You Might Be Subject To Late Enrollment Fees If You Forego Medicare Enrollment

If you do not sign up for Medicare Part B during your Initial Enrollment Period, you may be subject to late enrollment penalties if you decide to sign up later on.

The Part B late enrollment penalty is 10 percent of the Part B premium for each 12-month period in which you were eligible to enroll but did not. You will have to continue to pay the penalty for as long as you remain enrolled in Part B.

You may be able to avoid the Part B late enrollment penalty if you qualify for a Medicare Special Enrollment Period. Choosing not to enroll in Medicare Part B because you have VA coverage does not qualify you for a Special Enrollment Period.

There Can Be Advantages To Having Both Types Of Coverage

There can be some definite advantages in having VA benefits and Medicare insurance.

- Having both types of coverage can give you more health care options. If you only have VA insurance, you are limited to receiving covered care at only VA facilities. But adding Medicare coverage can open up the range of hospitals, doctors offices, pharmacies and other types of health care locations in which you may receive covered care.

- Having both types of coverage can benefit you in the event that an emergency occurs when you are not in close proximity to a VA hospital.

- Most people do not have to pay a premium for Part A of Medicare.

Do I Need Medicare If I Have Veterans Benefits

Home / FAQs / General Medicare / Do I Need Medicare if I Have Veterans Benefits?

For veterans approaching Medicare eligibility, it is common to have questions about whether it is necessary to enroll in Medicare alongside Veterans Affairs benefits. The short answer is that Medicare does not coordinate with VA benefits. However, you can have both types of insurance at the same time and benefit from doing so. Below, we answer the most frequently asked questions about Medicare for veterans.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: When You Turn 65 Is Medicare Free

Should You Enroll In A Medicare Part D Plan If You Have Va Benefits

Medicare Part D covers prescription drugs at the pharmacy and these plans cost on average around $35 a month. Most Vets do not select a Medicare Prescription Drug Plan as they have RX coverage from the VA. If you choose not to enroll in Part D when you are first eligible you can even still enroll in Part D later without paying a penalty.

For further questions about Medigap, Medicare Advantage or Medicare Part D, please call the number above or contact Senior65.

Please note: We are only able to give general information about Medicare related issues. If you have specific questions about your VA coverage, please contact Veterans Affairs directly.

What Is Va Health Care

Honorably discharged veterans who served in the Army, Navy, or Air Force may qualify for VA benefits. However, requirements vary by branch, years served, and when your loved ones service took place. Those who enlisted after September 7, 1980, or entered active duty after October 16, 1981, must have served for 24 months, although there may be exceptions for those disabled in the line of duty or those who faced other hardships. National Guard members who served in active duty during wartime can also receive benefits.

Based on these factors and others, veterans enrolled in VA benefits who wish to receive additional care are assigned to one of eight priority groups. The priority group number takes into account income, disability, and service history, and it helps to determine senior veterans copays. Veterans who sustained a disability or significant injury through service are placed in a higher priority group and receive a greater level of coverage than those who developed conditions later in life.

Read Also: When Do I Receive Medicare

How Does Va Health Care Work With Va Benefits

If you are a veteran, you may seek care at any VA medical center. VA health care includes inpatient and outpatient care, long-term care, and prescription drugs. When youre enrolled in Medicare, you may have to enroll in Part A , Part B , and Part D . However, if you receive drug coverage through the VA, you may not have to enroll in Part D of Medicare.

You may receive free VA health care that the U.S. Department of Veterans Affairs determines was from your military service for any illness or injury. There are certain services that are offered for free, such as mental health care. Other free services provided by the VA may be found here.

Copays may vary depending on your disability rating, military service record, and income level. When you enroll in VA healthcare, you may be assigned to different priority groups of 8. For example, if you have an illness that made you unable to work, you could be assigned into priority group 1. In this group, you may not have to pay for any tests, care, or medications.

There are no monthly premiums or deductibles with VA benefits. However, your VA health coverage may change over time, as the income limits may change each year.

Do Military Retirees Have To Pay For Medicare

Yes, military retirees have to pay for Medicare. Most people pay nothing for Part A, but if youre not eligible for premium-free Part A coverage, youll pay a premium that depends on how many quarters you worked and paid Medicare taxes. Youll also pay a deductible and coinsurance for services covered under Part A. For Medicare Part B, youll need to pay a monthly premium and a deductible for each benefit period. The Part B monthly premium is $170.10 for 2022 and yearly deductible is $233. You can expect to pay 20% coinsurance for most services covered under Part B. If you enroll in Part C or Part D, the premiums vary by plan.

Read Also: Does Medicare Cover Counseling For Depression

When To Enroll In Medicare

If youre eligible for Medicare due to your age, you can enroll during your initial enrollment period. Your IEP is a seven-month period starting three months before your 65th birthday and ending three months after your birthday month. The date you apply for coverage determines when your Medicare coverage begins. If you apply during the first three months of your IEP, your coverage will go into effect on the first of the month you turn 65. If you wait until the end of the IEP, you wont have Medicare coverage until the third month after you enroll.

If you miss your IEP, youll have to wait until the next General Enrollment Period to enroll, which can delay coverage significantly. The GEP is open from January 1 through March 31 with coverage beginning July 1 each year. You may qualify for a Special Enrollment Period if you have to pay for Part A or deferred enrollment in Part B because you had other credible health insurance coverage.

Do All Veterans Get Free Health Care

No, not all veterans get free health care. You may qualify for free VA care if you have a disability rating of at least 50% due to a service-connected illness or injury. The illness or injury must directly relate to your service. You may also qualify for free VA care if you cant afford medical care or if you need counseling and related services to help you readjust when you return from active duty. Even if you have VA benefits, you may still need to pay a copay for some types of care.

Read Also: What Are The Four Different Parts Of Medicare

Va Benefits And Medigap

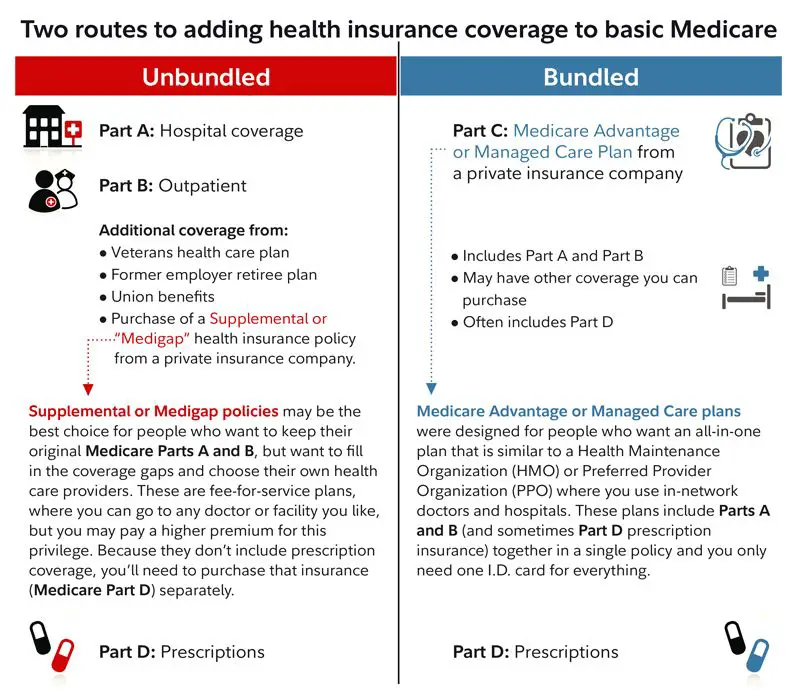

Medigap, also known as Medicare Supplement Insurance, covers copays, coinsurance, and most deductibles for services covered by Original Medicare. To purchase one of these plans, you must be enrolled in Medicare Part A and Medicare Part B. You cannot have a Medicare Advantage Plan and a Medigap policy at the same time.

You should consider a Medigap plan if theres a chance youll need care at a non-VA facility, as your VA benefits only cover services through VA providers. If you need to visit a non-VA hospital or clinic, youll be able to use your Original Medicare benefits. Then Medigap will pay its share of the remaining costs, leaving you with fewer unpredictable out-of-pocket medical expenses. You will pay a monthly premium for a Medigap policy.

Va And Medicare Part B

Part B is medical insurance for your doctor and specialist. It includes preventive healthcare, diagnostics and treatment for ongoing conditions.

Some vets may opt-out of Part B due to the monthly premium costs. However this may be a mistake. If you drop out, you wont be able to get it back until January of the following year. You may also have a penalty to reinstate the coverage.

The only way you can opt-out of B without penalty is if you have creditable coverage. This would be through an employer. VA benefits are not considered creditable for Part B.

Even though they do not overlap, you can use both Medicare and VA benefits for Part B type services. An example of this not covered under Medicare would be annual physical exams. These would be covered under VA benefits as long as you receive the care in a VA facility.

The one thing to watch out for with Part B benefits is the out-of-pocket costs. These will not be covered by your VA benefits.

Under Part B you are subject to an annual deductible. That is a small out-of-pocket expense. The larger expense you should be prepared for is the 20% co-insurance cost for doctor visits or outpatient services if not within a VA facility.

There are ways to cover these out-of-pocket medically-related expenses through either Medicare Advantage or a Medicare Supplement.

Don’t Miss: How Do I Apply For Medicare Part A Online

Find A $0 Premium Medicare Advantage Plan Today

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

How Tricare Works With Medicare

TRICARE provides health coverage for members of the military, their family members, and retired service members. The program also includes dental plans, prescription drug plans, and special programs for enrollees with certain medical conditions. If you qualify for Medicare, you can use your TRICARE benefits along with your Medicare benefits to reduce your out-of-pocket costs as much as possible.

If you have TRICARE for Life, Medicare acts as the primary payer. In most cases, TRICARE is your secondary payer. However, if you have some other type of insurance, TRICARE wont pay anything toward your health care costs until claims have been submitted to Medicare and your other insurance company. If you want coverage through TRICARE for Life, you must have Medicare Part A and Medicare Part B. TRICARE for Life acts as a supplement to Medicare and covers your Medicare cost-sharing.

TRICARE pharmacy benefits cover a wide range of prescription medications, as long as each drug is approved by the U.S. Food and Drug Administration. Your provider must also prescribe each medication in accordance with good medical practice and established standards of quality for the drug to be covered by TRICARE. Therefore, you may not need Medicare Part D, which also covers prescription drugs. However, if you meet certain financial criteria, you may qualify for help paying Medicare Part D premiums and drug costs.

Also Check: How Much Is Part B Medicare For 2020

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide who pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” to pay. In some rare cases, there may also be a third payer.

Medicare Advantage Plans Can Be Good Options For Veterans

A Medicare Advantage plan may be worth considering if you are a veteran.

A Medicare Advantage plan will provide all the same coverage as Original Medicare, and some Medicare Advantage plans may cover some additional benefits that Original Medicare doesnt.

Some of these additional benefits can include coverage for:

- Prescription drugs

Many Medicare Advantage plans may also come with $0 premiums, though $0 premium plans may not be available in all locations.

Read Also: Does Quest Labs Accept Medicare

If You Have Tricare You May Have To Enroll In Original Medicare

If you are not on active duty and are entitled to premium-free Medicare Part A, then you must also enroll in Part B in order to keep TRICARE coverage.

You must also be enrolled in both Medicare Part A and Part B in order to have TRICARE For Life. The lone exception is when the beneficiary is the spouse of an active duty service member, in which case Medicare Part B enrollment is not necessary.

Medicare For Veterans: A Comprehensive Guide

Veterans can receive both Veteran Affairs health care benefits and Medicare when they become eligible. It’s recommended for veterans to enroll in Medicare so they have more coverage options when seeking care from non-VA health care facilities.

-

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Our fact-checking process starts with vetting all sources to ensure they are authoritative and relevant. Then we verify the facts with original reports published by those sources, or we confirm the facts with qualified experts. For full transparency, we clearly identify our sources in a list at the bottom of each page.

Content created by RetireGuide and sponsored by our partners.

Key Principles

Editorial Independence

To support the health care needs of about 19 million veterans in the United States, the government has a number of health insurance programs available, such as VA benefits, Medicare and Tricare for Life.

This guide covers whether you should enroll in VA benefits and Medicare, how VA benefits work with Medicare, and how Tricare for Life works with Medicare.

Don’t Miss: What Is The Deductible For Medicare Plan G

Should Veterans Enroll In Medicare

The VAs health care package and Medicare are two distinct programs. They do not work together, but rather, alongside one another.

While the VAs plan provides veterans with benefits that Medicare does not offer, such as dental coverage and long-term nursing care, your medical costs are only covered if you receive care at a VA facility, or at a non-VA facility with prior authorization from a VA doctor.

Having both VA benefits and Medicare insurance broadens your coverage to include Medicare-approved hospitals and doctors.

The VA usually encourages veterans to enroll in both Medicare Part A and Medicare Part B .

-

You typically don’t have to pay a premium for Part A, while the standard Part B premium for 2022 is $170.10 or higher, depending on your income.

-

Part B covers Medicare-approved doctors services and outpatient services, so what you spend on Part B premiums may save you money in the long run.

There are a few advantages to enrolling in Medicare if you already have VA benefits:

Do I Need To Pay For Medicare If I Have Va Benefits

For individuals who have worked at least ten years or 40 quarters paying Medicare tax, Medicare Part A is premium-free. Therefore, it is beneficial to enroll in the hospital insurance you earned through Medicare.

However, like other beneficiaries, veterans with VA benefits will need to pay a standard Medicare Part B premium for Medicares outpatient coverage. You will want to enroll in Medicare Part B as soon as you are eligible. Delaying Medicare Part B coverage can result in a lifelong late penalty. The penalty occurs because, unlike group health insurance through a large employer, VA benefits are not coverage for Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

As a result, you save money long-term when you enroll during your Initial Enrollment Period. If you are looking to enroll in Medicare Part B but are in need of financial assistance with your Medicare Part B premium, you may qualify for a Medicare Savings Program.

Don’t Miss: Does Medicare Advantage Plan Replace Part B

If I Have Va Drug Coverage Do I Need Medicare Part D

You arent required to buy Medicare Part D prescription drug coverage if you have VA health benefits. The prescription drug benefits from the VA are considered to be as good as or better than Medicare Part D, which the Centers for Medicare & Medicaid Services calls creditable coverage, so you wont have to pay a penalty if you decide to sign up for Part D later.

But VA health care only covers VA providers and pharmacies. Some people sign up for Part D too, so they can also get prescriptions from doctors outside the VA and fill them at a nearby pharmacy.

Also, a Part D plan may cover different drugs than the VA and charge different copayments. VA copays for prescription drugs can vary by priority level. You cannot use your VA and Part D benefits for the same expenses.

If you have VA drug benefits, you can sign up for a Part D plan without paying a late-enrollment penalty any time after you enroll in Medicare Part A or Part B or within 63 days of losing VA drug benefits.

Keep in mind

Medicare has premiums, deductibles, copayments and other out-of-pocket costs. If your income and assets fall below certain levels, you may qualify for help with some of these expenses from a Medicare Savings Program. You also may be eligible for help with Medicare Part D premiums and copayments from the Extra Help financial assistance program .