What Does It Mean If My Prescription Drug Has A Requirement Or Limit

Plans have rules that limit how and when they cover certain drugs. These rules are called requirements or limits. You need to follow the rules to avoid paying the full cost of the drug out-of-pocket. If you do not get approval from the plan for a drug with a requirement or limit before using it, you may be responsible for paying the full cost of the drug. If needed, you and your doctor can also ask the plan for an exception.

Here are the requirements and limits you may see on a drug list:

PA Prior Authorization

If a plan requires you or your doctor to get prior approval for a drug, it means the plan needs more information from your doctor to make sure the drug is being used and covered correctly by Medicare for your medical condition. Certain drugs may be covered by either Medicare Part B or Medicare Part D depending on how they are used. If you don’t get prior approval, the plan may not cover the drug.

QL Quantity Limits

The plan will cover only a certain amount of a drug for one copay or over a certain number of days.

ST Step Therapy

The plan wants you to try one or more lower-cost alternative drugs before it will cover the drug that costs more.

B/D Medicare Part B or Medicare Part D Coverage Determination

Depending on how they’re used, some drugs may be covered by either Medicare Part B or Medicare Part D . The plan needs more information about how a drug will be used to make sure it’s correctly covered by Medicare.

LA Limited Access

7D 7-Day Limit

Find Medicare Part D Prescription Drug Plan Coverage

Medicare Part D prescription drug plans are offered by private insurance companies as standalone plans or as part of a Medicare Advantage Plan.

Common Medicare Part D Expenses To Know

While prescription drugs costs under the majority of Medicare Part D plans are low, the amount youll pay will vary by the Part D provider. These are the most common expenses youll need to familiarize yourself with…

Premiums: This is the amount you pay each month to ensure your plan is active.

Annual deductible: The amount you pay before coverage begins. This amount is capped at $435 annually, but some Medicare Part D plans offer zero deductibles.

Copayments: This is the set amount youll pay each time you file a prescription.

Coinsurance: The percentage cost you have to cover.

Coverage gap costs: This applies once your Medicare Part D plan covers $4,020 in drugs. Of course, that also means youll have to cover higher out of pocket costs.

Read Also: How Do Providers Verify Medicare Eligibility

Data Collection And Verification

Our data was collected from third-party rating agencies, official government websites and databases, and directly from companies via websites, media contacts, and existing partnerships. Our sources include: AM Best, the National Committee for Quality Assurance , J.D. Power, and the Centers for Medicare and Medicaid Services .

Data was verified to ensure data integrity and accuracy by cross-referencing the records and citation corresponding to each data point with our primary sources.

Annual Notice Of Change

Your plan must send your ANOC out before the Annual Enrollment Period, and the ANOC will outline the changes to Medicare Part D that will occur in your current program. These changes can include pricing, changes to your covered drugs on the formulary, new tier determinations, and more.

Of course, in most cases, you can remain on your current plan if the changes are acceptable. Still, you could miss out on more comprehensive coverage. Remember, every plan is making changes, so there may be other options that will cover your prescription medications better.

Don’t Miss: Does Mayo Clinic Take Medicare Patients

What Is The Medicare Donut Hole Or Coverage Gap

The Medicare donut hole is a phase of reduced insurance coverage that you enter once you and your plan have spent $4,660 on drug costs in 2023. During the coverage gap, youre required to cover up to 25% of the cost of generic and brand-name drugs out-of-pocket. Once youve spent $7,400 out-of-pocket in 2023, youll leave the coverage gap and enter the catastrophic coverage phase, which means youll pay a small copay or coinsurance amount for the rest of the year. Some plans offer additional coverage during the gap phase, which can significantly reduce costs.

Big changes are coming for Medicare beneficiaries in the coming years, thanks to the Inflation Reduction Act. Starting in 2024, there will be no coinsurance in the catastrophic phase, and a $2,000 out-of-pocket spending cap will be added for drug coverage in 2025.

What Is Medicare Part C

Medicare Part C, also known as Medicare Advantage, offers an all-in-one style plan that allows many options to tailor your healthcare coverage.

Medicare Part C provides all the benefits of Medicare parts A and B, also known as original Medicare. These plans also typically offer additional benefits, such as dental, vision, and prescription drug coverage.

For Medicare Part C, the Centers for Medicare and Medicaid Services contracts with public or private organizations to offer a variety of health plan options.

Read Also: Are All Medicare Plan F The Same

Definition Of Medicare Part D

Part D is an optional Medicare benefit that helps pay for prescription drug expenses. You must pay an additional premium if you want this coverage. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system, so different plans include different prescription drugs and have different associated costs.

Its important to review multiple plans before deciding which plan to buy, or if youll buy one at all. You can only buy Medicare Part D if you also have either Medicare Part A and/or Medicare Part B. You must have both Part A and Part B to join a Medicare Advantage plan that offers prescription drug coverage. Not all Medicare Advantage plans offer drug coverage.

What Is The Donut Hole

The donut hole is a coverage gap that begins after you pass the initial coverage limit of your Part D plan. Your deductibles and copayments count toward this coverage limit, as does what Medicare pays. In 2021, the initial coverage limit is $4,130.

The federal government has been working to eliminate this gap and, according to Medicare, youll only pay 25 percent of the cost of covered medications when youre in the coverage gap in 2021.

Theres also a 70 percent discount on brand-name medications while youre in the donut hole to help offset costs.

Once your out-of-pocket expenses reached a certain amount, $6,550 in 2021, you qualify for catastrophic coverage. After this, you will only pay a 5 percent copay for your prescription medications for the rest of the year.

Here are a few points to remember when choosing a plan:

Also Check: Why Have I Not Received My Medicare Card

Humana Medicare Rx: Best Medicare Part D Plan For Home Delivery

Humana Medicare Rx offers a good range of Medicare Part D plans with options for most types of customer. There are particularly good savings to be had for those who can take advantage of the partnership with Walmart, and for those that are happy to sign up for the mail delivery service.

The three MyHumana plans are clearly described, and potential customers should find it easy to disseminate the information and get a quote on their website.

When it comes to Humana Medicare, prices range from co-pays as low as $0 after deductible for Tier 1. There are over 5,200 Walmarts that stock, plus you have access to Walmart Neighbourhood and Sam’s Club pharmacies. More than 1,500 generics are included on the top tier plans list of covered drugs.

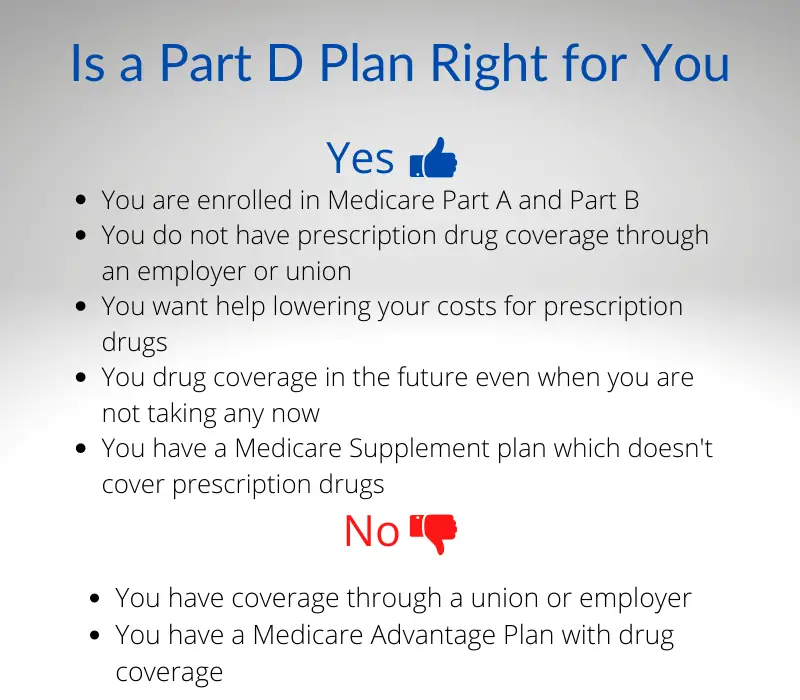

Who Is Eligible For A Medicare Part D Plan

You should plan to enroll in a Medicare prescription drug plan when youre eligible, which is either when you turn 65 or when your through an employer ends. If you miss the cutoff, youll pay a late enrollment penalty that will continue for the entire time you receive Medicare drug coverage, which may be the rest of your life.

You must be eligible for Medicare and enrolled in Original Medicare Part A and/or B to join a standalone Medicare Part D plan. You can search for an available plan in your area on the Medicare website.

If you choose to get your drug coverage benefit through a Medicare Advantage plan, you must be enrolled in Original Medicare Parts A and B. You can search for a MA-PD plan in your area on the Medicare website.

Also Check: Are Canes Covered By Medicare

How Much Unrealized Savings Are Medicare Patients Losing Out On

First, we estimated how much out-of-pocket costs vary across Medicare Part D plans, even for the same patient. Then, we calculated the unrealized savings each Medicare patient faces on each plan, capturing the difference in annual out-of-pocket costs compared to their cheapest plan. These unrealized savings demonstrate just how different a patients cost burden can be depending on the plan they enroll in.

While the best plan for the average Medicare patient costs $544 per year , the average part D plan costs $1,384 per year for the same medications. So we estimate that the average Medicare patient enrolled in the average Part D plan overspends on their prescription drugs by $840 every year by not enrolling in the cheapest plan for their medication needs.

The worst Medicare Part D plan for the average Medicare patient can cost them nearly $3,200 more per year than the best plan, amounting to over $3,700 in total annual out-of-pocket costs for medications.

Our analysis shows that out-of-pocket costs vary widely across Medicare Part D plans. If patients are not choosing the best plan available to them, they could end up substantially overpaying for their medications.

The Inflation Reduction Act Wont Force Part D Plans To Cut Benefits Or Exit The Market

In The Inflation Reduction Act Comes for Medicare , Casey Mulligan and Tomas Philipson argue that an Inflation Reduction Act provision that limits premium growth in Medicares Part D prescription-drug benefit will prevent Part D plans from covering their costs, forcing plans to either sharply cut benefits or exit the market. This argument rests on a misunderstanding of what the law does.

The authors are correct that the law temporarily limits growth in the base Part D premium paid by beneficiaries, generally to no more than 6% a year. The law also, however, increases federal subsidy payments to plans to exactly offset any resulting reduction in beneficiary premium payments, which the Congressional Budget Office estimates will cost roughly $40 billion over a decade. The combination of beneficiary premiums and federal subsidies will continue to cover plans full bids, and the revenue shortfalls that the authors predict wont occur.

Continue reading your article witha WSJ membership

You May Like: What Is Medicare Part G

Can I Get Automatic Prescription Refills In The Mail

Some people with Medicare get their drugs through an automatic refill service that automatically delivers prescription drugs before they run out. To make sure you still need a prescription before they send you a refill, drug plans may offer a voluntary auto-ship program. Contact your plan for more information.

| Note |

|---|

|

Be sure to give your pharmacy the best way to reach you, so you don’t miss the refill confirmation call or other communication. |

If you have both Medicare and

or qualify for

, also bring proof of your enrollment in Medicaid or proof that you qualify for Extra Help.

Who Should Get Medicare Advantage With Part D Coverage

A MA-PD might be a good fit if you:

- Want to bundle all your health and drug services together.

- Dont want to pay a premium for drug coverage and can choose a MA-PD zero-premium plan in your area.

- Dont mind using medications that are on your plans formulary.

- Dont mind using network pharmacies which may be more restrictive than PDPs.

- Dont mind following your plans rules for getting prescription drugs.

- Want an HMO or PPO plan. You cannot purchase a PDP if you have an HMO or PPO, even if you dont have drug coverage with your MA plan.

Read Also: Does Medicare Cover Dexcom G6

Medicare Part D Drug Tiers

Part D coverage varies for different types of prescription drugs, which are grouped into tiers. In general, drugs in lower tiers have lower costs, and drugs in higher tiers have higher costs.

For example, HealthPartners plans have five tiers:

- Tier 1: Preferred generic drugs This is the lowest tier. Lower-cost, commonly used generic drugs are in this tier.

- Tier 2: Generic drugs High-cost, commonly used generic drugs are in this tier.

- Tier 3: Preferred brand drugs Brand-name drugs without a lower-cost generic therapeutic equivalent are in this tier.

- Tier 4: Non-preferred drugs Higher-cost generic drugs and brand-name drugs with a lower-cost generic therapeutic equivalent are in this tier.

- Tier 5: Specialty drugs This is the highest tier. Unique and/or very high-cost generic and brand-name drugs are in this tier.

Part D has four stages of coverage, and you pay a different amount for your prescriptions in each stage. The coverage cycle begins on January 1 of each year. The cost of the prescription drugs you use will determine the number of stages youll reach throughout the year its important to understand how the coverage stages work so youre prepared for any changing costs.

In this stage, you pay 100% of your prescription drug costs until you meet your plans annual prescription deductible. Some plans call this the pharmacy deductible or prescription drug deductible.

In the initial coverage stage:

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

Also Check: Can I Be On Medicare And Medicaid

What Is The Part D Late Enrollment Penalty

The Part D late enrollment penalty is an amount thats permanently added to your Part D premium. You might have to pay this penalty if after your IEP, there are 63 days in a row where you dont have Medicare drug coverage or other creditable drug coverage. Creditable drug coverage refers to a drug plan that pays at least as much as Medicare Part D on average.

To avoid paying the late enrollment penalty, its important to enroll in Medicare Part D or have other creditable drug coverage during your IEP. Make sure to enroll in Part D if you lose your creditable drug coverage. If you keep your creditable drug coverage, its a good idea to keep records proving that you are enrolled.

Medicare Supplement Plan D And Medicare Part D Differences

Although both Medicare Plan D and Medicare Part D are used to help fill coverage gaps in Original Medicare , these types of coverage serve different functions.

Heres a look at the differences between Medicare Supplement Plan D and Medicare Part D.

| Medicare Supplement Plan D | Medicare Part D |

|---|---|

|

|

Note: You can have Original Medicare, a standalone Part D plan, and Medicare Supplement Plan D all at the same time. But you cantenroll in Medicare Advantage and a Medicare Supplement plan at the same time.

Read Also: Does Medicare Cover Any Nursing Home Costs

Great For $0 Copays: Cigna

-

Low or $0 copays for many generic medications

-

$0 deductible for many generics medications

-

Many plans with additional drug coverage in the Medicare gap

-

Comes with discounts on certain non-covered services

-

Free prescription home delivery for 90-day supplies of many drugs

-

Lower NCQA and Medicare star ratings than competitors

Cigna offers three plans to choose from, and though premiums arent as low as some competitors, each plan offers low or $0 copays on most generics and a $0 deductible for most generics. Like Aetnas SilverScript Plus Plan, the Cigna Extra Rx plan also offers additional coverage in the gap and low drug deductibles. Cigna is a good option if you take a lot of generic medications and would rather pay a higher premium with no or low copays and a very low deductible. It’s also a good option if you need additional gap coverage. Always check plan costs for your specific drugs as each insurance companys formulary differs.

Cignas plans also come with perks, like discounts on LASIK, Gaiam yoga products, and acupuncture, and most medications are available in a 90-day supply with free home delivery. Cigna PDPs are available in all 50 states.

For more information, read our full Cigna Medicare Review.

Anthem offers the highest-rated Part D prescription drug plans by the CMS, but is only available in 12 states. Very few of its plans offer additional drug coverage in the Medicare donut hole.