Can I Have Both Medicare And Employer Insurance

You can still retain your personal insurance policy even after enrolling for Medicare. However, you have to consider how much it will cost to maintain both plans and which plan healthcare providers will consider first for services. You must be aware of any complications regarding penalties for late Medicare enrollment if you have an ACA plan. You can learn more about the implications of having both ACA and Medicare here.

Can You Have Medicare And Private Health Insurance

Yes, you can keep your private health insurance plan even if you enroll in Medicare. However, it is important to review the costs you will incur by having two active plans . Additionally, you may need to find out which plan will get billed first for services.

In the case of ACA plans, your coverage would be considered duplicate. Medicare and ACA plans are not designed to coordinate benefits. So, medical costs would go to one plan or the other. Keeping your ACA plan may also mean dealing with late enrollment penalties for Medicare in the future.

Medicare Part A Coverage Details

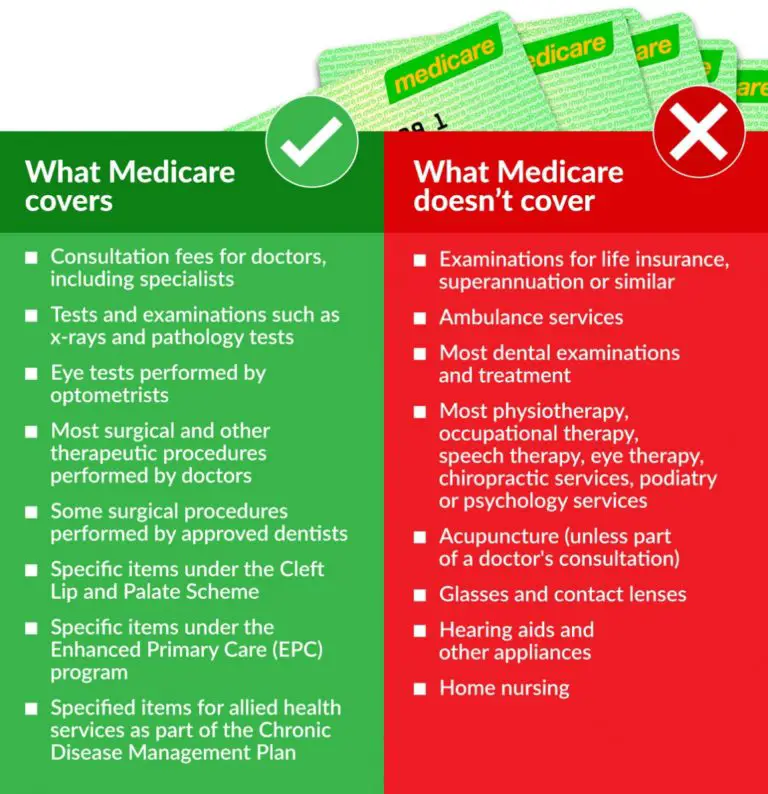

Medicare Part A, often referred to as hospital insurance, covers your inpatient healthcare costs. Most people will automatically become enrolled in Part A during their initial enrollment period if they already receive Social Security benefits. If you don’t want to enroll in Part A, you’ll have to contact Social Security.

Medicare Part A covers inpatient healthcare costs. This usually refers to hospitals, but can also refer to other inpatient settings, like hospices, skilled nursing facilities, and home care in some instances.

Most people will be able to receive premium-free Part A. This depends on how long youve paid the Medicare Tax. Medicare.gov contains many more details about Medicare Part A costs. Part A has a 20 percent coinsurance, and a deductible of $1,600 per benefit period in 2023.

Read Also: How Much Is The Cost Of Medicare Part B

How Much Does Medicare Advantage Cost

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Most have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium.

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The provider handles paying all your claims, and the cost of your plan is likely to change every year. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September, which goes into effect the following January 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

Medicare Vs Private Insurance: Dependents

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability. But in some cases, your spouse might help you qualify for certain coverage.

Also Check: Do I Need Part C Medicare

Can You Have Medicaid And Private Insurance At The Same Time

Because of the programs coverage limitations, many beneficiaries wonder if they can have Medicaid and private insurance at the same time. Ideally, this would allow the low-cost Medicaid program to provide basic medical care, while more comprehensive private insurance would be able to pick up some of the cost for higher-end services.

Unfortunately, as of 2020, Medicaid benefits are not compatible with private insurance coverage, and Medicaid beneficiaries are not allowed to carry private coverage in any state. An exception to this ban is Medicare coverage for seniors. Many seniors with limited income and assets are able to supplement their Medicare benefits with a Medicaid policy that plugs some of the coverage gaps, especially in seniors Part D prescription drug coverage. Seniors who are interested in using Medicaid as a Medicare supplement should be aware that many states Medicaid programs reserve the right to recover some costs from beneficiaries estates after they pass away, which could create financial issues for heirs.

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

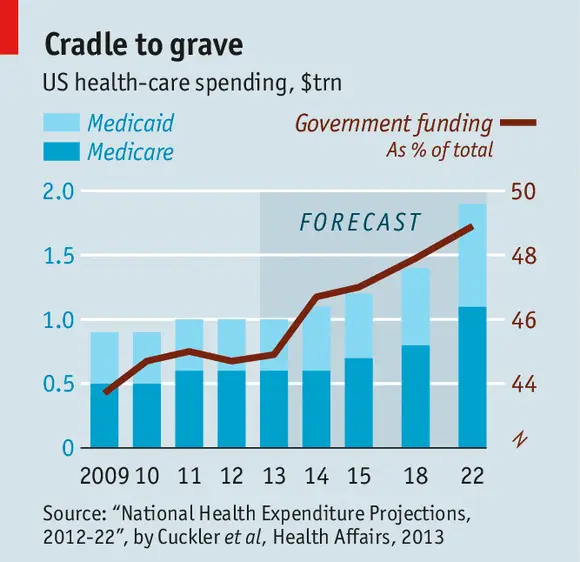

Medicare provides healthcare coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are age 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

Also Check: Does Medicare Advantage Cover Dialysis

Medicare Vs Private Insurance: Costs

When it comes to Original Medicare, the costs associated are fairly clear-cut and uniform. Most individuals qualify for premium-free Medicare Part A and pay a standard Part B premium . In addition to premiums, youll pay the following in 2022 for Medicare costs:

- Part A deductible: $1,556

- Hospital days 60-90: $389 per day

- Hospital days 91-120: $778 per day

- Skilled nursing facility days 21-100: $194.50

However with Medicare, you can enroll in a Medicare Supplement plan to cover most if not all of these costs. The nationwide average premium for these plans is about $150 per month.

In addition to Medicare Supplement insurance, you can elect to enroll in Medicare Part C. These plans work similarly to private insurance and combine your Medicare benefits into one program. Similar to Original Medicare, these plans have copays, coinsurance, and out-of-pocket expenses.

Private health insurance varies widely in terms of costs and out-of-pocket expenses. Prices for private insurance can include premiums, copays, coinsurance, deductibles, and out-of-pocket maximums. All of these potential costs will vary depending on the plan however, youll most likely pay more in terms of monthly premiums.

Depending on your income, Medicare Part B can become as costly as private insurance.

Medicare Is Usually Cheaper

When you enroll in Medicare, youre getting the same quality coverage regardless of which insurance provider youre working with. This is because all Medicare plans offer the same types of coverage and provide the same types of protection. The only difference between policies is the provider you choose to work with and the prices they charge for coverage.

This means youll want to shop around and use this MedicareWire tool to compare plan coverage before you commit to an agreement.

Once you do, youll typically save money with a Medicare plan compared to what youd spend with private insurance. Your deductibles will usually be lower and your insurance will cover more treatment options.

When you enroll in a private insurance policy, youre subject to the terms of that policy. Its not backed by the government and its up to the insurance provider to determine your maximum out-of-pocket costs for your coverage. The quality of that coverage varies widely and youll often end up paying a higher premium rate for better quality coverage as long as youre enrolled.

Also Check: Does Aetna Medicare Advantage Have Silver Sneakers

Medicare Vs Private Insurance: Premiums And Costs

Generally, private insurance companies can raise your premium based on three things that donât affect your Original Medicare premiums.

- Age: private insurance companies can charge premiums for older people up to three times higher than premiums for younger people, according to Healthcare.gov.

On the other hand, most people who qualify for Medicare donât pay a premium for hospital insurance . Most people with Medicare do pay a premium for medical insurance but this premium does not go up or down depending on your age.

- Location: According to Healthcare.gov, where you live has a big effect on your premiums from private insurance companies. The Medicare Part A and Medicare Part B premiums are the same regardless of your location in the USA.

If you get any type of Medicare coverage from a private insurance company, such as Medicare prescription drug coverage, a Medicare Supplement plan, or a Medicare Advantage plan, these premiums may vary from location to location. Premiums and other costs may also be different among insurance companies.

- Tobacco use: igarette use will not increase your Original Medicare premiums. However, according to Medicare.gov, Medicare Supplement plans may offer discounts to non-smokers.

Is Medigap Better Than Advantage

Medigap and Medicare Advantage plans provide many different benefits, depending upon health care needs. Medigap plans provide additional coverage for Medicare users who do not currently have a prescription drug plan. Similarly, Medicare Advantage plans offer similar insurance benefits to original Medicare, as well as additional benefits such as prescriptions and vision.

Don’t Miss: Do I Have To Pay For Medicare On Ssdi

Think About What Your Total Costs Could Be

Your total costs will vary based on the coverage you choose and the health services you use. But consider the below specifically when comparing which option fits your financial situation best.

- You get built-in financial protection with Medicare Advantage. The annual out-of-pocket limit provided can help keep your costs under control.

- Your premiums may be higher with Original Medicare. You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan or other additional coverage.

- You may pay more copays with Medicare Advantage than with Original Medicare. Depending on the health care services and providers you use, your copays could be more with a Medicare Advantage plan if costs vary in-network versus out-of-network.

- Medicare Advantage provides financial protection with an annual out-of-pocket limit. You can add protection to Original Medicare by buying a Medicare supplement plan.

- You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan and/or a Medicare supplement plan.

Most Healthcare Providers Accept Medicare

Medicare gives you many options regarding access to doctors, hospitals, specialists, and healthcare providers since its a Federal government program. Original Medicare allows you to get services from any provider who accepts the program. With a Medicare Supplement plan from an insurance company, you can choose the service thats right for your needs. Youll pay lower out-of-pocket costs like deductibles and copays.

Conversely, employer insurance plans have a limited number of hospitals and health providers they contract with, forming a network of individuals and locations. Outside this network, you get no or limited coverage from your health insurance provider, making it difficult to get an appointment, even though you have insurance. For instance, astudy by The Commonwealth Fund shows that 9 percent of individuals with employer insurance struggled to get a referral to a specialist compared with 2 percent of 65-plus individuals with Medicare.

Don’t Miss: Do Any Medicare Supplements Cover Dental

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated November 29, 2022

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Need Help With Medicare?

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Medicare Vs Private Health Insurance: Out

The next thing you may consider are your annual out-of-pocket costs. These include copays, coinsurance, and deductible amounts. Medicare has leverage to negotiate with healthcare providers as a national program, while private health insurance plans negotiate as individual companies. This negotiation lowers the amount that a healthcare provider can charge you. Youll see these negotiated prices reflected in lower copays and coinsurance charges.

You should also consider deductibles when looking at Medicare vs. private health insurance.

| Medicare Deductibles | ||

|---|---|---|

| The Medicare Part A deductible is $1,556. The Medicare Part B deductible is $233.3 | On average, an employer insurance plan will have an annual deductible of $1,400.5

This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons. |

On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730.6 This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons. |

Read Also: Is Medicare Medicaid The Same

Private Dental And Vision Plans

If you have Original Medicare, you wont receive dental or vision coverage. This is coverage that most people need, so its important to make sure you have a plan to get this coverage somehow.

Although Part C plans sometimes cover dental and vision, you may not want a Part C plan otherwise. In this case, you should look for a private dental and vision plan that works for you. You are free to purchase a private dental and vision plan that you choose for yourself.

The important thing to keep in mind here is that you should time your coverage so you dont experience a coverage gap. As you transition from your private healthcare plan to Original Medicare, have a dental and vision plan ready, or else you could be uninsured for a period.

What Are The Benefits Of Medicare Supplement Plans

Medicare supplement plans help you reduce the need for healthcare expenses. According to Jacobson, cost-sharing has helped to make it easy for people to get care without worrying that they owe money every time they visit their doctor. It’s possible to go anywhere you wish. I’ve seen almost every doctor.. For instance in Arizona, you could fly to Minnesota and see the Mayo Clinic. Jacobson says the benefit is more important for those who are sick.

Also Check: When Can You Start Collecting Medicare

Private Insurance Reimbursement Rate Vs Medicare

All health insurance plans set their own reimbursement rates for various medical services. In order to be in the insurance plans network, the provider has to agree to accept these payments.

In general, a private insurer will pay significantly more for a covered service than Medicare does. A 2020 study found private insurers pay almost 200% of Medicare rates on average. That means that private insurance is more attractive to medical providers. However, that doesnt stop doctors from accepting Medicare in fact, 93% of primary care physicians accept Medicare.

Medicare Part D Prescription Drug Plans

Original Medicare does not cover prescription drugs, with very few exceptions. If you need prescription drugs of any kind, you should make sure you have a Part D prescription drug plan.

Part D plans are offered by private insurance companies. This means that they vary in price and coverage, unlike Original Medicare. When you look for a Part D plan, make sure that you look at the plans formulary. This refers to a tiered list of drugs that the plan covers.

Usually, brand-name drugs will be higher on the list and will cost you more out-of-pocket when compared to generic drugs. Plans are defined by their formularies, so never decide on a plan without confirming that the drugs you need are available on their formulary at a cost you can deal with.

Also Check: Does Kaiser Medicare Cover Hearing Aids

Medicare Payments And Provider Costs

To assess the adequacy of Medicares hospital payment rates, MedPAC regularly compares the programs payments to hospitals care delivery costs. Their findings show that, across all hospitals over the period from 2010 to 2018, costs for the treatment of Medicare beneficiaries have exceeded Medicare payments, resulting in negative and declining aggregate Medicare margins .87 Both MedPAC and American Hospital Association analyses show aggregate all-payer hospital margins have remained positive between 6% and 8% during the same period due to the contribution of private payers.88,89 Somehospital industry groups and researchers see these data as evidence that higher payment rates from private insurers are necessary to offset the financial strain of Medicares relatively low rates.90

Figure 6: Medicare Margins are Negative Overall, but Have Been Positive for Relatively Efficient Hospitals Until Recently