When Can I Enroll In A $0 Monthly Premium Medicare Advantage Plan

There are a few different times you can shop for a $0 monthly premium Medicare Advantage Plan. Your Initial Enrollment Period for Medicare begins 3 months before the month of your 65th birthday, including your birthday month, and continues through the 3 months after the month of your 65th birthday. During this time, you could choose to sign up for a Medicare Advantage plan if you enroll in both Part A and Part B of Medicare.1

You may enroll in a $0 monthly premium Medicare Advantage plan during the Initial Coverage Election Period . This period may run parallel with your IEP, as it also begins 3 months before you turn 65 when you choose to enroll in both Medicare Parts A and B. However, if you decide to enroll in Part B later, your ICEP begins 3 months before your Part B coverage takes effect. During this period, you may enroll in a Medicare Advantage plan.2 For more information, see .

You could also shop for a $0 monthly premium Medicare Advantage plan during the Medicare Annual Enrollment Period . This is a period each year from Oct. 15 to Dec. 7, where you may switch to a new Medicare Advantage plan or enroll in Medicare Advantage for the first time.3

If you are already enrolled in Medicare Advantage, you could also shop for $0 monthly premium plans during the Medicare Advantage Open Enrollment Period

About 40% Of Medicare Advantage Plans Have No Monthly Premium But Did You Know Some Plans Actually Reduce Your Part B Premium

Part B reinsurance is gaining traction among beneficiaries. Although not officially billed for Medicare benefits, it can be obtained through some health care plans and can cover part of or all Part B monthly premiums .

Although not all plans offer this service, the option to pay less than $170 is available. These programs may help maximize your savings for Medicare, but the benefits will depend upon several factors before selecting a particular plan. Find out more about giving back or eligibility here.

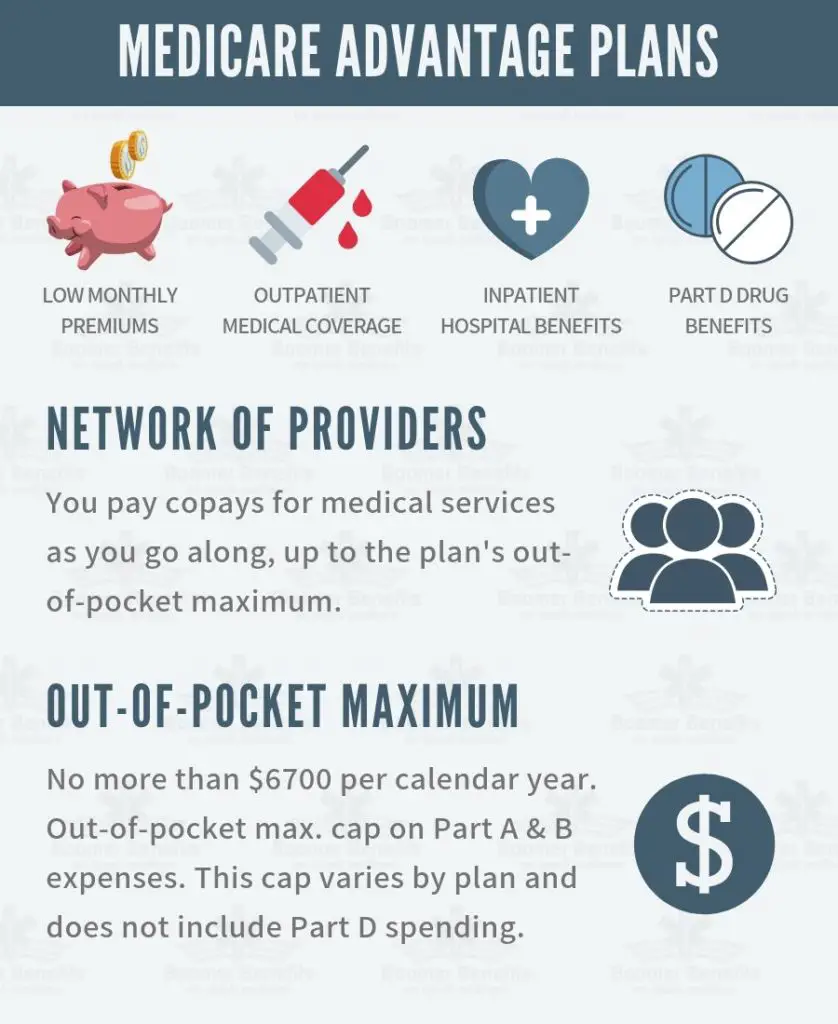

What Do Medicare Advantage Plans Cover

Medicare Advantage Plans cover all Medicare Part A and Part B services except hospice care. If you need hospice care, Medicare Part A will cover it, even if you are enrolled in a Medicare Advantage Plan..

Many plans, but not all, offer additional benefits such as vision, hearing, dental coverage, and prescription drug coverage. Another plus is that there is a yearly limit on what you pay out-of-pocket for your Parts A and B services. Once you reach that limit, you wont have to pay anything additional for that year.

All Medicare Advantage Plans include emergency and urgent care. You are also eligible for emergency coverage outside of the plans service area, though thats only within the U.S.

Read Also: What Is The Medicare Supplement Plan

What’s The Difference Between Medicare And Medicare Advantage Plans

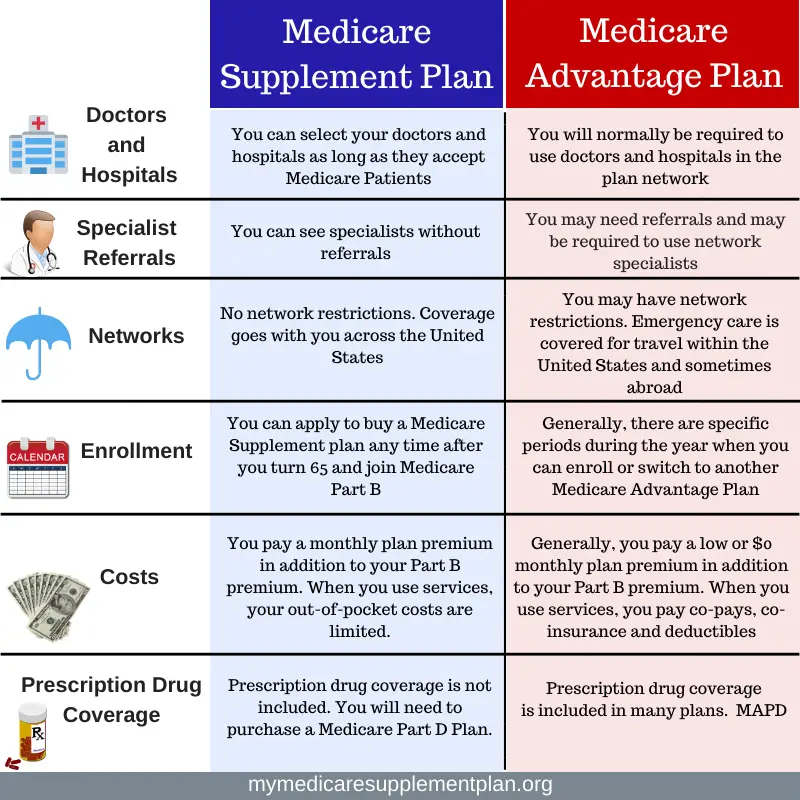

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you’ll pay more for care you get outside your network.

How Much Does Medicare Pay Ma Plans

The exact amount Medicare pays these private carriers gets a bit complex, but itâs based on a bidding process and a risk adjustment. The funding is different for each county.

Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium.

Also Check: What Does Medicare Part B Include

What Does The Future Look Like For Medicare Advantage

Medicare Advantage plans are an integral part of the Medicare program. They provide beneficiaries a multitude of options and offer additional benefits to enrollees. As the popularity of these plans continues to grow and enrollment rises, however, the Medicare program will face several challenges. First, higher costs relative to traditional Medicare will strain federal spending and the solvency of the Hospital Insurance trust fund. Second, increased enrollment could necessitate changes to the payment system for Medicare Advantage plans. Third, questions remain about the quality of Medicare Advantage plans relative to traditional Medicare.

With Medicare Advantage plans predicted to soon become the dominant form of Medicare coverage, it will be important to assess beneficiaries experiences and the long-term sustainability of the program to ensure Medicare Advantage plans provide effective, efficient, and equitable care.

What Is Part B Premium Reduction Benefit

If you enroll with Medicare Part B you will be charged an extra yearly fee. Part B rebates can reduce your Medicare benefits if you have received Medicare Advantage Part C coverage. You get a discount of between 1 and 100% on your coverage.

Even a lower monthly premium means you won’t receive any financial back. Instead, you only pay the lower price and you save what you would pay otherwise. If you pay Social Security premiums in your paycheck, your payments will be reduced.

When you are unable to make payment this will be recorded on your annual statement and will be refunded by your company’s taxable income.

Don’t Miss: Does Medicare Pay For Oral Surgery

Medicare Advantage Open Enrollment

During the open enrollment period, which runs from October 15 to December 7 each year, you can join, switch or drop a plan for your coverage to begin on January 1 of the following year.

If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on January 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

How Much Choice And Competition Is There Between Medicare Advantage Plans And Traditional Medicare

Medicare beneficiaries have a lot of Medicare Advantage plans to choose from each year. The average beneficiary had access to 39 plans in 2022, double the number in 2017.16

For Medicare beneficiaries, the choice between traditional Medicare and a Medicare Advantage plan, or between individual Medicare Advantage plans, can be frustrating, complex and confusing.17 Many beneficiaries seek advice from their doctor, a broker, a State Health Insurance Assistance Program , or other experts.18 To complicate matters, brokers are not required to offer all Medicare Advantage or Part D plans and typically offer a subset of the plans available. In addition, brokers are typically paid more to help people enroll in Medicare Advantage plans than traditional Medicare.19

Read Also: How To View Medicare Claims Online

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans may also require your primary care doctorâs referral to see specialists before they will pay for services.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Do I Need Medicare Part A

What Else Do I Need To Know About This Type Of Plan

-

These groups are eligible to enroll in an SNP: 1) people who live in certain institutions or who live in the community but require nursing care at home, or 2) people who are eligible for both Medicare and Medicaid, or 3) people who have specific chronic or disabling conditions , HIV/AIDS, chronic heart failure, or dementia). Plans may further limit membership to a single chronic condition or a group of related chronic conditions. You can join a SNP at any time.

- An SNP provides benefits targeted to its members special needs, including care coordination services.

- If you have Medicare and Medicaid , your plan should make sure that all of the plan doctors or other health care providers you use accept Medicaid.

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act changed Medicare Advantage plans several times. Almost all of these changes were related to the health insurance market as well. The ACA has reopened the Medicare donut hole, but it does not mean prescriptions for drugs have no limits.

Beneficiaries had to pay some of these expenses. The Medicare plan has a new policy which allows insurers across the country not to charge plan members more for services besides chemotherapy. It may affect the cost of your plans as well.

Don’t Miss: How To Enroll In Medicare Part B Online

Why Do Medicare Advantage Plans Cost More And How Are They Paid

The government pays Medicare Advantage plans a set rate per person, per year under what is called a risk-based contract.12 That means that each plan agrees to assume the full risk of providing all care for that inclusive amount. This payment arrangement, called capitation, is also intended to provide plans with flexibility to innovate and improve the delivery of care.

But there are layers of complexity built into and on top of that set rate that allow for various adjustments and bonus payments. While those adjustments have proved useful in some ways, they can also be problematic and are the main reason for the extra cost of Medicare Advantage vis-à-vis traditional Medicare.

Benchmarks. Plan benchmarks are the maximum amount the federal government will pay a Medicare Advantage plan. Benchmarks are set in statute as a percentage of traditional Medicare spending in a given county, ranging from 115 percent to 95 percent. For counties with relatively low spending, benchmarks are set higher than average spending for traditional Medicare for counties with relatively high spending, benchmarks are set lower than average traditional Medicare spending . Special Needs Plans and other Medicare Advantage plans are paid in the same manner, with the same benchmarks.

How Do I Pay My Medicare Premiums

Generally, a Medicare Advantage plan costs about $15 per month, according to the CDC. Medicare Advantage premiums can vary based on the type of plan and the place of your residence, and vary between 0 and 100 %. The Medicare Part B cost will be $188.10. Medicare Advantage plans receive payments from the federal government .

Recommended Reading: Is The Cologuard Test Covered By Medicare

How Do I Bill For Hospice Patients

For hospice patients under Part B only, you must include the GW modifier on COVID-19 vaccine administration claims if either of these apply:

- The vaccine isnt related to your patients terminal condition

- The attending physician administered the vaccine

How To Find The Best Medicare Advantage Plan

Find a knowledgeable insurance agent, says Joe Valenzuela, co-owner of Vista Mutual Insurance Services in the San Francisco Bay area. Having an agent doesnt cost the member anything. Medicare insurance agents are subject matter expertsmany have spent years learning the ins and outs of each plan they represent. There are also many nuanced differences between Medicare Advantage plans. An agent can narrow down the search to only those plans that most closely align with the clients needs.

Valenzuela recommends asking what is most important to you when choosing a Medicare Advantage plan and keeping that priority top of mind. He also suggests paying attention to the fine print in the plan you select.

Once you narrow your search down to one or two plans, look through the plans benefits line by lineyou dont want any surprises, he says. For example, a plan may have a low premium and copayments but might cost you much more each month in prescription copays.

A couple of important benefits to look at are the plans annual out-of-pocket maximum and your prescription drug costs, adds Valenzuela. Check all your medications on the plans formulary so youre aware of the prescription copayments, deductibles and any restrictions.

Compare Top Medicare Plans From Humana, a Forbes Health 5-Star Rated Carrier

Don’t Miss: What Is The New Medicare Plan

Medicare Advantage Plan Annual Prices By Location

| LOCATION | |

|---|---|

| 82061 | $0-$0 |

Most Medicare drug plans have a coverage gap called the donut hole, which means theres a temporary limit on what the drug plan will cover. A person gets limited coverage while in the donut hole. whether on a Medicare Advantage plan or a separate Part D plan, says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturers discount is on that medication and what the insurance company pays for that medication, she says.

How Do Medicare Advantage Plans Make Money

If youâre getting ready to sign up for Medicare, you have two paths to consider. One is signing up for Original Medicare and adding a Medicare Supplement along with a Part D drug plan. The other option is to choose a Medicare Advantage plan.

We have resources on our website to help you choose between these. You can also call our office to connect with a local agent â they will help you decide. But what we want to talk about today is how these Medicare Advantage plans work.

If youâve shopped around for one before, you mightâve noticed there are some options with a $0 monthly premium. A lot of people wonder how these plans can do that âhow are MA making any money if they donât have a premium?

Disclaimer:We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Join Our Email List

Join our newsletter for weekly emails about senior interest topics like Medicare, health and fitness, gardening, retirement planning, and more!

Don’t Miss: How Old Should You Be To Apply For Medicare

How Do You Receive The Part B Giveback

Medicare recipients can deduct Part B of their Social Security income. Beneficiaries that aren’t covered by Social Security can receive direct payment for the Part B premiums they received.

It can be used by anyone in either the case that the Social Security benefit is not being paid out or the benefits are reduced. If you pay the premium directly to Medicare you will pay a lesser rate.

Who Doesnt Qualify For Medicare Advantage

First, you must be enrolled in Original Medicare Part A and Part B to be eligible for Medicare Part C. Second, because Medicare Advantage Plans are administered by private companies, you must reside in the plans service area. You can find out if a plan operates in your area by checking out the governments Medicare site.

You cannot purchase a Medicare Advantage Plan and a Medigap plan at the same time.

Don’t Miss: What Is The Difference Between The Medicare And Medicaid Programs

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plans monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

Your Other Insurance Pays First When Medicare Is The Secondary Payer

Medicare serves as the secondary payer in the following situations:

Don’t Miss: What Is Difference Between Medicare And Medical