, and where you live. Chronic medical conditions are taken into account, including whether or not you smoke and if you sign up after the one-time Medigap Open Enrollment Period that starts when you first enroll in Medicare Part B and ends six months later.

Plan G costs were reviewed across four regions of the United States in 2020. Based on ages 65 to 75 years old, gender, smoking status, and cost summaries from Medicares Find a Plan search engine, Part G costs ranged $189 to $432 on the east coast , $104 to $479 in the midwest , $88 to $417 in the south , and $115 to $308 on the west coast . Costs could be higher or lower based on specific regional data.

Don’t Miss: Is Unitedhealthcare A Medicare Advantage Plan

Wellcare Health Plans Medicare: Good Choice Of Plans

Reasons to avoid

WellCare Health is a government-sponsored healthcare plan specialist, and so is a great resource for weighing up which Medicare Part D plan might be suitable for any potential customer.

Since these types of plan are definitely the focus, the customer service agents are equipped to give detailed and specialist knowledge, putting the company in a relatively good position compared to many of the peers in the marketplace.

WellCare has an excellent spectrum of available plans, ranging from very affordable entry-level, basic plans to good value, comprehensive plans for customers with extensive medication needs. Pricing is also nicely varied meaning there should be something for everyone.

Where Can You Buy Medigap Coverage

Medigap policies are available in every state, from private health insurance carriers. Americas Health Insurance Plans reported in 2021 that total Medigap enrollment in late 2021 stood at 14.5 million people up from 11.6 million in 2014 .

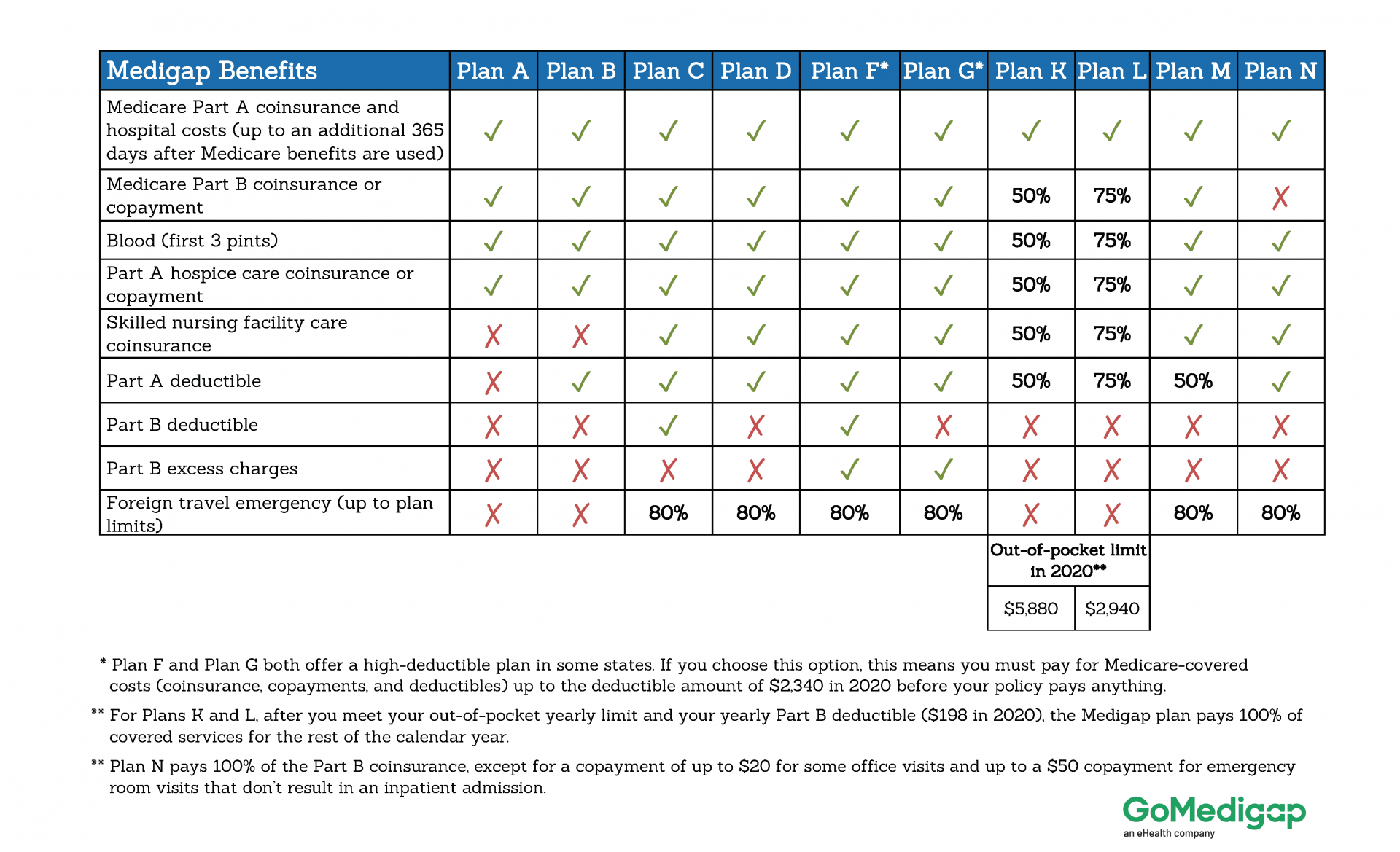

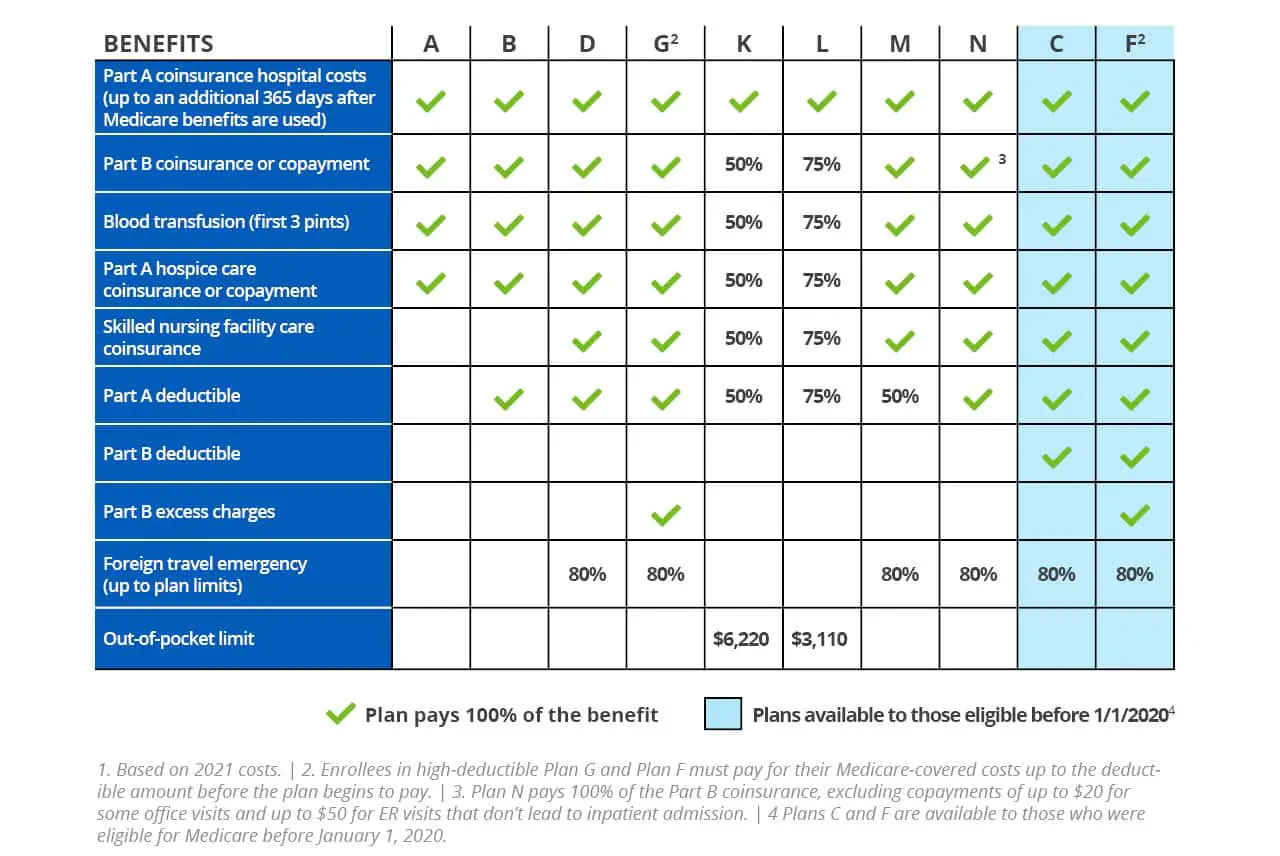

All Medigap insurers must abide by strict state and federal laws. In most states, Medigap carriers must offer standardized policies that are identified by the letters A through N. There are a total of ten different plan designs: A, B, C, D, F, G, K, L, M, and N , and although the price varies from one carrier to another, the plan benefits are the same from one state to another and from one carrier to another, within each letter. So all plan Ks, for example, offer the same benefits regardless of where you live or what insurance carrier you use.

In some states, not all types of Medigap coverage will be available. In other states, you may be able to purchase Medicare SELECT a Medigap policy that requires plan holders to use specific hospitals and, in some cases, specific doctors. Any of the ten Medigap plan designs can be offered as a Medicare SELECT plan, and they tend to be less expensive than typical Medigap policies due to the restricted network. If you choose a Medicare SELECT plan and use a provider thats not in the network, your Medigap plan wont pick up your Medicare out-of-pocket costs unless its an emergency.

Don’t Miss: Do I Need Medicare If I Have Tricare

How Do You Shop And Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if you’re approaching your 65th birthday, but you haven’t started taking Social Security benefits yet, you are eligible for Medicare.

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can’t be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles or you have a preexisting condition and want to know if there is a waiting period for coverage for it. Be sure to check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

How Do I Decide Between Medicare Supplement Plan F And Plan G

Our clients often ask us for help comparing Medicare Plan F vs. Plan G. We understand it can be a tough decision to make. Well help you compare the plans so that you can feel confident in your choice. First, lets take a look at what benefits the two plans cover.

| Medigap Plan Benefits | ||

|---|---|---|

| Part A coinsurance & hospital costs | Yes | |

| Part B coinsurance or copayment | Yes | |

| Part A hospice care coinsurance | Yes | |

| Skilled nursing facility care coinsurance | Yes | |

| Part B deductible | Yes | |

| Foreign travel emergency | Yes | Yes |

Don’t Miss: How Much Does Medicare Cost Me

Medicares Most Expensive Drugs

Comprehensive prescription drug coverage became part of Medicare in 2006 with the introduction of Part D plans. Since then, the number of beneficiaries has doubled, from 22 million to nearly 45 million. These plans help people 65 and older pay for their medications, but rising drug costs continue to concern enrollees.

To learn more about medication costs, we compared the 10 most expensive drugs covered by Medicare with the 10 most common drugs used by Medicare beneficiaries. We also looked at prices for drugs such as epinephrine and insulin, which have reputations for being expensive.

Heres what we discovered.

Unitedhealthcare : Easiest To Use

Medicare stars: 3.9 out of 5

Avg. monthly cost: $52

Avg. Part D drug deductible: $301

NAIC Complaint Index: 0.53

Read more: United Healthcare insurance review

UnitedHealthcare is a major insurance company that expanded its base of Medicare subscribers through its affiliation with AARP. Whether the plan name says UnitedHealthcare or AARP, UnitedHealthcare is the company that is providing the insurance benefits.

Prescription drug plans are widely available in all 50 states, Washington D.C. and several U.S. territories. Plans are very well-rated, averaging 3.9 stars. However, average monthly costs are more expensive than some other providers.

The insurer does offer ways to help members reduce the amount they spend on prescription drugs. This includes a network of preferred pharmacies that offer better prices and the option to order a discounted three-month supply through OptumRx mail order.

For low-cost generic drugs, choose the AARP MedicareRx Walgreens plan, which offers Tier 1 drugs for a copayment rather than requiring you to meet the plan’s deductible. The company also has some of the best Medicare Supplement plans if you want to reduce costs for other types of health care.

Recommended Reading: Can Medicare Be Used Out Of State

Medicare Supplement Insurance Basics

Before you start browsing plans, make sure you know the basics of Medigap. There are 10 different Medigap policies, and each one comes with standard benefits across the nation. The exceptions to this rule are Massachusetts, Minnesota, and Wisconsin, which standardize Medigap policies differently.

In order to buy a Medicare Supplement plan, you must also have Original Medicare. This includes Part A and Part B. You can have a Medicare Advantage plan when you apply for Medigap coverage, but youll need to leave the plan when your new Medigap policy begins.

You can buy a Medigap policy from any private insurance company thats insured in your state. Not all insurance providers offer every Medicare Supplement plan, but every health care provider who accepts Medicare must also accept your Medigap policy.

Decide If A Regular Or A High

Some providers offer two versions of Plan F: regular and high deductible. As the name suggests, the main difference is the deductible amount, and beyond that, the timing of the coverage. With a high-deductible Plan F, the coverage doesn’t activate until the deductible amount is met, but in exchange, you can expect much lower monthly payments than the regular Plan F, which works the same as other Plans, with lower deductibles and higher monthly payments.

Also Check: Do You Need Additional Insurance With Medicare

What Is A Medicare Supplement Plan

To help cover your out-of-pocket expenses after using Original Medicare , you can purchase a Medicare Supplement plan from an insurance company. These are also known as Medigap plans.

A Medicare Supplement plan is additional insurance you can purchase to reduce the out-of-pocket health care costs Medicare alone doesnt cover. You should always compare Medicare Supplement plans to choose the one that works best for you. You should also do this each year, as some of the benefits and Medicare regulations may change.

Keep in mind you will pay a monthly premium for your Medicare Supplement plan. You must pay these monthly premiums whether you use the covered services or not. This is why its crucial for retired seniors on a limited income to weigh the pros and cons of each Medigap plan.

RELATED: Speak with a licensed Medicare insurance agent by calling: .

Top 10 Most Expensive States For Medigap Plans

Home / FAQs / Medigap Plans / Top 10 Most Expensive States for Medigap Plans

There are many reasons why some states have more expensive Medigap plans than others. The rules in some states vary, and the cost of living can also play a factor. The states below are ranked the top 10 most expensive states for Medigap plans.

Also Check: Does Medicare Advantage Cover Chiropractic Care

Medicare Supplement Plan F Providers In 2021

- Best for Extras: Humana

- Best in Educational Information: Cigna

- Best in Price Comparison: AARP

- Best for Simplicity: Aetna

- Best for Ease of Use: Mutual of Omaha

Not eligible for Medicare Plan F? Medicare Plan G is the new Medicare Plan F, offering nearly the same benefits as Plan Fthe only difference is Part B coverage.

In addition to covering everything included in Medicare Parts A, B, and C at a low cost, Humanas Plan F offers extensive extra benefits. These include a SilverSneakers fitness plan and household discounts if more than one person in your household has a Medicare Supplement Plan with Humana.

-

Helpful information breakdown on the Plan Details page

-

$0 deductible available

-

$0 visits to specialists, no referrals needed

-

Discounts available for multi-policy households

-

Discounts on additional services such as hearing aids or eyeglasses

-

Required to enter zip code before comparing different plans

-

App receives average ratings for iOS app

Humanas process to determine your personal estimates requires a few too many clicks, but once youve navigated to where you need to be, all information relating to the Plan F plan is clear and easy to understand. There isnt much point in comparing costs herePlan F has a $0 deductible at the regular level.

Humana is also highly raked with AM Best, with an Excellent rating of A-.

Medicare Plan F does not cover ear or eye care, so these are not additional benefits that you can find with every provider.

Does Medicare Part G Plan Cover Acupuncture Services

Medicare Supplement Plans do not pay for health services directly. Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs. Medicare does not cover acupuncture for other indications.

Also Check: What Year Did Medicare Advantage Start

Dollars And Cents: Comparing The Costs Of Plan F Vs Plan G

Even though Plan F pays the annual Part B deductible, chances are youll still wind up with more cash in your pocket at the end of the year with a Plan G, instead.

For example, we can use our online Medicare Supplement quote tool to show the following comparisons for a 65-year old non-smoking male looking to purchase a Medigap plan for the first time in Florida, New York, Texas, and Kentucky :

In each situation, our example Medigap customer would come out ahead by purchasing a Plan G, even after taking into account the cost of his once-a-year Part B deductible.