Ask An Expert: Tips For Working After Retirement

Liz Lopez

Liz Lopez founded her company, Captivate Your Audience Business Services, 13 years ago in Tampa Bay, Florida. She provides resume design, job search strategies, LinkedIn training and other services to clients who want to stand out in a competitive, 21st century job market.

Think about what you want to do. What brings you joy in the workplace? Too often professionals make themselves miserable because they go after what they think is available rather than what makes them happy.

Late career is a lousy time to be stuck in a job you dont enjoy. Figure out what feels rewarding, then do the research to determine what jobs or businesses align with your goals and skills.

Embrace how things work now. The job market changes constantly. There is more automation, its a lot less personal and it can move very slowly. By marketing yourself strategically, you can land an opportunity where you make a meaningful impact and leave a valuable legacy.

Be prepared to develop a resume, cover letter and LinkedIn profile that aligns with current job market trends. Then learn how to interview effectively via video. You need to powerfully show that you are relevant in todays world.

Focus on your history and achievements from the last 10 to 15 years. Otherwise, you can age yourself out of consideration if you insist on talking about work you did 30 years ago. Ageism is sadly very real.

Can You Have Medicare And An Employer

Yes, you can. If you become employed and are offered a group health plan, you can enroll in that plan while still keeping your Medicare coverage. In this situation. Medicare will function as your secondary payer, which means that they will cover you when your primary insurance doesnt.

This can be a good option for some, but it depends on your specific situation. Especially for those who receive premium-free Medicare Part A coverage, keeping that coverage is a no-brainer.

Understand Your Employers Health Coverage Costs

In the past, many employers offered health care with little or no premium required from the employee. Employees are now required to carry a bigger and bigger portion of the premium. It is important to not only know the employee portion of premium, but all other relevant costs like deductibles, coinsurance, and Maximum-Out-of-Pocket .

Recommended Reading: Can You Have A Medicare Advantage Plan And Va Benefits

What Are The Benefits Of Getting Medicare While I Am Working

If youre unhappy with your current insurance, you might prefer the Medicare coverage. For example, your private health insurance may restrict you to a small network of doctors, while 99% of nonpediatric physicians accept Medicare. Switching to Medicare may also save you money on out-of-pocket costs versus your existing plan.

Even if you like your current insurance, you can enroll in Medicare as well. If you work for a large employer, Medicare would typically be your secondary policy.

Theres little downside to enrolling in Part A. It covers hospital stays and skilled nursing care once youve paid the deductible , and its premium-free to anyone who worked for at least 40 quarters in Medicare-covered employment.

Do I Need To Get Medicare Drug Coverage

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, dont go 63 days or more in a row without Medicare drug coverage or other .

If you have other drug coverage: Ask your drug plan if its creditable drug coverage.

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information you may need it when youre ready to join a Medicare drug plan.

|

If you: |

|---|

Read Also: Does Medicare Cover Life Line Screening

Retirement Guidance: Can You Remain On Medicare If You Return To Work

Its not uncommon for people to leave the workforce and return later on. But what does this mean for your Medicare coverage? If your employer offers health insurance, you may be able to take it and remain on Medicare. One will act as primary coverage, while the other will act as secondary coverage, according to UnitedHealthcare. However, the size of the employer offering health coverage matters.

Find: How Much the Average Person Collects in Social Security

At companies with under 20 employees, workers generally need to be enrolled in Medicare once they reach the age of 65 to avoid paying extra later. If they go back to work for an employer with less than 20 employees, theyll want to keep both Part A and B because Medicare is primary and the group coverage is secondary, Danielle Roberts told CNBC, co-founder of insurance firm Boomer Benefits.

At larger companies, or those with 20 employees or more, there are a few more rules. CNBC noted that if employer coverage comes with a health savings account, you cannot contribute to it if you remain on any part of Medicare, including just Part A.

Related: How Much You Should Have in Your Savings Account at Every Stage of Life

Canceling Part A to take advantage of the HSA might not make much sense, either. If theyve already begun taking Social Security retirement benefits, they cannot cancel Part A without having to pay back all the benefits they received from Social Security so far, Roberts added.

What Is Cobra Insurance

About 20 years ago, Congress passed the COBRA bill, which stands for Consolidated Omnibus Reconciliation Act. The major aim was to provide families with some form of insurance safety net. Before the bill was passed, individuals that lost their health insurance when they quit their jobs or got fired had to find inexpensive individual insurance, quite a difficult feat.

There were times when getting insurance was impossible, particularly with individuals that had pre-existing conditions such as heart disease and diabetes. People had two options, either face exorbitant premiums or get turned down.

When COBRA was finally passed, it allowed individuals to extend their previous employer’s health insurance policy. They could benefit from the same coverage even though they were responsible for paying the coverage fees, rather than their former employers.

Your employer may decide to establish a COBRA group health plan instead of maintaining your previous plan. However, the COBRA group plan will cover inpatient and outpatient care, physician visits and prescription drugs, and visual and dental care and surgeries. It does not cover life insurance, nor does it include disability benefits. COBRA also covers a former employee’s partner or dependent children.

Read Also: What Is The Difference Between Medicare Supplemental And Advantage Plans

Understand Your Employers Drug Coverage

Currently employer prescription coverage is typically better than what an individual can get from Medicare. The formularies are usually broader and the copays are typically lower. Since prescriptions can be one of the biggest costs for those on Medicare, verifying drug costs could save you a lot of money in the long run.

While it is possible to have group insurance and Medicare, it generally doesnt make financial sense to have both. Secondary coverage doesnt provide much actual benefit. So when you are turning 65, try to gather all of the information needed to effectively compare your options. For example, you should know your state laws and talk with a trusted advisor. If you decide to keep group coverage, it would be advisable to compare the coverage to Medicare every year since both costs and benefits may change annually.

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency . Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Finding The Right Post

Retirement can be a great time to pursue what you love and make money at the same time.

Due to the pandemic, an increasing number of part-time jobs and side hustles can be done remotely at home, making them ideal for seniors.

According to a July 2020 research paper by Harvard University and University of Illinois professors, remote work is most common in industries with better educated and better paid workers.

More than a third of firms that switched employees to remote work said they think it will remain more common even after the COVID-19 pandemic ends.

Online tutoring, freelance content writing and customer service positions are just a few virtual ways older Americans can supplement their income.

And if youre not sure where to start, or need help finding a job, organizations like Goodwill Industries have expanded their online services to help people build resumes, polish dress etiquette and find employment at no cost to jobseekers.

According to Lauren Lawson-Zilai, senior director of public relations at Goodwill Industries International, 70 percent of locations have transitioned at least some of their career services online.

The future of work and skills is changing fast, Lawson-Zilai told RetireGuide.com. If youre only looking in your local classifieds for your next job, youre missing out on a large number of opportunities.

Also Check: Is Medicare Plan F Still Available

How Will My Current Employer Plan Work With Medicare

If you have Medicare and also have health insurance through your job, these plans will work together. The coverage through your job will pay for some services, and your Medicare plan might cover some other services. If you have questions about Medicare choices as an employed person, ask for advice from your current plan or benefits office.

Connect with experts

You Can Safely Delay Medicare Part B Enrollment If:

If you meet the two conditions, you can delay enrolling in Medicare for up to eight months after you have stopped working at the job that provides your current insurance.

You May Like: How To Find A Dentist That Accepts Medicare

What Is Substantial Gainful Activity

Social Security uses the term “substantial gainful activity” to describe a level of work activity and earnings. If you receive SSDI, Social Security uses SGA to decide if your eligibility for benefits continues after you return to work and complete your TWP. Social Security generally compares your monthly earnings to set amounts, known as earnings thresholds, to evaluate if your work activity is SGA.

After you start working, your Medicaid coverage can continue, even if your earnings become too high to receive SSI. Under the Continued Medicaid Eligibility Work Incentive ), you may qualify for continued Medicaid coverage when your SSI payments stop if you:

- Have been eligible for an SSI benefit for at least one month.

- Continue to be disabled .

- Meet all other non-disability SSI requirements, including the resources test.

- Need Medicaid in order to work.

- Have gross earned income that are below your state’s threshold of eligibility.

If your gross earnings are higher than your state’s threshold amount, Social Security can calculate your individual threshold amount if you have:

- A plan to achieve self-support .

- Publicly-funded attendant or personal care.

- Medical expenses that exceed the state per-capita amount.

In some states, through the Medicaid Buy-In Program you may be able to apply to buy Medicaid from the state Medicaid agency if you are disabled and no longer entitled to free Medicaid because you work. You may qualify if you:

Can My Medicare Part B Enrollment Start The Day My Work Coverage Ends

Yes, you should be able to enroll in your Medicare Part B a few months in advance and select a future Part B start date. That way you can time it that when your work coverage ends, your Medicare Part B all start at the same time. You should not have a gap when your work coverage has ended but your Medicare has yet to begin.

Read Also: How Old To Be Covered By Medicare

Medicare Private Insurance And Post

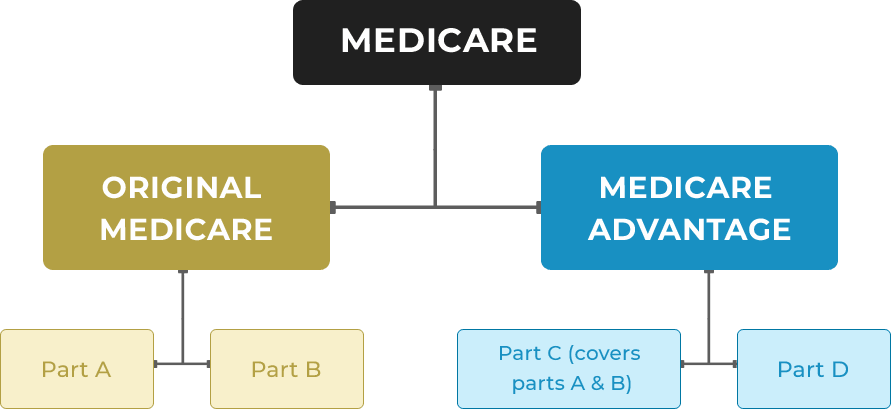

If youre 65 or older, you likely get health insurance from Medicare or a Medicare Advantage plan.

Original Medicare is made up of two parts Part A hospital insurance and Part B medical coverage. You may also choose to purchase a standalone Medicare Part D prescription drug plan or a Medigap supplement insurance policy.

Most people dont pay a monthly premium for Medicare Part A. But nearly everyone pays a monthly premium for Medicare Part B. In 2022, the Part B premium is $170.10.

If you return to work for an employer who offers private health insurance, you can take it and still keep your Medicare coverage. Youre allowed to have both.

Medicare may act as your primary coverage or your secondary coverage.

You may consider dropping Medicare Part B if you return to work. Some people do this to avoid paying the $170.10 monthly premium in addition to any employer health care costs.

However, this can be tricky. If youre not careful, you may owe penalties and face other issues down the road.

First, your employer must have more than 20 employees. If thats not the case, you may be penalized for dropping Medicare Part B.

If you have active employer coverage, you can choose to disenroll from Medicare Part B.

Once you lose your employer health insurance or return to retirement, you must sign up for Part B again within eight months.

Otherwise, you may face a lifetime late enrollment penalty.

Other Social Security Considerations

Its smarter financially to delay Social Security benefits until your full retirement age, Ross said.

Still, theres a couple ways to recoup at least some of those losses.

First, if your benefits were reduced because you made more than the income limits mentioned earlier, you actually get that money back eventually. It isnt gone forever.

Heres how it works.

Lets assume you take Social Security at age 62 and receive a monthly benefit of $1,000. At age 63, you decide to go back to work.

You work for 12 months and earn more than the $19,560 income limit. Your Social Security benefits are reduced to $500 for 12 months as a result.

Once you hit full retirement age, those 12 months of reduced benefits are paid back to you.

In this case, youd receive your normal $1,000 monthly benefit plus $500 for 12 months.

After that, your benefit goes back to your standard $1,000 a month.

Heres something else to keep in mind: Your Social Security check is based on your top 35 years of earnings.

If your latest year of work turns out to be one of your highest, Social Security will refigure your monthly benefit and you may see a boost in your check once you hit your full retirement age.

This is different than recouping your reduced benefits, and it likely wont affect you if you returned to work for a low-paying or part-time job.

For more information about working and Social Security benefits, check out the SSAs How Work Affects Your Benefits booklet.

Read Also: Is Spaceoar Covered By Medicare

Aged & Disabled Federal Poverty Level Medi

If you are not eligible for SSI, but you have a disability, you may be able to get Medi-Cal through the Aged & Disabled Federal Poverty Level Medi-Cal program. In order to qualify for A& D FPL Medi-Cal, you must:

- Be either aged , or disabled

- Have less than $2,000 in assets . Like SSI, this program does not count all of your assets. for a list of exemptions.

- Have less than $1,481 in countable monthly income for an individual .

Read here for more information on the Aged & Disabled Federal Poverty Level Medi-Cal program.

What If Im Disabled And Go Back To Work

If you are receiving Medicare and Social Security Disability Insurance , you can continue your Medicare coverage when going back to work for 93 months if you go off SSDI. You can receive a trial work period for 9 months to receive your SSDI payments in full. The trial work period lets you test your ability to work, but the 9 months do not have to be completed consecutively. As long as the work trial period is completed within a 60-month period and you continue to be disabled, then it will go into effect. Once the 9 months are completed, then the 93 months of Medicare coverage will begin.

The Medicare coverage will include premium-free Part A and you can continue payments for Part B. After the 93 months has ended along with the premium-free Part A, you can continue your Part A coverage by paying for the full premium.

If you have any questions or concerns about re-enrolling for Medicare, we are here to serve you. Give us a call at 698-2928 and set up an appointment today.

You May Like: Does Medicare Pay For Maintenance Chiropractic Care

What If I Only Want Coverage From My Employer

You have the option to drop your Medicare plan at any point in time if you are receiving healthcare benefits from your employer, but its important to know the outcome of doing so instead of dropping it immediately.

If your employer can provide you with coverage that could be considered a primary source, then you can drop your Medicare coverage and re-enroll when you feel its necessary. You wont receive any fees or penalties for doing so. If you choose to drop Medicare but your employer doesnt offer you creditable coverage, you will receive penalties for when you do choose to re-enroll again.