Moving With Original Medicare And A Medigap Plan

Nearly 70% of Medicare beneficiaries are NOT enrolled in a Medicare Advantage plan. Instead, they have Original Medicare consisting of Part A and Part B coverage. Some will also have a Medigap plan that works alongside their Medicare Part A and B benefits.

Original Medicare is a federal benefit. Your benefits under Parts A and B do not change when you move from one state to another with Medicare. You can also take your Medigap plan with you to another state.

Your zip code determines the price of your monthly Medigap premium. Medigap plan prices do vary from state to state. Healthcare in some areas is more expensive than in other areas. That said, there is a chance your plans price will increase or decrease when you move.

If the price increase is more than you can afford, give us a call to shop your plan. There may be another carrier in your new zip code with a more affordable premium for you.

Be aware that you will most likely need to go through medical underwriting when you apply to change plans. This means answering health questions so the carrier can decide whether to accept or decline you based upon your answers to those questions.

If you choose to apply for a new plan, know that a few states have unique Medigap plans and rules that arent like other states. Moving Medicare from one state to another in Wisconsin, Massachusetts, or Minnesota means that the structure of your benefits may also change.

Is Medicare Different In Each State

Home / FAQs / General Medicare / Is Medicare Different in Each State

Even though Medicare is a federal program, states can implement various rules if they meet the basic Medicare regulations. Most states across the country have implemented rules to ease the requirements for seniors to make changes to their Medigap plans. Below, we will highlight unique Medicare rules and their applicable states.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Differences In Medigap Plans Between States

Medicare Supplement insurance also known as Medigap policies help you cover your out-of-pocket expenses if you have Original Medicare. Its the only private Medicare-related insurance for which the federal government does not set a mandatory open enrollment period.

You have six months starting with your 65th birthday and once youre enrolled in Medicare Part B to buy a Medigap policy available in your area.

After that, youre often locked into the Medigap plan you choose. It is difficult or extremely expensive to switch to another Medigap plan in most states.

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Examples of Rare State Rules for Medigap

Medicare does not require states to guarantee access to Medigap plans for people under 65 who qualify for Medicare due to a disability such as End-Stage Renal Disease or ALS . But most states have some type of rule in place giving people with these conditions access.

Also Check: Does Medicare Advantage Have A Donut Hole

Guaranteed Issue Rights And Open Enrollment Periods

Guaranteed issue rights are protections for Medicare enrollees in certain situations. These rights prevent insurance companies from denying enrollment in certain Medigap policies when beneficiaries meet specific criteria.

To utilize guaranteed issue rights, beneficiaries must abide by MACRA when selecting their plan. At this time, only those who enrolled in Part A before January 1, 2020, can be guaranteed issue to Plan F or Plan C.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Like guaranteed issue rights, Open Enrollment Periods allow beneficiaries to enroll in a Medigap plan with no underwriting health questions. Those who receive Medicare after January 1, 2020, must abide by MACRA when in an open enrollment period. Thus, individuals who enrolled in Medicare prior to January 1, 2020, may enroll in any Medigap plan they wish.

Let Us Handle Your Medicare Move To Another State

When you are a Boomer Benefits client, we help you with this crazy process at no charge. The odds are you have multiple plans that you will need to change when moving to another state.

Our Client Service Team is excellent at reviewing rates and exploring options within your new state. We can get your plans updated in a timely manner, leaving you with no worries about changes in coverage.

We have team members licensed and appointed in every state with knowledge of each of their specific rules. They will be able to inform you of how Medicare works within your new state. You can compare basic options at our website as well.

Moving from state to state is already a hectic task. Dont let Medicare be another burden you have to think about. Call us today at 1-855-732-9055.

Don’t Miss: Does Medicare Pay For Lift Chairs For The Elderly

Moving States When Enrolled In A Medicare Advantage Plan

Medicare Advantage Plans have networks that operate in select counties where you live, so if you move from one state to another, you will almost always need to change your plan.

When you move, you can enroll in a new Medicare Advantage plan in your new zip code or choose to return to Original Medicare and apply for a Medigap policy. Moving out of your Medicare Advantage plans service area opens up a Guaranteed Issue window for Medigap plans, meaning you could apply for a Medigap plan without having to answer health questions.

Medicare Advantage Plan Quality By State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent.

The metrics used in scoring a plan include:

Nationally, 55% of Medicare Advantage plans have earned either a 4-star or 5-star rating for 2022, meaning they are top-rated Medicare plans.

North and South Dakotas high plan costs can be partly justified by their high plan quality. Both states average at least 86% of plans carrying a 4-star or 5-star rating. Other states with high quality plans include Iowa, Minnesota, Maryland, Montana and Utah.

Plan quality is lowest in Wyoming, Georgia and Arkansas, with all three states having just a quarter of their Medicare Advantage plans rated 4 stars or higher.

Read Also: Do Any Medicare Advantage Plans Cover Dental Implants

Federal Law Provides Limited Consumer Protections For Medigap Policies

In general, Medigap insurance is state regulated, but also subject to certain federal minimum requirements and consumer protections. For example, federal law requires Medigap plans to be standardized to make it easier for consumers to compare benefits and premiums across plans. Federal law also requires Medigap insurers to offer guaranteed issue policies to Medicare beneficiaries age 65 and older during the first six months of their enrollment in Medicare Part B and during other qualifying events . During these defined periods, Medigap insurers cannot deny a Medigap policy to any applicant based on factors such as age, gender, or health status. Further, during these periods, Medigap insurers cannot vary premiums based on an applicants pre-existing medical conditions . However, under federal law, Medigap insurers may impose a waiting period of up to six months to cover services related to pre-existing conditions, only if the applicant did not have at least six months of prior continuous creditable coverage.5 As described later in this brief, states have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards.

Federal law also imposes other consumer protections for Medigap policies. These include guaranteed renewability , minimum medical loss ratios, limits on agent commissions to discourage churning of policies, and rules prohibiting Medigap policies to be sold to applicants with duplicate health coverage.6

Using Medicare In Other States

If you have Original Medicare, then you will be covered anywhere in the U.S.

Since Original Medicare is a federal program, it provides blanket coverage across the country. But, even in another state, you still have to receive treatment from a doctor who is enrolled in Medicare.

If you have Medicare Advantage, then it will depend on your specific plan. Some plans require you to stay within a network or use certain doctors, limiting you if you travel outside of your network.

Recommended Reading: Is The Urolift Procedure Covered By Medicare

What Do Medicare And Medicaid Cover

Medicare Part A is hospital insurance and Part B is medical insurance. Medicare Part D is prescription drug coverage, and Part C is an all-in-one coverage option that combines Parts A, B and D, as well as other benefits that may include items like dental, vision, fitness and hearing. Medicare Part A and Part B coverage is standard, but Part C and Part D will vary based in terms of coverage provided depending on the plan, the insurance provider and your location.

Medicaid programs include federally mandated benefits and optional benefits. Each state decides what optional benefits to include.

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

Recommended Reading: Does Medicare Offer Dental And Vision

Location Determines Medigap Rates

Where you live will play a big role in how much your personal Medigap plan costs. The reason why can get a little messy and confusing, but heres the gist: Each state has the liberty to make different legislation.

This means that Medigap rates will vary from state to state. Factors like availability, regulation of Medicare plans, and Medicare beneficiaries in different areas will change how the pricing is done.

Another big factor is that, in general, its hard to switch from one Medigap plan to another, especially if youre health isnt in tip-top shape. Some states have recognized this, and theyve passed legislation to make it easier to switch.

States like California, Oregon, Maine, and Missouri have done this. This means that unhealthy people are switching onto different plans, which means those plans are bound to shoot up in price.

Prices vary a lot, from about $139/month in Hawaii to $226/month in New York for the same plan. And, actually, rates can even vary considerably by zip code within the same state. Its always best to price check plans based on where you live not by what the average might be.

If You Move To A New Area And Your Plan Is Still Available But There Are New Options Too

If youre moving to a new area that offers plans you couldnt get before, notify your plan provider of your move. Youll have the month before you move plus 2 months after you move to make a change.

If you wait to notify your plan until after youve moved, youll be able to make changes to your existing plan in the month you notify your plan plus an additional 2 months after.

Don’t Miss: How Much Does Medicare Supplemental Health Insurance Cost

Do Medicare Benefits Vary By State

There are four main parts to Medicare. These include Part A and B which form Original Medicare. There is also Part C, known as Medicare Advantage, and Medicare Part D, which offers prescription drug coverage.

Original Medicare is provided by the government to those who are age 65 and over, and who have worked in Medicare-covered employment for at least 10 years. Some individuals who are under the age of 65 may also qualify for Medicare benefits, provided that they have received Social Security disability benefits for at least 24 consecutive months.

Coverage that is provided via Medicare Parts A and B is primarily the same from state to state in terms of hospitalization and medical insurance , as well as the required out-of-pocket co-payments and deductibles that are required from enrollees.

However, for those who opt to also include Medicare Part D for prescription drug coverage, benefits can vary from one plan to another, as well as from state to state. In many instances, the benefits can even differ from one region to another.

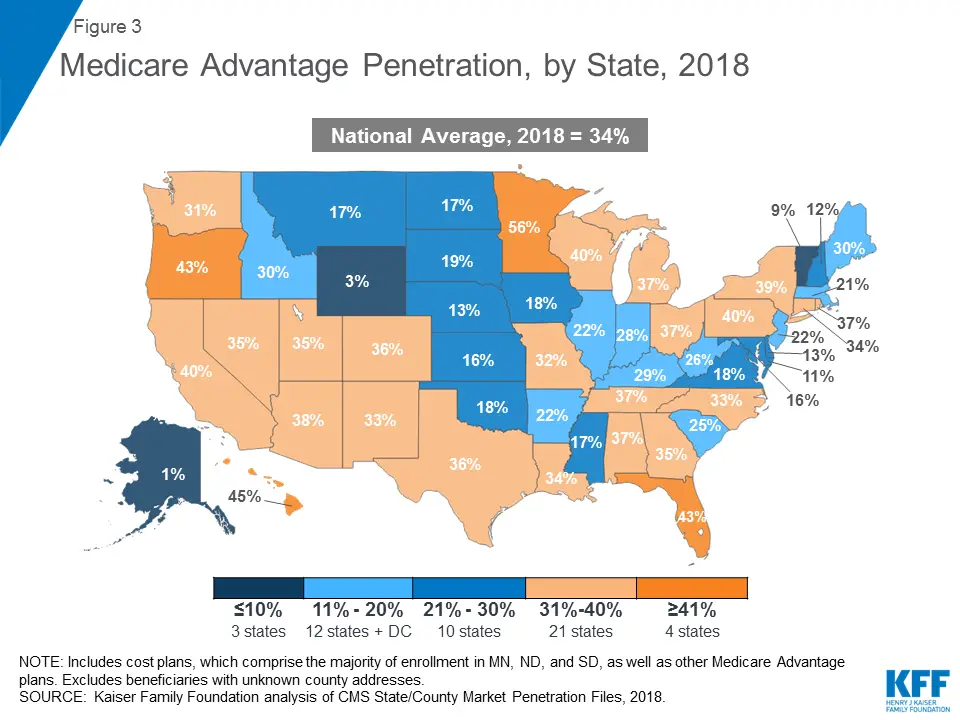

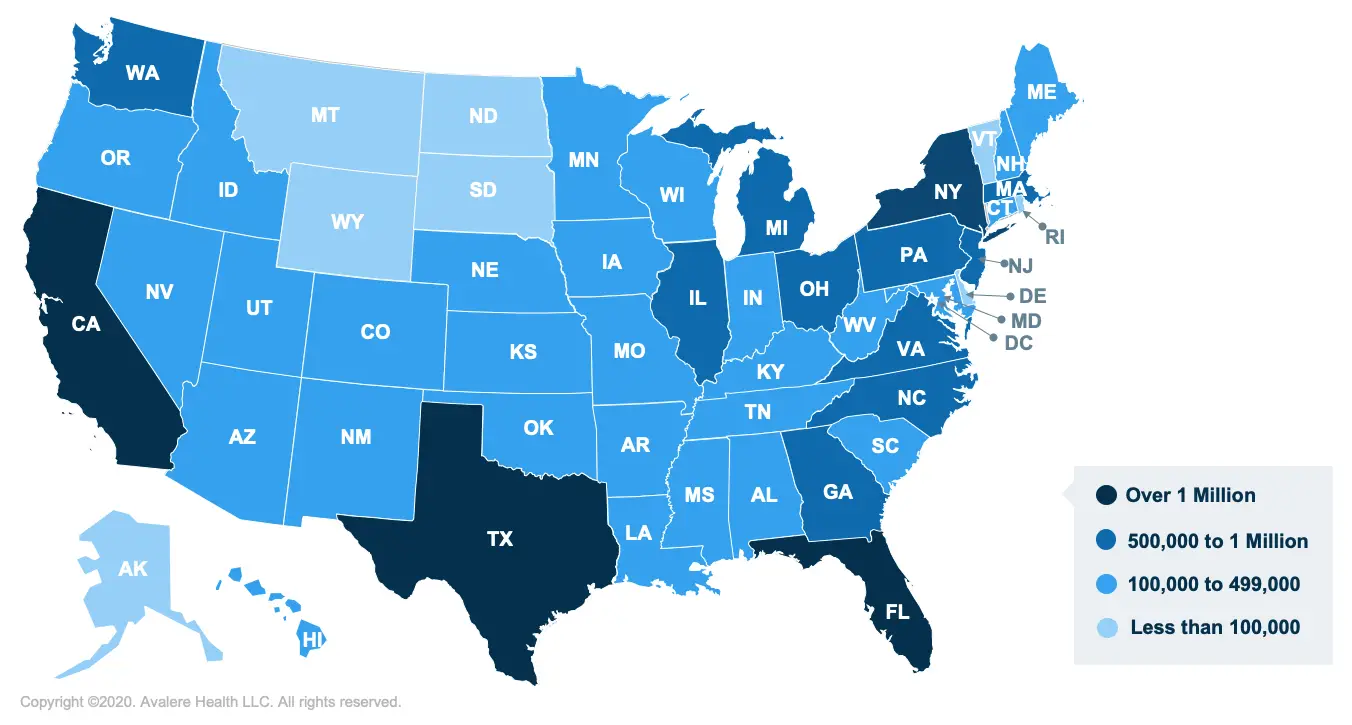

Likewise, for those who choose to receive their Medicare coverage through a Medicare Advantage plan , both the cost and availability of plans can vary from one state to another, as well as by the private health insurance company that offers them.

Can You Have Medicaid And Medicare At The Same Time

Yes, some beneficiaries are eligible for both Medicaid and Medicare. Depending on where you live and your eligibility, you may be able to enroll in a special type of Medicare Advantage plan called a Dual-eligible Medicare Special Needs Plan .

A D-SNP can offer benefits that Original Medicare dont cover, such as dental, hearing, vision and more. All D-SNP plans are required to cover prescription drugs.

To learn more about these special types of plans and to find out if any are available where you live, you can compare plans online or call to speak with a licensed insurance agent.

Don’t Miss: What Is Aarp Medicare Supplement

Why Do Medicare Advantage Plans Cost More And How Are They Paid

The government pays Medicare Advantage plans a set rate per person, per year under what is called a risk-based contract.12 That means that each plan agrees to assume the full risk of providing all care for that inclusive amount. This payment arrangement, called capitation, is also intended to provide plans with flexibility to innovate and improve the delivery of care.

But there are layers of complexity built into and on top of that set rate that allow for various adjustments and bonus payments. While those adjustments have proved useful in some ways, they can also be problematic and are the main reason for the extra cost of Medicare Advantage vis-à-vis traditional Medicare.

Benchmarks. Plan benchmarks are the maximum amount the federal government will pay a Medicare Advantage plan. Benchmarks are set in statute as a percentage of traditional Medicare spending in a given county, ranging from 115 percent to 95 percent. For counties with relatively low spending, benchmarks are set higher than average spending for traditional Medicare for counties with relatively high spending, benchmarks are set lower than average traditional Medicare spending . Special Needs Plans and other Medicare Advantage plans are paid in the same manner, with the same benchmarks.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Also Check: Does Medicare Cover Home Sleep Apnea Test

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

What Types Of Medicare Advantage Plans Are Available

Medicare Advantage plans can come in a variety of types:

- Private Fee-For-Service

- Medical Savings Accounts

- Special Needs Plans

The available selection of plan types may differ from one county and state to another. The different types of Medicare Advantage plans that are available in your area may include one or more of these plan types.

Read Also: Does Medicare Cover Hair Loss Treatment

How Does Medicare Work When You Move To A Different State

Medicare is a federal healthcare program for people age 65 and over, as well as those who have certain health conditions or disabilities.

Because its a federal program, Medicare provides services in every part of the country. It doesnt matter which state you live in your basic Medicare coverage will stay the same.

Although your Medicare coverage wont end or change when you move, youll often need to find new healthcare professionals who participate in Medicare. Doctors must accept Medicares payment terms and meet certain requirements to participate in the program.

Regardless of where you live, participating doctors and healthcare professionals will submit a bill to Medicare for the services they provide to you.