Do I Have Alternatives To Original Medicare When You Turn 65

When you are eligible to sign up for Medicare at 65 you may want coverage in addition to Original Medicare . This could include:

- Medicare Supplement Insurance plans: Medicare Supplement insurance plans help pay out-of-pocket costs such as copayments, coinsurance and deductibles. You have a six month Medicare Supplement Open Enrollment Period that begins the month you turn 65 and are enrolled in Medicare Part B.

- Medicare Part D: Medicare Part D is prescription drug coverage. Original Medicare generally doesnât cover most of the prescription drugs you take at home which is why some Medicare beneficiaries chose Part D coverage. You have a 7-month Initial Enrollment Period for Part D which starts three months before the month you turn 65, includes the month you turn 65, and lasts three months after the month you turn 65.

You also may want a Medicare Advantage plan.

- Medicare Advantage is an alternative way to get your Part A and Part B benefits from a private insurance company. Medicare Advantage plans must cover everything that Medicare Part A and Part B covers, with the exception of hospice care, which is still covered by Medicare Part A. The Medicare Advantage Initial Enrollment Period is the same as the Medicare Part D Initial Enrollment Period, which is 7 months. It starts three months before you turn 65, includes the month of your 65th birthday, and ends three months after your 65th birthday.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Scenario #: You Are Under 65 And On Medicare Disability

If you are already receiving Social Security disability benefits, you will be automatically enrolled into Medicare Part A and Part B after you have been receiving disability benefits for 24 months.

You do not have to sign up for Medicare if you are receiving Social Security disability. You will receive your red, white and blue Medicare card in the mail before your 25th month of disability.

Don’t Miss: How Does Medicare Supplement Plan G Work

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, it is best to enroll during your initial enrollment period to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You May Like: Does Aspen Dental Accept Medicare

Monthly Medicare Premiums For 2022

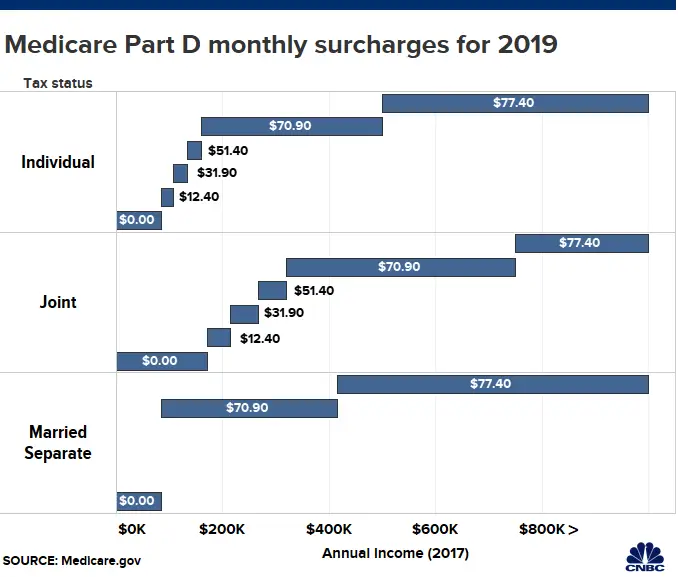

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

What About Medicare Part A

No matter your answer to question #4, we recommend that you sign up for at least Medicare Part A unless you are contributing to a health savings account and want to continue doing so.

Why should you enroll in at least Part A? Well, for most people, Part A costs $0/month.

If you have worked at least 40 quarters in the United States, this is you. So, it doesnt cost you anything to add Part A at age 65. If you have an inpatient hospital stay, that Part A coverage may help to reduce your spending under your group health plan.

Learn more about Medicare and Employer Coverage here.

You May Like: Is Medicare Running Out Of Money

About Medicare Part D

The last part of Medicare is Part D, which is prescription drug coverage. If you dont sign up for a Medicare Advantage Plan that offers prescription drug coverage, then it is a good idea to sign up for this when signing up for Parts A and B. For each month that you delay your enrollment after your initial enrollment period, the Medicare Part D premium will increase by a minimum of one percent. If you have prescription drug coverage from a private insurer, you will be exempt from this penalty.

Medicare Part B Premiums

Each year, the Centers for Medicare & Medicaid Services announces the Medicare Part B premium amount. CalPERS sets the standard Medicare Part B premium reimbursement amount on January 1 based on the amount determined by the CMS. According to the CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount.

However, if your Modified Adjusted Gross Income as reported on your IRS tax return is above the set threshold established by the CMS, youll pay the standard Medicare Part B premium amount plus an additional Income-Related Monthly Adjustment Amount . If youre required to pay an IRMAA, youll receive a notice from the Social Security Administration advising you of your Medicare Part B premium cost for the following calendar year, and how the cost is calculated.

You may defer Medicare Part B enrollment because you are still working. Contact the SSA at 772-1213 to defer. This will ensure that you avoid a late enrollment penalty when you decide to retire and enroll in Medicare Part B upon retirement.

If you choose to enroll in Medicare Part B while still actively working, youll remain in a CalPERS Basic health benefits plan and your CalPERS Employer Group Health Plan will be the primary payer, and Medicare becomes the secondary payer.

Read Also: How Much Will Medicare Pay For Assisted Living

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Is It Mandatory To Sign Up For Medicare At Age 65

May 28, 2021 By Danielle Kunkle Roberts

Many people who are still working wonder whether it is mandatory to at age 65. Not knowing the proper answer could cost you, literally. So, is it mandatory to sign up for Medicare at age 65?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage.

Sothe straightest answer I can give you is yes and no. Heres why:

Your specific circumstances affect the answer to the Medicare at 65 question. In order to discover a more precise answer for this question for YOU, you will need to answer some questions.

The answers to these questions will ultimately determine your personal answer for that frustrating question Is it mandatory to sign up for Medicare at age 65?

Learn Medicare for Free: Enroll in 6-Day Medicare Mini-Course

Also Check: How Much Is Medicare B Cost

Who Is Automatically Enrolled In Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits at least four months before your 65th birthday, youll be enrolled automatically in Medicare Part A and Part B. If you live in Puerto Rico and are receiving those benefits, only Part A will come to you automatically youll need to take extra steps to enroll in Part B.

Youll receive your Medicare card in the mail and can start using it the beginning of the month you turn 65. If your birthday is on the first day of a month, your coverage will start a month earlier.

Part A, which covers hospitalization, is free if you or your spouse has paid Medicare taxes for 40 quarters, the equivalent of 10 years. Part B, which covers doctor and outpatient services, has a monthly premium of $170.10 for most people in 2022, and the Social Security Administration will automatically deduct the premium from your monthly benefit.

But if you or your spouse is still working and you have health insurance from that employer, you may not have to enroll in Part B yet. You can send back the card and enroll in Part B later. Follow the instructions on the back of the card to delay enrolling in Part B if youre already receiving Social Security or Railroad Retirement benefits.

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

You May Like: How Do I Get Money Back From Medicare

Did You Answer Yes To Question 2

If you are still working, then we immediately move to the next question, which is how many employees does the company that you work for have? Your answer will determine whether or not you will need to sign up for Medicare at age 65.

Was your answer, less than 20 employees?

Then you will need to as soon as youre eligible. If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Was your answer, 20 or more employees? Great, then you have options.

How To Apply For Medicare Through The Rrb

If you worked for the railroad, call the Railroad Retirement Board at 877-772-5772 or submit an online service request through the RRB website.

The best time to apply is during the Medicare Initial Enrollment Period. Or, you can sign up during the Medicare General Enrollment Period.

Note: If you are still working, you can still sign up for RRB Medicare coverage when you turn 65. No need to retire.

If you, or a family member, are already receiving a railroad retirement annuity, you will automatically be enrolled in Medicare Part A and B. Coverage begins when you turn 65.

Also Check: Does Medicare Cover Keloid Removal

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

How To Apply For Medicare

Medicare enrollment is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of plans in which to enroll. As we mentioned earlier, some beneficiaries can receive automatic enrollment, and some must apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday through Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare applications generally take between 30-60 days to obtain approval.

You May Like: Does Medicare Pay For Dental Visits

Getting To Know The Options

There are several different options to consider when and how to sign up for Medicare at age 65. There are four primary parts of Medicare:

- Part A This covers any time you have to spend in a hospital.

- Part B This covers fees from doctors and physicians.

- Part C This allows those receiving Medicare to receive their medical care from a number of different delivery options.

- Part D Covers your prescription medication.

There are also Medigap policies, which offer you extra coverage when you enroll in Medicare Part A and B.

Medicare: How To Join

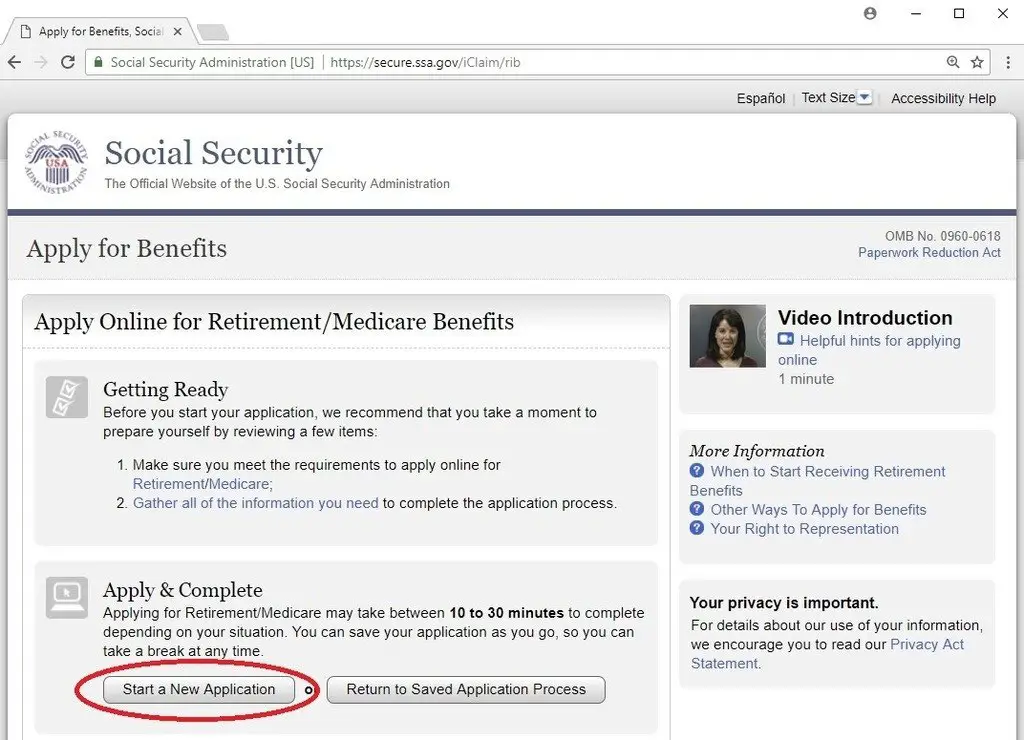

If you won’t start Medicare automatically, you must take steps to enroll. One possibility is to go online to . You can go through the process and choose Medicare only.

You also can call Social Security at 800-772-1213. Or visit your local Social Security office.

During your initial enrollment period, there are other choices. You can sign up for a Medicare Advantage Plan, known as Part C.

Those Part C Advantage plans, run by private companies, generally have networks of doctors and hospitals. If you stay in the network, you may pay less to insurance companies for coverage and to health care providers for their services than you would with basic Medicare.

Also Check: Is Medicare Issuing New Plastic Cards

What Are Medigap Plans

One reason: you won’t pay for a Medigap insurance policy. Medigap is supplementary health insurance that covers some health care costs not covered by original Medicare, such as co-payments and deductibles. Medigap policies sold after Jan. 1, 2006 aren’t allowed to provide prescription drug coverage, which is offered by Part D plans. Plan F, the most popular of Medigap’s many versions, has a national average annual cost over $1,700.

And Advantage plans usually have prescription drug coverage.

Without an Advantage plan, you may want Medigap as well as a Part D plan that covers drug costs. With Medicare Advantage or original Medicare, you’ll still owe the Part B premium.

So check local Advantage plans as well as the available Medigap and Part D policies. Don’t worry if you’re not happy with your first choice you can change your selection each year, during the annual Medicare open enrollment period from mid-October to early December.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Also Check: When To Sign Up For Medicare Part D