Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Age can also be a factor when deciding between enrolling in Medicare or a private insurance plan. To qualify for Medicare, an individual must be at least 65 years of age or have certain conditions that meet the eligibility criteria, such as end stage renal disease. On the other hand, private insurance is available to anyone, regardless of age.

Medicare Vs Private Insurance: Benefits

Original Medicare has some significant gaps in coverage for things that private insurance usually covers, like prescription drugs. Original Medicare may cover prescription drugs you receive in the hospital or certain medications you receive in a doctorâs office, but generally doesnât cover most prescription drugs you take at home.

The only way to get Medicare prescription drug coverage for most medications you take at home is through a Medicare-approved private insurance company. You can opt for a stand-alone Medicare Part D prescription drug plan to go alongside Original Medicare, or a Medicare Advantage prescription drug plan.

To look for a Medicare plan from a Medicare-approved private insurance company, enter your zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Switching Between Medicare Advantage And Medigap Plans

This brings up another important point. Many people ask us if they can start with a Medicare Advantage and then move to a Medicare supplement if they get sick or need more coverage. The answer is usually NO.If you leave a Medicare supplement plan to go to a Medicare Advantage plan, you may not be able to go back to your Medigap plan. Once you are out of your open enrollment or guaranteed issue period, you will have to qualify through health underwriting to go back.

Don’t Miss: Is Mutual Of Omaha A Good Medicare Supplement Company

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Option : Original Medicare

- Medicare is primary and Medi-Cal is secondary. In Original Medicare, also known as fee-for-service, it is important to present providers with both Medicare and Medi-Cal cards. With Original Medicare you can choose any medical provider that accepts Medicare and Medi-Cal, no referrals to a specialist is needed.

- In addition to the Medicare and Medi-Cal card, beneficiaries also have a CalOptima Member Identification card and a Part D Prescription Drug Plan card.

- Medi-Medi beneficiaries that do not enroll in a Part D Plan or a Medicare Advantage Plan will automatically be enrolled in a Part D benchmark plan. Medi-Medi beneficiaries are automatically eligible for , the program that helps pay for prescription drug plan co-payments.

Also Check: Where To Apply For Medicare Part D

Is Medicare A Better Option Than Your Employer Health Coverage Lets Take A Look

If you are over 65 and still working, you may have the option to choose your employers health insurance plan or Medicare. The best plan is the one that meets your health care needs, budget, and lifestyle. Is that Medicare or your employers health insurance? Answer: it depends.

Here are a few factors to weigh in making your decision.

Consider Medicare Before You Retire.

As more Americans over the age of 65 choose to stay at work, many aging workers and their employers view Medicare as a post-retirement health plan solution. That simply is not true. Employees 65 and older are eligible to enroll in Medicare, and it is often the better option. As employees enter the eligibility age for Medicare, they should consider all options for health care coverage, not just their companys benefits.

Medicare Offers More Plan Options Than Employer Coverage

Most employers offer only a handful of health coverage plans for employees to choose from. By comparison, Medicare has hundreds of plans. The number of available plans can be overwhelming, but with that many options, it can work in your favor to find the exact plan that meets your specific needs. Also, many Medicare plans are offered by the same carriers that employers use for health coverage. If you favor your current insurance carrier, you may be able to continue using them through Medicare. Licensed Medicare advisors, like Medicare Choice Group, help you evaluate and find the best plan for your needs.

Weighing Your Options

What Types Of Medicare Coverage Is Offered By Private Insurance Companies

Medicare works with private insurance companies to provide Medicare benefits. The types of Medicare coverage you can get from Medicare-approved private insurance companies include:

- Medicare Part D prescription drug coverage

- Medicare Supplement insurance to help cover out-of-pocket Medicare costs, such as deductibles, copayments, and coinsurance

- Medicare Advantage plans, which include your Part A and Part B insurance in one convenient plan. Medicare Advantage plans also might include added benefits, like prescription drugs, routine vision, routine hearing, and routine dental coverage.

No matter which coverage option you may choose, youâre still in the Medicare program. You still need to stay enrolled in Medicare Part A and Part B to qualify for Medicare Advantage or Medicare Supplement. If you sign up for a stand-alone Medicare Part D prescription drug plan, you need to have either Medicare Part A or Part B .

Read Also: Does Medicare Cover Nerve Blocks

How Do The Benefits Differ

Private insurance and original Medicare plans provide varying benefits and coverage.

Most of both types of plans cover hospital care and outpatient medical services, including doctors visits, physical therapy, and diagnostic tests.

However, Medicare may have gaps in coverage that private insurers cover. For example, Medicare does not cover prescription drugs, meaning that a person needs to get a Medicare Part D plan. However, private insurance plans often include prescription drug coverage.

Medicare Advantage plans, which replace original Medicare, may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

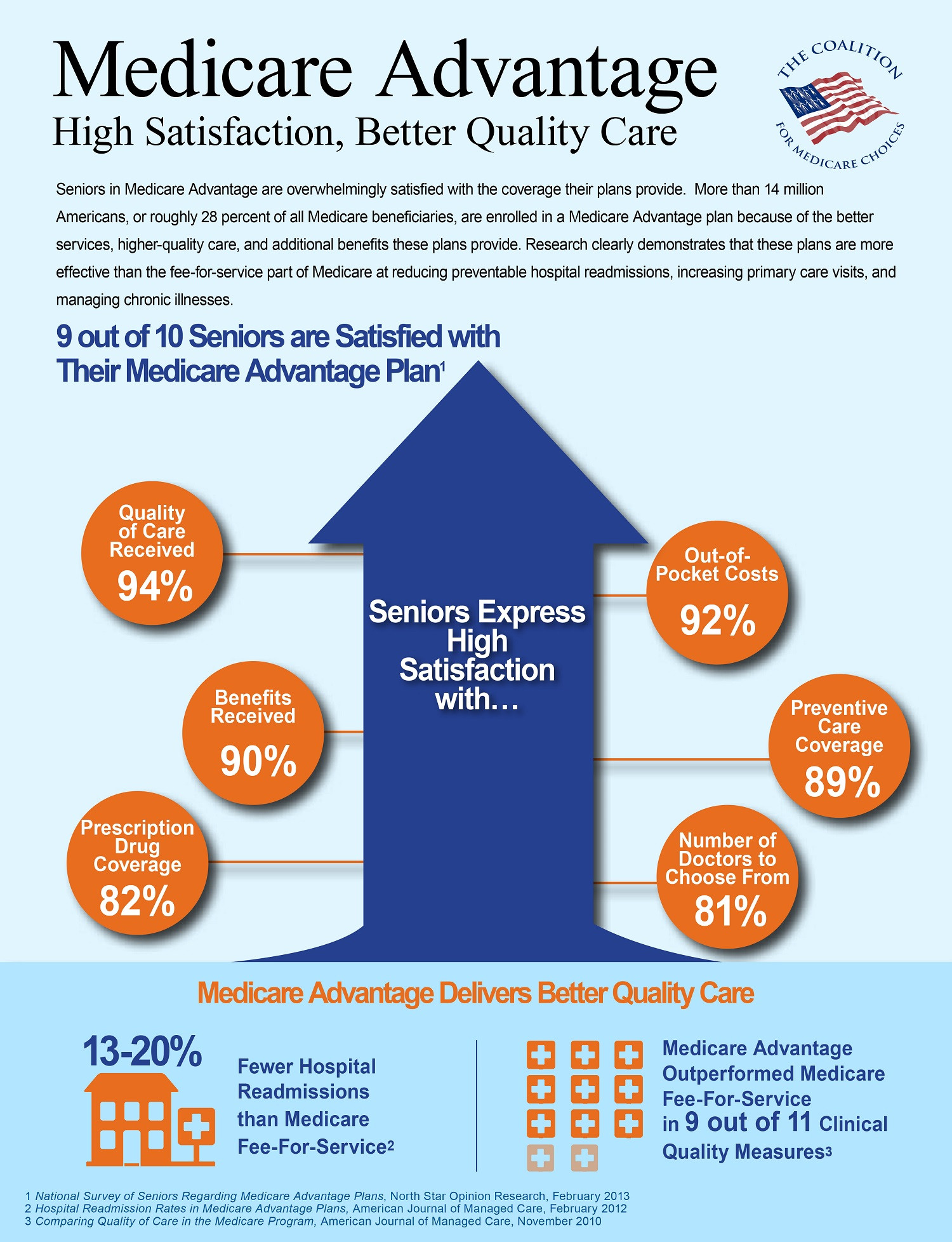

Main Differences Of Medicare And Medicare Advantage

Original Medicare is run by the federal government and is overseen by the U.S. Centers for Medicare & Medicaid Services . Medicare Advantage is an alternative to Original Medicare. These plans are sold through private insurers who contract with CMS to provide coverage.

Who provides coverage is the biggest difference between the two, but there are several more that you should consider before deciding which option is right for you.

Biggest Differences Between Original Medicare and Medicare Advantage

Most in the United States accept Original Medicare. The federal government also limits how much health care providers can charge people on whether the doctors or hospitals participate in Medicare or not.

All must cover the same things Original Medicare covers. But Medicare Advantage plans may also cover other benefits such as hearing, vision, dental and prescription drug coverage.

Recommended Reading: Who Can Get Medicare Part D

Read Also: Does Medicare Cover Transport Wheelchairs

Medicare Advantage Plans Start At $0/month

In 2020, nearly two-thirds of Medicare Advantage beneficiaries paid no premium for their plan.Youll still be required to pay your Medicare Part B premium. That said, it may be an enticing option for those who dont want to juggle paying multiple premiums each month.

If youre interested in seeing Medicare Advantage Plans with $0 monthly premiums, Ensurem offers an online quote tool thatll allow you to compare plans in your area.

You May Like: Does Medicare Pay For Ensure

How To Choose The Right Health Care Coverage For You

Although you may be eligible for both programs, in some cases, you might be in a position to choose between Medicare and Medicaid.

If youre eligible for Medicare, you have to choose between Original Medicare or Medicare Advantage, based on your preferences. But how do you decide? Take a look at some of the key differences.

Also Check: How Soon Can You Enroll In Medicare

Medicare Vs Private Health Insurance: Out

The next thing you may consider are your annual out-of-pocket costs. These include copays, coinsurance, and deductible amounts. Medicare has leverage to negotiate with healthcare providers as a national program, while private health insurance plans negotiate as individual companies. This negotiation lowers the amount that a healthcare provider can charge you. Youll see these negotiated prices reflected in lower copays and coinsurance charges.

You should also consider deductibles when looking at Medicare vs. private health insurance.

| Medicare Deductibles | ||

|---|---|---|

| The Medicare Part A deductible is $1,556. The Medicare Part B deductible is $233.3 | On average, an employer insurance plan will have an annual deductible of $1,400.5

This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons. |

On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730.6

This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons. |

Pros Of Original Medicare

With Original Medicare, the benefits are identical from person to person. There are no copays, no waiting periods, and no pre-existing condition limitations. There are also no networks. You can see any doctor that accepts Medicare. Any out of pocket costs will remain the same regardless of the provider you choose to receive care from. Your coverage will travel with you across the United States.

You May Like: Does Medicare Cover Eye Exams For Glaucoma

What Is The Difference Between Health Insurance And Medicare

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents. Not only does Medicare provide many coverage combinations to choose from, but there are also plans within those combinations that offer varying levels of coverage.

When shopping for private health insurance, choosing coverage isnt too complicated. If it is an employer plan, you choose between a limited number of options provided by your company. If it is an Affordable Care Act plan, you can shop for plans based on premiums, out-of-pocket costs, and differences in coverage. These things are often listed in plans the Summary of Benefits.

HealthMarkets can help you review your options. If you choose a Medicare combination, you can compare those types of plans to find the best premium and coverage for your needs. Select a plan combination that matches your needs, and then view in-depth information about what each plan will cover. Start comparing plans now.

Cons Of Medicare Advantage

With Medicare Advantage, the benefits are different from plan to plan. You still have to pay your Part B premium. The biggest downfall to Medicare Advantage is the limited doctor networks. When you need to see a specialist with a small network, access to care can be more challenging. Another con to Part C plans is the high cost per service. Yes, zero to low premiums are appealing, but when you add the additional out of pocket costs you pay as you use the benefits, some find its just not worth it.

Unlike Original Medicare, Part C plans come with annual coverage changes. The plan that works for you now, may not work for you next year. These plans also do not travel with you. Lastly, the Maximum Out Of Pocket limit can still break the bank.

Now that we went over a few of the pros and cons of both Original Medicare vs Medicare Advantage, lets compare doctor visits, covered services, and costs a little more in detail.

Doctor Visits

When you have Original Medicare, you can see any doctor or specialist that accepts Medicare. You dont need a referral to see a specialist either. Since plans dont change annually, you wont need to worry about your doctor leaving the plans network.

When you have Medicare Advantage, your coverage will be very similar to your employer group coverage. The majority of them are health maintenance organizations and preferred provider organizations.

Covered Services

Recommended Reading: When Does Medicare Part D Start

Also Check: Does Medicare Cover Home Health Aide Services

Help Me Choose A Plan

Not sure what you need? Answer a few questions to help you decide. Get started

Now that youve picked a plan, its time to enroll

This Information is a solicitation for insurance.

Medicare Supplement Insurance Plan Notice:Not connected with or endorsed by the U.S. Government or Federal Medicare Program.

Medicare Supplement Insurance Plans are offered by Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association.

File is in portable document format . To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at

You are leaving this website/app . This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. In addition, some sites may require you to agree to their terms of use and privacy policy.

Medicare Vs Private Insurance: Rhetoric And Reality

Michelle M. DotyCathy SchoenKaren DavisFacts and Figures

- Twenty-two percent of privately insured people found that their plan did not pay for care that they thought was covered, compared with 9 percent of elderly Medicare beneficiaries.

- Nine percent of privately insured people had difficulty getting a referral to a specialist, compared with 2 percent of elderly Medicare beneficiaries.

- Medicare beneficiaries were more likely to be very confident in their ability to get care in the future as those covered by employer plans .

- Thirty-three percent of privately insured people were unable to pay their bills or had been contacted by a collection agency, compared with 18 percent of elderly Medicare beneficiaries.

Publication Details

Don’t Miss: What Is The Deadline To Sign Up For Medicare

How Do They Differ On Cost

Having Medicare Part A and Part B without any supplemental coverage can be costly because there is no cap for cost-sharing or no limit on out-of-pocket expenses.

If you dont need much medical care and dont have many prescriptions, you might find Original Medicare to be cost-efficient. Original Medicare has copayments for Part A services and a 20% coinsurance for most Part B services. While a Medicare beneficiary has the option to enroll solely in Original Medicare, they should be informed about the penalty if they dont enroll in a Part D plan when eligible, and then decide much later to enroll in a Part D plan.

With Medicare Advantage, enrollees pay copayments, though annual out-of-pocket costs are capped at $6,700. That can be helpful for those with complicated conditions who get regular, expensive medical care. Premiums for Medicare Advantage plans range from $0 to more than $100. Plans with no or low premium can have higher copayments and/or deductibles than plans with higher premiums.

Read Also: Must I Take Medicare At 65

Medicare Consists Of 4 Parts:

- Part A covers inpatient hospitalization hospice home health

- Part B covers outpatient care, services from doctors and other medical providers, durable medical equipment many preventive services

- Part C plans that cover all benefits and services under Parts A and B and usually covers prescription drug benefits. Plans may also include extra benefits and services not covered by Medicare such as basic vision and hearing.

- Part D covers prescription drug costs

Read Also: Does Medicare Pay For Cancer Drugs

Does Medicare Coverage From Private Insurance Companies Cost More

Medicare coverage from Medicare-approved private insurance companies may cost you an additional monthly premium, but might also save you money over time.

You might be surprised to learn that Original Medicare has no out-of-pocket maximum. This means that if you need extensive medical care, you could face enormous bills. Two Medicare Supplement plans, Medicare Supplement Plan K and Plan L, have out-of-pocket limits. Other Medicare Supplement plans may still help you cover Medicareâs out-of-pocket costs.

All Medicare Advantage plans are required to have an out-of-pocket limit, protecting you from devastating financial responsibility if you have a serious health condition. Limits may vary among plans.

Eligible For Both Medicare And Medicaid

Dual Special Needs Plans are for people who could use some extra help. That may be because of income, disabilities, age and/or health conditions. Dual eligible health plans are a special type of Medicare Part C plan. Youll keep all your Medicaid benefits. Plus, you could get more benefits than with Original Medicare. And you could get it all for a $0 plan premium.

Recommended Reading: Is Stem Cell Treatment Covered By Medicare

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

- Inpatient hospital services. These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

- Outpatient medical services . These benefits include coverage for preventive, diagnostic, and treatment services for health conditions.

Original Medicare generally doesnt cover prescription drugs, dental, vision or hearing services, or additional healthcare needs.

However, for people who have enrolled in original Medicare, there are add-ons such as Medicare Part D prescription drug coverage and Medicare supplement plans that can offer additional coverage.