There Are Legitimate Reasons To Consider The Plans But Certain Nuances Are Also A Huge Part Of The Conversation

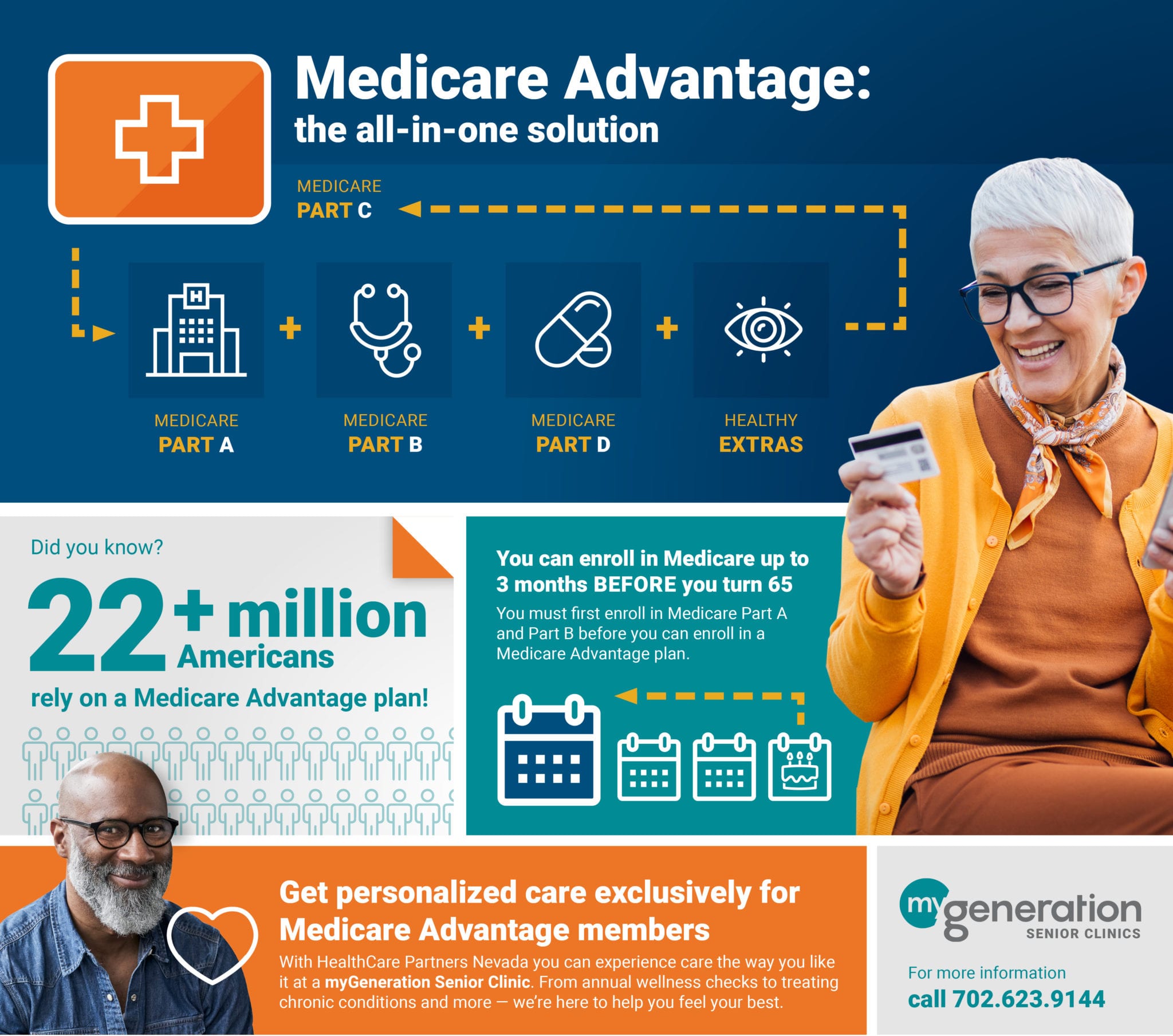

First of all, it is very important to establish some basics around what Medicare Advantage is. Over a decade ago, Medicare Part C was approved as an option for beneficiaries. The fact that it is considered a part of Medicare makes it extra confusing. Medicare has four parts. Parts A and B make up traditional Medicare. This is the public option of Medicare where the Centers for Medicare and Medicaid Services administers claim approval for beneficiaries. Part D is the stand-alone drug coverage. For most of my clients, I recommend having Parts A and B with a Part D plan, and a Medigap plan to cover some holes in Parts A and B. The alternative option is to choose Part C, which often bundles the other three parts together and is administered by a private company. When this happens, the private company gets to make decisions about your claims approvals instead of CMS.

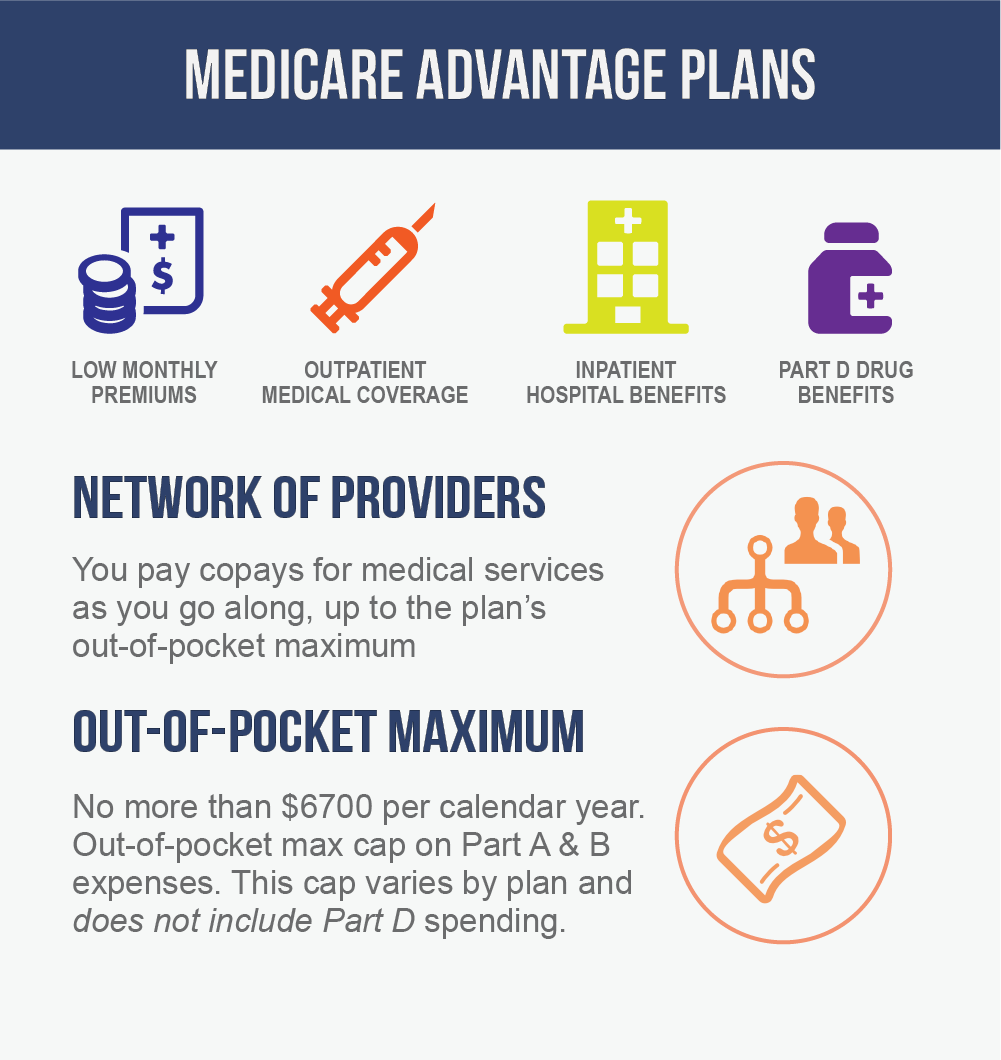

Now, this alone is not necessarily a dealbreaker, but it’s something that many salespeople do not talk about when selling the plans. These Part C plans normally have a maximum out of pocket that is between $3,500 $7,500, and a $0 premium. This can make them an appealing way to protect yourself against unforeseen out-of-pocket without having to pay a premium. However, there are a few more nuances to the plans that should be considered.

What Are The Different Medicare Part C Plans

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

There are 5 major types of Medicare Advantage plans:

What Does Medicare Part C Cost

The cost of Medicare Part C coverage may vary by location, the type of plan offered and by the plans coverage limits.

Though Medicare Advantage insurance companies are usually not permitted to use traditional underwriting standards for care and cost decisions, plans can charge group rates that fall across a wide spectrum.

Some beneficiaries may be able to get a Medicare Advantage plan with $0 monthly premiums. Other Part C plans can charge a monthly premium, with a full, partial or no deductible for services, depending on plan details.

Don’t Miss: What Age Can You Start To Collect Medicare

Think Before You Switch

So, Savage advised, “think very carefully before you switch out of traditional Medicare, which lets you see just about any doctor or go to any hospital.”

I noted a recent study by the nonprofit health care research group The Commonwealth Fund that looked at Medicare Advantage plans and traditional Medicare. Overwhelming majorities of Medicare beneficiaries in both traditional Medicare and Medicare Advantage were satisfied with their care.

The researchers discovered that the Advantage plans didn’t substantially improve beneficiaries’ health care experiences compared to traditional Medicare, but did offer somewhat more care management.

That means the Medicare Advantage enrollees were more likely to have a treatment plan where someone would review their prescriptions for them and handle medical concerns relatively quickly. “By providing this additional help, Medicare Advantage plans are making it easier for enrollees to get the help they need to manage their health care conditions,” the study said.

Of those with a health condition, a larger share of Medicare Advantage enrollees in the study said that a health care professional had given them clear instructions about symptoms to monitor and had discussed their priorities in caring for the condition.

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

You May Like: Does Medicare Pay For A Rollator

Medicare Part D Premiums

Medicare Part D prescription drug plan premiums may vary. The average Part D premium in 2022 is $47.59 per month.1

You can compare how much Part D premiums cost where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

As with Medicare Part B, you may be required to pay a higher Part D premium depending on your income.

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAAWhat Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

You May Like: Is It Mandatory To Have Medicare Part D

Reason : Plan Benefits Costs And Providers Change Every Year

This is true. Under the rules set out by the Centers for Medicare and Medicaid ServicesThe Centers for Medicare & Medicaid Services is the U.S. Federal agency that runs the Medicare, Medicaid, and Childrens Health Insurance Programs…. , insurers may change the benefits and costs in their plans. They are also allowed to change their provider networks.

This is the primary reason Medicare Advantage members should compare plans every year. Unfortunately, most enrollees dont.

Pros Of Original Medicare

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs.

Access to a broader network of providers: Original Medicare has a nationwide network of providers. Best of all, that network is not restricted based on where you live like it is with Medicare Advantage. All you need to do is pick a healthcare provider that takes Medicare. If you find a healthcare provider that accepts assignment too, meaning they also agree to the Medicare Fee Schedule that is released every year, even better. That means they can offer you preventive services for free and cannot charge you more than what Medicare recommends.

Keep in mind there will be healthcare providers that take Medicare but that do not accept assignment. They can charge you a limiting charge for certain services up to 15% more than Medicare recommends. To find a Medicare provider in your area, you can check Physician Compare, a search engine provided by the Centers for Medicare and Medicaid Services.

Ability to supplement with a Medigap plan: While most people get Part A premiums for free , everyone is charged a Part B premium based on their annual income. There are also deductibles, coinsurance, and copays to consider. For each hospitalization, Part A charges a coinsurance and for non-hospital care, Part B only pays 80% for each service, leaving you to pay 20% out of pocket.

You May Like: Can You Have Private Health Insurance And Medicare

Reason : You Are More Likely To See A Nurse Practitioner Than A Doctor

In many cases this is true. HMO and PPO health plans use a method called capitation to pay providers. A capitated contract pays a provider in the plans network a flat fee for each patient it covers. Under a capitated contract, an HMO or managed care organization pays a fixed amount of money for its members to the health care providerA person or organization thats licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers…..

For this reason, many primary care group practices use nurse practitioners and aides to reduce their costs so they can see as many patients as possible. These healthcare workers are supervised by a physician.

How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were nearly 28 million Advantage enrollees in 2021, which accounts for more than 43% of all Medicare beneficiaries Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

Also Check: How To Get A Medicare Number As A Provider

Medicare Part C Premiums

The average Medicare Advantage premium is roughly $63 per month in 2022, though many plans feature $0 monthly premiums.1

How much you pay for your monthly premium depends on the Medicare Advantage plan you enroll in.

- You will typically pay your Medicare Advantage premium in addition to your Medicare Part B premium. Some Medicare Advantage plans are called “Part B giveback” plans because they credit your standard Part B premium back to you in some way.

- Some Medicare Advantage have $0 monthly premiums.

- Some insurers may offer a credit towards your Medicare Part B premium.

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

In addition to the fact that Medicare Advantage plan insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan . These are valuable benefits that Original Medicare does not cover. For healthy people, these extras make a Medicare Advantage plan a very good deal.

Many of the extra benefits that some insurance plans offer look very enticing, but they often come with limits or high out-of-pocket costs. For example, a plan may have excellent healthcare benefits and a poor Part D plan .

Also, it is important to understand that the extra benefits, including Part D prescriptions, are not included in the plans maximum out-of-pocket limit. So, lets say you use the plans dental coverage and pay $1,500 in copays for restoration work, that $1,500 is not included in your MOOP, nor are your Part D medications. This is why so many people feel that traditional Medicare, plus a supplement plan, dental plan, and a stand-alone Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan are the best way to go.

Read Also: How Do I Qualify For Medicare Low Income Subsidy

What About The Medicare Advantage Give Back Benefit

The give-back benefit allows some Medicare Advantage plans to offer plan members a rebate on their monthly Medicare Part B premium. Beneficiaries with a give-back plan receive the benefit through Social Security. No direct payments are allowed.

The technical term for the benefit is Medicare Part B premium reduction. When you enroll in one of these plans, the insurance carrier pays some or all of your premium. In the evidence of coverage document the plan is required to provide, you will find a section titled Part B Premium Buy-Down. This is where you will find the amount the plan contributed towards your Part B premium.

Plans with a give-back benefit are becoming more popular, but they are still not widespread. The largest companies offering these plans include Aetna, Cigna, and Humana. Give-back amounts range from as little as $.10 to as much as the full $170.10 standard Part B premium.

If you pay your own Part B premium you are eligible for a give-back plan. If you have full or partial Medicaid, including aid through a Medicare Savings Program, you are not eligible.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Read Also: Does Medicare Cover Lasik Eye Surgery

Medicare Part B Premiums

Part B premiums aren’t determined by the length of time you worked or paid taxes. Most Part B beneficiaries pay a monthly premium for their Part B benefits.

The standard Medicare Part B premium in 2022 is $170.10 per month.

Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is partly based on your reported income from two years ago .

People who had higher income in 2020 may pay higher Part B premiums, which is called the IRMAA .

Medicare Part B IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

How Many Types Of Medicare Advantage Plans Are There

Insurance companies offer six different approaches to Medicare Advantage plans, although not all of them are available in all areas: an HMO , a PPO , an HMOPOS , a PFFS , an MSA , or an SNP .

You need to choose your own primary care doctor with an SNP, HMO, or HMOPOS, but not with an MSA, a PPO, or a PFFS. HMOs and SNPs are the only plans that require a referral prior to seeing a specialist, and the HMO plan is the only plan in which you must only receive care from doctors in that network.

In most instances, prescription drug coverage is included in Medicare Advantage plans, with the exception of the MSA plan and some PFFS plans. If you want to have prescription drug coverage and youre choosing an HMO or PPO Medicare Advantage plan, its important to select a plan that includes prescription coverage , because you cant purchase stand-alone Medicare Part D if you have an HMO or PPO Advantage plan. SNPs are required to cover prescriptions. PFFS plans sometimes cover prescriptions, but if you have one that doesnt, you can supplement it with a Medicare Part D plan. MSAs do not include prescription coverage, but you can buy a Part D plan to supplement your MSA plan.

Recommended Reading: Is Medicare Getting A Raise

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam-dunk choice for some people, they’re not right for everyone.

Pros:

-

Additional benefits, which may include some cost savings or subsidies toward hearing, dental and vision care.

-

Potentially lower premiums for coverage.

-

Limits on how much you may have to pay out of pocket for hospital and medical coverage. This limit is determined by the Centers for Medicare & Medicaid Services, and in 2021 it is $7,550.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

-

The potential for the plan to end, either by the insurer or by the network and its included medical providers.