What Prescription Drugs Are Covered By Medicare Part B

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider , or through medical equipment at home. Examples of drugs covered under Medicare Part B include:

- Injections for osteoporosis

- End-stage renal disease medications

- Flu, pneumonia, and Hepatitis B shots

Medicare Part D may cover medications that arent covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

What Is Medicare Part B

Medicare Part B is medical insurance that pays for doctor visits, screenings and other outpatient services and supplies. Youll pay a monthly premium and have a deductible and coinsurance payments.

The standard Part B premium is $170.10 a month in 2022, but you could pay more, depending on your income and if you didnt sign up when you first became eligible.

The annual Part B deductible is $233. After meeting the deductible, youll pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment. Youll pay nothing for other services, such as preventative care.

Original Medicare Part B Medical Coverage

What it helps cover:

Other Part B costs:

- There is a $233 . After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for and .

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Read Also: How Can I Pay My Medicare Bill Online

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $170.10 for 2022. It may be higher if your income is more than $91,000.

Youll also be subject to an annual deductible, set at $233 for 2022. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Speak With A Licensed Agent Today

To learn more about your Medicare options Part A, B, C or D and to learn more about the benefits that might be available in Medicare Advantage plans in your area, call today to speak with a licensed insurance agent.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

You May Like: How Much Is Medicare Part C

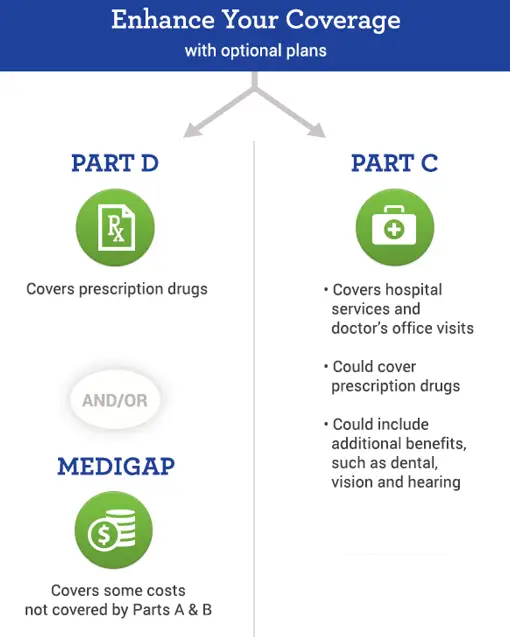

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

One important thing to know about Medigap: It only supplements Medicare and is not a stand-alone policy. If your doctor doesn’t take Medicare, Medigap insurance will not pay for the procedure.

Insurance agents are not allowed to sell Medigap to participants of Part C, Medicare Advantage.

Medigap coverage is standardized by Medicare but offered by private insurance companies. According to, Patrick Traverse, founder of MoneyCoach, Mt. Pleasant, S.C.,

“I recommend that my clients purchase Medigap policies to cover their needs. Even though the premiums are higher, it is much easier to plan for them than what could be a large out-of-pocket outlay they might have to face if they had lesser coverage.”

Whats Medicare Supplemental Insurance

Original Medicare pays for a lot of healthcare costs, but doesnt cover everything. A person might purchase a Medigap policy to help pay for any remaining healthcare costs such as copays, coinsurance, and deductibles.

As with Medicare Advantage Plans, Medigap policies are sold by private insurance companies, and you pay a monthly premium in addition to the monthly Part B premium that you pay to Medicare.

If you want extra benefits beyond Medicare Part A and Part B, both Medicare Advantage Plans and Medigap are options, but you cant have both at the same time.

You May Like: How Can You Find Your Medicare Number

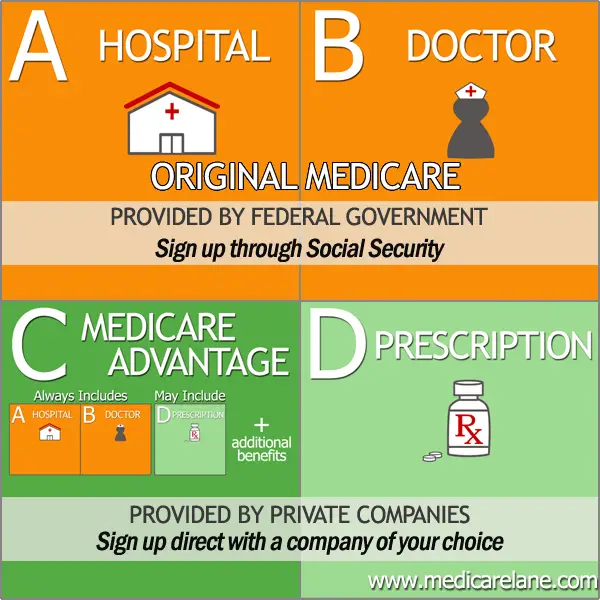

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

What Does Medicare Part B Cover

Part B covers two types of services:

- Medically necessary services: Services and supplies that meet accepted medical standards and are required to diagnose or treat a medical condition. These include ambulance services, durable medical equipment, mental health services, outpatient hospital services and a limited number of prescription drugs.

- Preventative services: Vaccinations, wellness visits and screenings related to mental health, cancer and other health conditions. Most preventative care is free if the provider accepts assignment.

If you have Part B, you can use any Medicare doctor, health care provider, hospital or facility that is taking new patients, and you can see a specialist without a referral.

Read Also: Who Funds Medicare And Medicaid

Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions.

Once you have paid $7,050 in out-of-pocket costs for covered drugs, you have reached the level of “catastrophic coverage,” for 2022 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

Based On Enrollment Decisions For 2019 The Average Monthly Premium For Stand

Figure 5: Average Monthly Premium for Medicare Part D Plans, 2006-2019

In 2019, PDP enrollees are in plans with a weighted average monthly premium of $39.63, a 4 percent reduction from 2018. The average monthly PDP premium amount has remained within a few dollars of this amount since 2010. The combined average Part D premium for PDP and MA-PD enrollees is $29.20 in 2019, a reduction of 8 percent from 2018. The overall Part D premium is lower than the average for stand-alone PDPs due in part to the ability of MA-PD sponsors to use rebate dollars from Medicare payments for benefits covered under Parts A and B to lower their Part D premiums.

Don’t Miss: Will Medicare Cover Lasik Surgery

Most Part D Enrollees Face Relatively Low Cost Sharing For Preferred Generic Drugs But Higher Amounts For Generics Not On The Preferred Tier

Figure 7: Distribution of Medicare Part D Enrollment by Cost Sharing for Generic Drugs in 2019

Around one-fourth of Part D enrollees pay $0 for preferred generics in 2019, but many pay $10 or more for generics that are not on the preferred tier. For preferred generics, 24 percent of PDP enrollees and 28 percent of MA-PD enrollees have a $0 copayment, while 74 percent of PDP enrollees and 63 percent of MA-PD enrollees face copays greater than $0 but less than $6. For generic drugs that are not on the preferred generic tier, nearly 4 in 10 PDP enrollees and 66 percent of MA-PD enrollees pay between $10 and $20.

What Are Medicare Parts A B C And D

Whether youre on Medicare, are looking to enroll or are a caregiver to a Medicare patient, the list of different plans and options can be confusing to navigate.

Medicare is a federal insurance program for adults who qualify due to age, disability or certain health conditions, but thats just the beginning.

What coverage do you need? What are the costs? Do you have any options or is Medicare a one-size-fits-all program?

Dont stress out. Learning the basics of Medicare can be as easy as A, B, C and D.

Don’t Miss: When Must I Apply For Medicare

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022:

- An annual deductible of $1,556 for in-patient hospital stays.

- $389 per day coinsurance payment for in-patient hospital stays for days 61 to 90.

- After day 91 there is a $778 daily coinsurance payment for each lifetime reserve day used.

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Recommended Reading: Does Medicare Pay For Sleep Apnea

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

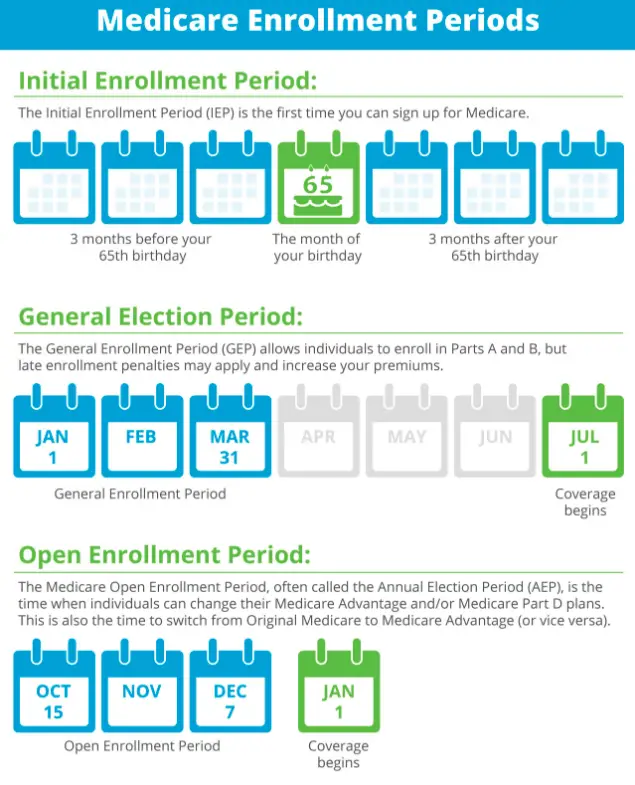

Late Enrollment Penalties For Medicare Part A And Part B

Both Medicare Part A and Part B can have late enrollment premium penalties.

The Part A Late Enrollment Penalty

If you must pay a Part A premium and enroll late, you could pay a penalty. The Part A late enrollment penalty is 10% of the Part A premium. You pay the penalty in addition to your Part A premium for twice the number of years you delay enrollment.

Example: If you delay 2 years, you will pay an additional 10% of the Part A premium for 4 years .

The Part B Late Enrollment Penalty

The Part B penalty is 10% of the monthly premium amount for each full 12-month period enrollment is delayed. You pay the Part B premium penalty in addition to your Part B premium for as long as you have Medicare Part B.

Example: You delayed Part B 3 years. To calculate how much your penalty will cost, you’ll multiply x . In this case, x . Thus, your Part B premium penalty will be 30% of the Part B premium.

You May Like: Is Silver Sneakers Available To Anyone On Medicare

Medicare Prescription Drug Coverage

Medicare Prescription Drug Coverage helps cover your prescription drug costs.

Prescription Drug Plans can be purchased as stand-alone plans from private insurers in addition to Original Medicare or Medicare Advantage plans that dont offer drug coverage.

Many Medicare Advantage plans also include Part D coverage.

If you’re looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Recommended Reading: Will Medicare Pay For A Podiatrist

What You Need To Know About Medicare Parts A B C And D

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

How Much Less Will Medicare Part B Cost In 2023

You won’t see a hefty reduction in the amount you currently pay, but it will be less than what you’re paying. Here’s how payments break down for Medicare Part B full coverage in 2023.

Standard monthly premium: $164.90 in 2023, a decrease of $5.20 from $170.10 in 2022.

Annual deductible: $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

If you earn more than $97,000 as a single tax filer, or $194,000 as a joint filer, you’ll have to pay a little extra for Medicare Part B. Here are the income-related adjustments for Part B full coverage in 2023.

Also Check: Does Medicare Cover Annual Gyn Exam