Can I Get Benefits That Pay For Services Medicare Does Not Cover

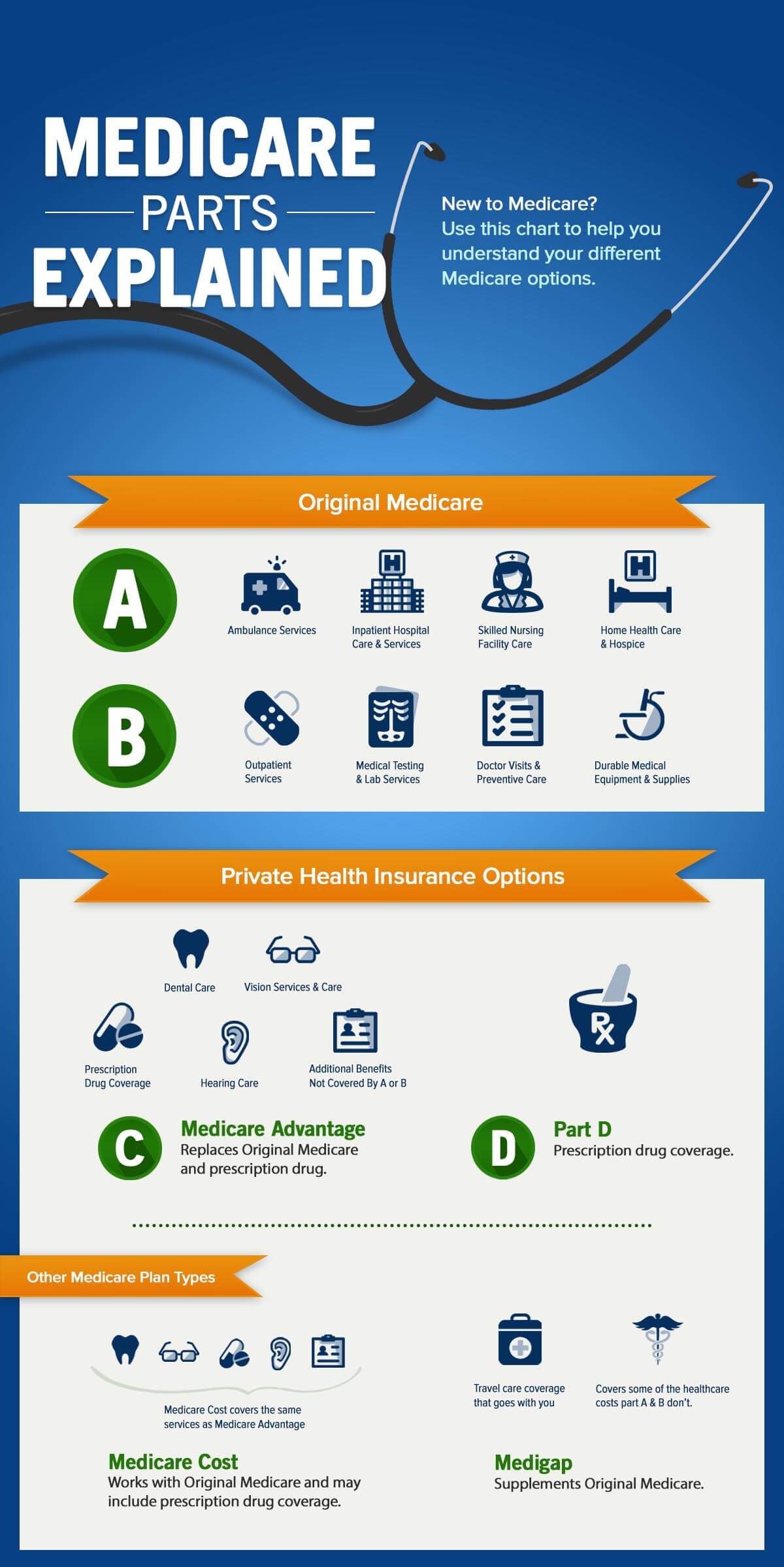

Medicare Advantage plans may be an option to consider since they are required to have at least the same level of coverage as Original Medicare, but may have other benefits, such as routine vision, dental, and prescription drug coverage. Hospice services are covered directly under Medicare Part A instead of through a Medicare Advantage plan. You need to keep paying your Part B premium .

What Kinds Of Health

- May 31, 2020

Q: What kinds of health-related services are not covered by Medicare?

A: Medicare beneficiaries receive comprehensive coverage for most health issues and the treatment of acute illness, but there are some expenses Medicare doesnt cover. To make sure you are covered for some of these services, you may choose to purchase additional insurance. Heres what you need to know:

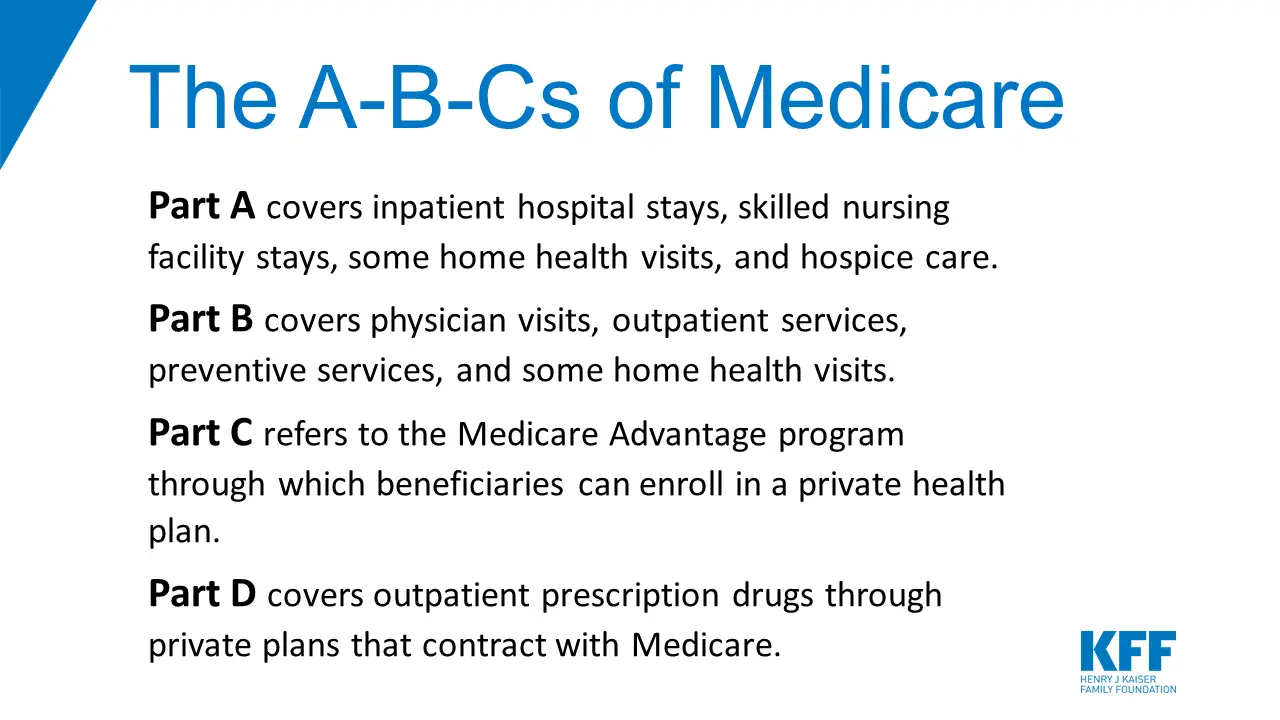

What Is Medicare Part A What Does Medicare Part A Cover

Medicare Part A is hospital insurance. Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments. Additionally, this includes inpatient care that received through:

- Acute care hospitals

- Mental health care

- Participation in a qualifying clinical research study

Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

Medicare Part A covers the entire cost for covered home health care services. As mentioned, if you need durable medical equipment and itâs ordered by your doctor this is covered under Medicare Part B and you are responsible for 20% of the Medicare-approved amount.

Skilled nursing facility stays are covered under Medicare Part A after a qualifying hospital inpatient stay for a related illness or injury. To qualify for SNF care, the hospital stay must be a minimum of three days, beginning on the day you are formally admitted as an inpatient. The day you are discharged does not count towards this minimum three-day requirement. Time spent under observation as an outpatient also does not count towards your qualifying stay.

Read Also: What Is A Medicare Ppo Plan

Services Medicare Doesnt Cover

Though Medicare can be a huge help in covering home health care, it doesnt cover everything. Here are some of the services that arent included as part of these benefits:

- Around-the-clock care

- Meal delivery

- Personal care services if you dont also require skilled medical care or therapy

- Homemaking services if you dont also require skilled medical care or therapy.

Before your care starts, your Medicare-certified home health agency should present you with a breakdown of the charges and what Medicare will pay. This notice should also include how much youll be required to pay out of pocket.

If the agency wants to provide care that isnt covered, its required to give you an Advance Beneficiary Notice . This notice explains the treatment plan, directions for getting Medicare to decide on coverage, and instructions for filing an appeal.

Checklist And Counseling Information:

Long term care insurance agents are required to leave a number of documents with you when they sell a long-term care insurance policy.

Among the items you should get is a copy of a “Personal Worksheet” that helps you understand some of the issues related to purchasing long-term care insurance and the name, address, and local phone number of the HICAP office nearest you where you can receive, free of charge, information and counseling about long-term care insurance.

Recommended Reading: Does Medicare Pay For Insulin Pumps

Will Coverage On Hearing Aids Change

Over the years, many organizations and lawmakers have tried to update Medicare to cover vision, hearing and dental costs for seniors.

Many people would like to see Medicare evolve to cover dental, vision and hearing care. A Commonwealth Fund report details the financial and health burdens these gaps place on older adults. The report said:

“Among Medicare beneficiaries, 75 percent of people who needed a hearing aid did not have one 70 percent of people who had trouble eating because of their teeth did not go to the dentist in the past year and 43 percent of people who had trouble seeing did not have an eye exam in the past year.”

However, so far, no one has been successful at getting changes made to this part of Medicare coverage. In the summer of 2019, several U.S. representatives introduced H.R. 4056, a bill that would require Medicare to pay for certain audiological services. Time will tell if this bill gets passed.

Medical Coverage Outside The United States

Original Medicare generally does not cover treatment outside the United States, except under very limited circumstances, such as on a cruise ship within six hours of a U.S. port.

However, some Medicare supplement insurance policies also known as Medigap cover overseas health care costs.

Medigap plans C, D, F, G, M, and N provide foreign travel emergency health care coverage outside the United States.

These Medigap Plans Will Cover

- Foreign travel emergency care if it begins during the first 60 days of your trip

- Eighty percent of billed charges for certain medically necessary emergency care after a $250 yearly deductible is met

A lifetime coverage limit of $50,000 applies.

In 2020, the average premium for a Medigap policy was roughly $150 per month, or $1,800 per year, according to full-service insurance organization Senior Market Sales.

Don’t Miss: How Often Does Medicare Pay For A Mammogram

What Does Medicare Part A And Part B Cover

Original Medicare

- Hospice care

- Some home health care

You can enroll in Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

- Some preventive services

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Medicare Part B Premiums

| Above $85,000 | $428.60 |

Basic Medicare does not cover prescription drugs, although you have the option of getting coverage when you first sign up for Medicare. If you choose not to and change your mind later, you’ll pay a life-lasting penalty unless you meet certain exclusions .

You can get this coverage either through a standalone prescription drug plan or through a Part C plan, which is also called a Medicare Advantage Plan.

If you go with the latter, which often includes some extra benefits above basic Medicare, your Part A and Part B coverage also will be delivered via the insurance company offering the plan.

Recommended Reading: When Does A Person Sign Up For Medicare

Which Services Are Covered By Medicare Part D

These services are only covered under private Part D prescription drug plans :

- Vaccinations other than flu, pneumonia, and Hepatitis B . When a coronavirus vaccine is developed, Medicare Part B will cover it.

- Outpatient prescription drugs other than medications used with an item of durable medical equipment, injectable and infused drugs, oral end stage renal disease drugs under certain circumstances, and a few other medications.

Before the Affordable Care Act, preventive screening exams generally were not covered by Medicare, but numerous screening tests are now covered under Medicare Part B because of the law.

To cover long-term care, some Medicare enrollees purchase private long-term care insurance, although this can be quite expensive. Medicaid provides coverage for long-term care services in every state, and covers a number of other things Medicare doesnt pay for, like non-emergency medical transportation.

The Maximum Lifetime Benefit

The approximate number of years you want the policy to provide benefits will determine the Maximum Lifetime Benefit. The longer the period of coverage, the higher the premium. Your Lifetime Maximum Benefit is computed by multiplying the Daily Maximum benefit you select by the approximate number of days you want benefits to be paid or reimbursed.

Recommended Reading: How To Get A Power Wheelchair Through Medicare

Does Medicare Cover Elective Procedures

Services that are not considered medically necessary are generally not covered by Medicare Part A or Part B. For example, breast augmentation for cosmetic reasons isnt covered by Medicare, but reconstructive surgery after a mastectomy is covered.11

Medicare wont cover Lasik surgery just to avoid the need for glasses. But treatment for chronic eye conditions like cataracts or glaucoma may be covered if your doctor considers it to be medically necessary.12

Always err on the side of caution! Confirm your coverage before you commit to a procedure youre unsure about.

What Is Medicare Part

Part-A is hospital insurance, which helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities . Medicare Part-A also helps cover hospice care and some home health care, but you must meet certain conditions to get these benefits.

Cost of Medicare Part-A: Most people don’t have to pay a monthly premium for Part-A, because they or a spouse paid Medicare taxes while working for a certain number of calendar quarters during their lifetime.

If you don’t get premium-free Part-A you may be able to buy it if you or your spouse aren’t entitled to Social Security because you didn’t work or didn’t pay enough Medicare taxes while you worked and are age 65 or older, or you are disabled but no longer get free Part-A because you returned to work.

In most cases, if you buy Part-A coverage, you must also enroll in Part-B and pay the Part-B premium too. If you have limited income and resources, your state may help you pay for Part-A and/or Part-B.

Read Also: Do I Need Health Insurance With Medicare

Prescription Drugs You Take At Home

PartB medical insurance covers only drugs that cannot be self-administered and thatyou receive as an outpatient at a hospital, a clinic, or at the doctor’soffice.

MedicarePart A covers drugs administered while you are in the hospital or in a skillednursing facility, and coverage for all other prescription drugs falls underMedicare Part D, which you must enroll in and pay for separately from Parts Aand B.

Eyesight And Hearing Exams Glasses And Hearing Aids

Medicaremedical insurance does not cover routine eye or hearing examinations. Neitherdoes it cover hearing aids, eyeglasses, or contact lenses, except for lensesrequired following cataract surgery. However, if your eyes or ears are affectedby an illness or injury other than simple loss of strength, the examination andtreatment by an ophthalmologistan eye doctor who is an M.D.or other physicianis covered.

Don’t Miss: Is Prolia Covered By Medicare Part B Or Part D

Delivering Health Care Services To Specific Groups

We provide certain direct health care services to some population groups, including:

- First Nations people living on reserves

- Inuit

- serving members of the Canadian Forces

- eligible veterans

- tax rebates to public institutions for health services

- deductions for private health insurance premiums for the self-employed

What Is Covered By Medicare

Medicare is the basis of Australia’s health care system and covers many health care costs. Most Australian residents are eligible for Medicare. Under Medicare you can be treated as a public patient in a public hospital, at no charge. Medicare will also cover some or all the costs of seeing a GP or specialist outside of hospital, and some pharmaceuticals.

Medicare does not cover private patient hospital costs, ambulance services, and other out of hospital services such as dental, physiotherapy, glasses and contact lenses, hearings aids. Many of these items can be covered on private health insurance.

Medicare is the basis of Australia’s health care system and covers many health care costs. Most Australian residents are eligible for Medicare.

You can get a Medicare card if you live in Australia or Norfolk Island and meet meet certain criteria. You may also get a reciprocal Medicare card if you visit from certain countries.

You can choose whether to have Medicare cover only, or a combination of Medicare and private health insurance.

The Medicare system has three parts: hospital, medical and pharmaceutical.

Also Check: How To Determine Medicare Part B Premium

What Is A Medigap Policy

A Medigap policy is an insurance policy that you can buy from a private insurance company, which supplements original Medicare Part-A and Part-B coverage and pays the Medicare coinsurance, copayments and deductibles for covered medical services that you would otherwise have to pay for out-of-pocket if you didn’t have a Medigap policy.

You must have Medicare Part-A and Part-B to be eligible to buy a Medigap policy. You have to pay a premium for Medigap insurance and you also must continue to pay your premium for Medicare Part-B. Medigap premiums vary from one insurance company to another and usually increase as you get older.

You can buy a Medigap policy during the six month period that begins on the first day of the month in which you turn 65. If you do not buy a Medigap policy during this enrollment period, your ability to buy one at another time may be restricted and your premiums could be higher.

However, there is a special rule that allows you to buy a Medigap policy if you leave original Medicare for the first time to join a Medicare Advantage plan but decide to return to original Medicare within the first year because you are dissatisfied with the Advantage Plan.

How Much Does Medicare Cover

While the focus here has been on which type of care is not provided by Medicare, beneficiaries receive an impressive array of services, treatments and equipment. With Original Medicare , youll receive preventive care to keep you healthy, and inpatient and outpatient services when you do need medical treatments. Depending on what you need, Medicare will cover it at different levels. For example, Part B often covers 80% of approved costs , while Part A has a different price structure.

Those with Medicare Advantage receive at least the same coverage as Parts A and B and often have more benefits included. Part C plans also have different costs.

No matter what form of Medicare you have, whether or not your service or item is covered comes down to a few primary details.

Don’t Miss: What Does A Medicare Card Look Like

What Services Do Insurance Companies Cover

Insurance policies describe what they will cover, what kind of care they will cover, who can provide the care and conditions that need to be met before a company will pay/reimburse the cost of benefits. Described below are the services required in a long-term care insurance policy approved under current California law. Be aware however, that California law has changed many times over the years and that insurance policies sold in previous years may have different requirements than are shown here.

What Does Medicare Part B Cost

Some of your Part B cost is a monthly premium of $148.50 however, your premium could be less or more or less depending on your income.

Some services are covered under Medicare Part B at no additional cost to you if you see a doctor that accepts Medicare. If you need a service outside of what is covered by Medicare, you will have to pay for that service yourself.

Don’t Miss: When Can You Start Medicare

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as Hospital Insurance. Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Inpatient Hospital Care

One of the most basic coverages provided under Medicare Part A is inpatient care in a hospital or rehabilitation facility. It also provides coverages related to inpatient mental health care, if this type of treatment is needed.A few of the inpatient expenses covered by Medicare Part A include:

- General nursing staff

- Medications used while in care

- Various other medical services and supplies used while in the hospital

- A semi-private room

- Meals

However, there are some hospital-related expenses that Medicare Part A does not provide coverage toward. These include certain non-medical expenses, such as costs associated with having a telephone or television in your room. It also does not cover charges assessed for personal care items such as a razor or set of slippers.Skilled Nursing Facility Care

If skilled nursing facility care is required, Medicare Part A will cover some of these expenses as well. However, theyre only covered if:

- Skilled nursing care

- Meals and dietary counseling

Hospice Care

Home Health Care

MORE ADVICE

The Bottom Line: What Does Medicare Cover For You

Know your options. Do your homework. Take some time to understand your Medicare plan.

Remember that are required by law to offer all the benefits of Original Medicare, but most plans offer much more.

Knowing which types of common medical costs are not covered will be helpful when planning for your out-of-pocket medical costs.

Explore Medicare

You May Like: How Do You Qualify For Medicare In Texas

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

What Medicare Part D Doesnt Cover

Medicare Part D is optional prescription drug coverage. You can enroll in this coverage through a stand-alone Medicare Part D Prescription Drug Plan, or through a Medicare Advantage Prescription Drug plan.

Each Medicare Prescription Drug Plan has a formulary. The formulary may change at any time. You will receive notice from your plan when necessary.

Generally, Medicare Part D will cover certain prescription drugs that meet all of the following conditions:

- Only available by prescription

- Approved by the Food and Drug Administration

- Sold and used in the United States

- Used for a medically accepted purpose

- Not already covered under Medicare Part A or Part B

Based on these criteria, there are certain drugs that Medicare Part D does not generally cover:

- Weight loss or weight gain drugs

- Erectile or sexual dysfunction drugs

- Over-the-counter, non-prescription drugs

- Hair growth drugs, or drugs used for cosmetic reasons

- Fertility drugs

- Drugs used for symptomatic relief of coughs or colds

- Prescription vitamins and minerals

If you are taking a medication that is not covered by Medicare Part D, you may try asking your plan for an exception. As a beneficiary, you have a guaranteed right to appeal a Medicare coverage or payment decision.

Recommended Reading: Does Medicare Cover Counseling For Depression