How Do I Enroll In A New York Medigap Plan

To enroll in a Medigap plan, you must also be enrolled in Medicare Part A and Medicare Part B. The best time to enroll is during the Medigap open enrollment period that starts the month of your 65th birthday and lasts for six months. Medigap open enrollment is the best time to sign up because you’ll have unlimited access to all New York Medigap plans. Insurance companies can’t deny your application because of your health history or charge you more money than a healthy person for the same plan. Therefore, Medigap plans are a “guaranteed issue” form of insurance during your Medigap open enrollment period.

If you don’t enroll during Medigap open enrollment, insurance companies can use underwriting to determine how much to charge you or decide whether to turn down your application for coverage. For example, if you have heart disease or another chronic medical condition, an insurer may charge you a higher premium than someone without any serious illnesses.

There are some exceptions, however.

New York Medicare Supplement Plans In 2022

Get A Free Medicare Quote

There are 12 Medigap plans you have the option to choose in New York. Medigap plans protect you from unpredictable and high out-of-pocket expenses when receiving medical services. Choosing a Medicare Supplement plan allows peace of mind and predictable medical costs.

Choosing the correct Medigap for your needs is essential. Well show the average cost for each letter plan in New York, how many Medicare beneficiaries are in each letter plan, the top Medicare Supplement carriers in New York, and the most popular plans.

Most Affordable In Ny: Wellcare

WellCare is known for its highly-rated price accuracy, appeals process and accessibility. It offers the most affordable Medicare Advantage plans in New York $0 premiums and $0 drug deductibles.

This provider also offers vision, hearing and dental coverage as well as fitness benefits to its members. You can expect copays as little as $10 for primary doctor visits with this provider.

Recommended Reading: What Income Is Used For Medicare Part B Premiums

How To Sign Up For Medicare In Ny

If you are interested in signing up for Original Medicare , there are 3 ways to do so:

- Visit a Social Security office near you.

If youd like to explore your options for a Medicare Advantage plan, you can:

- Compare the Medicare health plans available in your area. Be sure to look for plans in the ZIP code where you reside, as plans can vary by county.

- Once you have found a plan that you are interested in, you can visit the companys website to see if you can enroll in the plan online. If you cannot enroll online, contact the company to ask for a paper enrollment form.

- You can also call 1-800-MEDICARE to enroll in a Medicare Advantage plan.

Cities In New York With Estimated Premiums For Medicare Supplement Coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

Are Medicare Supplement plans expensive in New York?

Yes! Compared to other states, New York has some of the highest costing Medigap plans.

Whats the average cost for a Medigap Plan in New York?

In New York, the average cost for a Medicare supplements plan will vary according to the plan letter:

- Plan F is about $378

- Plan G is around $359

- Plan N averages $240

Whats the most popular Medigap plan in New York?

Plan N is the most popular Medicare Supplement in New York.

Also Check: How Old Before Eligible For Medicare

The Annual Election Period

During the AEP, which runs from October 15 to December 7, those eligible for Medicare can enroll in the following:

- Medicare Advantage with or without a Part D prescription drug plan

- Medicare prescription drug coverage

Your new plans effective date: the first day of the month following your enrollment.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In New York

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in New York includes overviews of these programs, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Don’t Miss: Does Medicare Pay For Shower Chairs

Which Health Insurance Company Is The Best For Medicaid Recipients In New York

There are a number of health insurance providers in New York State that offer Medicaid coverage plans to Medicaid recipients. It can be difficult to know which plan is the best for you or for your family, but a little bit of research and inquiry will help you identify which provider will suit your needs the best.

As you research, keep in mind that you may only be accepted by one or two of the insurance companies that you apply to for coverage. Out of all the New York health insurance providers, these are the best for Medicaid recipients:

Do You Need A Medicare Supplement In New York

| Should you consider a Medicare supplement? | |

Yes, if you:

|

No, if you:

|

You May Like: Does Medicare Cover Hospital Bed For Home Use

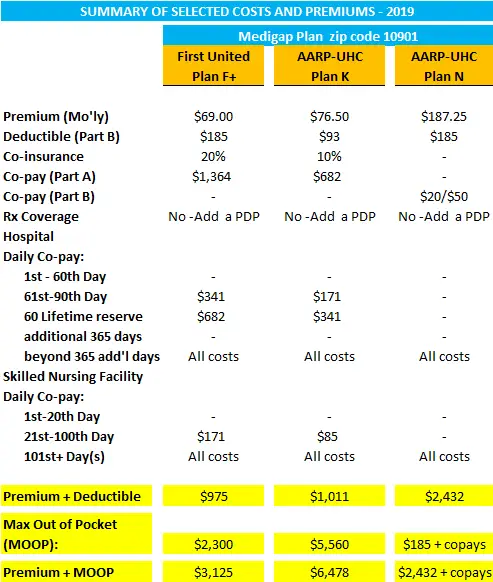

What Medigap Plans Cost In New York

Expect to pay about $169 to $672 each month for a Medigap plan A, G, or N in New York if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

Medigap policies can be rated in three ways:

- Community rated : Your premium isnt based on your age and may only increase due to inflation or other factors. Everyone, regardless of age, is charged the same premium.

- Issue-age rated : Your premium is based on your age when you buy the policy and wont increase as you grow older. Your premium may only increase due to inflation or other factors.

- Attained-age-rated: Your premium is based on your age and can increase as you grow older and due to inflation and other factors.

Tips For Enrolling In Medicare In New York

When deciding which type of plan works best for you, consider the following:

- Out-of-pocket costs. Monthly plan premiums arent the only cost to consider as you compare plans. Youll also pay coinsurance, copayments, and deductibles until you meet your plans annual out-of-pocket limit.

- Services covered. All Medicare Advantage plans cover Medicare parts A and B services, but other covered services may vary. Make a list of services youd like your plan to cover, and keep your wish list in mind as you shop around.

- Doctor choice. Medicare plans generally have a network of doctors and other healthcare providers. Before you choose a plan, make sure your current doctors are in the network.

- Star ratings. The Centers for Medicare & Medicaid Services Five-Star Rating System can help you find high-quality plans. CMS ratings are based on customer service, care coordination, healthcare quality and other factors that affect you.

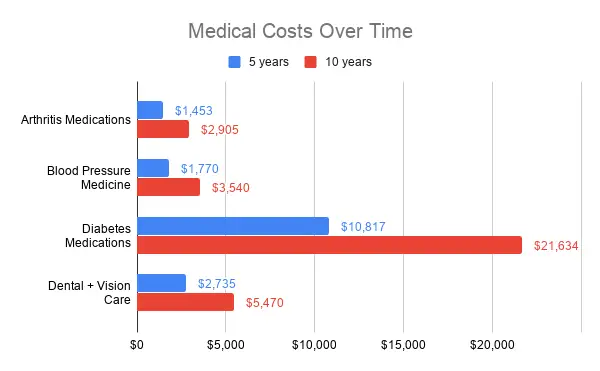

- Healthcare needs. If you have a chronic health condition, such as diabetes or HIV, you may want to look for a Special Needs Plan. These plans offer tailored coverage for people with specific health conditions.

You May Like: What Are The Four Different Parts Of Medicare

How To Apply For Medicaid In New York

In the state of New York, Medicaid applicants are separated into 2 different groups: MAGI and non-MAGI applicants. The Medicaid application process is different depending on which group you fall into.

â Pregnant women,

â Foster children,

â Children under the age of 19,

â Relatives of parents or caregivers

â Childless adults between the ages of 19 and 64 who are not pregnant and who do not have and do not qualify for Medicare, but who have a certifiable disability,

â Women who are receiving fertility treatments,

â FPBP beneficiaries.

Medicaid applicants who fall under the MAGI applicant category must apply through the New York State Department of Health Marketplace.

Non-MAGI applicants include people in the following groups:

â Medicaid Cancer Treatment Program

â AIDS Health Insurance Program

â Medicaid Savings Program

â Social Security Income recipients

â ADC-related medical needy individuals

â COBRA

â People age 65+ who are not relatives of parents or caregivers

â People who are blind or disabled, but who do not fall into any of the MAGI applicant categories

â Medicaid Buy-In for People with Disabilities

â Residents of Adult Home by LDSS, OMH Residential Care Centers/Community Residences

For non-MAGI applicants, itâs necessary to apply through your local Department of Social Services.

Still Have Questions About Medicare Supplement Insurance In New York

Are you trying to reduce your overall health care costs by lowering your out-of-pocket costsOut-of-Pocket Costs for Medicare are the remaining costs that are not covered by the beneficiary’s health insurance plan. These costs can come from the beneficiary’s monthly premiums, deductibles, coinsurance, and copayments.? One of these article may be what you’re looking for:

Recommended Reading: What Does A Medicare Card Look Like

Best New York Medicare Advantage Plans

While there are many factors to consider when choosing the best Medicare Advantage plan, comparing plans by cost and quality rating is an important first step in understanding if a plan is a good value.

For 2022, 115 Medicare Advantage plans with prescription drug coverage are offered throughout New York state, though plan availability varies. On average, any given county has access to 34 plans. Also called Medicare Part C, these bundled plans bring together coverage for medical care, hospitals and prescription drugs. Frequently, plans also include benefits for dental, vision and other add-ons.

Humana Medicare Advantage plans stand out for having a relatively high star rating of 4.0 out of 5 stars, combined with a low average cost of just $9 per month. That’s why for 2022, we recommend Humana as the best Medicare Advantage plans for most people in New York.

| Company | |

|---|---|

| 3.3 | $89 |

Data shows the average monthly cost of 2022 Medicare Advantage plans offered in New York and the national average star rating for Medicare Advantage plans on Medicare.gov.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How Old Do You Have To Be For Medicare

Plan N: Best Medicare Supplement Plan For Cost

Cost is always important when shopping for health insurance, and some consumers will even place it as their top priority.

High-deductible Plan G and high-deductible Plan F are typically the two lowest-cost Medigap plans available. Each of these plans requires beneficiaries to meet an annual deductible before the Medigap plan coverage kicks in. In 2022, the deductible for high-deductible Plan F and high-deductible Plan G is $2,490.

This means that in exchange for a much lower monthly premium, you agree to pay up to $2,490 in 2022 for your covered services before your Medigap plan will cover most the rest of your out-of-pocket Medicare costs for the rest of the year.

Either of these plans can be a good fit for a beneficiary who doesnt expect to use many medical services during the year and who wants to save money each month on their Medigap premiums.

Plan N is also a good plan to consider if you want a plan with lower monthly premiums. Plan N pays for most out-of-pocket Medicare costs, including 100% of your Medicare Part B coinsurance costs. The main exception is that you pay a copay of up to $20 for some of your doctors office visits and a copay of up to $50 if you visit the emergency room but arent admitted to the hospital for inpatient care.

These low but predictable copays allow insurance companies to typically offer Plan N at a lower monthly rate than some other Medigap plans.

Information On Medicare Supplement Insurance Plans In New York

While a Medicare beneficiary already enrolled in Medicare Part B may enroll in a Medicare Supplement insurance plan in New York at any time after age 65, the best time to do so is during the six-month Medigap Open Enrollment Period . The OEP begins on the first day of the month that you are both age 65 or older and enrolled in Medicare Part B. During this six-month period, you have the guaranteed-issue right to enroll in any plan of your choosing, without fear of medical underwriting, higher monthly premiums, or exclusion from complete coverage.

However, if you choose to enroll after the OEP, you may be required to submit a medical history for underwriting purposes, and could be denied or charged more for coverage due to any pre-existing conditions*.

Also Check: Is Medicare Advantage Part Of Medicare

Top Medicare Supplement Carriers In New York

Based on a 65-year-old female in New York, you can see an example of Medigap rates for New Yorkers. In New York, Medicare Supplement carriers use community age rating methods.

| Carriers | ||

| AARP United Healthcare Insurance Company Of New York | $318 | |

| Empire Healthchoice Assur Inc | $336 | |

| Globe Life Insurance Company Of New York | $374 | |

| Humana Insurance Company Of New York | $447 | |

| Mutual Of Omaha Insurance Company | $514 | N/A |

What Does Health Insurance Cover

The Affordable Care Act instituted a number of controls on health insurance plans and providers. One of the biggest changes is that every health insurance plan, regardless of tier or provider, must offer at least some coverage for 10 essential benefits. Those benefits are:

These are the bare minimum services that every type of ACA-compliant plan must cover. Keep in mind that if you purchase a short term health insurance plan, these requirements dont apply.

Read Also: Where Do I File For Medicare

The 6 Best Medicare Supplement Plan G Providers Of 2022

- Best Overall Plan: Humana

- Best Access for High-Deductible Plan G: Mutual of Omaha

-

High-deductible plans in most states

-

Multiple discount programs

-

Offers dental, vision, and Part D plans for extra coverage

-

Rates increase based on age

We chose Humana for its intuitive website, mobile app, household discounts, and many other perks, as well as its coverage in 47 states. Humana was founded in 1961 as a nursing home company, and it began selling health insurance in the 1980s. It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

The Humana website discusses many Medicare topics, including eligibility, coverage, and costs for each part of Medicare. It is instinctive to navigate and can be a great resource for common questions about the program. You can turn to its mobile app, MyHumana, to access your benefits on the go.

There are many perks to enrolling in a Humana Medicare Supplement Plan G. A 5% household discount off your premiums is available if you live with another policyholder and you can take off even more if you arrange for automatic bank payments. Its 24/7 nursing line is especially helpful if you have medical questions, and it also offers a basic SilverSneakers gym membership available at over 15,000 locations in the U.S., plus discounts on hearing aids, non-prescription medications, and vision exams.

Comparing Medicare Supplement Insurance Plans In New York

As previously mentioned, Medicare Supplement insurance plans in New York do not vary in coverage or benefits between plans of the same letter. However, each independent insurance company offering Medicare Supplement insurance plans may determine its own monthly premium structure. Thus, an identical Medicare Supplement insurance plan for a certain cost in one county may cost more or less in another county. You may want to compare all Medicare Supplement insurance plans in New York available to you, and make a selection based on your health needs and your budget.

We can help you start your comparison of Medicare Supplement insurance plans in New York today. Simply enter your zip code at the top of this web page and we will provide a customized list of Medigap plans and their carriers available to you in your area.

*Pre-existing conditions are generally health conditions that existed before the start of a policy. They may limit coverage, be excluded from coverage, or even prevent you from being approved for a policy however, the exact definition and relevant limitations or exclusions of coverage will vary with each plan, so check a specific planâs official plan documents to understand how that plan handles pre-existing conditions.

Recommended Reading: How Much Will Medicare Cost In 2022