How To Enroll In Medicare Part D

Typically, if you qualify for Medicare, you qualify for Part D prescription drug coverage. But its important to keep in mind that you must enroll in Part D coverage only in a few specific periods:

- Your Medicare Initial Enrollment Period : You can enroll in a Part D plan in the 3 months you turn 65, the month of your 65th birthday or 3 months after.15

- The Medicare Annual Enrollment Period : This runs from Oct. 15 to Dec. 7 every year. During the AEP, you may make changes to your Medicare Part C and Part D coverage. They will take effect on Jan. 1 of the following year.16

- The Medicare Advantage Open Enrollment Period : This lasts from Jan. 1 to March 31 each year. You may add, drop or change your Part D coverage during this time.17

- Special Enrollment Period : You may be able to enroll in a new Part D plan if youre eligible for an SEP. You may qualify for an SEP under certain circumstances, such as if you make changes to a job-based drug coverage plan, or if you have or lose Extra Help.18

How Does A Tiered Formulary Work

Many plans have a tiered formulary where the plan’s list of drugs are divided into groups based on cost. In general, drugs in low tiers cost less than drugs in high tiers. Additionally, plans may charge a deductible for certain drug tiers and not for others, or the deductible amount may differ based on the tier.

Formulary tiers:

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

Read Also: When Will I Be Eligible For Medicare

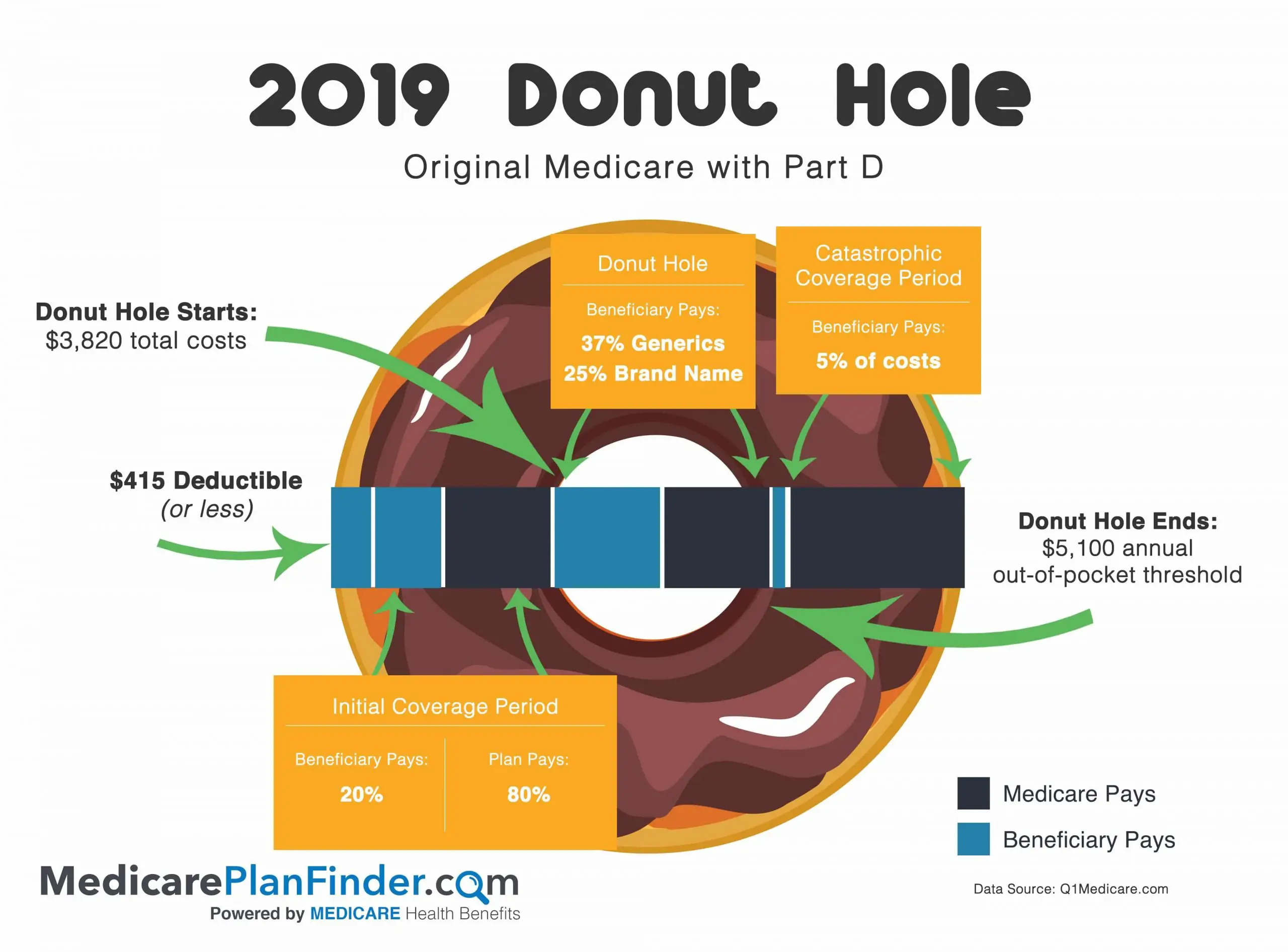

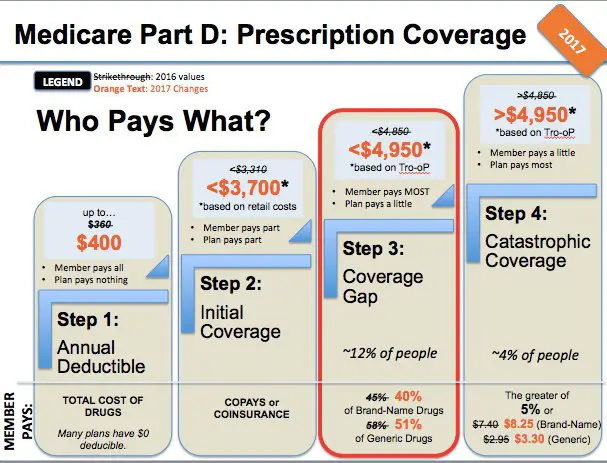

What Is The Medicare Part D Coverage Gap

Most Medicare Part D plans have a coverage gap, also called a donut hole. This coverage gap happens when youve reached the limit of what your Part D plan will pay for your prescription drugs. This limit is lower than your catastrophic coverage amount, however, which means that you will have a gap in your coverage.

Heres how the coverage gap for Medicare Part D works in 2021:

- Yearly deductible. $445 is the maximum deductible that Medicare Part D plans can charge in 2021.

- Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

- Catastrophic coverage. The catastrophic coverage amount kicks in once you have spent $6,550 out of pocket in 2021.

So, what happens when youre in the coverage gap of your Part D plan? That depends on the following:

First Of All What Is Medicare Part D

All across the nation, many Medicare beneficiaries rely on prescription medications to maintain their quality of life. This includes those over the age of 65 and those who have been diagnosed with certain diseases or disabilities.

Medicare Part D is primarily focused on Medicare drug coverage, and is responsible for helping you pay for the costs associated with prescription medications. Like Medicare Advantage, Medicare Part D plans are offered by private insurance providers.

As a result, the exact pricing, benefits, and drugs you are eligible to receive coverage for can vary from plan to plan , but most common outpatient drugs can be covered by Medicare Part D. Medicare Part D coverage can usually be bundled into a Medicare Part C plan, but Part D can also be had as a standalone plan as well.

Recommended Reading: Which Type Of Care Is Not Covered By Medicare

How Can I Get Help With My Prescription Drug Costs

Medicare beneficiaries who have trouble meeting prescription drug costs may benefit from the Extra Help program. Extra Help is a Medicare Part D program that assists in paying premiums, deductibles, and coinsurance costs associated with your prescription drug plan.

To qualify for Medicare Extra Help, your resources must not exceed a set total amount. Your resources include cash on hand or in the bank, savings, and investments. If you qualify for Extra Help, you can apply through your prescription drug plan with supporting documents, such as an official Medicare notice.

Even if you dont qualify for Extra Help, you may still qualify for Medicaid. Medicaid provides healthcare coverage for people with low income who are under age 65. However, some Medicare beneficiaries are also eligible for Medicaid coverage, depending on income level. To see if you qualify for Medicaid, visit your local social services office.

How Does Medicare Part D Work

Part D adds prescription drug coverage to your existing Medicare health coverage. You must have either Medicare Part A or Part B to get it. When you become eligible for Medicare , you can elect Part D during the seven-month period that you have to enroll in Parts A and B.

If you dont elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty that permanently increases your Part D premium.

For Part D coverage, youll pay a premium, a deductible, and copays that differ between types of drugs. Drugs covered by each Part D plan are listed in their formulary, and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

The drugs in the plans formulary may be further placed into different tiers that determine your cost. What tiers are called and what they include can differ between plans, but heres an example:

- Tier 1: The most generic drugs with the lowest copayments

- Tier 2: Preferred brand-name drugs with medium copayments

- Tier 3: Non-preferred brand name drugs with higher copayments

- Specialty: Drugs that cost more than $830 per month, the highest copayments, for years 2022 and 2023.

Beginning in 2022, some plans may offer a second, lower-cost specialty tier.

Also Check: Is Viberzi Covered By Medicare

What Is The Medicare Drug Plan Tier System

To accommodate all budgets and needs, plans may offer tiered formularies. While tiers may be divided differently from plan to plan, lower tiers generally represent less costly medications, and upper tiers covering higher-cost brand-name options.

Though your plans tier system may be different, here is an example of how one might work:

- Tier 1 is the lowest copayment option and likely consists of mostly generic prescription medications.

- Tier 2 is a medium copayment option and may represent preferred brand-name prescription drugs.

- Tier 3 is a higher copayment, with nonpreferred brand-name prescription drugs

- Tier 4, or Specialty Tier, is the highest copayment and represents the highest-cost prescription medications

But there are exceptions to this, such as if your health care provider feels you need a drug from a higher tier group, rather than a similar one in a lower group. In this case, you or your doctor may ask for an exception for a lower copayment for an upper-tier drug. This needs to go along with a supporting statement from your doctor or prescriber describing the medical reason for the higher-cost drug.

But no matter your income level or prescription drug needs, Medicare Part D is likely to have a plan to fit them.

Help With Paying For Your Prescription Drugs

You can save costs with original Medicare if you have a Medigap plan to help pay some of your out-of-pocket costs.

Depending on the medications you take, its a good idea to do a cost comparison between Part D with Medigap and a Medicare Advantage plan that includes prescription drug coverage.

Medicare also has a program called Extra Help for people with limited resources or who need help paying their Part D costs. You may qualify if you meet income requirements, are on Medicaid, or meet other eligibility standards.

Some pharmaceutical companies offer medications at a reduced cost for people who qualify. If youre having trouble paying for your prescription medication, try contacting the manufacturer to see if they have an assistance program.

You May Like: How Can I Pay My Medicare Bill Online

Does Medicare Part B Cover Prescriptions

There is very limited prescription drug coverage under Medicare Part B. Part B generally covers medications given by injection or infusion, either at home by a home health provider or in an outpatient setting such as a doctorâs office or emergency department.

For example, if you go to the doctor because you were bitten by a dog, your doctor may order antibiotics to prevent infection as well as the rabies shot. If you get a rabies injection during the visit, Medicare Part B typically covers it. If the doctor prescribes oral antibiotics for you to take at home, Part B would not pay for your medications.

Medicare Part B also pays for prescription drugs used with durable medical equipment such as a nebulizer machine or infusion pump. If you have lung disease and need nebulizer treatments at home twice a day, Part B covers the medications that go in the machine. On the other hand, if you use a hand-held inhaler for your lung disease, it is typically not covered.

Finally, there are a few situations in which Medicare Part B pays for oral medications you take at home. Oral chemotherapy drugs, as well as prescription drugs used to manage nausea during cancer treatment, are generally covered. Oral prescription drugs for treatment of end-stage renal disease are usually covered, as are immunosuppressant medications used after organ transplant surgery.

How Do You Move Forward With Part D

As you get close to the time for entering Medicare, it is a good idea to learn as much as you can about the program and its benefits. Youll want to decide whether you need a standalone Part D plan, or figure out if a Medicare Advantage plan with drug coverage is best for you.

It is always wise to compare quotes for any plans that you are interested in, while making sure that they cover your preferred doctors and any drugs that you are currently taking.

AgingInPlace.org keeps our resources free by working as an affiliate partnerwith some companies mentioned on our site. We may earn a commission when you click on certain product links.

You May Like: Will Medicare Pay For Alcohol Rehab

What Is Not Covered By Medicare Part D Plans

The drugs you take may not be covered by every Part D plan. You need to review each plans drug list, or formulary, to see if your drugs are covered. The following will not be covered:

- Drugs not listed on a plan’s formulary

- Drugs prescribed for anorexia, weight loss or weight gain

- Drugs prescribed for fertility, erectile dysfunction, cosmetic purposes or hair growth

- Prescription vitamins and minerals

- Non-prescription drugs

- Drugs that are already covered by Medicare Part A and Part B

The Long Wait For New Benefits

More than a decade passed before there was another major effort to introduce prescription drug coverage under Medicare. Even though the Democrats controlled both the legislative and executive branches of government in the wake of the Watergate scandal and the election of President Jimmy Carter in 1976, the energy crisis, a weak economy, and rising inflation precluded costly new initiatives . Inflation and growing unemployment were threatening the solvency of Social Security, and Congress responded by raising payroll taxes in 1977. Richard Himelfarb observed that

the economic troubles of this period transformed the politics of federal programs serving the elderly. Whereas the 1960s and early 1970s had been marked by significant expansion of federal aid to the aged, the late 1970s and 1980s constituted an era of scarcity in which public officials struggled to maintain the gains of an earlier era. In short, from the Carter years onward, legislators would face no more easy votes on programs affecting the elderly.

You May Like: How Much Does Medicare Pay For Knee Replacement

Costs You Could Pay With Medicare Part D

With stand-alone Part D plans, you will pay a monthly premium and may also pay an annual deductible, copays and coinsurance.

Some plans charge deductibles, some do not, but Medicare sets a maximum deductible amount each year. In 2022, the annual deductible limit for Part D is $480.

Copays are generally required each time you fill a prescription for a covered drug. Amounts can vary based on the plans formulary tiers as well as what pharmacy you use if the plan has network pharmacies.

Some plans may also set coinsurance rates for certain drugs or tiers. In this case the plan charges a percentage of the cost each time you fill a prescription.

D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

You May Like: What Age Can I Qualify For Medicare

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

Eligibility And Enrollment: Part B Vs Part D

Not everyone who turns 65 years of age must have Medicare. Some people may continue to work and choose to use their employers health insurance or their spouses insurance. In these instances, a person must send documentation to the Centers for Medicare & Medicaid Services to show that they have appropriate medical insurance coverage.

If a person is no longer eligible for their own or their spouses employers health insurance, they may qualify for a special enrollment period during which they are still able to enroll for Medicare coverage.

A person should enroll in Medicare parts B and D when they are first eligible. Waiting until after the initial enrollment period , which ends 3 months after the month in which a person turns 65, could result in additional penalties for the monthly premiums.

Unlike some private insurance plans, Medicare accepts all individuals who qualify without considering preexisting health conditions.

Also Check: Does Medicare Cover Retirement Home

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.16

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.