Beneficiaries Could See A Reduced Part B Premium After Biogen Announced It Would Slash The Price Of Its Expensive And Controversial New Alzheimer’s Treatment Aduhelm

Seniors could see a cut in their monthly Medicare Part B premiums for 2022 after a controversial new drugs price was slashed.

In November, Medicare set the monthly Part B premium at $170.10 for this year, a more than 14% increase from 2021. The agency said the increase was due in part to Medicare beneficiaries potentially being prescribed Aduhelm, an Alzheimers treatment manufactured by Biogen that was approved by the Food and Drug Administration last year. Since the drug must be administered by a physician, it is covered under Part B. Initially, the drug would cost $56,000 each year per patient, though Biogen later announced the price would be reduced to $28,200.

Health & Human Services Secretary Xavier Becerra said on Monday in a press release that he had asked Medicare to reassess the recommendation for the 2022 Medicare Part B premium, given the dramatic price change of the Alzheimers Drug, Aduhelm.

With the 50% price drop of Aduhelm on January 1, there is a compelling basis for CMS to reexamine the previous recommendation, he added.

The Kaiser Family Foundation estimated in June before the drugs price was cut that if just a quarter of the 2 million Medicare beneficiaries who were prescribed an Alzheimers treatment under Part D in 2017 took Aduhelm, it would cost Medicare $29 billion in one year. Overall, Medicare spent $37 billion on all Part B drugs in 2019, according to KFF.

What Is The Medicare Part B Premium In 2022

Each month, Medicare beneficiaries who have Medicare Part B coverage are responsible for paying the Medicare Part B premium. In 2022, the Medicare Part B base premium is $170.10 but can be as high as $578.30 for those with a higher income.

When you , you become responsible for paying the monthly premium. Unlike Medicare Part B is not premium-free for beneficiaries. To receive each month, you must satisfy the premium.

Each year, the Medicare Part B premium changes based on several outlying factors. So, you can expect to pay a different premium starting each January.

Medicare Part B Premium Reduction Wont Happen This Year

- About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer’s drug Aduhelm.

- The cost of Aduhelm was cut in half after the premium was determined, and treatment is limited to certain patients.

- Any savings that result from lower-than-estimated spending this year will be applied to the calculation for the 2023 Part B premium, which will be set later this year.

Your Medicare Part B premiums won’t be reduced this year, the government has announced.

After being directed by Health and Human Services Secretary Xavier Becerra in January to reassess this year’s $170.10 standard monthly premium a bigger-than-expected 14.5% jump from $148.50 in 2021 the Centers for Medicare & Medicaid Services has released a report determining that a mid-year correction is not feasible. Instead, any savings that result from lower-than-estimated spending this year will be applied to the calculation for the 2023 Part B premium.

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite actuaries not yet knowing the particulars of how it would be covered because Medicare officials were still determining that.

More from Personal Finance:There’s an ‘un-retirement’ trend amid this hot job market

Read Also: How To Get A Power Wheelchair Through Medicare

How Is The Medicare Part B Premium Calculated

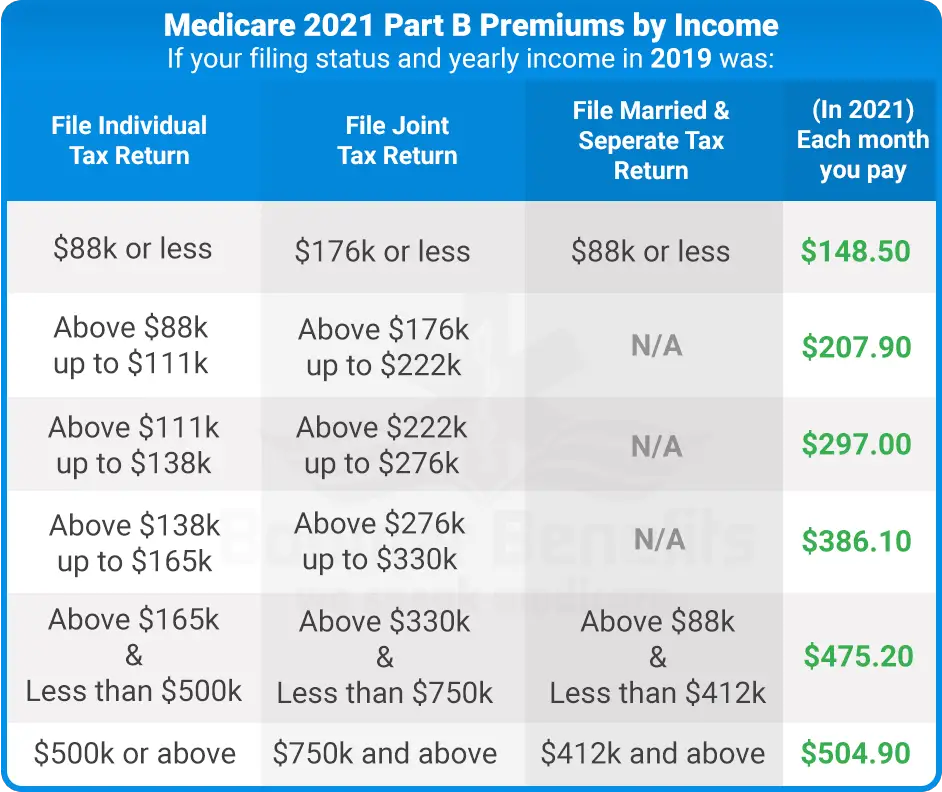

The Medicare Part B premium is calculated based on your income and tax filing status from two years prior to the current year. Each fall, the base Medicare premium and deductible costs are released for the following year.

However, if your income exceeds a set amount, you will receive an Income Related Monthly Adjustment Amount in addition to your monthly Medicare Part B premium.

To notice a difference in your premium, your annual income would need to exceed $91,000 when filing individually or $182,000 when filing jointly.

| Individual tax return | |

|---|---|

| $409,000 or above | $578.30 |

Suppose you delayed Medicare Part B without creditable coverage in place. In that case, you will be responsible for paying an additional Medicare Part B late enrollment penalty on top of your monthly premium . Thus, it is important to enroll in Medicare Part B when you are first eligible.

So How Are The Medicare Premiums You Pay For Calculated

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.

Don’t Miss: How Do Medicare Recipients Qualify For Home Health Care

Does Social Security Count As Gross Income

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married …

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrig’s disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If you’re eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you don’t sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didn’t enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicare’s website to find out more.

You May Like: Do I Qualify For Extra Help With Medicare

Understanding Medicare Part B Premiums

Medicare is a U.S. federal health insurance program that is funded by a wage tax. That is the amount labeled as FICA, for Federal Insurance Contributions Tax, on a standard paycheck.

Medicare Part A, which is free to most of those who are eligible for coverage, covers hospital-related costs as well as costs for treatment at skilled nursing facilities, hospice care, and home health care.

There is an annual deductible for Part A. You’ll pay a maximum of $1,484 out of pocket in 2021 and $1,556 in 2022. There is no coinsurance payment unless a hospital stay exceeds 60 days.

Part B is insurance for outpatient medical care such as doctor visits, preventative services, ambulance services, mental health costs, and the cost of durable medical equipment.

The standard monthly fee for Part B is $148.50 in 2021 and $170.10 in 2022. It is higher for Medicare recipients who have higher incomes.

The annual deductible for Part B is $233 for 2021 and $233 in 2022. In addition, the patient pays 20% of the bill as a coinsurance payment.

| Medicare Part B Costs for 2021 |

|---|

| Individuals |

Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Filing Individual Tax Returns Total Monthly Part B Premium

$91,000 or less

Total Monthly Part B Premium

$170.10

$544.30

$578.30

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

| Total Monthly Part B Premium |

|---|

|

$91,000 or less |

$91,000 or less

Total Monthly Part B Premium

$170.10

Recommended Reading: How To Get Medicare To Pay For Hearing Aids

Medicare Part D Costs By Income Level

Like Medicare Part B, Medicare Part D prescription drug plans use the IRMAA to determine plan premium costs by income level.

2022 Medicare Part D plan premiums, based on income level from 2020, are as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Are you looking for Medicare prescription drug coverage?

You can compare Medicare drug plans available where you live and if you’re eligible enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

Also Check: Does Blue Cross Blue Shield Medicare Supplement Cover Silver Sneakers

When And How To Apply For Medicare

If you already receive benefits from Social Security , you will automatically be enrolled in Part B, and Part A, starting the first day of the month in which you turn 65. If you’re not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare.

There are a few other enrollment situations to be aware of, including if you’re a disabled widow or widower between age 50 and 65 but have yet to apply for disability benefits if you’re a government employee and became disabled before age 65 if you, a spouse, or dependent child has permanent kidney failure or if you’ve had Medicare Part B in the past.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

You May Like: Does Medicare Cover Scooters For Seniors

What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Although not available in all areas, some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

Medicare Part C Premiums

The average Medicare Advantage premium is roughly $63 per month in 2022, though many plans feature $0 monthly premiums.1

How much you pay for your monthly premium depends on the Medicare Advantage plan you enroll in.

- You will typically pay your Medicare Advantage premium in addition to your Medicare Part B premium. Some Medicare Advantage plans are called “Part B giveback” plans because they credit your standard Part B premium back to you in some way.

- Some Medicare Advantage have $0 monthly premiums.

- Some insurers may offer a credit towards your Medicare Part B premium.

Don’t Miss: Can I Get Medicare If I Live Outside The Us

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Don’t Miss: Does My Doctor Accept Medicare Advantage

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Medicare Part B Premiums

Medicare Part B premiums for 2022 will increase by $21.60 from the premium for 2021. The 2022 premium rate starts at $170.10 per month and increases based on your income, up to to $578.30 for the 2022 tax year. Your premium depends on your modified adjusted gross income from your tax return two years before the current year.

The signup period for Medicare Parts A and B takes place at the same time as when you apply for Social Security.

The rate of $170.10 is for single or married individuals who file separate tax returns with MAGIs of $91,000 or less and for married taxpayers who file jointly with MAGIs of $182,000 or less.

You May Like: Does Medicare Offer Home Health Care

Medicare Part B Rate Changes: A History And Some Possible Relief For 2022

Over the past decade, Medicare Part B rates have risen by an average of 6% annually. A key reason for rate hikes in recent years is the cost of specialty drugs covered by Part B. Because Medicare isn’t authorized to negotiate drug prices, Medicare recipients shoulder those costs in the form of higher monthly premiums.

In 2022, the standard Medicare Part B premium jumped by $21.60 â the largest dollar increase in the program’s history. The rate went up partly to pay for an expensive new Alzheimer’s drug called Aduhelm, which the Food and Drug Administration approved at a very high cost. But in a rare move, the drug maker greatly reduced the price of Aduhelm â after Part B premiums were established for 2022.

Due to the decreased drug price, Centers for Medicare & Medicaid Services is looking into lowering the 2022 Part B rate. Reducing the rate would be unprecedented and would provide relief to Medicare recipients this year, but long-term solutions are needed. One option being discussed by Congress is the Elijah E. Cummings Lower Drug Costs Now Act, which would cap drug prices and empower Medicare to negotiate costs.