Qualifying For Medicare Savings By Marriage

There are several ways that marriage can save you money in Medicare. Each part of Medicare has its own rules. When you file taxes jointly, you may be put into a different income bracket that will change how much you are required to pay for your Part B or Part D premiums. Depending on your joint income, you may also be eligible for different Medicare savings programs. The income thresholds for these programs may be less for than for single people.

The biggest benefit comes with Medicare Part A coverage. You can receive this hospital insurance for free, meaning that you will not pay a monthly premium, if you have worked 10 years in Medicare-eligible employment. Essentially, the government wants to know that you paid your fair share of Medicare taxes into the system. It may be the case that you have not worked an adequate number of quarters to qualify you. However, you can be eligible for free Part A premiums on your spouse’s record.

For this to happen, your spouse needs to be eligible for Social Security and have contributed 40 quarters in Medicare-taxed employment. You must also be married for at least one year before applying for free Part A benefits.

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

2022 Medicare Part A Premium Cost|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

B Late Enrollment Penalty

If you do not sign up for Medicare Part B when you first become eligible but later decide to enroll, you may have to pay a late enrollment penalty for as long as you remain enrolled in Part B.

The late enrollment penalty for Part B can be a premium increase of up to 10% for each 12-month period that you were eligible for Part B but not enrolled.10

So, for example, if three years lapsed between the time you became eligible for Part B and the time you decided to enroll, you would face a late enrollment penalty of 30% of the premium.

You May Like: Who Is Eligible For Medicare Extra Help

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Making Sense Of Medicaid Income Limits

A long-term care Medicaid beneficiary is expected to pay all their income to the nursing home since Medicaid foots the bill for their room, board, utilities and care. Aside from personal items, such as clothing, snacks, toiletries and other incidentals, everything is covered. So, there is no need for them to retain this income. Medicaid nursing home residents are allowed to keep a small personal needs allowance of at least $30 per month for these incidental purchases, but the exact amount varies by state.

Unlike assets, each spouses income is considered separately based on who the payments are addressed to/intended for. Therefore, a community spouses income, no matter how large, does not have any bearing on whether their spouse qualifies for long-term care Medicaid. This aspect sounds refreshingly straightforward, but the rules can still be complex in certain situations.

You May Like: How Much Does Medicare Cost At 65

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Medicare If You’re Married

You and your spouse’s Medicare coverage might not start at the same time. Medicare is an individual plan . However, you may be eligible for Medicare based on your spouses work history — even if you are not eligible on your own. You and your spouse’s Medicare coverage might not start at the same time. Since you each must enroll in Medicare separately, one of you may be able to sign up before the other one, depending on your age.

Your premiums may change because of your total income. There are no family plans or special rates for couples in Medicare. You will each pay the same premium amount that individuals pay. Here’s what to know about costs:

You May Like: How Much Is Deducted From My Social Security For Medicare

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: What Date Does Medicare Coverage Start

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each lifetime reserve day after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Also Check: What Are The Four Different Parts Of Medicare

Can You Get Medicare If You Have Never Worked

As outlined above, you may still get Medicare even if you have never worked a day in your life. You may even potentially qualify for premium-free Part A, provided that your spouse has paid Medicare taxes for at least 40 quarters and meets all other Medicare eligibility requirements. Those 40 quarters do not need to be consecutive.

B Deductible Also Increased For 2022

Medicare B also has a deductible, which increased to $233 in 2022, up from $203 in 2021. The Medicare Part B deductible only has to be paid once per year, unlike the Part A deductible, which has to be paid once per benefit period.

After the Part B deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services for the remainder of the year. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Don’t Miss: Does Aarp Medicare Complete Cover Dental

Can My Spouse Use My Health Insurance

Some employers will not allow you to cover your spouse on your plan if your spouse can get their own coverage from their employer. Each spouses plan may have a different provider network with different doctors. Make sure you and your family have enough coverage. Get peace of mind by comparing health insurance plans.

You May Like: Does Humana Offer A Medicare Supplement Plan

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

Don’t Miss: Does Medicare Plan F Cover Acupuncture

Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2022 is $33.37, but costs vary.

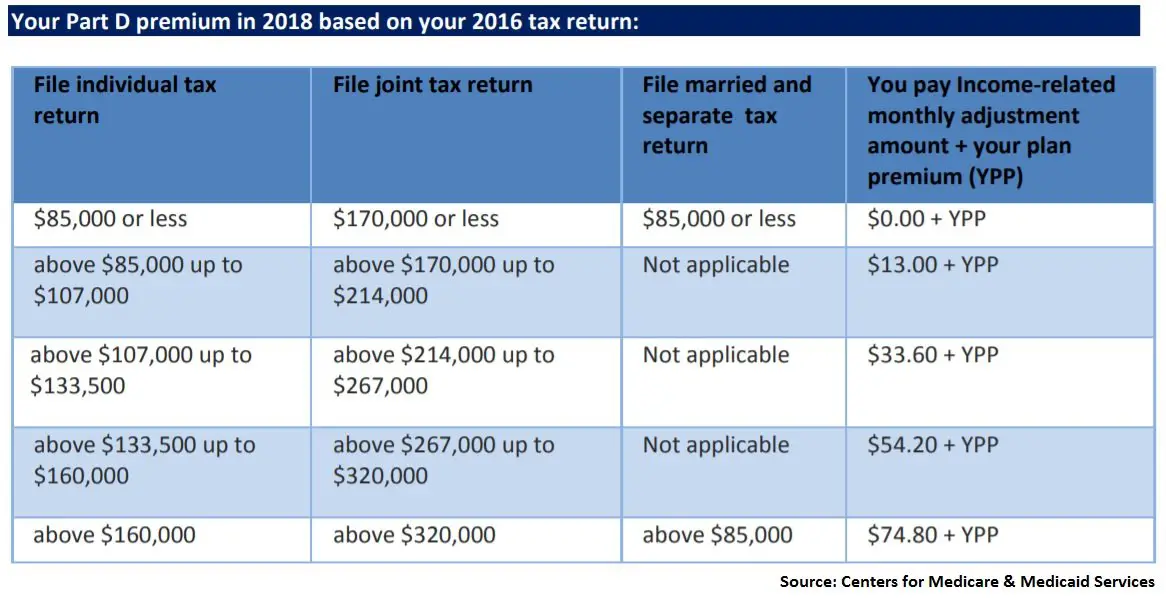

Your Part D Premium will depend on the plan you choose. Just like with your Part B coverage, youll pay an increased cost if you make more than the preset income level.

In 2022, if your income is more than $91,000 per year, youll pay an IRMAA of $12.40 each month on top of the cost of your Part D premium. IRMAA amounts go up from there at higher levels of income.

This means that if you make $95,000 per year, and you select a Part D plan with a monthly premium of $36, your total monthly cost will actually be $48.40.

Is It A Good Idea For Couples To Choose The Same Medicare Insurance Plan

Q: Is it a good idea for couples to choose the same Medicare insurance plan?

A: No, you should normally choose Medicare coverage based on your own health care needs. The exception is if both spouses are offered retiree coverage, and in that case you both may end up in a more generous plan than what is available to most Medicare enrollees.

Also Check: Does Medicare Pay For Inogen Oxygen Concentrator

You May Like: Does Walmart Take Medicare For Glasses

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

How Much Does Health Insurance Cost For A Family Of 4

The average premium for a family of 4 in 2018 was $1,168, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use and number of plan members.

Recommended Reading: Does Medicare Cover Eye Specialists

How Does Social Security Work For Married Couples

When most people reach their 60s, they start thinking about their retirement benefits from Social Security. For married couples, there are advantages to making decisions about retirement as a couple, rather than as individuals. Taking into consideration joint life expectancy, future plans, and your household budget, you can make some decisions about retirement together.

Are you eligible to receive benefits as a spouse?It is likely that both you and your spouse have earned enough Social Security credits to be eligible for your own benefits after retirement. Anyone who is married can apply for Social Security benefits on their own, or they can take the option to get up to 50 percent of their spouses benefit amount at full retirement age.

If you decide to opt for the spousal benefit but have not yet reached full retirement age yourself, that benefit will be less than 50 percent. This may still be a good option if you have not been working much through the years. You should look into how much your estimated benefits would be at full retirement age so you can make a comparison.

Do you qualify for your own Social Security benefits as well as spousal benefits?

Social Security pays your benefits first, but if the benefits you would receive through your spouse are higher than yours, you can receive a combination of these benefits to reach the amount you would receive as a spouse.

Related articles:

Should A Married Couple File Jointly Or Separately

An excellent way to find out if you should file jointly or separately with your spouse is to prepare the tax return both ways. First, double-check your calculations and then look at the net refund or balance due from each method.

If you use TurboTax online tax filing to prepare your return, they will do the calculations for you and recommend the filing status that gives you the biggest tax savings.

Also Check: Does Medicare Medicaid Cover Assisted Living

Monthly Medicare Premiums For 2021

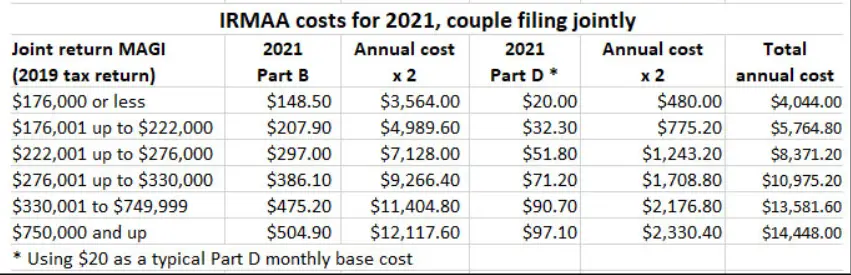

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

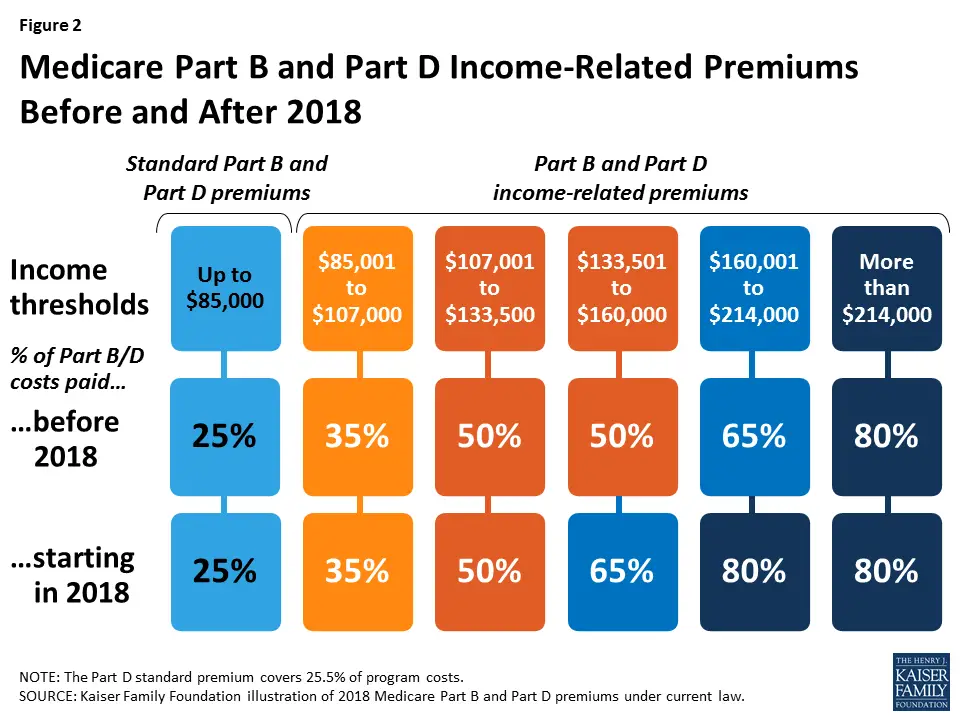

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAARead Also: Can You Go On Medicare If You Are Still Working

Recommended Reading: What Is The Penalty For Not Enrolling In Medicare