What Is The Maximum Cost Of Medicare Part B

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B deductible. After your deductible is paid, youll need to pay coinsurance for each visit or service. This is often 20% of the Medicare-approved cost. Original Medicare does not have an out-of-pocket maximum, so theres no limit to how much you could end up paying for Medicare Part B.

Your cost may go up even more if you dont sign up for Medicare when youre first eligible Medicare Part B has a 10% penalty for every 12-month period you werent enrolled in Medicare but were eligible. Youll pay this enrollment penalty as long as youre enrolled in Part B.

There are options for lowering the overall cost of Medicare Part B. Medicare Supplement Insurance has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs. Medicare Advantage is Medicare coverage offered by private insurance companies and often has different costs for Part B coverage than Original Medicare.

Medicare Part B Vs Medicare Part C

Since Original Medicare do not cover everything, some Medicare recipients opt for Medicare Part C. Also known as Medicare Advantage, these health insurance policies are provided by Medicare-approved private health insurance companies and may cover additional services â like dental or vision care â or help lower out-of-pocket expenses.

However, to get a Medicare Advantage plan, you still need to enroll in Original Medicare and pay your Medicare Part B premium in addition to the Medicare Advantage premium. The exact cost and benefits will depend on the insurer and the plan that you choose. Part C plans often operate like private health insurance plans and may come with their own restrictions on how to use them.

Read more about Medicare Part C.

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Read Also: Is My Spouse Covered Under My Medicare

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Rittenhouse’s Mother Gives Eyebrow

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey and controversial new Alzheimer’s drug.

Don’t Miss: Are Medicare Advantage Plans Hmos

Who Pays More For Medicare Part B

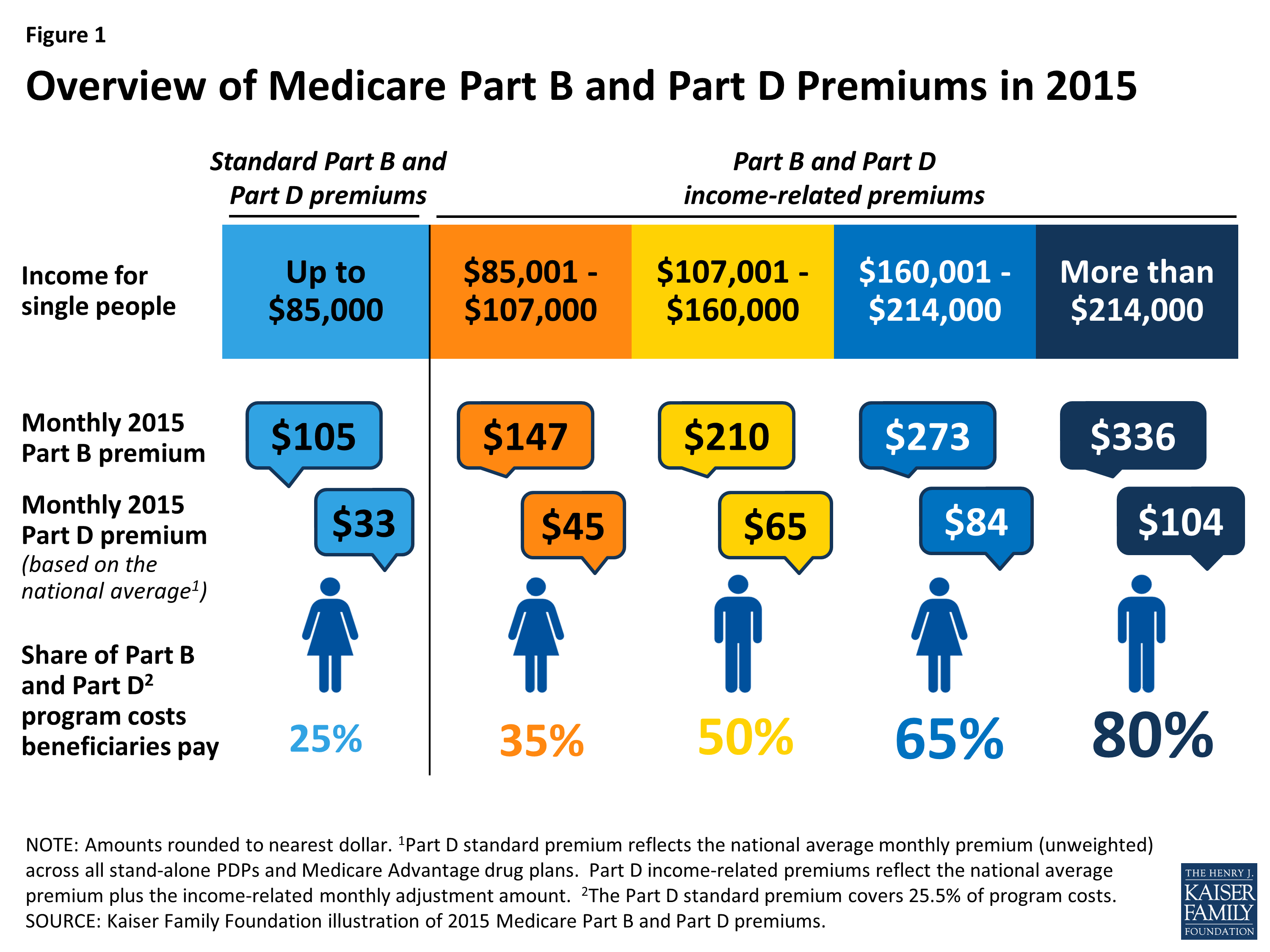

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

If your income is above those levels, the government shifts more of the premium cost to your personal balance sheet. Instead of covering 75% of the premium cost, the government pays anywhere from 65% to as little as 15% of the premium, based on your IRMAA.

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

Is Medicare Part B Right For Me

Medicare Part B coverage is right for you if you are currently not working and do not want to enroll in a Medicare Advantage plan.

In order to decide if you should enroll in Medicare Part B, you must first look at your health insurance situation before you turn 65 years old. This will help you determine if Medicare Part B makes sense for your health care situation. However, in most cases an individual will automatically or manually enroll in both Medicare Part A and B during their initial enrollment period. Then, they may select Medicare supplement policies, which would fill in the coverage gaps.

One situation in which you may decide to delay your enrollment is if you are still working. In this case, you can opt to continue on your employer group health insurance plan and not enroll in Medicare Part B.

In this case, you can avoid paying the late enrollment fee if that employer policy is a qualified health insurance plan as defined by the IRS. You should, however, confirm with your company’s benefits manager that the health plan does qualify before you decide to push your Original Medicare enrollment.

Don’t Miss: Will Medicare Pay For A Patient Lift

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan . Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Is Medicare Part B Free

Medicare Part B premiums may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

The standard monthly Part B premium: $148.50 in 2021.

If your income exceeds a certain amount, your premium could be higher than the standard premium, as there are different premiums for different income levels.

See below for more details about the Medicare Part B premium.

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnt enroll in Part B.

| Medicare Part B monthly premium in 2021 |

| You pay |

| $412,000 or more |

Also Check: What Is A Medicare Discount Card

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $148.50 in 2021. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2021 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2021, the Part B premium is $148.50.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

You May Like: Does Humana Offer A Medicare Supplement Plan

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while it’s easy to argue that seniors will still come out ahead financially, let’s also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes won’t take seniors’ entire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. That’s a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.

Medicare Part B Premiums

Each year, Medicare Part B premiums can go up or down. How does the 2021 Medicare Part B premium stack up? Heres a breakdown:

- Medicare Part B premium 2018: $134

- Medicare Part B premium 2019: $135.50

- Medicare Part B premium 2020: $144.60

- Medicare Part B premium 2021: $148.50

Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

If your individual or joint income is above the standard bracket, you may pay an Income-Related Monthly Adjustment Income-Related Monthly Adjustments determine the premium costs for Medicare Part B and Part D based on your income.. Find your IRMAA rate for 2021 below:

Annual income: Individual & Joint

- IRMAA: $0

Annual income: Individual & Joint

- IRMAA: $59.40

Annual income: Individual & Joint

- IRMAA: $148.50

Annual income: Individual & Joint

- IRMAA: $237.60

Annual income: Individual & Joint

- IRMAA: $326.70

Annual income: Individual & Joint

- IRMAA: $356.40

- Part B premium: $504.90

You May Like: Does Medicare Cover A1c Test

How Much Does Medicare Cost

The amount of money youll need to spend on Medicare depends on several factors, including the type of coverage you choose, when you enroll, your annual income, the amount of medical services you need, and whether you have other health insurance. Your costs include your premiums , deductible , and coinsurance or copayments .

- Late-enrollment penalty.

Is Prolia Covered By Medicare

- Is Prolia covered by Medicare?’ Learn about the cost of this osteoporosis drug and how much you can expect to pay for it if your doctor prescribes it for you.

The National Osteoporosis Foundation reports that roughly 10 million Americans have osteoporosis and that an additional 44 million people suffer from decreased bone density and may develop the disease in the future. Osteoporosis puts you at an increased risk for debilitating fractures, but there are treatments available to lower the likelihood of injury due to a fall or other accident. Prolia is approved by the U.S. Food and Drug Administration to treat bone loss and minimize fracture risk. In many cases, Medicare covers Prolia to make treatment more affordable.

Read Also: How To Replace A Medicare Health Insurance Card

Find Cheap Medicare Plans In Your Area

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

In 2021, the standard monthly premium for Part B is $148.50, which is either deducted from your Social Security benefits or paid out of pocket. Part B coverage makes sense for most individuals due to its cheap monthly premiums, but you should evaluate your current health insurance coverage before enrolling in the federal plan.

How Much Does Medicare Part B Cost

Medicare consists of several different parts, including Part B. Medicare Part B is medical insurance and covers medically necessary outpatient care and some preventative care. Together with Medicare Part A , it makes up whats called original Medicare.

If youre enrolled in Part B, youll pay a monthly premium as well as other costs like deductibles and coinsurance. Continue readingto take a deeper dive into Part B, its costs, and more.

Recommended Reading: How Does Medicare Supplement Plan G Work

Premiums Deductibles And Copays Will Be Highermedicare Changes For 2022

This article is reprinted by permission from NerdWallet.

Video: Traditional Medicare Premiums Will Soar in 2022

Open enrollment for Medicare goes from Oct. 15 to Dec. 7 each year, when Medicare beneficiaries choose their coverage for the next plan year. As Medicare enrollees contemplate their choices for 2022, here are overall Medicare changes to keep in mind.

Original Medicare costs are going up

Original Medicare includes Part A and Part B. A separate Medicare drug plan, called Part D, is also available. Heres how deductibles, premiums and coinsurances are changing in 2022:

Medicare Part A

Although most Medicare beneficiaries dont pay a premium for Medicare Part A, those who do will see higher costs, paying $499 a month in 2022, up from $471 a month in 2021. This premium applies to you if you worked and paid Medicare taxes for less than 30 quarters. If you worked and paid Medicare taxes for 30 to 39 quarters, youll pay $274 a month for Part A in 2022, up from $259 in 2021. If you paid Medicare taxes for 40 quarters or more, you wont owe a premium.

The Part A inpatient hospital deductible is increasing to $1,556 in 2022 for each benefit period, up from $1,484 in 2021. Coinsurance is also rising as follows:

Coinsurance for skilled nursing facility care will remain at $0 for days 1 to 20 for each benefit period, and will be $194.50 per day for days 21 to 100 of each benefit period in 2022, up from $185.50 per day in 2021.

Medicare Part B

Medicare Part D