Is Medicare Part C Good For Veterans

Medicare Part C works like a private health insurance policy. You get all of your treatment from hospitals and doctors who accept Medicare, but your health plan is actually managed through a private health insurance company. You can get HMO, PPO or PFFS with Medicare Part C plans. Each company has these plans, but they are all of different costs. To choose the right one, you should pick a plan that allows you to see your own doctors but also pays for most out-of-pocket costs.

MedicarePartC.com, a website owned by Health Network Group, LLC, markets products underwritten by National Health Insurance Company, Integon National Insurance Company and Integon Indemnity Corporation. Health Network Group National Health Insurance Company, Integon National Insurance Company and Integon Indemnity Corporation are all related companies under National General Holdings Corp.

Health Network Group – 1199 S. Federal Highway, STE 403, Boca Raton, FL 33432

Copyright © MedicarePartC.com | California Consumer Privacy | Privacy Policy | Terms of Use | About Us | Sitemap

Get A Custom Quote Right Now On A Medicare Plan – Simply Complete This Form Or Call Us Toll Free

Medicare Enrollment Questions? Speak with an Agent

Do I Need To Pay For Medicare If I Have Va Benefits

For individuals who have worked enough quarters, Part A is premium-free. Therefore, its beneficial to take this hospital insurance through Medicare.

However, like other beneficiaries, veterans with VA benefits will need to pay a standard Part B premium for outpatient coverage through Medicare. The premium is subject to increase the longer you go without Part B coverage after youre eligible, via a lifelong late penalty. The penalty occurs because, unlike group health insurance through a large employer, VA benefits arent for Medicare.

As a result, youll save money long-term when you sign up as soon as youre eligible. If you need financial assistance with your Part B premium, you might qualify for a Medicare Savings Program .

Should You Get A Medicare Advantage Plan If You Have Va Benefits

Probably.Medicare Advantage plans can help reduce your out-of-pocket risk should you go to a non-VA facility. Many MA plans have no little or no additional cost.

If you go down this path we recommend that you look for a zero premium policy. Be sure to select one that doesnt include prescription drugs since you most likely get those through the VA. We can help you enroll in a no-cost Medicare Advantage plan at 800-930-7956.

Don’t Miss: Does Medicare Cover Blood Pressure Machines

Do I Need Medicare If I Have Va Benefits

You can use your VA benefits with a private insurance plan, Medicare, or Medicaid. However, just because you can use them together doesnt mean that you need both. So, do you need Medicare if you already have VA benefits?

To keep things brief, no, you do not need Medicare if you have VA benefits. You can get all of your care through your VA benefits. That said, the VA will put you into groups based on your disabilitys severity. Your group can determine the extent of care that you get with your VA healthcare plan.

As a result, we recommend using some form of Medicare with your VA benefits. You can get inpatient and outpatient coverage, in addition to your coverage through Veterans Affairs. Whether you just want Original Medicare, or you want extra coverage with Part D, Medigap, or Medicare Advantage, it is well worth it to enroll when you qualify.

Champva And Medicare Advantage

Medicare Advantage plans cover at least the same benefits as original Medicare . However, a person may have a different copay or coinsurance. For example, they may pay a set cost for seeing their primary care provider or specialist.

Depending on a persons plan, CHAMPVA will usually cover the costs of copays or coinsurances related to the Medicare Advantage plan.

There may be some assistance with paying out-of-pocket costs, including the following:

- Extra Help: This Medicare program helps people with a low income pay for prescription drugs.

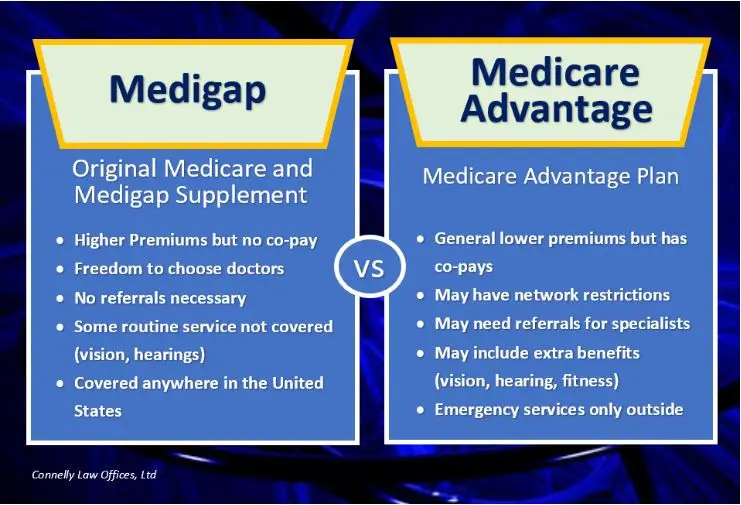

- Medigap: Also known as Medicare supplement insurance, Medigap is a separate policy to help cover out-of-pocket costs for people enrolled in original Medicare . According to a VA report, a person enrolled in both CHAMPVA and original Medicare could benefit from an additional insurance policy to cover out-of-pocket costs.

- Medicare savings programs: These income-based programs may help pay for original Medicare premiums, deductibles, and coinsurances. Because CHAMPVA does not pay for Medicare Part B premiums, these programs may help reduce costs for a person enrolled in CHAMPVA.

Also Check: When Can A Disabled Patient Enroll In Medicare Part D

Who Pays First If You Have Va Benefits And Medicare

If you are eligible for both Medicare and VA benefits, then you can receive medical treatment at facilities that accept both programs. However, you must choose which benefits youll be using each time that you go to see a doctor or receive any type of treatment. Medicare wont be able to pay for some services that are only available through VA facilities, so its important that you check what type of coverage you have and how it can be used with veterans healthcare plans.If you want the US Department of Veterans Affairs to pay for your medical treatment, then you have to go to a VA facility or have VA allow you to get services at a non-VA hospital or rodctor.Medicare will pay the bill at a non-VA hospital if you cant get coverage for all of the treatment that you received. Medicare will part for the part of the services that your other benefits dont cover. Medicare may also be able to pay your co-payment for care that you are authorized for through veterans benefits but only if you go to a non-VA hospital.In general, veterans should try to receive care first at a Veterans Affairs facility and then try to supplement any costs with a Medicare Plan.

Veterans With Disabilities And Medicare

Since veterans with disabilities may qualify for Supplemental Security Income or Social Security Disability Insurance , you may also be eligible for Medicare based on disabilities under SSDI.

Qualifying disabilities differ between the VA and Medicare. In order to receive disability benefits through the VA, applicants must have a disabling condition that was caused by or worsened because of active duty. Veterans who were discharged may not be eligible for disability benefits.

On the other hand, to qualify for SSI and SSDI, the disability doesnt have to be service-related, but it must render you unable to do substantial work and must last or be expected to last at least a year. Additionally, your discharge status isnt taken into account.

There are two cases in which you can get expedited processing for your SSI or SSDI applications.

Once approved for SSDI, veterans automatically get Medicare coverage after theyve been receiving disability benefits for two years.

You May Like: Can You Receive Medicare Without Social Security

Can Veterans Enroll In Medicare

- If youre receiving Social Security benefits at least four months before you turn 65, youll automatically be enrolled in Medicare Part A and Part B. If your birthday is on the first day of the month, Medicare coverage starts on the first day of the previous month. Otherwise, your coverage starts the first day of the month you turn 65.

- If you wont receive Social Security benefits at least four months before you turn 65, then you wont automatically get Medicare coverage. Youll have to enroll in Medicare on your own.

- If you have private insurance or some other type of health coverage, you may want to enroll in Medicare to expand your coverage and possibly reduce your out-of-pocket medical expenses. When you turn 65, you should enroll in Medicare Part A if you are eligible based on 10 quarters of taxable work history. If you or your spouse are covered by a current employer group health plan, you may defer Part B coverage without incurring late enrollment penalties or delayed coverage in the future.

Do Veterans Need Medicare

Technically, veterans do not need Medicare because many veterans qualify for VA benefits and TRICARE. However, a private insurance plan called a Medicare Advantage plan may offer supplemental benefits that you cant receive with just VA benefits.

For example, some Medicare Advantage plans have a $0 monthly premium and some even come with a fitness benefit. That could mean that your Medicare Advantage plan provides a gym membership. VA benefits and TRICARE do not.

Read Also: What Is Medicare On My Paycheck

Medicare For Veterans: A Comprehensive Guide

Veterans can receive both Veteran Affairs health care benefits and Medicare when they become eligible. It’s recommended for veterans to enroll in Medicare so they have more coverage options when seeking care from non-VA health care facilities.

Our fact-checking process starts with vetting all sources to ensure they are authoritative and relevant. Then we verify the facts with original reports published by those sources, or we confirm the facts with qualified experts. For full transparency, we clearly identify our sources in a list at the bottom of each page.

Content created by RetireGuide and sponsored by our partners.

Key Principles

Editorial Independence

To support the health care needs of about 19 million veterans in the United States, the government has a number of health insurance programs available, such as VA benefits, Medicare and Tricare for Life.

Veterans can benefit from both VA health care coverage and Medicare if they meet the eligibility requirements. About half of veterans who have VA benefits also have Medicare coverage, expanding their options for where and how they receive care.

This guide covers whether you should enroll in VA benefits and Medicare, how VA benefits work with Medicare, and how Tricare for Life works with Medicare.

Here Are Some Examples

One of our dear family members is 70 years young. He served in the Navy and receives VA benefits. He visits the VA oftenmainly for prescriptions drugs and hearing aids.

But his Florida Medicare Supplement plan has been invaluable for many years. Most recently he needed to see a dermatologist the day he was leaving for a cruise.

We were able to find him a Medicare approved doctor and get him an appointment that morning. The doctor billed Medicare and the Medicare Supplement Plan G paid the remainder of Medicare approved charges.

Another Veteran, Mr. M, is a client who has a Medigap Plan F in Kansas. He lives 200 miles from the nearest VA facility.

He takes a full day to drive to the VA center, have the appointment and drive home. In certain situations, Mr. M doesnt mind making the trip if its for an item that Medicare doesnt cover.

However, Mr. M likes having peace of mind about his healthcare coverage. With his Medicare Supplement insurance, hes able to stay in town and visit any Medicare approved doctor, hospital, or specialist he desires.

Also Check: Do You Have Dental With Medicare

Do You Need Medicare Part B As A Veteran

You should consider enrolling in Medicare Part B even if you have VA health benefits. Medicare Part B covers doctors services, preventive care, durable medical equipment, ambulance transportation, and a wide variety of other health services. In many cases, VA benefits dont cover services provided at non-VA facilities. Even if the VA agrees to pay for some expenses incurred at a non-VA facility, you may be billed for items not covered by your VA benefits. Medicare may pay for any approved expenses not covered by your VA benefits, making health care more affordable. Enrolling in Part B also gives you more flexibility when choosing providers. Check Medicares website to see if it makes sense to you to enroll in Part B. You can also get free, unbiased help from your local SHIP agent.

Can A Veteran Get A Medicare Advantage Plan

Those who have both VA benefits and Parts A and B of Medicare have the option to replace the latter two with a Medicare Advantage plan. Private insurance companies offer these plans, and when you have one, the carrier pays instead of Medicare.

The monthly costs for Advantage plans are relatively low. Sometimes, Advantage plans come without premiums. So these plans arent a bad option for extra coverage when you already have VA benefits. In an emergency scenario where youd need care at a civilian facility, Advantage plans can help with costs, as they involve maximum out-of-pocket limits that Original Medicare doesnt include.

Don’t Miss: How To Find Out If I Have Medicare

Do I Need Part D If I Have Va Benefits

VA benefits include prescription drug coverage. Additionally, this coverage is creditable for Medicare Part D. Meaning, its comparable to the level of prescription drug coverage Medicare requires companies offering Part D policies to provide.

Consequently, those with Medicare and VA benefits dont need to worry about getting prescription drug coverage through a Part D plan. Although, if there comes a time when you choose to cancel your VA coverage, youll want to pick up a Part D plan as soon as possible. Otherwise, youll face a different type of late penalty on top of your premium, for lacking creditable coverage. This amount will be higher the longer you go without creditable coverage.

Additionally, there are some situations in which an individual with Medicare and VA benefits could benefit from signing up for Part D. These circumstances include residing in an area where VA facilities are inaccessible or wanting more options for pharmacies at which to pick up prescriptions.

For individuals who struggle to pay for their prescriptions, a Part D plan could also be a good option. If you qualify for Extra Help, your prescriptions may have lower copays than they would through VA benefits.

Prescription Drug Coverage Can Vary

VA coverage includes prescription drug benefits, and for this reason, many VA members may choose not to enroll in Medicare Part D .

And because VA drug benefits are considered creditable coverage by Medicare, VA members are not required to pay a late enrollment penalty if they choose to sign up for Medicare Part D at a later date.

You can use this helpful Medicare plan finder to look for Medicare prescription drug coverage that may be available in your area.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

You May Like: What Is Medicare Plan F

Are Medicare Plans Available For Veterans

Many veterans dont realize that they can take advantage of both Veterans Affairs benefits and Medicare. While you can use both healthcare benefits as a veteran, Medicare and VA benefits dont work together. For example, Medicare doesnt pay for the services that you receive at a VA facility. In order for Medicare to adequately cover your healthcare needs, you have to receive medical treatment at a Medicare-accepted facility that is in your plan. If you want to receive VA care, then you have to go to a VA facility.

Medicare Supplemental Insurance And Va Benefits

When you sign up for Medicare during your six-month initial enrollment period, you have the option of purchasing a Medigap policy to help supplement the portions of your medical bills that Medicare doesnt pay, such as deductibles and copayments. If you prefer to use your Medicare Part B medical insurance to visit non-VA doctors because, maybe you dont live close to a VA facility or youre enrolled in a VA lower priority group, you may wish to choose a Medigap plan to supplement your Medicare costs. Learn more about Medigap.

For further information about finding a Medicare plan that works with your VA health benefits and individual needs, call TTY 711 to talk with an experienced Medicare.org licensed sales agent.

You May Like: How To Pay Medicare Premium

Va Coverage And Medicare Advantage Plans

Posted November 11, 2021 by Sue Titterington Vice President, Sales & Market Development

If youre eligible for Medicare and are a Veteran, youre probably receiving a lot of information from Medicare plans since were now in the Medicare Annual Enrollment Period The AEP is from October 15 through December 7 and this is when most Medicare-eligibles select their coverage for the coming year.

If youre currently using VA health care, you may have questions about whether you should supplement your VA health care with a Medicare Advantage plan. While everyones needs are different, in many instances, enrolling in an MA plan may be a good option.

Below are some things to consider as you review your options: