How Do I Change My Medicare Coverage

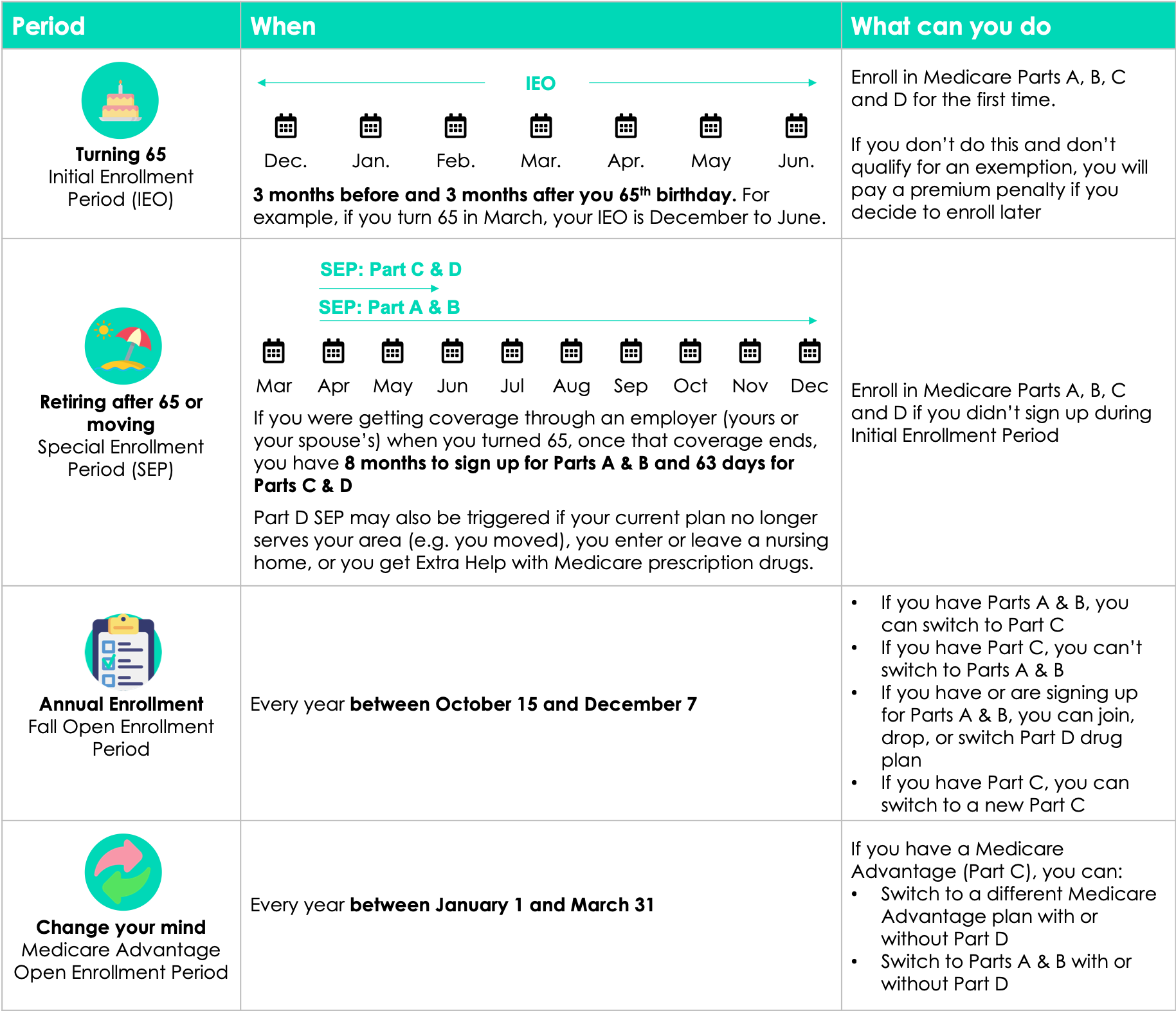

Your Medicare choices are not set in stone after the first time you enroll. You can make changes to your Medicare coverage during a few special Medicare enrollment periods.

- The Medicare Annual Enrollment Period , October 15 December 7

- The Medicare Advantage Open Enrollment Period, January 1 March 31

- The Medicare Special Enrollment Period for qualifying life events dates vary based on qualifying event

Learn how to make changes to your Medicare coverage during these three time periods:

When Is The Medicare Advantage Plan Annual Election Period

You can also add, drop, or change your Medicare Advantage plan during the Annual Election Period , which occurs from October 15 to December 7 of every year. During this period, you may:

- Switch from Original Medicare to a Medicare Advantage plan, and vice versa.

- Switch from one Medicare Advantage plan to a different one.

- Switch from a Medicare Advantage plan without prescription drug coverage to a Medicare Advantage plan that covers prescription drugs, and vice versa.

Tell Ors Your Medicare Number And Effective Dates For Parts A And B

When your new 11-digit Medicare card arrives, tell ORS your Medicare number as soon as you receive your card.

- Log in to miAccount and send a secure message on Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message for the individual going on Medicare.

- Use miAccount to update your Medicare information and complete a plan change to enroll in the Medicare health and prescription drug plan. Print the confirmation page and mail or fax it to ORS.

- Make a copy of your Medicare card. Write your name, member ID, address, and date of birth on the copy and mail or fax the copy of your card.

- Mail or fax a completed Insurance Enrollment/Change Request form to ORS with your Medicare information.

Do not enroll yourself or your eligible dependents in an individual Part D plan . All prescription drug plans offered by the retirement system for Medicare members are Part D plans, including those offered by our HMO options.

Don’t Miss: Can I Transfer My Medicare To Another State

What If Youre Still Working At 65

If youre still working at 65 and receiving health insurance through your employer, you may still need to sign up for Medicare. If your company offers health insurance and has fewer than 20 employees, your health insurer will refuse to pay for costs that Medicare would have covered. Signing up for Medicare will ensure that those costs are covered.

If your company has more than 20 employees, its still a good idea to enroll in free Part A coverage right away. Your coverage will be free since you already paid Medicare taxes. However, if you have a Health Savings Account, you wont be able to contribute to it once you enroll in Medicare, even if you only enroll in Part A.

When Can I Enroll In Medicare Prescription Drug Coverage

Medicare prescription drug coverage is optional and does not occur automatically. You can receive coverage for prescription drugs by either signing up for a stand-alone Medicare prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage, also known as a Medicare Advantage Prescription Drug plan. Medicare prescription drug plans and Medicare Advantage plans are available through private insurers. Please note that you cannot have both a stand-alone Medicare prescription drug plan and a Medicare Advantage plan that includes prescription drug coverage.

Read Also: Will Medicare Pay For Dental Care

What Happens After I Register For Medicare

After your application is received and processed, a letter will be mailed to you with the decision. If you encounter any questions or problems during the process, you can always contact Social Security for assistance.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application is approved. Unfortunately, waiting times can be as long as 90 days in some cases.

However, if you automatically enroll in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Recommended Reading: Does Medicare Supplement Plan Cover Medicare Deductible

I Am Turning 65 In A Few Months And Want To Go On Medicare Will I Be Automatically Enrolled In Parts A And B Or Do I Need To Sign Up

It depends. If youre receiving benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65, you do NOT need to sign up youll automatically get Part A and Part B starting the first day of the month that you turn 65. You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B. To sign up to receive Parts A and B, you can enroll online with Social Security, call Social Security at 1-800-772-1213, or visit your local Social Security office.

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Also Check: How To Appeal Medicare Part B Late Enrollment Penalty

Disability & Medicare Eligibility And Enrollment What You Need To Know In 2022

Some people can qualify for Medicare due to disability. In this case, if you have a qualifying disability, you are eligible for Medicare even if you are not yet age 65. To find out if your disability qualifies for disability benefits or for Medicare, youll need to speak with Social Security directly, but in general, you become eligible the 25th month of receiving Social Security Disability Insurance benefits .

If you have a qualifying disability, you must first file for disability benefits through Social Security before you can even be considered eligible for Medicare due to disability. Approval of the request by Social Security is an important first step. It is also important to note that these benefits are different from Supplemental Security Income benefits, and that SSI benefits do not qualify you for Medicare.

Receiving Social Security Benefits Without Medicare

You likely already know that you can start your Social Security benefits as early as age 62, and you dont qualify for Medicare until you reach age 65. So, you can easily receive Social Security retirement benefits for three years before starting Medicare. However, once you hit your 65th birthday, you will be automatically enrolled in Medicare if you are already receiving Social Security. What happens if you want to get your Social Security benefits without getting Medicare? You can decline Medicare coverage and still receive Social Security.

Since there is a monthly Part B premium, many people choose to decline their Part B coverage and receive only Medicare Part A hospital insurance. With many Americans working later in life, many are still covered through an employer-sponsored health care plan when they reach age 65. If you are still receiving medical insurance through your employer when you become eligible for Medicare, some special rules apply. You can choose to delay your enrollment in Medicare, and you will not need to pay the late enrollment penalty. As long as you meet the requirements, you will qualify for a special enrollment period. This means that you can when you leave your employer, and you wont be charged a penalty.

You May Like: Can I Draw Medicare At 62

When Is My Initial Enrollment Period For Medicare Part D

You can enroll in a stand-alone Medicare prescription drug plan during your Initial Enrollment Period for Part D. You are eligible for prescription drug coverage if:

- You live in a service area covered by the health plan, and

- You have Medicare Part A AND/OR Medicare Part B.

Generally, your Initial Enrollment Period for Part D will occur at the same time as your Initial Enrollment Period for Medicare Part B .

Once you are eligible for Medicare Part D, you must either enroll in a Medicare prescription drug plan, Medicare Advantage Prescription Drug plan, or have creditable prescription drug coverage . Some people may choose to delay Medicare Part D enrollment if they already have creditable prescription drug coverage through an employer group plan.

However, if you do not sign up for prescription drug coverage when you are first eligible for Part D, you may have to pay a late-enrollment penalty for signing up later if you go without creditable prescription drug coverage for 63 or more consecutive days.

Documents You Need To Apply For Medicare

To begin the application process, youll need to ensure you have the following documentation to verify your identity:

- A copy of your birth certificate

- Your drivers license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

You may need additional documents as well. Make sure to have on hand:

- Your Social Security card

- W-2 forms if still active in employment

- Military discharge documents if you previously served in the U.S. military before 1968

- Information about current health insurance types and coverage dates

If you are already enrolled in Medicare Part A and have chosen to delay enrollment in Medicare Part B, you must complete the additional forms .

- 40B form:This allows you to apply for enrollment into Medicare Part B only. The 40B form must be included in your online application or mailed directly to the Social Security office.

- L564 form:Your employer must complete this form if you delayed Medicare Part B due to creditable group coverage through said employer. You must also include the completed L564 form in your online application, or mail it directly to the Social Security office.

You May Like: How Do You Know If You Are Medicare Eligible

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

How To Sign Up For Medicare Supplement Insurance Plans: When Can I Enroll

Medicare Supplement insurance plans are voluntary, additional coverage that helps fills the gaps in coverage for Original Medicare. The best time to enroll in a Medicare Supplement insurance plan is during your individual Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month you turn 65 and have Medicare Part B. If you decide to delay your enrollment in Medicare Part B for certain reasons such as having health coverage based on current employment, your Medigap Open Enrollment Period will not begin until you sign up for Part B.

During your Medigap Open Enrollment Period, you have a âguaranteed-issue rightâ to buy any Medigap plan sold in your state. This means that insurance companies cannot reject your application for a Medicare Supplement insurance plan based on pre-existing health conditions or disabilities. They also cannot charge you a higher premium based on your health status. Outside of this open enrollment period, you may not be able to join any Medigap plan you want, and insurers can require you to undergo medical underwriting. You may have to pay more if you have health problems or disabilities.

Read Also: What Is The Difference In Medicare And Medicare Advantage

What Does A Medicare Card Look Like

Your Medicare card is red, white, and blue, and it contains your name and your Medicare ID number. Note that your card will not contain your or your spouses Social Security Number this change was implemented ato help keep that important detail under wraps.

Your Medicare card will indicate whether you have Medicare Part A, Medicare Part B, or both. Finally, your Medicare card will note the date when your health coverage began. You may be surprised to see that your Medicare card is paper, not plastic. Paper cards are easier for providers to copy, which is why Medicare made the switch.

Read Also: Does Medicare Pay For Freestyle Libre

How To Enroll In A Medicare Advantage Plan

Also Check: What Does Part G Cover In Medicare

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

Donât Miss: What Do Medicare Advantage Plans Cover

Effects Of Other Coverage

It is your responsibility to keep ORS informed of any changes that may affect your own and your dependent’s eligibility and/or coverage, so be sure to notify ORS when anyone on your insurance has coverage under another insurance plan. You can do this in miAccount or by sending in a completed Insurance Enrollment/Change Request R0452C) form. Enrolling in another health or prescription drug plan may result in termination of your retiree coverage for you, your spouse, and enrolled dependents. If you aren’t sure if you’ll be affected, send a secure message to an ORS representative using Message Board.

If you and your spouse are both Michigan public school retirees and enrolled with the same carrier, you will be covered together under one contract.

Read Also: What Does Medicare Supplement Cover

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

How To Apply For Medicare

Medicare enrollment is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of plans in which to enroll. As we mentioned earlier, some beneficiaries can receive automatic enrollment, and some must apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday through Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare applications generally take between 30-60 days to obtain approval.

Don’t Miss: Can I Get A Free Wheelchair From Medicare

How To Apply For Medicare Through Social Security

Apply online: The easiest way to complete the Medicare enrollment application is online at ssa.gov. Its convenient to sign up from home. You can start and stop the application and save your information. After you submit your application, youll get a receipt to print and keep. You can also check the status of your application.

Apply in person: Visit your local Social Security office. You can find the nearest office with the Social Security office locator. They recommend that you make an appointment.

Apply by phone: Call Social Security at 800-772-1213 .