What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

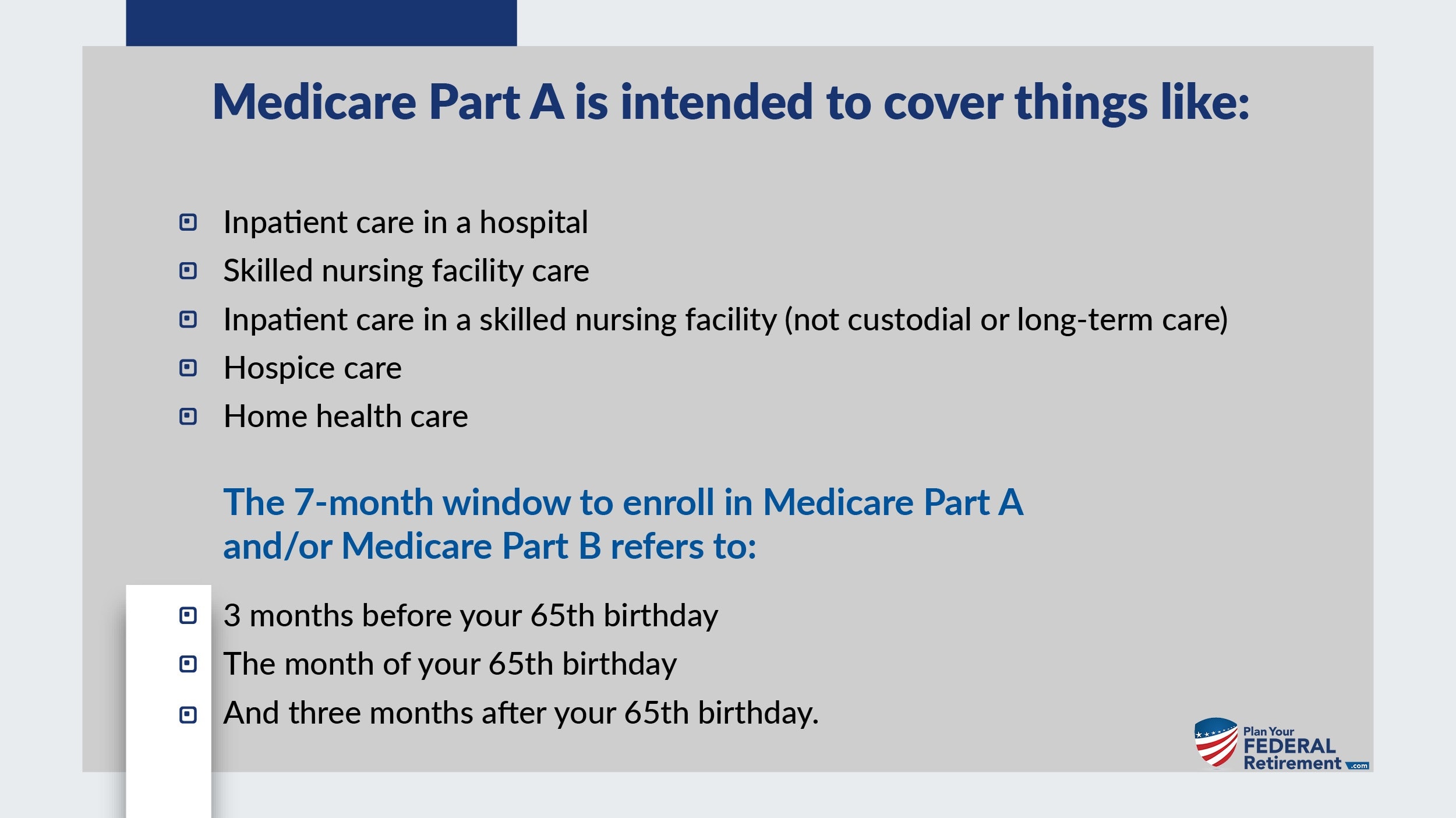

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Effective Date Of Coverage

Once an individual is determined eligible for Medicaid, coverage is effective either on the date of application or the first day of the month of application. Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

Medicare Part A Eligibility Requirements

While qualifying for Medicare Part A is straightforward, qualifying for premium-free Medicare Part A is a bit more complicated. When enrolling in Medicare Part A, having the right legal status and meeting the age or disability requirements is enough to be able to buy Medicare Part A.

Your eligibility for premium-free Medicare Part A depends on the amount youve paid in Medicare taxes throughout your career. If you have been paying Medicare taxes your whole career, you probably qualify for premium-free Medicare Part A.

The Centers for Medicare & Medicaid Services, or CMS, measures eligibility for premium-free Medicare Part A in work credits. In order to avoid paying the premium, you would have to accumulate 40 work credits over your working life. These credits arent attached to the amount of money you have paid into Medicare. Instead, its a measurement of how long you have been putting money into Medicare.

Each credit corresponds to one quarter-year in which you paid Medicare taxes. Worked for a summer paying Medicare taxes? Congratulations, youve earned one working credit. Have you spent ten years behind a desk paying Medicare taxes? Great, youve earned 40 work credits and have qualified for premium-free Medicare Part A.

If you fail to accumulate 40 work credits, all is not lost when it comes to Medicare Part A. You can still qualify for a premium discount if you worked between 30 and 39 work credits. The cost of the Medicare Part A premium is as follows:

Don’t Miss: Does Medicare Offer Home Health Care

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Who Would Be Eligible For Medicare At 60

When someone with U.S. citizenship of at least five years reaches age 65, they become eligible for Medicare. Currently, it seems as though the age would lower to 60 without any additional requirements. Therefore, millions more Americans would be able to obtain Medicare. Additionally, it isnt clear if the penalties that people must pay for delaying enrollment would become effective when they turn 60 rather than 65.

Now, those who lack creditable coverage and dont enroll when aging in at 65 pay late penalties through increased premiums. Its possible that the penalties could start at 60 or remain for those who wait until after 65 to enroll.

Recommended Reading: When Can A Disabled Patient Enroll In Medicare Part D

Social Security Disability And Medicare

A person may have a disability that restricts their ability to work. People with these disabilities may often qualify for Social Security or Railroad Retirement Board benefits.

Once a person has received these benefits for 24 months, they can start a Medicare plan, even though they are under 65 years of age.

A person with a disability may otherwise have difficulty getting health insurance, as a private insurer may charge them higher premiums due to pre-existing medical conditions.

As a result, Medicare provides a more cost-effective coverage option for people who have disabilities.

Examples of disabilities that may qualify a person for Social Security or RRB benefits include:

- back injuries and other musculoskeletal issues

- bleeding disorders

- heart conditions, including congestive heart failure

- mental health disorders, such as depression

- sensory issues, such as vision loss

- speech disorders

- severe respiratory illnesses, such as COPD

Medicare has specific criteria for children under the age of 18 years who wish to claim disability benefits or enroll in Medicare.

The SSA does not pay disability benefits to a young person until they reach 18 years of age. Therefore, a person with a disability does not qualify for Medicare until they are 20 years of age.

An exception to this rule applies to people who are 18 years of age and have ALS. They qualify for Medicare benefits once they reach this age.

Those with ESRD can qualify for Medicare if they meet the following criteria:

Medicare Eligibility Before Age 65

If youre under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for at least 24 months in a row

- If you have amyotrophic lateral sclerosis

- If you have end-stage renal disease . ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant

If youre eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A and Medicare Part B , which make up Original Medicare. Your enrollment in Medicare may or may not be automatic, as explained below.

Read Also: Can You Get Medicare If You Work Full Time

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Recommended Reading: Is A Psa Test Covered By Medicare

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

Read Also: How Is Medicare Irmaa Calculated

When To Apply For Medicare: Whats The Initial Enrollment Period

For most people, the Medicare Initial Enrollment Period is a seven-month period. It starts three months before the month you turn 65, includes your birthday month, and goes three more months after that. So if your 65th birthday is in November, your IEP runs from August through February.

Your IEP is different if youre not yet 65, but you qualify for Medicare by disability. For example, you might be automatically enrolled during your 25th month in a row of receiving Social Security disability benefits.

Learn how enrollment works if youre under 65 but eligible for Medicare through disability.

Whathappens When A Qualifying Spouse Is Younger

A person is eligible for Medicare Part A if they or their spouse have paid Medicare taxes for at least 40 quarters of work.

This might become more challenging when an older adult with a younger spouse did not work 40 quarters but their spouse did.

If a younger spouse worked for 40 quarters, they can qualify their partner for Medicare coverage once they reach 62 years of age and the older, nonworking spouse reaches 65 years of age.

If a person reaches 65 years of age, did not pay Medicare taxes for 40 quarters, and has a spouse under the age of 62 years, they may have to pay for their Medicare Part A benefits until their qualifying spouse reaches 62 years of age.

Recommended Reading: Where Can I Go To Sign Up For Medicare

Other Ways To Get Medicare Coverage At Age 65

If you dont qualify for premium-free Medicare Part A coverage, you may be eligible to buy coverage. However, you must still be a U.S. citizen or a permanent resident for at least five years to qualify.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. Premium costs vary based on how long you have worked and paid into Medicare.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. Your premium will be the standard rate and would depend upon the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

Also Check: How Much Is Medicare Part A Premium For 2020

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: What Is The Requirement For Medicare

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

Retirees And Those Still Working

If you paid into a retirement system that didnt withhold Social Security or Medicare premiums, youre probably still eligible for Medicareeither through your retirement system or through your spouse. To receive full Medicare coverage at 65, you must have earned enough credits to be eligible for Social Security.

Each $1,470 you earn annually equals one credit, but you can only earn a maximum of four credits each year. You will receive Social Security benefits at retirement if you have earned 40 credits10 years of work if you earned at least $5,880 in each of those years. If you continue to work beyond age 65, things get a bit more complicated. You will have to file for Medicare, but you may be able to keep your companys health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Theres a lot to consider that makes it prudent to talk to a person knowledgeable in Medicare about your specific choices. This could be your Human Resources department or a Medicare representative.

If you continue to work beyond 65, theres a lot to consider that makes it prudent to talk to a Medicare expert about your choices.

Don’t Miss: How To Get Dental With Medicare