Which Medicare Supplement Plans Cover Foreign Travel

If you have Medicare Supplement Plan C, D, F, G, M, or N, you have additional protection for overseas travel. Its important to note that you only have a $50,000-lifetime reserve towards expenses incurred while abroad, and once youve been out of the U.S. longer than 60 days, youre no longer covered by your supplement. You also have a $250 yearly deductible that youll need to meet before your plan kicks in. Just like in the U.S., your Medicare Supplement plan will only pay if Medicare pays.

Should I Have Medicare Coverage If I Retire Abroad

For coverage in your new country, youd need to purchase private health insurance or buy into the countrys public health plan, if that option is available. If youre willing and able to return to the United States for hospital care, youll still have access to Medicare Part A .

But youd need to purchase Medicare Part B in order to have outpatient coverage, and theres a 10% premium increase for each year that you were eligible for Part B but not enrolled . Advocacy groups have pushed for Medicare coverage to be portable for retirees who choose to live overseas, but so far, its not.

What Will Medicare Cover While Youre Traveling

Medicare provides some coverage for the same emergencyexpenses overseas as it does in the U.S. If your expense isnt covered by Medicare in the U.S., like prescriptionmedications, it wont be covered abroad either.

Medical travel reimbursement is also provided at the same rate that Medicare covers servicesin the United States. Youll most likely be responsible for your typicalcopayment or coinsurance. If you have a Medicare Supplement plan, it may helpyou with some of the Medicare-approved expenses.

Don’t Miss: What Is Medicare Plan F

Do I Need Travel Insurance If I Already Have Health Insurance

If you are traveling outside of the U.S., consider buying travel medical insurance even if you have a U.S.-based health plan. Many health plans wont cover you outside the U.S. or provide only limited global coverage. If you get sick or injured, you could be stuck paying for your medical expenses out-of-pocket.

Senior travelers should definitely get travel medical insurance because Medicare isnt accepted outside the U.S., except in very limited cases.

Does Medigap Cover You While Abroad

Most Medicare Supplement plans, include a foreign travel benefit check to see if yours does. Medicare Supplement plans C, D, E, F, G, H, I, J, M, and N that cover travel, pay for 80% of the cost of medically necessary emergency care outside of the U.S. and its territories.

Youll be responsible for a separate $250 deductible. The medical emergency must occur within 60 days of the start of your trip. So it wont work if you leave the country indefinitely. Plus, theres a $50,000 lifetime limit to the amount this benefit will payout.

Medigap policies are not a Medicare replacement. Theyre an additional benefit on top of your existing coverage under Original Medicare . And be aware that Medicare Part D prescription benefits also do not extend outside the U.S. and its territories.

Recommended Reading: Does Part B Medicare Cover Dental

Also Check: Do I Have Medicare Advantage

How Much Travel Medical Insurance Should You Have

Its a good idea to select a plan with enough coverage based upon the type of trip youre taking. For example, emergency medical evacuation from a cruise ship can cost between $50,000 and $100,000, according to the Centers for Disease Control.

The most generous travel insurance plans provide $500,000 per person for emergency medical expenses and $1 million for emergency medical evacuation.

Other good plans have ample medical coverage of $250,000 or $100,000 per person. And some have less, which you might find sufficient. See Forbes Advisors ratings of the best travel insurance.

Here are examples of travel insurance plans with at least $100,000 coverage for medical expenses and at least $250,000 for emergency evacuation.

What If I Become Eligible For Medicare When I Am Abroad

If you are a US national living abroad, and you become eligible for Medicare , then you can request Medicare enrollment forms from the United States Embassy or Consulate in the country where you currently live. You dont necessarily need to return to the US just so you can enroll.

You will also receive a letter from the Social Security Administration , informing you that youve reached your Initial Enrollment Period and a form which you can use to request the enrollment pack. You may have to send the forms and required paperwork via certified mail.

If you are not eligible for premium-free Medicare Part A, then you may actually have to go to the US to enroll. Additionally, if you do not enroll during the Initial Enrollment Period , you may have to wait for the General Enrollment Period, which starts from January to March.

Also Check: Does Medicare Help Pay For Incontinence Supplies

Is Travel Health Insurance An Option

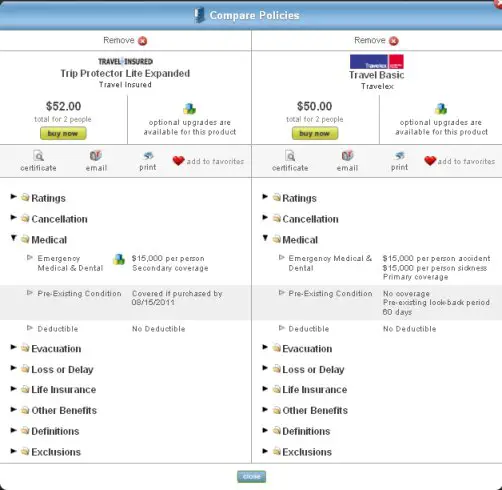

Trip-specific travel health insurance is an option for if you dont want or need the ongoing premiums of a Medigap or Part C plans but want coverage while traveling abroad. Coverage varies in scope and price depending on several factors, including trip length and the travelers age.

Make sure to find a plan that covers medical emergencies, including medical-team medevac evacuations, and not just trip protection cancellations because of illness. Also, be aware of policy exclusions, such as preexisting conditions and penalties for cancellations in the event your trip is postponed or put off altogether.

Many experts recommend getting insurance for at least $50,000 in medical expenses and $100,000 in evacuation costs. Some plans feature benefits over that, such as $250,000 in medical coverage and $1 million in evacuation costs.

Carriers generally offer travel health insurance for trips of up to a year in length. There are also health insurance options for Americans who visit foreign countries for longer periods. For extended stays abroad, youll want to seek out long-term expatriate health insurance.

Those plans generally will include more comprehensive coverage beyond emergencies and evacuations. In general, healthcare outside of the United States is less costly. Still, even those lower costs can mount without insurance.

Traveling Internationally With Original Medicare

Made up of Part A and Part B , Original Medicare is the backbone of most retirees health-care coverage. But, for the most part, it doesnt cover you unless both your feet are firmly planted on US soil. The good news is that US soil includes popular destination territories such as Puerto Rico, the Northern Mariana Islands, Guam, American Samoa, and the US Virgin Islands.

There are a few exceptions. You could receive coverage in the following situations:

- You live in a border town in the US, but the closest hospital is in another country.

- You need emergency dialysis .

- Youre on a cruise ship within six hours of a US port with a US-approved doctor.

- Youre traveling to or from Alaska via Canada, and an emergency occurs. To receive coverage, you must be on a direct route and travel without delay.

If you receive coverage in one of these situations, be prepared to file your own insurance claims. Foreign hospitals arent required to file Medicare claims for you like US hospitals are.

Read Also: Who Is Eligible For Medicare In Georgia

Recommended Reading: Can You Get Medicare If You Retire At 62

Does Medicare Cover Air Ambulance Services

There are a variety of situations in which you might need some form of ambulance service. If youre injured in an automobile accident or a serious fall at home, for example, you might need to be rushed to an emergency room. In some cases, though, medical personnel might suggest an air ambulance. Since this is an expensive option, you might hesitate because youre not sure if Medicare coverage extends to air ambulance services.

Medicare Ambulance CoverageWhether you have Original Medicare Part A and Part B or are enrolled in a Medicare Advantage Plan, you may have some coverage for ambulance services. As a general rule, the plans strongly favor ground transportation ambulances because the service costs are substantially lower. That being said, Medicare Part B and Medicare Advantage plans will also cover air ambulance services in some cases.

Medically NecessaryThe defining question in terms of Medicare coverage for air ambulance services is this: Is it medically necessary? Your care must require immediate and rapid ambulance transportation that ground transportation cant provide. Medical necessity can look very different to a doctor than it does to Medicare. An example of medical necessity might be if you require a specialized, complex, time-critical surgery.

Related articles:

Some Types Of Medigap Plans Can Help Pay For Foreign Emergency Medical Care

While Original Medicare is limited in its coverage of emergency care received outside of the U.S. and U.S. territories, some Medicare Supplement Insurance plans provide coverage for emergency care received outside of the U.S.

These plans provide 80% coverage of the emergency care costs after you meet an annual deductible :

Recommended Reading: Will Medicare Pay For Drug Rehab

You May Like: Does Social Security Disability Qualify You For Medicare

Do Medigap Plans Cover International Travel

Medigap plans are supplemental insurance policies designed to cover the out-of-pocket expenses associated with Medicare, such as copays, coinsurance and deductibles. These plans, which are sold through private insurers, may also provide coverage for medical services or supplies received while traveling outside of the United States if theyre not reimbursable through Medicare.

Medigap Plans C, D, E, F, G, H, I, J, M or N cover medically necessary services for individuals who seek emergency treatment for an accident or illness during the first 60 days of a trip. Before coverage begins, beneficiaries must meet a $250 annual deductible, after which theyll be responsible for 80% of billed charges. The program has a lifetime cap of $50,000 for international travel emergency coverage.

Read Also: Are Lidocaine Patches Covered By Medicare

Medicare Advantage Coverage Overseas

Medicare Advantage is another way to get your Medicare coverage. Depending on the plan you choose, your plan may include vision, hearing, dental, and prescription drug coverage.

Medicare Advantage plans generally limit you to the doctors and facilities within a Health Maintenance Organization or Preferred Provider Organization and may or may not cover out-of-network care.

To buy a Medicare Advantage plan, you must already be enrolled in Medicare parts A and B. Coverage through a Medicare Advantage plan is offered through a private insurance plan.

Medicare Advantage plans may lower your out-of-pocket costs overall or provide additional coverage, such as when you travel.

There are no rules that dictate whether Medicare Advantage will cover a certain percentage of foreign hospital bills. Therefore, its important to check with your insurance carrier before you travel to know how much, if any, your individual plan covers international healthcare emergencies.

Read Also: Does Medicare Cover Cataract Surgery And Implants

Is Medicare Accepted Everywhere

Travel within the U.S.If you have Original Medicare, you have coverage anywhere in the U.S. and its territories. This includes all 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands. Most doctors and hospitals take Original Medicare.

Q: Will My Health Plan Cover Me If I Have A Medical Emergency While Overseas

A: More health plans cover this kind of care than routine care performed abroad. Even then, dont be surprised if you find out yours puts limitations on care for medical emergencies that happen when youre outside the U.S.

Talk to your insurer about what these exceptions or limitations may be before you travel.

You May Like: Can I Get Social Security Without Medicare

Can I Use Medicare For Medical Treatment On A Cruise

Just as with trips to a foreign country, Medicare will not cover your medical expenses that occur during a cruise. But there is a very small window, starting from when the cruise starts, during which you have Medicare protection:

- The present doctor is authorized to provide medical care to you

- The ship is still in US waters, not international waters, and

- The ship is within 6 hours away from a US port, regardless of whether it is an emergency or not. If you are more than six hours away from the port, then Medicare will not cover your medical expenses.

When Do Private Medicare Policies Fill The Gap

As a result, if you suddenly find yourself in need of medical or emergency care in a foreign country, you may have to pay 100 percent of the costs out of pocket unless you have a private Medicare Supplement Insurance policy, also called Medigap. In addition, youll need to scrutinize your prescription drug coverage in the same way. If you accidentally lose or misplace your medication while traveling, your current coverage may not be of much help.

Recommended Reading: When Does Permission To Contact Expire Medicare

Do I Need Travel Insurance If My Insurer Offers Overseas Health Insurance

When you’re planning an overseas trip, you should call your insurance company beforehand to ask if your plan includes overseas health insurance. Some do, some don’t, and some will cover you only in certain situations. The U.S. Department of State suggests some questions to ask your insurer, including:

- Does my plan cover emergency expenses abroad such as returning me to the United States for treatment if I become seriously ill?

- Do you require pre-authorizations or second opinions before emergency treatment can begin?

- Do you guarantee medical payments abroad?

While we can’t speak to what your specific insurance policy will cover overseas, here are the general policies of a few major insurers.

Anthem Blue Cross and Blue Shield does offer travel coverage, but draws a line between “urgent care” and “emergency care.” Emergency care, Anthem says, is requires by an injury or condition severe enough to result in “placing the Member’s physical and or mental health in serious jeopardy serious impairment to bodily functions or serious dysfunction of any bodily organ or part.”

“Urgent care,” on the other hand, “may not be covered to the same extent as emergency care.” For example, Anthem says, a fever not higher than 104° is considered urgent, not emergency care.

What Other Foreign Travel Emergency Coverage Is Available

Other policies provide some coverage for foreign travel emergencies:

Medicare Advantage. Some private Medicare Advantage plans cover foreign travel emergency care, but the coverage limits and details vary. Find out more about the Medicare Advantage plans available in your area by using the Medicare Plan Finder.

Travel insurance. While some travel insurance policies cover trip cancellations, others also cover emergency medical care in a foreign country and medical evacuation to a nearby medical facility or back to the United States for care. However, some travel insurance policies exclude preexisting conditions, so find out about exclusions, coverage limits and other details before choosing a policy.

Tricare for Life. If youre a military retiree, you may have foreign-country health care coverage through Tricare for Life after you enroll in Medicare. Tricare for Life typically covers Medicares deductibles, copayments and coinsurance, but it also provides some additional benefits, such as health care outside of the United States. It provides the same foreign travel coverage under Tricare that military retirees and dependents have before enrolling in Medicare. You pay any deductibles and copayments for that coverage.

Keep in mind

Read Also: Does Medicare Cover Inspire Sleep Apnea Treatment

Do I Need Health Insurance When Traveling Abroad

Even in countries with public health care, there may be specific treatments or medications that are not covered. In addition, if you are injured or become sick while abroad, you may need to be airlifted to a country with better medical facilities. This can be a costly proposition, and it is essential to make sure that you are covered in case of an emergency.

Chaperone/faculty Leader Replacement Rider

If you are a designated chaperone/faculty leader and experience an unexpected death of a relative, a medical emergency, or the destruction of your residence that causes you to cancel or interrupt your travel, purchase insurance that covers reimbursement for a round trip economy airline ticket up to $3,000 for a replacement chaperone/faculty leader.

Also Check: Can I Get Medicaid If I Have Medicare

What Does Medically Necessary Mean

According to Medicare, medically necessary refers to services or supplies that are required for the diagnosis and treatment of medical conditions, and must align with the standards of medical practice. Before embarking on any medical transport paid for by Medicare, a physician needs to certify that the trip is medically necessary.

For example, a patient with End-Stage Renal Disease will need a NEMT vehicle equipped with a dialysis machine for the medical trip. The term medically necessary also applies to a cystic fibrosis patient who needs a mechanical ventilator to go on a doctors appointment.

Medigap Plans With Foreign Benefits

Each of the 6 Medigap plans currently available that include coverage of foreign emergency care also include the following coverage:

Copyright 2022 TZ Insurance Solutions LLC. All rights reserved.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: What Is The Difference Between Medigap Insurance And Medicare Advantage