What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

Is Hemorrhoid Surgery Covered By Medicare

This includes facility and doctor fees. You may need more than one doctor and additional costs may apply. This is the Medicare approved amount, which is the total the doctor or supplier is paid for this procedure. In Original Medicare, Medicare generally pays 80% of this amount and the patient pays 20%.

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Don’t Miss: When Do Medicare Premiums Start

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Don’t Miss: How To Get Dental With Medicare

Medicare Part C Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage. Medicare Advantage plans are required by law to cover everything found in Medicare Part A and Part B, and many Medicare Advantage plans may typically include benefits not covered by Original Medicare such as dental, vision, hearing, prescription drugs and more.

Medicare Advantage plans are sold by private insurance companies and dont have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs.

How Are Medicare Late Enrollment Penalties Calculated

If you do not sign up for certain parts of Medicare when you first become eligible but choose to add one of these coverage options at a later date, you may have to pay a late enrollment penalty that will be added to your monthly premium.

- Medicare Part AMost people are eligible for premium-free Part A coverage. If you arent eligible for premium-free Part A dont enroll in Part A when youre first eligible but decide to enroll later, your Part A late enrollment penalty will be calculated based on how long you went without Part A coverage.The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didnt sign up.

- Medicare Part BMedicare Part B is optional coverage, but if you dont sign up when youre first eligible, your late enrollment penalty will be calculated based on how long you went without this Medicare coverage.The Part B late enrollment penalty is as high as 10 percent of the Part B premium multiplied by each 12-month period that you werent enrolled but were eligible.For example, if you were eligible for Part B for three years but were not enrolled, your late enrollment penalty could be 30 percent of the Part B premium once you finally do enroll in Part B. You must pay the Part B late enrollment penalty for as long as you have Part B coverage.

Don’t Miss: How Old Do I Have To Be For Medicare

How To Enroll In Medicare Part B

Are you or a loved one turning 65 and looking to enroll in Medicare? Youll want to know when to enroll, and how. As a starting point, find your Initial Enrollment Period and mark it on your calendar. This is your first chance to sign up for Medicare. Its a seven-month window that begins three months before your birth month. Enrolling in Part B during your IEP can pay off enrolling late means you could be stuck paying late enrollment penalties for as long as you have a Part B plan.

Theres plenty more to know about enrolling in Medicare Part B, including how to sign up and what your options are.

Get real Medicare answers and guidance — no strings attached.

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Don’t Miss: Is Dexcom G6 Cgm Covered By Medicare

How Is Medicare Part B Premium Calculated

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services . The standard amount for Part B coverage in 2022 is $170.10 per month.

If your income is high enough, you may pay more for your Part B premium each month. Medicare measures your modified adjusted gross income to determine your income level. Depending on how much money you make, you may have to pay an Income Related Monthly Adjustment Amount on top of your Part B premium. While most people pay the standard amount, an IRMAA can make your premium payment balloon up to as much as $578.30 per month.

Medicare provides IRMAA limits for adults who are:

- Single

Here are the Part B income limits and IRMAA amounts for 2022:

Single income: $91,000 or less

Joint income: $182,000 or less

$91,000 or less

Part B premium plus IRMAA: $170.10

Single income: $500,000 and up

Joint income: $750,000 and up

$409,000 and up

Part B premium plus IRMAA: $578.30

How Much Does Medicare Part C Cost

Medicare Part C plans are sold by private insurance companies. Therefore, premiums will differ according to provider, plan and location.

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Find $0 premium Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Also Check: Does Medicare Cover Hospice Expenses

Medicare Part C And Part D

If youre divorced or recently widowed, youll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

Plan costs and coverage can also change from one year to the next, so its always good to review your coverage each year. A licensed insurance agent can help you determine your plan options and compare the plans that are available where you live.

Compare Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

Read Also: Why Do Doctors Hate Medicare Advantage Plans

What Is The Cost Of Medicare Part B For 2022

Have you ever asked a friend or family member: How much does Medicare Part B cost? If so, they probably responded with their monthly premium amount. This is the monthly cost of Medicare Part B when you have Original Medicare . Its income-based and changes each year. To illustrate, heres how the 2022 Medicare Part B premium compares to the year prior:

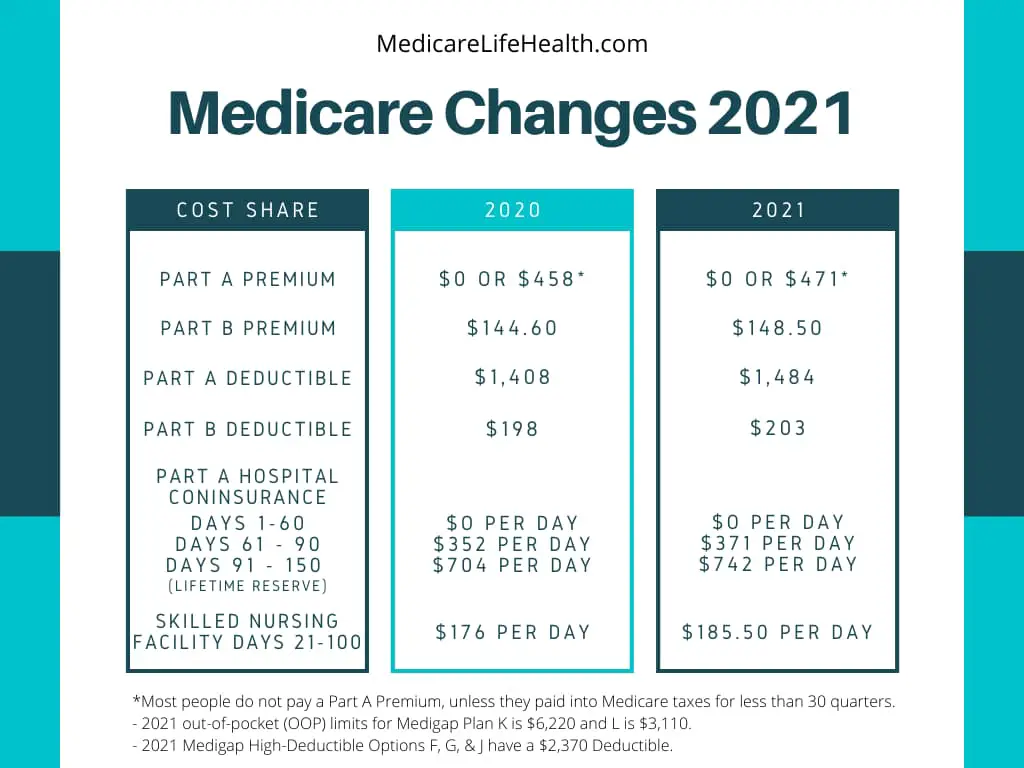

- Medicare Part B premium 2021: $148.50 and up

- Medicare Part B premium 2022: $170.10 and up

Your Medicare Part B premium is an important piece of your budget to figure out, but its just a part of what youll end up paying. How much is Medicare Part B overall? That depends your Part B premium may go up if your income is high enough, and several other costs will also factor into what you pay. These include your deductible and out-of-pocket costs like coinsurance and copayments.

How Much Does Medicare Part B Cost In 2022

The premium for Medicare Part B in 2022 is $170.10 per month. You may pay less if youâre receiving Social Security benefits. You also may pay more â up to $578.30 â depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $233 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

Read Also: Does Medicare Pay For Licensed Professional Counselors

Find Cheap Medicare Plans In Your Area

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

In 2022, the standard monthly premium for Part B is $170.10, which is either deducted from your Social Security benefits or paid out of pocket. Part B coverage makes sense for most individuals due to its cheap monthly premiums, but you should evaluate your current health insurance coverage before enrolling in the federal plan.

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Don’t Miss: Is Obamacare Medicare Or Medicaid

Government May Scale Back Medicare Part B Premium Increase

- This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

- The manufacturer has since cut the estimated per-patient annual treatment cost to $28,000, from $56,000.

- Medicare officials are expected this week to issue a preliminary determination of whether or to what extent the program will cover the drug.

There’s a chance that your Medicare Part B premiums for 2022 could be reduced.

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year’s standard premium, which jumped to $170.10 from $148.50 in 2021.

About half of the larger-than-expected increase was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite not knowing yet to what extent the program would cover it. Either way, the manufacturer has since cut in half its estimated per-patient price tag to $28,000 annually from $56,000 meaning Medicare’s cost estimate was based on now-dated information.

More from Personal Finance:

“With the 50% price drop of Aduhelm on Jan. 1, there is a compelling basis for CMS to reexamine the previous recommendation,” Becerra said.

A CMS spokesperson said the agency is “reviewing the secretary’s statement to determine next steps.”

How Much Does Xarelto Cost With Medicare

- Our review outlines how much you might pay for Xarelto with a Medicare drug plan, along with more information about how Medicare drug coverage works. Learn more and find out how to find a Medicare plan that covers Xarelto.

Xarelto is a brand name blood thinner drug that is covered by most Medicare Part D plans and Medicare Advantage plans that include prescription drug coverage. There may be rare situations in which Xarelto is covered by Medicare Part A or Part B when administered by a health care professional in an inpatient setting. But Medicare Part A and Part B do not typically cover prescription drugs obtained at pharmacies.

Xarelto lists the full cost of a 30-day supply of the drug at $492 but claims that approximately 75% of patients pay between $0 and $47 for a 30-day supply after insurance.

You can compare Medicare Part D plans including how much Xarelto costs with each plan online for free, with no obligation to enroll. You can even find out if your pharmacy is part of a plans preferred pharmacy network.

Recommended Reading: Can You Cancel Medicare Part B