How Much Does The Average Medicare Supplement Plan Cost In 2021

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2021-2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2021-2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|---|

| $235.87 |

Is It Possible To Keep My Doctor On Medicare

If you have Medicare Part B coverage, you can go to any health care provider who takes Medicare and is taking new Medicare customers. You should inquire with your doctor about becoming a new Medicare patient.

However, not all providers accept Medicare as payment in full. Medicare divides healthcare providers into three categories:

Accepting Medicare and Medicare-approved payment for services: They accept Medicare and Medicare-approved payment for services.

Nonparticipating: They accept Medicare but may charge more for services than Medicare allows.

Opt-out: They do not take Medicare and patients are responsible for all medical expenditures.

What Determines The Medicare Supplement Plan Premium

Factors that can influence the Medicare Supplement plan price are:

- Which plan you want: there are up to ten Medicare Supplement plans available labeled A, B, C, D, F, G, K, L, M and N. Medicare Supplement plan A doesnt cover everything that Medicare Supplement plan F covers, for example. Plans with more coverage may cost more.

- Which insurance company offers the plan

- The geographic area the plan covers

- How the plan is rated which is how they factor your age into your cost. Some plans charge the same monthly premium to everyone, regardless of age. Some plans charge according to the age you are when you buy the plan, and some plans charge according to your current age so your premium may increase yearly.

You May Like: Does Medicare Cover Hospice Expenses

Compare Medigap Plans Where You Live

| TTY 711, 24/7

1 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

2 AHIP. State of Medicare Supplement Coverage: Trends in Enrollment and Demographics. . https://www.ahip.org/wp-content/uploads/AHIP_IB-Medicare-Supp-Cvg-Report.pdf.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Recommended Reading: When Is Open Enrollment For Medicare

So How Much Does Medicare Cost Per Month

As you can see, Medicare costs are built up out of many building blocks. Theres no way to tell exactly how much you will pay each month, but this should give you the resources to do those calculations based on your own plans, income level, and healthcare needs. For someone with a premium-free Part A plan or a $0 monthly premium Part C plan, monthly costs can vary quite a lot compared to someone who pays the full amount for Part A or has a low-deductible, high-premium plan.

Medicare Part C And Part D

If youre divorced or recently widowed, youll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

Plan costs and coverage can also change from one year to the next, so its always good to review your coverage each year. A licensed insurance agent can help you determine your plan options and compare the plans that are available where you live.

Compare Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

Recommended Reading: Does Medicare Pay For Inogen Oxygen Concentrator

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy. Some Medicare Advantage plans may also help cover these costs. See Medigap: Medicare Supplemental Insurance and Medicare Advantage for more information.

How Much Do Medicare Parts A

As you might know, Medicare has four different coverage options- Parts A, B, C and D. Each provides support for different medical services, from hospital stays under Part A to prescription drug coverage under Part D.

Although they have their differences, each Medicare option will include a monthly premium. The premiums for Part A and Part B are set by the federal government, and premiums for Part C and Part D are usually dependent on aspects like your yearly income and can therefore vary by household. If youre curious about what a Medicare plan might cost for you per year, check out Priority Healths Medicare Cost Calculator.

Read Also: What Is Medicare In Simple Terms

Understanding The Cost Of Medicare Supplement Plans

Now that you know Medicare supplement plans are standardized, and that you can choose the coverage you want, its time to learn about the cost of Medicare supplement plans .

Many people ask questions like, How much does Medicare Supplement Plan G cost? It makes sense that Plan F and Plan G are the most expensive plans because they have the most coverage, and people want to know the cost of Medicare supplement plans. But, the pricing is different for everyone.

Insurance carriers have more than one way to rate their plans for an initial premium and rate increases. Also, insurance companies must factor in the number of people in their insurance pool, including their demographics. As a result, rates can differ wildly even when the same coverage is offered in the same local area. Thats why it is difficult to give the average cost of supplemental Medicare insurance.

When a private insurance company has more members it generally has better financial stability, rates are lower, and rate increases dont come as frequently in comparison to smaller companies with a smaller member pool.

Rate increases are a delicate balance for insurance companies. As premiums increase, healthy people shop around for better rates to reduce their costs. As a result, the pool of healthy people shrinks and the insurance company has to raise their rates even more to cover costs.

. Theres no obligation, and they offer more plan options than any other national agency.

How Much Do Prescriptions Cost With Medicare

Its no secret that prescription payments are a common worry today. Naturally, those worries will linger when it comes to enrolling in Medicare and completing monthly payments. This is where Medicare Part D comes in handy.

Part D provides two options, given that youre already enrolled in Parts A and B. One is a prescription drug plan that can come through private insurance plans like Priority Health Medicare Advantage plans. The other is a stand-alone prescription drug plan . While the exact price of monthly premiums for these plans vary by provider, most will provide a formulary list that can tell you what specific drugs might be covered, which is another great way to get clear-cut answers for your health plan. If youre a Priority Health member, you can also use the Cost Estimator tool to help estimate potential costs for prescriptions and other specific services.

Read Also: What Is The Cost Of Medicare Supplement Plan F

Medicare Is Helping Out A Large Number Of Citizens Every Year To Help Cover Medical Expenses But Will It Cost You Anything If You Pursue It If Yes How Much

Paying for health insurance is an enormous part of the vast majoritys financial plans, and it is anything but an expense that disappears once you reach 65 and can get insurance through Medicare. Realizing the amount you will pay for Medicare is critical to ensuring you have the assets to cover those costs. In any case, since there are many different parts of Medicare, which you can buy independently, the total expense of Medicare can change fundamentally. So how much does Medicare cost? Let us find out.

What Is The Best Supplemental Medicare Plan

Theres no single supplemental health insurance plan for seniors that fits everyone. But there is most likely a plan that will fit your specific needs. HealthMarkets can make finding a plan easy. Get a quote for supplemental health insurance for seniors, at no cost to you. You can also call to speak to a licensed insurance agent.

48203-HM-1221

Read Also: When Is Medicare Supplement Open Enrollment

Medicare Part A Costs

Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs.

If youâve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.â¯That means you donât have any monthly costs to have Medicare Part A.

This doesnât mean that Medicare Part A doesnât have other costs like a deductible and coinsurance â because it does â but you wonât have to pay those costs unless you actually need care.

For most people, having Medicare Part A is free.

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current Part A costs for 2022:

- $1,556 deductible

- Days 1 â 60: $0 coinsurance

- Days 61 â 90: $389 coinsurance

- Days 91+: $778 coinsurance per âlifetime reserve day,â which caps at 60 days

- Beyond lifetime reserve days: You pay all costs

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $194.50 in 2022.

How Do I Make My Medicare Payments

If youâre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youâre not on federal retirement benefits, youâll get a Medicare Premium Bill for any parts of Medicare that youâre paying for each month. You can pay this bill via your bankâs online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Read Also: How To Get Medicare For Free

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

How Do You Know If Youre Eligible For Medicare

If youre at least 65 and a U.S. citizen or a permanent legal resident for the past five years, youre eligible for Medicare. Some disabled people under the age of 65 are also covered by Medicare. After a two-year waiting period, people who receive Social Security disability insurance are usually eligible for Medicare. Those with end-stage renal disease are automatically included when they join up, while those with amyotrophic lateral sclerosis are eligible the month their impairment starts.

Read Also: Does Medicare Pay For Prep

B Late Penalties: Avoid At All Costs

The Part B late penalty is even more severe than the penalty for Part A because, for most people, it never goes away. For Part B, youll pay a 10 percent increase in your premiums for every 12-month period you could have had Part B but didnt. This means that if you dont have Part B for two years when you could have enrolled, your premiums will go up by 20 percent.

The worst part is that this 20 percent will stay with you the late enrollment premium addition doesnt go away. For this reason, its best to make sure you avoid the Part B late enrollment penalty. There are some situations that allow you to defer coverage without incurring this extra fee, for example, if you are covered by your employer. Make sure to check the details so you dont experience any unhappy surprises.

Low Or $0 Premium Plans Can Add Up To Real Savings

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. That’s rightzero dollars per month. And that usually includes coverage for services that arent covered under Original Medicare.

With Medicare Advantage plans, rather than pay your medical bills directly, the federal government contracts with private insurance companies to administer your plan. You still have all the rights and benefits that come with Original Medicare, but private insurerslike Humanacompete for your business with low premiums and added benefits.

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money out of pocket if you see a doctor outside the plans network

You May Like: What Is The Average Cost Of Medicare Supplement Plan F

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

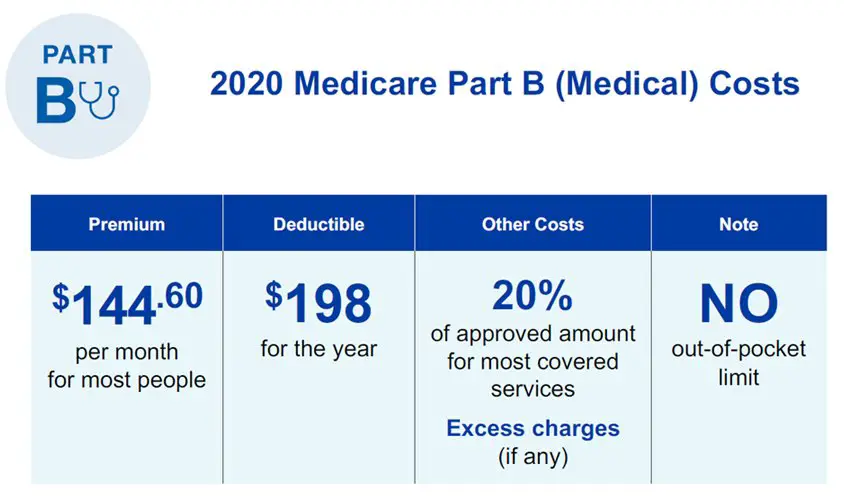

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

You May Like: What Are All The Medicare Parts