How To Submit Foreign Claims With Medicare

Original Medicare only covers international health care costs under a few uncommon circumstances.

However, if you receive Medicare-covered services under these exceptions, you will need to fill out some paperwork.

Because foreign hospitals are not required to file Medicare claims, you may be required to submit an itemized bill to Medicare for any foreign health care services you receive.

If you receive Medicare-covered services on a cruise ship, the doctor will file a claim on your behalf.

For more information on where to send a foreign claim, visit the Centers for Medicare & Medicaid Services, and print the Patients Request for Medical Payment form .

You can also call 1-800-MEDICARE .

Restrictions On Use Of Us Domains

Under .us nexus requirements, .us domains may be registered only by the following qualified entities:

- Any United States citizen or resident,

- Any United States entity, such as organizations or corporations,

- Any foreign entity or organization with a bona fide presence in the United States

To ensure that these requirements are met, GoDaddy frequently conducts “spot checks” on registrant information.

To prevent anonymous registrations that do not meet these requirements, in 2005 the National Telecommunications and Information Administration ruled that registrants of .us domains may not secure private domain name registration via anonymizing proxies, and that their contact information must be made public. Registrants are required to provide complete contact information without omissions.

Under the locality namespace, delegated managers may impose additional requirements. For example, the Texas Regional Hostmaster restricts each of its delegated localities to organizations that have a mailing address in that locality.

The Bottom Line On Medicare Supplement Plans And Foreign Travel

Centers for Medicare and Medicaid Services recommends talking to a Medicare supplement insurance agent before you book a trip outside the United States. Make this conversation a part of your travel planning so you can receive information about all of your Medicare supplement plan options and be prepared should you need medical care on your trip.

Related Articles

Also Check: Which Medicare Plans Cover Silver Sneakers

How Can I Get Medicare Benefits For Overseas Travel

If you definitely want coverage for health care outside the U.S., you may want to enroll in Original Medicare and a Medicare Supplement Plan. Medicare Supplement Plans C, D, E, F, G, H, I, J, M, and N may cover up to 80% of certain health care services you need when youre traveling overseas, after you meet your plan deductible for foreign travel. The expenses must occur within the first 60 days of your trip, and not otherwise be covered by Original Medicare. These plans also have a $50,000 lifetime limit on overseas travel benefits. You can get more information about overseas travel benefits, restrictions, and exclusions in your plan brochure.

Medicare Supplement Plans can only be used with Original Medicare, however, so you unfortunately cant purchase a plan if you choose Medicare Advantage.

Do you want to start looking for a Medicare Advantage plan today? Just enter your zip code on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

How Do I Purchase Travel Medical Insurance

Before you buy a travel insurance policy, its a good idea to compare quotes from multiple insurers. Most travel insurance companies offer free quotes on their website. You can save time by visiting an insurance comparison website that compares quotes from multiple companies.

But price shouldnt be the only deciding factor. Its a good idea to find a plan that also covers Covid-related problems. The best travel insurance companies offer a solid range of coverage options at a fair price.

Don’t Miss: Will Medicare Pay For Handicap Bathroom

Does Medicare Cover You While On A Cruise

One of the concerns for travelers enrolled in Medicare is coverage while abroad. Unlike some private medical insurance plans, Original Medicare coverage is confined within the United States borders. Though Medicare Advantage plans offer Medicare benefits beyond the traditional program, care while traveling out of the country is not typically part of the offering.

There are a few exceptions to the U.S boundary rule. Medicare recipients on a cruise may be covered for medically necessary services if the physician is permitted under specific laws to provide medical services on the ship. When the healthcare service is provided, the ship must be either docked in a U.S. port or no greater than six hours away from a U.S. port. This stands whether or not the care is of an emergency nature.

Medigap Policies May Cover TravelPeople whose lifestyle includes travel may gravitate toward Medicare Supplement, or Medigap, policies. Medigap, the term for supplemental plans that enhance Original Medicare coverage, addresses the need for foreign travel care in six of the ten current supplement plans. Effective January 1, 2020, this will be pared down to four of eight plans. At that point, Plans C and F will phase out. The remaining plans that cover travel will be D, G, M and N. Medicare recipients already enrolled in Plans C and F will be able to retain these plans.

Related articles:

Does Medicaid Or Medicare Cover Me Abroad

If you are a Medicaid recipient, you may be dropped from enrollment in the medical plans if you do not keep a U.S. state residence or address or if you lose your SSI eligibility . Loss of enrollment creates a gap of coverage upon return home from traveling abroad, especially if the travel health insurance does not cover you in your home country.

Individuals who are entitled to Medicare and leave the United States are still enrolled in the Medicare program The issue is that Medicare will not make payments for services given or supplies sent outside the United States.*

If you are a U.S. citizen or permanent resident on Medicare, consider purchasing a Medicare supplement plan from a local insurance agent instead of getting separate international coverage. This supplement will cover you for the first 60 days of a trip outside of the United States. There is a $250 deductible. After meeting the deductible, the insurance will cover 80% of all billed charges up to a lifetime maximum of $50,000. This “Foreign Travel Emergency” benefit is just one of the many benefits included in the supplement package. The premium will likely be between $100 and $150 depending on your age, and if you already have a Medicare supplement, you may only need to add as little as $9.00 for overseas coverage.**

Contact the Social Security Administration and the Medicaid/Medicare office for more information .

** Information from: Good Neighbor Insurance, subject to change

Read Also: How To Get A Wheelchair From Medicare

Does Medicare Cover Surgery

Medicare covers most surgeries that are deemed medically necessary. Part A covers inpatient surgeries, while Part B covers outpatient surgeries. For example, eye surgery can be covered by Medicare even though Medicare does not typically cover vision care, as long as the surgery is required to retain or repair sight . However, Original Medicare does not cover laser eye surgery.

Medigap Coverage Outside The Us

If you have Medigap Plan C, D, E, F, G, H, I, J, M or N, your plan:

-

Covers foreign travel emergency care if it begins during the first 60 days of your trip, and if Medicare doesn’t otherwise cover the care.

-

Pays 80% of the billed charges for certain

medically necessary

emergency care outside the U.S. after you meet a $250

deductible

Don’t Miss: How Is Medicare Irmaa Calculated

Medicare’s Lack Of Coverage Abroad

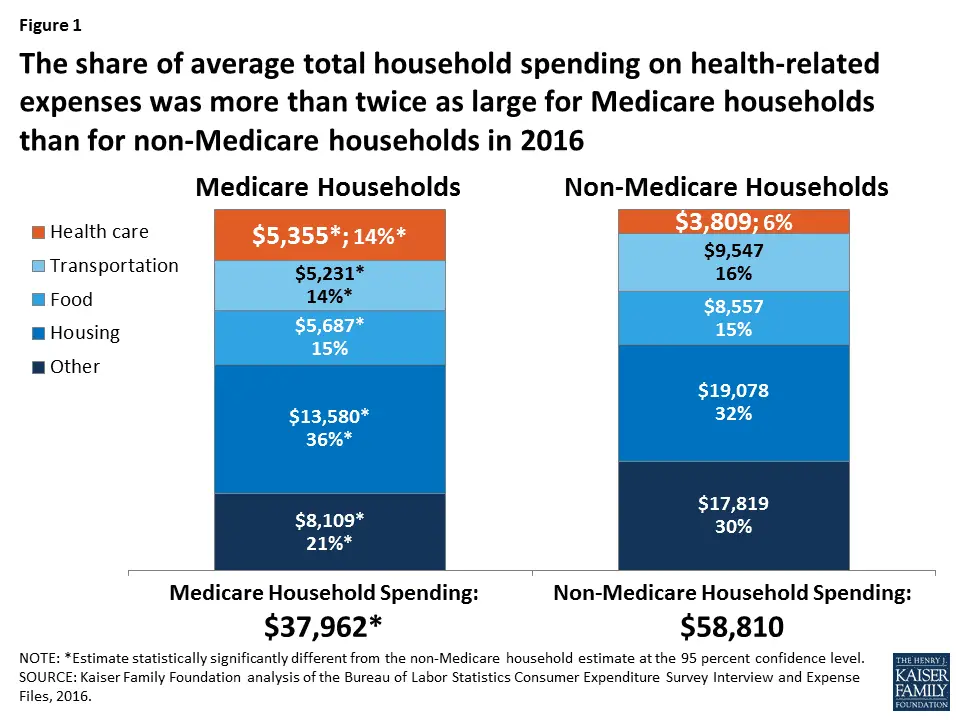

The U.S. Social Security Medicare Program does not cover health services outside of the United States. Medicare-eligible beneficiaries who travel or reside abroad must obtain some form of supplemental insurance to cover health care costs incurred abroad or pay out-of-pocket. The policy may be a disincentive for retirees in the United States to travel or live abroad and certainly presents an inconvenience for those who do travel or live abroad. On the surface, this policy may be viewed as a potential cost-saver for Medicare: Medicare is not required to reimburse costs incurred abroad nor to develop what could certainly be a costly administrative infrastructure to certify providers and reimburse for care abroad.

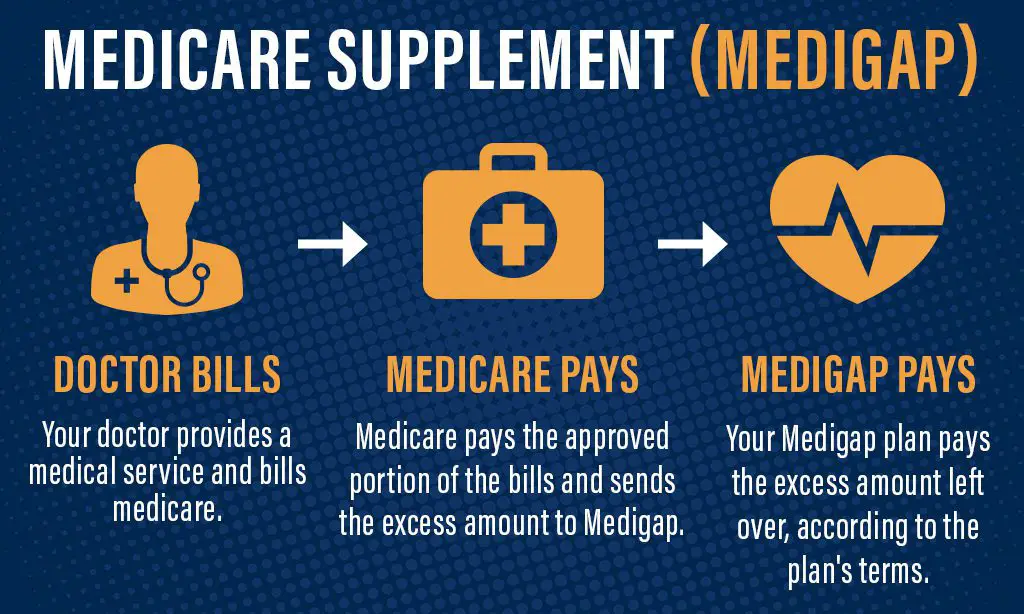

Many Medicare beneficiaries purchase Medigap policies to cover gaps in their Original Medicare coverage, such as coinsurance, co-payments, and deductibles. Medigap policies are standardized private health insurance policies designed to supplement Original Medicare. Of the standard Medigap policies A through L, C through J offer a Foreign Travel Emergency Benefit up to plan limits. However, the benefit applies only when beneficiaries are away from the United States for six weeks or less, covers emergency services only, and requires the beneficiary to pay a separate deductible of $250 USD per year.

Do I Need Travel Health Insurance

If you are planning to travel for an extended period of time or if you know that you dont have coverage through Medicare or Medicare Advantage, then its best to purchase a travel health insurance policy to go with you on your stay. these are supplemental coverage policies that will provide for your medical care if you need to see a doctor or visit a hospital while traveling outside of the US.In some cases, you can find Medigap policies for those with Medicare that will allow you to travel outside of the United States and still get coverage. A Medigap policy pays for the costs that Original Medicare plans do not cover. Medigap is not available if you are enrolled in a Medicare Advantage Plan.

Recommended Reading: Do Oral Surgeons Accept Medicare

Does Medicare Advantage Cover Travel

Medicare Advantage plans must cover the same limited foreign emergency care expenses as Original Medicare.

Some Medicare Advantage plans may offer additional coverage as well. Certain rules and restrictions may apply.

For example, your Medicare Advantage plan may require you to pay your expenses upfront and get reimbursed by the insurance company later. Other plans might cap overseas travel benefits.

Its important to check the details of your specific plan for more information. Make sure to contact your plan provider to ask about costs and coverage rules.

Are You Covered By Medicare When Traveling Abroad

Does Medicare cover you when you’re overseas? What happens if you’re traveling on vacation and get sick? Or what if you retire abroad?

The general answer is that Medicare coverage outside the U.S is available only in very limited circumstances, such as:

If you’re traveling on vacation overseas, it’s critical that you arrange for medical coverage during your stay. There are two ways to do this:

It becomes more complex if you decide to retire overseas and live permanently outside the U.S. You’ll want to make arrangements for medical insurance in your host country, and it will vary substantially between countries.

“If you’re overseas for an extended period, you might be tempted to cancel your Medicare until you return — be careful,” said Andy Landis, author of “Social Security: The Inside Story.” “If you re-enroll after a 12-month cancellation, your enrollment will be delayed. and you’ll pay a late enrollment fee for the rest of your life.”

Think again. It’s not that simple.

Don’t Miss: How Can I Find Out If I Have Medicare

Do I Have Medicare Coverage Abroad

No, in most cases, Medicare does not offer coverage for medical treatment outside the US or its territories. Medicare does not cover international travel. The instances where you could potentially be covered abroad are very limited, as follows:

- Youre within the US when you have a medical emergency, but a foreign hospital is closer to your location than the closest US hospital than can treat your emergency.

- You are within Canada, on your way back from Alaska. If you have a medical emergency as you are travelling across Canada without unreasonable delay* directly between Alaska and another US state and a Canadian hospital is closer than a US hospital.

- Non-emergencies: Only if you live in the US but the hospital that can treat your medical condition closest to you is a foreign hospital rather than a US hospital.

*To be determined by Medicare on a case-by-case basis.

If you fit into one of the situations described above, then you can be reimbursed for medical expenses as follows:

- Inpatient hospital care, when you have been admitted in a foreign hospital with a doctors order

- Emergency services . This includes the services you receive immediately prior to and during your hospital stay.

Basically, in the instances described above and only those, you will be covered in the same manner as you would in the US, including all coinsurance/copayments and deductibles.

Does Medigap Cover You While Abroad

Most Medicare Supplement plans, include a foreign travel benefit check to see if yours does. Medicare Supplement plans C, D, E, F, G, H, I, J, M, and N that cover travel, pay for 80% of the cost of medically necessary emergency care outside of the U.S. and its territories.

Youll be responsible for a separate $250 deductible. The medical emergency must occur within 60 days of the start of your trip. So it wont work if you leave the country indefinitely. Plus, theres a $50,000 lifetime limit to the amount this benefit will payout.

Medigap policies are not a Medicare replacement. Theyre an additional benefit on top of your existing coverage under Original Medicare . And be aware that Medicare Part D prescription benefits also do not extend outside the U.S. and its territories.

You May Like: Are Cancer Drugs Covered By Medicare

Does Medicare Advantage Provide Coverage While I’m Traveling Internationally

Some Medicare Advantage plans cover medical emergencies that arise during foreign travel. If youre considering Medicare Advantage and are planning to travel outside the United States, check with the carrier to see if they cover emergency care outside the United States. Medigap plans cannot be used in conjunction with a Medicare Advantage plan.

If your Medicare coverage is supplemented by retiree health benefits from your employer, check with your plan to see if you have coverage for emergencies during foreign travel.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Recommended Reading: Can I Buy Private Health Insurance Instead Of Medicare

What Are The Steps Forward

Given the possibility that an extension of Medicare to Mexico could benefit consumers, the Mexican government, and the American government, further consideration of the policy options and a detailed analysis of the issues make sense. Although we argue that Options 2 and 4 are likely the most sensible to pursue, we suggest modeling each option to assess the effects on various parties across several dimensions. A critical starting point for such a modeling exercise is to develop more-accurate estimates and projections for the size of the Medicare-eligible population in Mexico. Today’s estimates vary significantly , as do projections of future increases. A model could then be developed to demonstrate explicit benefits and costs of extending Medicare to Mexico under different policy scenarios. Such a model would assimilate information about population sizes, relative prices, behavioral responses, and program costs to generate estimates of the fiscal consequences for CMS, the quality of care in Mexico, and the expansion of the health economy in Mexico. We have included a short description of what such a modeling exercise would entail in Box A.

What Does Medigap Travel Insurance Cover

The insurance is limited to the costs of treatment in the first 60 days that travelers are outside of the country. Coverage pays 80% of the charges for most medically necessary emergency care. Medically necessary is defined case by case by Medicare, but this guide explains what is deemed unnecessary. Dont expect your Medigap plan to pay for nonemergency surgery. Instead, it will pay to get you in good-enough shape to fly back home.

Neither Medigap nor Medicare Part D pay for drugs outside of the U.S., but Medigap will probably pay 80% of the cost of drugs administered in a hospital if they are medically necessary.

Medigap pays for an ambulance ride to a foreign hospital. It also may pay to airlift you via plane or helicopter to the hospital. In a worst-case scenario, Medigap wont pay to fly your body home if you die.

Recommended Reading: What You Need To Know About Signing Up For Medicare

Medical Benefits Outside Of Bc

Due to COVID-19, the Government of Canada and Province of British Columbia have advised all residents to restrict non-essential travel:

If essential, urgent medical treatment is recommended and treatment is not available in Canada, your attending specialist in B.C. must carefully review your care and current travel advisories.

If you are eligible for coverage while temporarily absent from B.C., MSP will help pay for unexpected medical services provided the services are medically required, rendered by a licensed physician and normally insured by MSP. Reimbursement for physician services will be made in Canadian funds and payment will not exceed the amount payable had the same services been performed in B.C. Any excess cost is the responsibility of the beneficiary.

MSP does not provide any coverage for treatment provided by a health care practitioner outside the province .

PharmaCare does not provide coverage for prescription drugs or medical supplies when obtained outside B.C. Provincial assistance is also not provided to subsidize payment for ambulance services outside B.C.

Although the province does provide some coverage for emergency hospital care when you travel outside Canada, the province limits coverage to a maximum daily payment of $75.00, in Canadian funds.