Medicare Part A Deductible In 2022

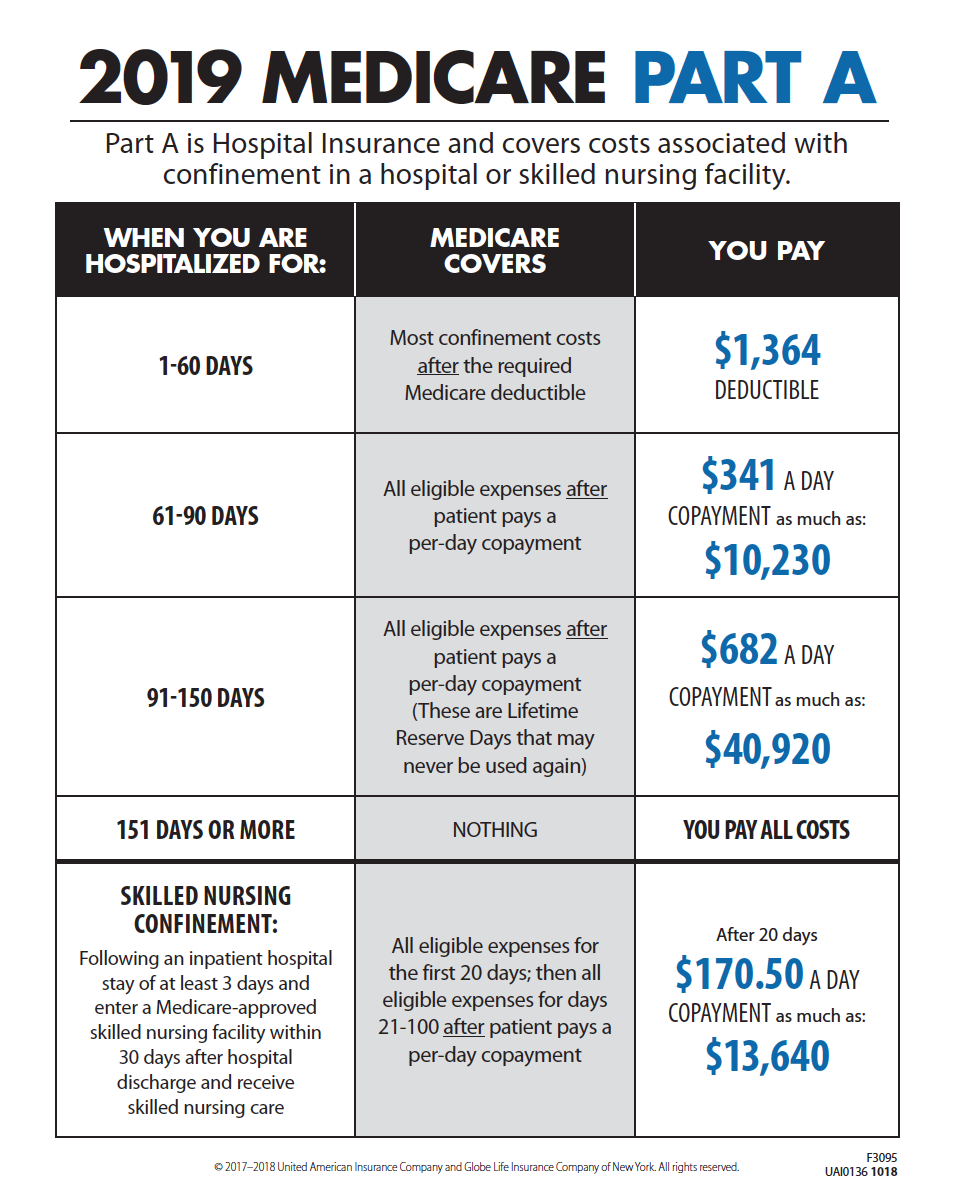

Medicare Part A comes with some costs to you. Most people donât have to pay a Part A monthly premium. You may pay coinsurance and/or copayments. You can read more about Part A costs.

The Part A deductible is not an annual amount. Instead, itâs âper benefit period.â A benefit period starts the day youâre admitted as a hospital or skilled nursing facility inpatient. It ends when you havenât had inpatient care for 60 days in a row. So, you might pay multiple Part A deductibles in one year if you spend a lot of time in a hospital.

The Medicare Part A deductible is $1,556 in 2022.

Would you like to take a look at some of the Medicare plans available in your area? Just enter your zip code in the box on this page to display a list and start comparing plans.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

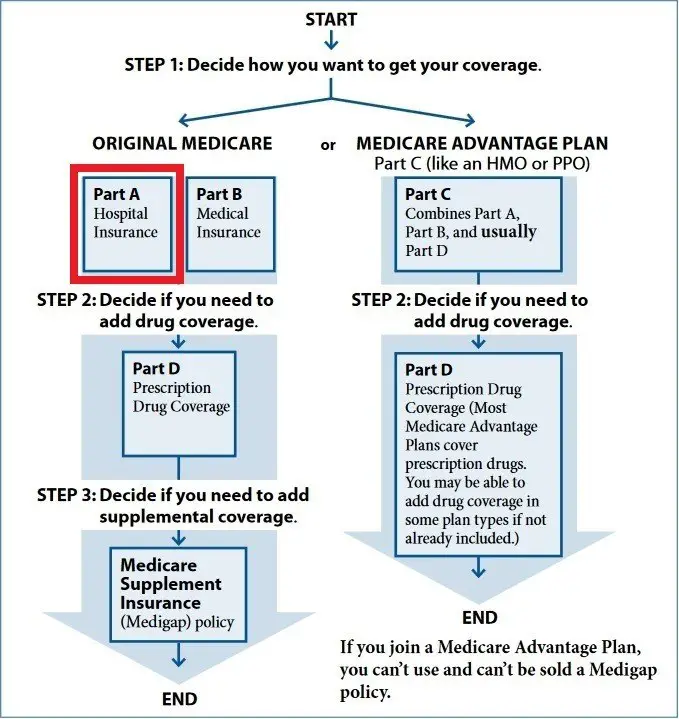

Medicare Original Vs Medicare Advantage

See also

Although Medicare sets the rules that guide the standardized benefits that Medicare Advantage plans must have, these plans are not the same as Original Medicare. Private insurers provide Medicare Advantage plans, but Original Medicare is a government-run program. Both of these healthcare options can cover doctor appointments and hospitalization expenses. However, Medicare Advantage policies usually include additional healthcare coverage that Original Medicare does not cover.

Another difference between Medicare Advantage versus Original Medicare is cost. When talking about cost it is important to note that the full cost of a Medicare plan is not just the monthly premium. The cost includes deductibles, copays or coinsurance, and whether there is a maximum-out-of-pocket or not, what is that maximum.

A key difference is that Original Medicare does not have any cap to the out-of-pocket expenses, while Medicare Advantage plans have an annual maximum-out-of-pocket cap, after which the plan pays for covered costs for the rest of the year.

For Original Medicare, the premiums, deductibles and copays are determined every year by the Center for Medicare Services , while for Medicare Advantage they are set by private insurance companies with guidance from CMS.

What To Do Next When You Become Eligible For Medicare

If you currently have a health plan through Covered California:

If you dont currently have a health plan through Covered California:

If youre currently enrolled in Medicare Part A, or eligible for premium-free Medicare Part A, you cant enroll in new coverage through Covered California. This is because Medicare Part A is considered minimum essential coverage under the Affordable Care Act. But depending on your income and assets, you may be eligible for additional coverage through Medi-Cal. Once youre enrolled in Medicare, you can contact your local county office or complete the Covered California application to see if you also qualify for Medi-Cal.

Don’t Miss: Is Dermatology Covered Under Medicare

Ways To Find Out If Medicare Covers What You Need

How Do I Enroll In A Medicare Supplement Plan

Medicare Supplement Insurance plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health. Information about the Medicare supplement plans sold in North Carolina is available from SHIIP by calling us toll-free at 1-855-408-1212.

Use our free tool to find estimated premium rates.

Also Check: Will Medicare Pay For Cialis

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

How Much Does Medicare Part C Cost

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or plus a variety of coverages and benefits not offered by Original Medicare .

Also Check: When Do You Have To Enroll In Medicare

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

Medicare Enrollment Periods What Are The Enrollment Months For Medicare

For most people, enrolling in Medicare Part A is automatic. However, there are several instances where you may have to manually enroll in Medicare Part A and/or Part B during your Initial Enrollment Period , the seven-month period that begins three months before you turn 65, includes the month of your 65th birthday, and ends three months later.

Some situations where you would enroll in during your initial Medicare open enrollment include:

Initial Enrollment Period â The IEP is for enrolling in Original Medicare, Part A and Part B, but you can generally enroll in a Medicare Advantage plan, Medicare prescription drug plan, or Medicare Supplement insurance plan during this period. The dates for this period depend on when you become eligible for Medicare. The IEP is usually a 7-month window.

General Enrollment Period : If you did not enroll during the IEP when you were first eligible, you can enroll during the General Enrollment Period. This is another opportunity to enroll in Medicare Part A and/or Part B, from January 1 â March 31 each year. Keep in mind that you may have to pay a late enrollment penalty for Medicare Part A and/or Part B if you did not sign up when you were first eligible.

Annual Election Period: You can change your coverage in several ways . It runs October 15 â December 7 annually.

Medicare Advantage Open Enrollment Period: If you already have a Medicare Advantage plan, you can change plans during this period.

You May Like: Does Medicare Pay For Snf

Is Medicare Part A Free What To Do When It Isnt

June 7, 2019 By Danielle Kunkle Roberts

My team and I often discuss the issues that we hearfirst-hand from Medicare beneficiaries. We are fortunate to have awide-reaching community of Medicare-aged beneficiaries that trust us with theirMedicarejourney .

Recently, a member of our team came to me with a questionthat doesnt get much air time in the world of Medicare discussions: whatoptions are available to people who do not qualify for freeMedicare Part A?

If you are reading this, you are likely looking for someanswers yourself. Heres what you can do if you dont qualify for premium-freePart A.

Medicare Part C Eligibility

To enroll in a Medicare Part C plan, you must be eligible and meet specific requirements. You must:

- Be enrolled in Original Medicare, both Part A and Part B

- Live within the service area of the insurer and plan you are applying to enroll in

- The plan must be accepting new users.

You must also enroll in Medicare Part C during specific times.

Don’t Miss: How To Find Out Your Medicare Number

Medicare Part A Hospital Care Coverage

As a Medicare Part A beneficiary, you will receive coverage for hospital expenses that are critical to your inpatient care, such as a semi-private room, meals, nursing services, medications that are part of your inpatient treatment, and any other services and supplies from the hospital. This includes inpatient care that received through:

- Acute care hospitals

- Mental health care

- Participation in a qualifying clinical research study

Please note that Medicare Part A hospital insurance does not cover the costs for a private room , private-duty nursing, personal care items like shampoo or razors, or other extraneous charges like telephone and television.

Can I Get Obamacare Coverage If I Have Medicare A Only

Find 2023 health plans. Enrollment ends Jan 15th in most states. 4 out of 5 can find a marketplace plan for $10 or less a month with cost assistance!

My uncle has been diagnosed with Colon Cancer, however, due to a misunderstanding with SSN dept, he just starting receiving coverage for Medicare Part A, but was told Medicare Part B would not take effect until July 2016. He is over the age of 65. He will need to go to see an oncologist and may need surgery to remove the mass, with additional tests. However, my understanding is Medicare Part A will not cover this unless he is admitted to a Hospital. My question is would he able to qualify/received Obamacare Coverage to cover these additional expenses. If so, would needs to be done to receive Obamacare Coverage ASAP.

Read Also: What Is The Phone Number To Apply For Medicare

Understanding Medicare Part A Eligibility

Like many American citizens, you may be automatically enrolled in Medicare coverage if one of the following applies to you:2

- Youre 65 and already receive benefits from Social Security.

- Youre 65 and already receive benefits from the Railroad Retirement Board .

- Youre under 65, have a disability, and are receiving disability benefits.

- You have ALS or ESRD .

If any of the above Medicare Part A eligibility qualifications apply to you, then youre considered Medicare eligible. Your Medicare card will be mailed to you three months before your 65th birthday or on your 25th month of disability.

If you arent getting benefits from Social Security at least four months before you turn 65, youll need to sign up with Social Security directly.2

Why You Should Get A Medicare Flu Shot

As a Medicare beneficiary, you may wonder whether your coverage includes the seasonal influenza vaccine, commonly referred to as a flu shot. As long as the doctor or qualified healthcare provider accepts Medicare, your Medicare flu shot will be covered once each flu season at no cost to you. HealthMarkets can help you learn how

Also Check: How To Sign Up For Medicare At Age 65

Are You Required To Sign Up For Medicare Part D

You are not required to enroll in a Medicare Part D plan unless you are dual-eligible for Medicare and Medicaid. If you receive low-income subsidies, you are enrolled automatically in a Part D plan if you dont choose one on your own.

Suppose you choose not to enroll in a Part D plan when first eligible. If you dont have creditable drug coverage that is at least as good as standard Part D coverage, you could pay a late enrollment penalty if you enroll later. This penalty will be added to your premium as long as you have Part D coverage.

You May Like: Procter And Gamble Employee Benefits

Is Medicare Part D Always Primary

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse’s former employer’s or union’s retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

Don’t Miss: Which Blood Glucose Meters Are Covered By Medicare

Your Plan Options And Premiums Will Change

After you submit proof of Medicare enrollment to STRS Ohio, your STRS Ohio plan options and premiums will change.

Plans for Medicare enrollees include the Aetna Medicare Plan, the Medical Mutual Basic Plan or a regional plan if available in your area.

Premiums for the STRS Ohio Medicare plans are lower than the non-Medicare plans. Also, premiums for benefit recipients enrolled in an STRS Ohio Medicare plan have been reduced by a $30 Medicare Part B premium credit.

You can review your new plan options and premiums in your Online Personal Account or call STRS Ohio for this information.

Note: If you are not currently enrolled in an STRS Ohio plan, initial eligibility for and enrollment in Medicare is a qualifying event that allows you to add STRS Ohio coverage outside of open enrollment. You can enroll in a plan through your Online Personal Account.

Also Check: Social Security And Medicare Benefits

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Also Check: Are Pre Existing Conditions Covered Under Medicare

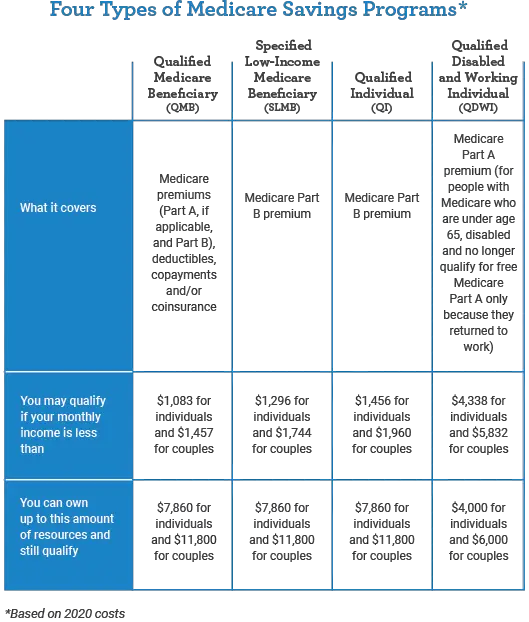

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Also Check: Do You Need Medicare If You Are Still Working

Original Medicare: Key Takeaways

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.