How A Medicare Advantage Msa Plan Works

The first step to getting an MSA plan is to select a high-deductible MSA plan. You can do this when you first sign up for Medicare or during the annual open enrollment period between October 15 and December 7. You won’t pay a monthly premium for your Medicare Advantage MSA, however, you must continue to pay your monthly Medicare Part B premium.

Your plan selects a bank to work with, so youll need to set up a special MSA with that bank. However, once youve set up that account, you can move the money to another banks savings account that works better for you. If you stay with the bank your plan selects, youll get a monthly account statement that tracks your expenses for you. However, if you move your deposit to another bank, youre responsible to track your expenses.

Medicare-covered expenses that you pay before your deductible is met will count toward your deductible. But you can still use your MSA to pay for qualified medical expenses that arent covered by Medicare, such as vision and dental care. Those expenses just wont count toward the deductible. Once your deductible is met, the plan will pay for all your Medicare-covered services.

Doctors who accept this type of insurance cannot charge you more than the Medicare-approved amount.

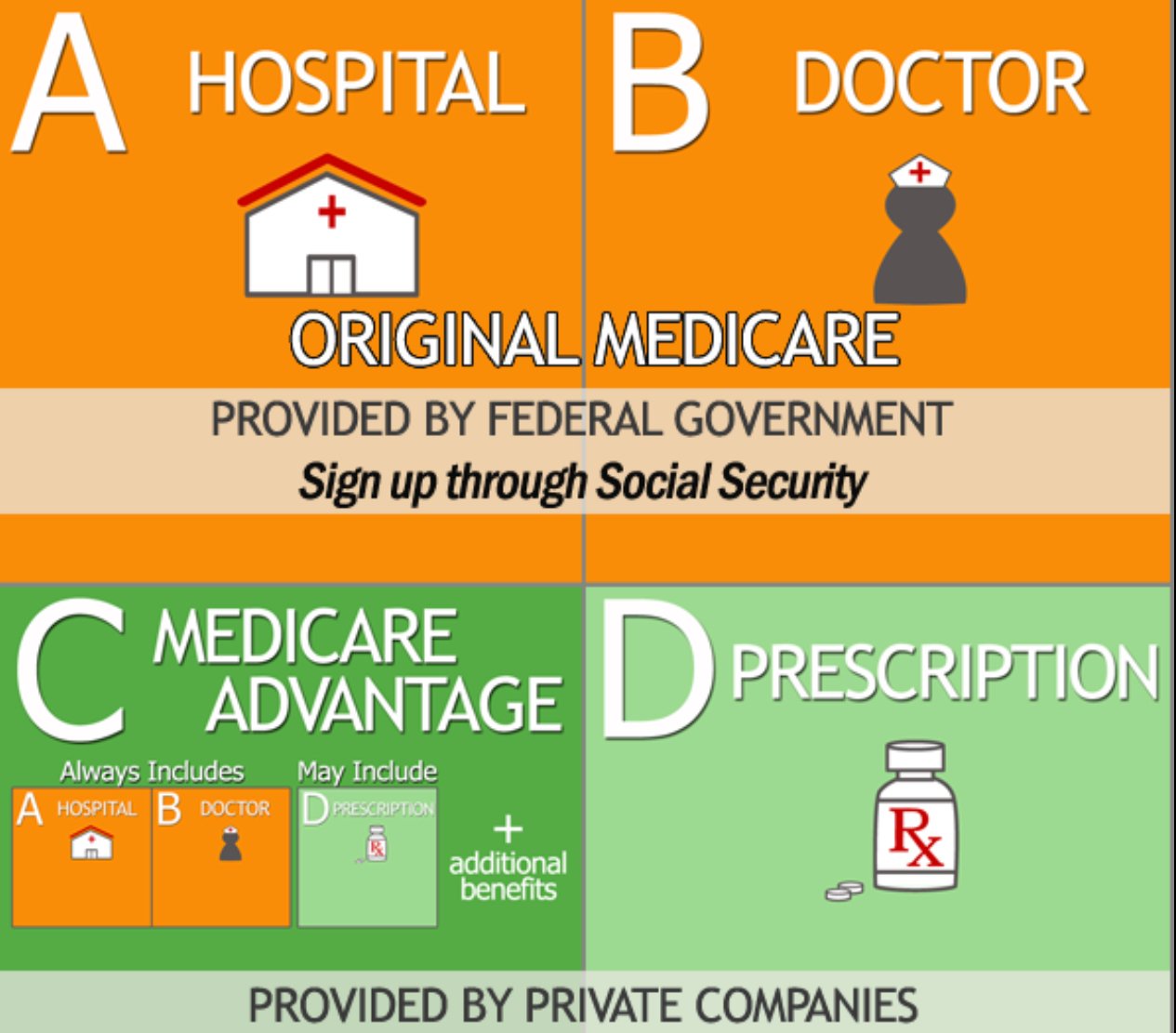

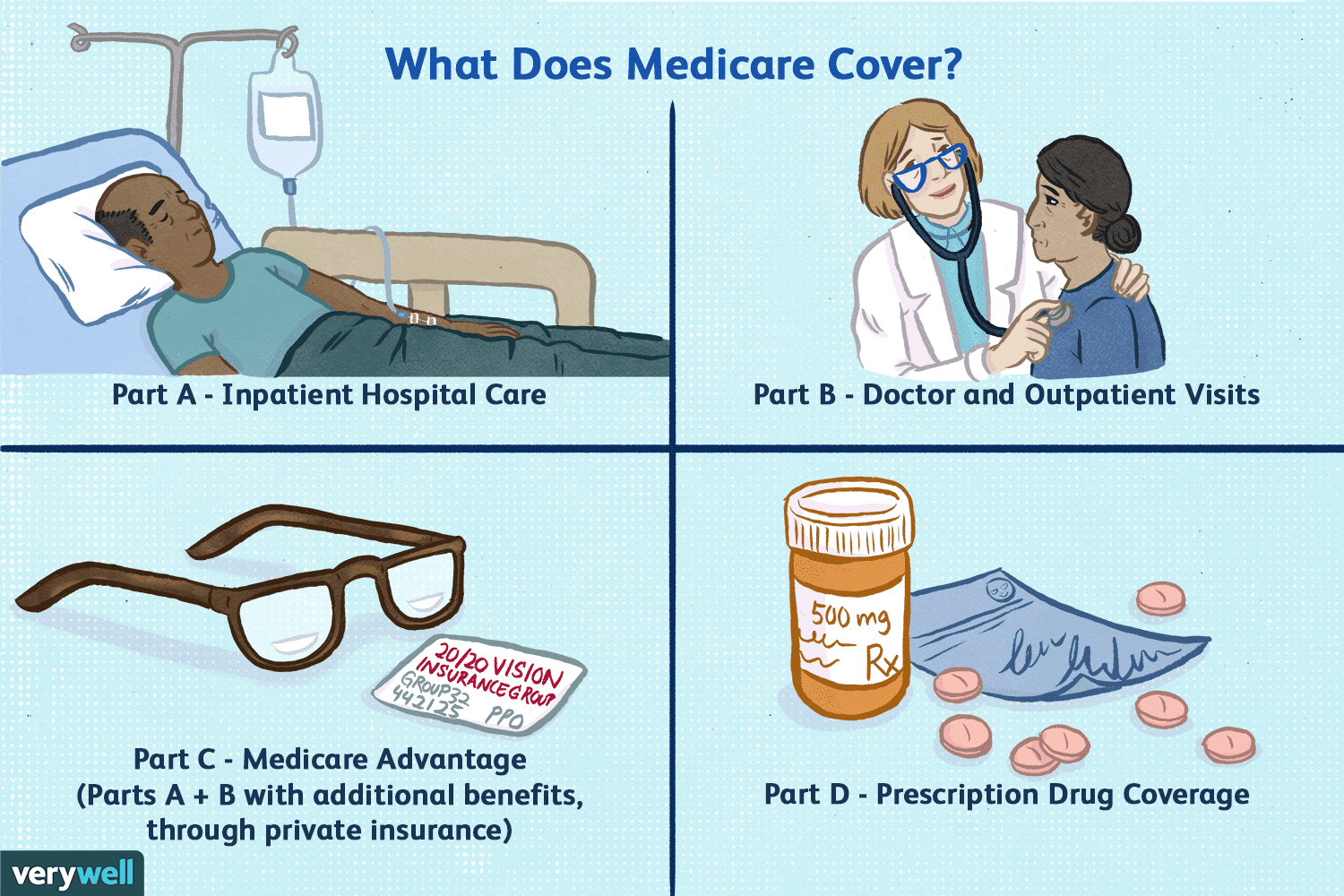

What Is Medicare Advantage

Medicare Advantage is part of the Medicare program offered to older people and disabled adults who qualify. Also referred to as Medicare Part C, Medicare Advantage plans are provided by private insurance companies instead of the federal government. They generally include hospital, medical, and prescription drug coverage. Anyone who joins an MA plan still has Medicare.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Age Do You Enroll In Medicare

How Can A Medicare Advantage Plan Have A $0 Monthly Premium

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money if you see a doctor outside the plans network

Is An Mapd Plan Right For Me

Original Medicare coverage is limited to hospital and medical services. By choosing a Medicare Advantage Prescription Drug plan, your medications may also be covered, plus some plans may offer a range of other benefits. An MADP plan can provide the convenience of all-in-one coverage and the reassurance that your out-of-pocket health care spending is limited.

Your choice of health care providers could be more limited with some Medicare Advantage plans than with Original Medicare. If you are considering an MAPD plan, it’s worth taking time to compare the coverage details for each of the available plans in your area. An MAPD plan may offer more affordable coverage than Original Medicare, but more rules to follow.

Read Also: How Old Do I Have To Be For Medicare

Examples Of Medicare Advantage Plan In A Sentence

-

Some plan sponsors have made arrangements with us to offer a Medicare Advantage plan even though you arent entitled to Part A based on former employment.

-

To the best of my knowledge, this Medicare supplement policy will not duplicate your existing Medicare supplement or, if applicable, Medicare Advantage coverage because you intend to terminate your existing Medicare supplement coverage or leave your Medicare Advantage plan.

-

If you enrolled in a Medicare Advantage plan for January 1, 2022, and dont like your plan choice, you can switch to another Medicare health plan or switch to Original Medicare between January 1 and March 31, 2022.

-

If you enrolled in a Medicare Advantage plan for January 1, 2021, and dont like your plan choice, you can switch to another Medicare health plan or switch to Original Medicare between January 1 and March 31, 2021.

-

There are exceptions that may allow you to enroll in a Medicare Advantage plan outside of this period.Please read the following statements carefully and check the box if the statement applies to you.

Medicare Program Savings And Employer

Between 1997 and 2003 Medicare continued to lose money on those beneficiaries who enrolled in MA plans, partly because of the payment floors and partly because of favorable selection into Part C. Indeed, the continued favorable selection overwhelmed the ability of risk adjustment to pay less for less expensive beneficiaries. An analysis of the Medicare Current Beneficiary Survey found that in the early 2000s, MA enrollees were less likely than TM enrollees to report that they were in fair or poor health, that they had functional limitations, or that they had heart disease or chronic lung disease . But the analysis found no difference in reported rates of diabetes or cancer.

The evolution of Medicare and commercial insurance also continued to differ. On the private side, traditional indemnity insurance had all but disappeared in the private market, a stark contrast from Medicare . Moreover, the BBA’s treatment of Part C suffered from bad timing because of a halt in the downward trends in the growth of health spending achieved by managed care in the private market in the mid-1990s.

Also Check: How Much Does A Married Couple Pay For Medicare

What Is An Hmo

A health management organization with a point of service option is a type of Medicare Advantage plan, an alternative way to receive Medicare benefits.

Get A Free Quote

Find the most affordable Medicare Plan in your area

HMO-POS plans offer coverage for members that travel a lot within the country, different from the location restrictions of HMO plans. Although, members should expect a higher cost when using the point of service option .

What Are Medicare Advantage Plans

Medicare Advantage plans, also called Part C, are an alternative to original Medicare Part A and Part B. The plans are offered by health insurance companies contracted to Medicare. To be eligible to join a Medicare Advantage plan, a person must be enrolled in original Medicare.

Advantage plans offer the same basic coverage as original Medicare , except for hospice services. The plans may also offer additional benefits, including prescription drug benefit . From January 2020, plans must offer coverage for outpatient department services.

Medicare pays a fixed sum to the insurance company for health care. The insurer may renew its contract with Medicare yearly, and Advantage plan costs, benefits, and drug lists may change from year to year.

Don’t Miss: Can You Receive Medicare Without Social Security

Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

CMS requires that Medicaid pay for copayments and coinsurance for certain people enrolled in MSPs. However, Medicaid is not required to help pay for Medicare Part C insurance premiums. Federal Medicaid laws allow each state Medicaid agency to decide if they will pay Medicare Part C premiums for those enrolled in a MSP as a qualified Medicare beneficiary.

An insurance company can also decide to charge a premium for Part C SNP enrollees who have both Medicare and Medicaid as well as those who dont have both. In this case, you would pay the full Part C premium . SNPs typically have the same basic costs as other Part C plans. This means you could pay around the same average monthly premiums as shown in the table above or maybe even $0 in premiums.

46585-HM-1121

What Is The Medicare Donut Hole

Some Medicare Advantage Prescription Drug Plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much the drug plan will pay for prescription drug costs.

Generally, once you and your drug plan spend more than $4,430 in a single year on prescription drugs, you enter the coverage gap. While you are in the coverage gap, you are responsible for paying a larger portion for covered drugs until you reach $6,550.

Once youve spent $7,050 on prescription drugs in 2022, you will leave the donut hole and enter catastrophic coverage. While in the catastrophic coverage phase, you only pay a small coinsurance or copayment for covered drugs for the remainder of the year.

Don’t Miss: How To Avoid Medicare Part D Penalty

Disadvantages Of Ma Plans

- MA plans are annual contracts. Plans may decide not to negotiate or renew their contracts.

- Plans may change benefits, increase premiums and increase copayments at the start of each year.

- You may have higher annual out-of-pocket expenses than under Original Medicare with a Medicare supplement plan.

- Your current doctors or hospitals may not be network providers or may not agree to accept the plan’s payment terms.

- In most cases, you cannot keep your stand-alone Medicare Part D plan and the Medicare Advantage plan.

Medicare Advantage Vs Original Medicare

Medicare Advantage plans may have provider networks that limit your choices. If you go outside the network, your care may not be covered or may cost significantly more than if you stay in-network. With Original Medicare, you generally can use any doctor or medical facility that accepts Medicare assignment.

In exchange for less freedom, though, you often pay less. You would still be required to pay a monthly premium for Part B, but the additional cost for a Medicare Advantage plan may be less than for a Medigap plan. Sometimes the Medicare Advantage plan may have a $0 premium.

Medicare Advantage plans may also have a maximum out-of-pocket limit for covered care. That caps the amount youll be expected to pay in addition to your premiums. In 2022, that cap is $7,550.

You May Like: Does Medicare Cover Annual Gyn Exam

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, you can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans are more restricted in terms of their provider networks. If you go out of network, your plan may not cover your medical costs, or your costs may not apply to your out of pocket maximum.

Medicare Cost Plan Enrollment

Once youre enrolled in Part B, you can enroll in a Medicare cost plan. Remember that you can only enroll in a Medicare cost plan in your area thats accepting new members.

To find a Medicare cost plan near you, use Medicares plan comparison tool. You can also contact your local State Health Insurance Assistance Program for help.

Companies that offer Medicare cost plans must provide Medicare beneficiaries with an open enrollment period of at least 30 days. During this time, youll submit an application to the plans provider to enroll.

Enrollment details may be different depending on the company thats offering the cost plan. Be sure to check with the plans provider for specific details on enrollment periods and application materials.

Read Also: How Soon Before Turning 65 Should You Apply For Medicare

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Cap On How Much You’ll Pay For Covered Services

Unlike traditional Medicare, Medicare Advantage plans have out-of-pocket limits that cannot be more than $7,500 a year for beneficiaries who access care through plan networks. This is especially good for those who have ongoing medical conditions because if you have Parts A and B alone, you won’t have a cap on your medical spending.

Going outside of the network is allowed under many Medicare Advantage preferred provider plans, though medical costs are higher than they are when staying within the plan network. The highest out-of-pocket maximum for health care spending both inside and outside of networks is $11,300 annually.

Recommended Reading: Are You Required To Get Medicare At 65

Medicare Advantage Provider Networks

Medicare Advantage plans are required to include a specified number of physicians for each of 26 medical specialties, plus chiropractic care, along with hospitals, and other providers within a particular driving time and distance of enrollees in order to ensure that Medicare Advantage enrollees have access to the physicians that they may need. Medicare Advantage plan networks have been found to include 51% of all hospitals in their county and 46% of the physicians in their county, on average. In 2015, more than one-third of Medicare Advantage enrollees were in plans with narrow physician networks.

Health Care Costs Vary Based On Your Medical Care

An important downside is that your total costs will fluctuate based on how much health care you need.

Many beneficiaries assume that Medicare Advantage plans are cheaper alternatives because their monthly premiums are often low or even nonexistent. But most of the costs with Medicare Advantage plans come from copays, coinsurance, deductibles and other out-of-pocket costs that emerge as part of the overall care process.

And these costs can quickly escalate. If you need expensive medical care, you could end up paying more out of pocket than you would with Original Medicare.

Example of how medical expenses compare for a hospitalization

A hospitalized beneficiary covered under a traditional Medicare plan will have to meet a Plan A deductible of $1,480. But after that deductible is met, there are no more costs until the 60th day of hospitalization.

Most Medicare Advantage plans have their own policy deductible. But the plans start charging copays on the first day of hospitalization. This means a beneficiary could spend more for a five-day hospital stay under Medicare Advantage than Original Medicare.

Recommended Reading: Is Medicare Good Or Bad

Who Is Eligible For Medicare Advantage

To join a Medicare Advantage plan, you must be enrolled in parts A and B of Medicare. The plan cannot refuse your application, regardless of your health needs.

In the past, you couldnt sign up for Medicare Advantage if you had permanent kidney failure, known as end-stage renal disease. But the 21st Century Cures Act of 2016 changed the rules, and since Jan. 1, 2021, people with kidney failure can now choose either original Medicare or Medicare Advantage.

Medicare Advantage plans cannot charge you higher premiums, deductibles or copays based on your current state of health or preexisting conditions. Some Medicare Advantage plans, called Special Needs Plans , provide coverage for certain groups of people, including plans that focus on coverage for those with chronic conditions, such as diabetes, heart failure or kidney failure.

You can sign up for Medicare Advantage or switch plans only at certain times, including when you first enroll in parts A and B and during open enrollment each year from Oct. 15 to Dec. 7 for new coverage starting Jan. 1. If you already have a Medicare Advantage plan, you can also switch to a different plan or change from Medicare Advantage to original Medicare, from Jan. 1 to March 31 each year.

Keep in mind

Whats the Difference Between Original Medicare and Medicare Advantage?

More on Medicare

What Are The Types Of Mapd Plans

There are various types of MAPD plans available. Depending on your location, the types of plans that may be available can typically include:

- Health Maintenance Organization plans These plans typically use a specified provider network, and services received outside of the network arent covered except in the case of emergency care.

- Preferred Provider Organization plans These plans will pay for services received outside of the provider network, but they will be less expensive if you stay within the network. Because these plans are less restrictive than an HMO plan, premium costs are typically higher.

- Private Fee-for-Service plans A PFFS plan can provide greater flexibility, as you arent required to select a primary care physician and you are typically not restricted to a provider network.

- Special Needs Plans These plans can provide tailored care for those with specific chronic medical conditions, people with low incomes or care home residents.

You May Like: Why Do I Need Medicare Part B