Looking Forward To 2023 Medicare Advantage Premiums

Enrollment in Medicare Advantage plans has increased significantly in recent years, with nearly half of all Medicare recipients now currently enrolled in a Part C plan. Enrollment is expected to continue to shift toward Medicare Advantage, and many experts believe that competition will continue to improve the plans that insurers are offering.

Recipients may see additional benefits at no extra cost, or they may see a slight reduction in their Medicare Advantage plan cost. However, every plan and private insurer is different, and its crucial that people shopping for a Part C plan consider all the costs and benefits associated with each plan. If you have received your Annual Notice of Change and are hoping to change plans, you can do so between October 15 and December 7 during the AEP.

How Much Does Medicare Advantage Cost

Medicare still costs money even though its funded through the government via taxes. The government sponsors Medicare Part C, and extra services may be included in the plan, which can drive up costs. In general, costs break down as follows:

- In order to enroll in Medicare Advantage, you must have both Part A and Part B, which means that you have to pay a Part B premium. In 2021, the standard Part B premium is $148.50 per month for new beneficiaries. This will increase to $170.10 in 2022.

- The cutoff amount for the standard premium is an income of $88,000 or less per year . If you have a higher income based on tax returns from two years ago, that is you will generally pay a higher premium.

- The deductible is $203 per year in 2021, which increases to $233 in 2022.

- You also pay a 20 percent coinsurance or 20 percent of all medical costs after meeting the deductible for Part B.

- Medicare Part C has additional costs, which mean that you pay a monthly premium for it as well. These premiums vary but can be as low as $0 per month. Per our analysis of 2022 state data from the Centers for Medicare and Medicaid Services, premiums average to around $23 a month next year.

Medicare Part C Inpatient Coverage

The inpatient coverage youll receive with Medicare Part C will at least match those of Medicare Part A. These services include:

- inpatient hospital care

- vaccinations for flu, hepatitis B, and pneumococcal disease

Any additional coverage for these services will be outlined by the specific plan you choose. For example, some plans offer basic vision exams, while others include allowances for prescription eyeglasses or contact lenses.

The cost of a Medicare Part C plan will depend on a variety of factors. The most common costs within your plan will be:

- your Part B monthly premium, which may be covered by your Part C plan

- your Medicare Part C costs, which include a deductible and monthly premiums

- your out-of-pocket costs, which include copayments and coinsurance

Below are some cost comparisons for Medicare Part C plans in some major cities around the United States. All the plans listed below cover prescription drugs, vision, dental, hearing, and fitness benefits. However, they all differ in cost.

Don’t Miss: Can I Keep Medicare If I Get A Job

Medicare Part C Plans

Medicare Part C plan availability will change from location to location, and several providers only operate in select states or service areas. When choosing a Medicare plan, the first step is to find out what providers and plan options are available to you.

If one of our best-rated Medicare Part C plans is available in your region, these picks can help you find a Medicare plan that’s a good value. Otherwise, compare cost, coverage and overall rankings to find a plan that works for your medical needs and budget.

| Provider |

|---|

Average star ratings and cost of 2022 plans on Medicare.gov

Medicare Part C Medicare Advantage

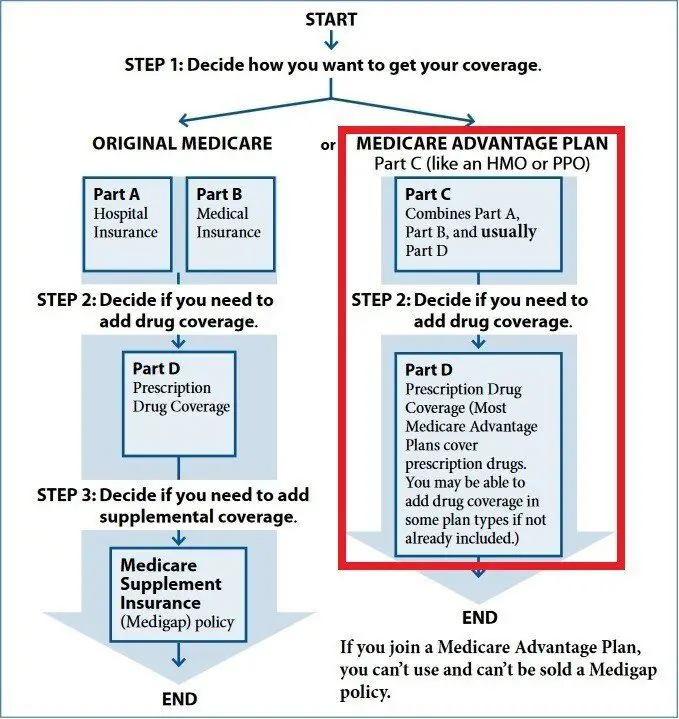

A Medicare Advantage Plan is another plan choice you may have as part of Medicare. These plans, sometimes called Part C or MA Plans, are offered by private insurance companies approved by Medicare. The premiums are a flat rate, regardless of age.

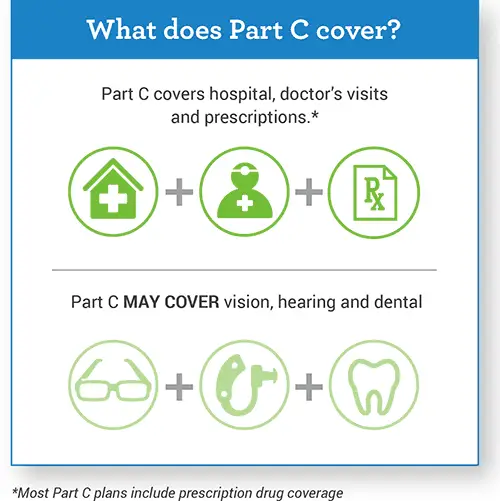

If you join a Medicare Advantage Plan, it will provide:

- Medicare Part A coverage

- Medicare Part B coverage

- Limits on the out-of-pocket costs you pay

Most include:

- Medicare prescription drug coverage

- Provider networks to help manage costs

- Extra coverage, such as vision, hearing, dental, and/or health and wellness programs

In all types of Medicare Advantage Plans, youre always covered for:

- Emergency and urgent care

Plans can charge different copays, coinsurance, and deductibles for these services.

Depending on the Medicare Advantage Plans offered in your area, you may have these options:

Also Check: When Can You Join Medicare

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled. If thats not the case, you can apply online at ssa.gov/medicare.6

That said, while most people should enroll in Medicare Part A, some people may choose to delay signing up for Part B. This typically depends on the kind of health coverage you have. For instance, if youre working and you still have health coverage through a job, or you have coverage through your spouse whos still working, you may be able to delay coverage without paying a late enrollment penalty.7 There are a lot of nuances find out about those and other situations here.

If you have Lou Gehrigs disease , end-stage renal disease , or youre under 65 and you are receiving Social Security Disability Insurance benefits, find out about enrollment here.

How Do You Enroll In A Medicare Advantage Plan

If you want to enroll in a Medicare Advantage plan, you must:

- Be eligible for Medicare

- Be enrolled in both Medicare Part A and Medicare Part B

- Live within the plans service area

- Not have end-stage renal disease

Want more information about enrollment? Visit Medicare Part C Eligibility and Enrollment Information

You May Like: What Is Medicare Part A & B Coverage

Who Is Eligible For Medicare Advantage Plans

There are 3 general eligibility requirements to qualify for Medicare Part C:

You enroll in a Medicare Advantage plan through a private insurance company, not the government.

You must be enrolled in Original Medicare before you can enroll in a Medicare Advantage plan.

You cannot have a Medicare Advantage plan and a Medicare Supplement insurance policy at the same time.

If your Medicare Advantage plan does not include prescription drug coverage, you may be allowed to add a Medicare Part D plan as well.

More info: Medicare Advantage eligibility

What Isn’t Covered By Medicare Part C

Medicare Advantage plans must provide at least the same amount of coverage as Original Medicare. Once a plan meets the minimum requirements, its up to the insurer to determine if additional services are covered.

Depending on the plan selected, Medicare Part C may not cover prescription medications. If it doesnt, you must have other prescription drug coverage. If you have a HMO or PPO, you are not allowed to purchase a separate Part D prescription drug plan. Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care.

If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary. A private room is medically necessary if putting you in a semi-private room would endanger your health or the health of someone else. For example, if you have an infectious disease, Medicare Part C will cover a private room to ensure you remain isolated and prevent the disease from spreading to other patients.

Also Check: Are Walkers Covered By Medicare

How Do I Enroll In A Medicare Advantage Plan

Even if youâre happy with your current health care coverage, you should review your plan during open enrollment to see if youâre overpaying or if your benefits will be changing in the coming year. You can join online, call your preferred Medicare Advantage provider for information about joining, or visit your local Social Security office for in-person support while choosing a plan.

As for timing, hereâs when you can enroll…

-

Initial Enrollment Period: With a few exceptions, most people have a 7-month open enrollment period surrounding their 65th birthday to join Medicare. You can join three months before your 65th birthday, during the month of your 65th birthday, or three months after.

-

Fall Open Enrollment: Fall open enrollment for Medicare coverage runs from October 15 to December 7. Any plans you choose during that time will go into effect on January 1.

-

Medicare Advantage Open Enrollment: From January 1 to March 31, you can switch Medicare Advantage Plans, move back to original Medicare, sign up for Medicare Part D, or remove Medicare Part D.

-

Special Enrollment Period: This enrollment period is triggered by a change in circumstance and differs based on your personal situation.

Whats The Difference Between Original Medicare And Medicare Advantage

The main difference between Original Medicare and Medicare Advantage is that Original Medicare benefits are administered by the government, and Medicare Advantage benefits are administered by private insurance companies.

Medicare Part A is known as hospital insurance. It covers services that are considered medically necessary to treat a disease or condition you may have.

In general, Part A can cover:

- Skilled nursing facility care

- Inpatient care in a hospital

- Nursing home care

- Home health services including : physical therapy, occupational therapy, and speech-language pathology services

Medicare Part B is known as medical insurance. It covers medically necessary services needed to diagnose and treat a medical condition, as well as services to prevent or detect common illnesses at an early stage.

Part B can cover:

- Outpatient medical services

- Ambulance services, including emergency ground transportation to a critical access hospital or skilled nursing facility when you cant be safely transported by car or taxi

- Durable medical equipment , including canes, oxygen equipment, and blood sugar monitors

- Mental health services, including inpatient, outpatient, and partial hospitalization

- Second opinions before non-emergency surgery to know and understand your treatment options

- Limited outpatient prescription drugs under limited conditions

- Clinical research

Don’t Miss: Is An Eye Exam Covered By Medicare

Medicare Part C: How Do I Enroll

First, youll need to enroll in Original Medicare . You can apply online for Original Medicare on the Social Security website, or over the phone by calling the Social Security Administration at 1-800-772-1213.

Once youve enrolled in Original Medicare, you can choose a Medicare Advantage plan using HealthCare.coms plan selector.

Medicare Advantage Vs Medigap

Medicare Advantage should not be confused with Medigap which is also often provided by the same private health insurance companies. Medigap is only for the purpose of providing supplemental coverage to Original Medicare and can only be purchased if you are receiving care through Original Medicare. For more information please refer to this article on Medigap vs. Medicare Advantage.

Don’t Miss: Can You Apply For Medicare Part A Online

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are two other types of Medicare Advantage plans to consider.

Private Fee-For-Service plans

PFFS plans may or may not have a doctor/provider network, but cover any doctor or provider who accepts Medicare. If the plan doesn’t include prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any doctor or provider you choose. MSA plans don’t cover prescription drugs, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

Don’t Miss: Does Medicare Cover Aquatic Therapy

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

How Do You Sign Up For Medicare Part C

You can sign up or change your Medicare Part C plan during one of the Medicare enrollment periods.

For most people, initial enrollment in Medicare happens around your 65th birthday, starting three months before your birthday month and ending three months after your birthday month.

Because plan availability and benefits change each year, we recommend reviewing your coverage during the annual open enrollment period. This can help you make sure youre continuing to get the best deal on the level of coverage you need.

Don’t Miss: Does Medicare Pay For Soclean

What’s The Average Cost Of Medicare Part C

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month.

There’s a wide range of plan costs. Many enrollees choose low-cost or free plans, and $0 Medicare Part C plans are available in 49 states. On the high end, some plans can cost several hundred dollars per month. Expensive plans usually provide better benefits such as a broader network of medical providers, more coverage for specialized care or better cost-sharing benefits.

An HMO plan is generally cheaper than a PPO plan. A Medicare Part C HMO plan costs about $23 per month, while local PPO plans average $43 per month. The most expensive plans are Regional PPO plans, which average $80 per month, and Private Fee-for-Service plans, which average $77 per month.

|

Medicare Part C plan type |

# of plans offered |

|---|

Medicare Part C enrollees also pay for Original Medicare

Even though Medicare Part C unifies your coverage and benefits, your monthly costs are managed separately. This means Medicare Part C enrollees will pay for Original Medicare as well as the cost of a Medicare Part C plan.

- Medicare Part A: Usually free

- Medicare Part B: $170.10 per month deducted from Social Security

- Medicare Part C: $33 average cost paid to insurance company

Cost of Medicare Part A

Most people get Medicare Part A for free because theyve been in the workforce for at least 10 years and paid Medicare taxes as a payroll deduction.

Cost of Medicare Part B

Yes, you can get $0 Medicare Part C plans

| State |

|---|

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

You May Like: Does Medicare Cover Toenail Clipping