What Are The Ten Plans

Medigap plans are each given an identifying letter: A, B, C, D, F, G, K, L, M, and N. Each plan of the same letter must offer the same benefits across all the states, with the exception of Massachusetts, Minnesota, and Wisconsin.

However, costs can vary from state to state, and between the different insurance companies.

Medigap plans are guaranteed renewable, which means that if someone pays their monthly premium, the insurer cannot stop their plan. This applies even if someone becomes ill after purchasing a plan.

Not all plans are available in all states.

Some Medigap policies provide additional benefits, such as healthcare when traveling outside the United States.

Aarp Medigap Costs In States With Alternative Plans

Medicare Supplement plans in Massachusetts, Minnesota and Wisconsin have different structures. Rather than the typical plan letters and benefits, these states use alternative plan names. Below are the average costs for AARP Medicare Supplement plans for a 65-year-old female nonsmoker in these states. Note that Minnesota and Massachusetts donât allow price increases by age, but Wisconsin does.

- Minnesota : $192-$239

- Massachusetts : $123-$172

- Wisconsin : $86-$126

Top Ten Reviews Verdict

AARP MedicareRx from UnitedHealthcare is an excellent all-round provider of Part D plans. It has a network of preferred providers that includes Walgreens and Duane Reed, and the quote process is easy. Some options are only available to AARP members though.

Pros

- – Some options only for AARP members

Medicare prescription drug coverage is a way to manage the cost of your ongoing medication needs. In our AARP Medicare Rx review, which also features in our round-up of the best Medicare Part D plans, we’ll look at the different options available to you with this provider. We’ll also look at the costs involved with each plan and what considerations you’ll need to make if you plan on selecting one.

Before we get to that, let’s look a little closer at the two companies behind this prescription drugs cost coverage. UnitedHealthcare is one of the more recognizable health insurance companies in America, operating all across the United States. UHC boasts over 115 million customers and in 2018 reported an annual revenue of well over $200billion.

Its parent company, United HealthGroup, was founded in 1977, so they bring decades of experience to the table. As such they are able to offer a wide range of insurance plans, which is one of the company’s biggest strengths. AARP is another powerful organization, with over 38 million members across the United States.

Also Check: Which Of The Following Is True Regarding Medicare Supplement Policies

Aarp Unitedhealthcare And Expanded Medicare Advantage Benefits

In 2018, the Centers for Medicare and Medicaid Services approved a list of new supplemental benefits for Medicare Advantage plans. These benefits are designed to help people age safely at home.

UnitedHealthcare was one of the first insurers to add some of these new benefits to their Medicare Advantage plans. Many AARP Medicare Advantage plans include one or more of these optional supplemental benefits at no additional cost:

- Nonmedical transportation

- Allowance for over-the-counter medications and devices

- Personal emergency response system

In addition, most AARP UnitedHealthcare Medicare Advantage plans include the new insulin savings program which caps copays for insulin at $35 in all four stages of prescription drug coverage.

Get More Complete Coverage With Medicare Supplement And Part D

Prescription drugs can be expensive, and Medicare Parts A and B may not provide the coverage you need. Pairing an AARP® MedicareRx Part D Plan from UnitedHealthcare with a Medicare Supplement plan can help protect you from unexpected medical and prescription drug costs now or in the future.

AARP MedicareRx Part D plan options include:

- Low monthly premiums

Don’t Miss: Is Prolia Covered By Medicare Part B Or Part D

Best In Ease Of Use: Humana

Humana

Humanas smooth website and simple process for comparing plans make it a winner. When you look into Humanas Part D offerings, the page automatically fills in your location data and immediately shows you the plans available in your area. You may also have access to preferred cost-sharing benefits when you fulfill your prescriptions at Walmart, depending on the plan you choose.

-

Extremely easy to get access to plan comparisons

-

Offers basic, moderate, and comprehensive plans, with costs and coverage that scale up from plan to plan

-

Advertises other Medicare plans on the webpage for Part D enrollment

Humana was rated the easiest to use for its genuine focus on making the health care application process as easy for its customers as possible. It doesnt require you to click through several different windows to get the information youre looking for as you try to apply its all right there, easily accessible. Humana is also ranked highly with a positive rating of A- with AM Best, meaning the company is financially stable. And, Humana has educational material on its website, including a number of help and how-to articles . Live Humana associates are available via phone if you need help with any questions along the way.

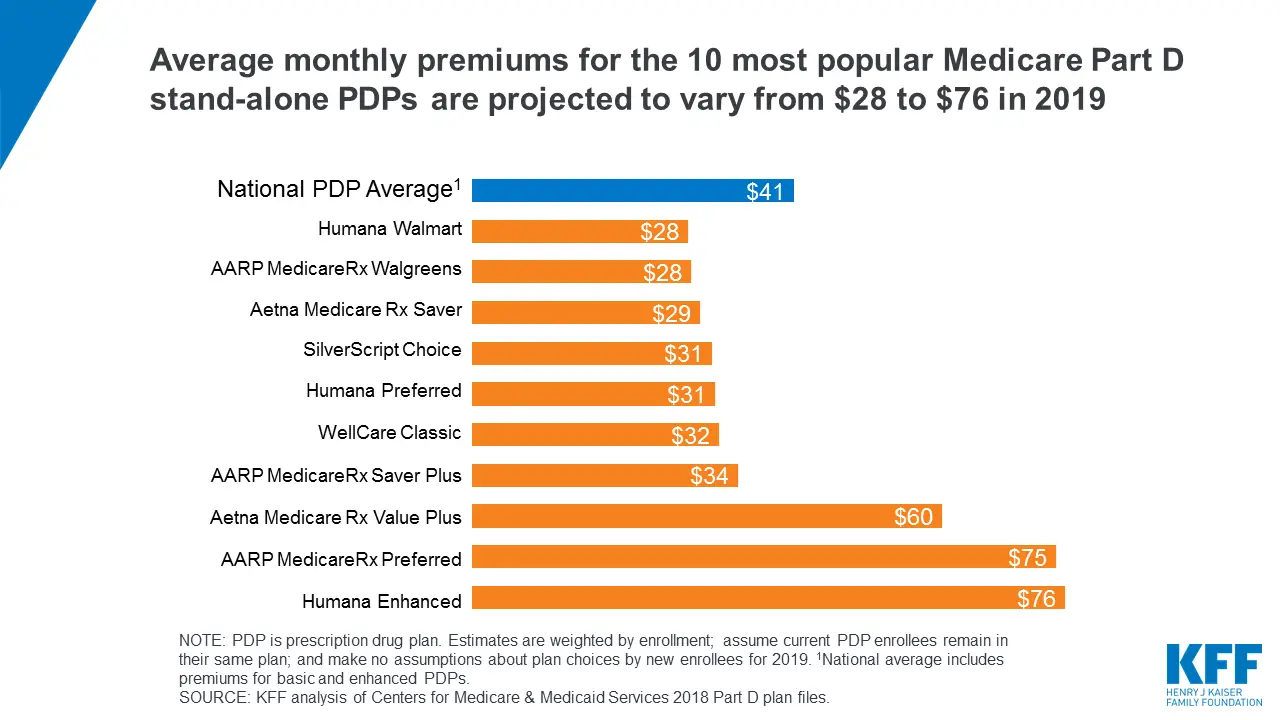

Humanas Walmart Value Rx plan, its most basic offering, can cost as low as $28.50 per month, with possibility for reduction based on Medicaid status.

Cost Of Aarp Medicare Supplement Insurance

Medicare Supplement insurance plans from AARP charge a monthly premium. This premium is in addition to your Part B premium, which you must also pay. Premiums vary based on which standardized plan you choose more comprehensive plans like plan F have higher premiums.

Premiums for AARP Medigap plans are affected by many factors but are generally set based on the demographics of the community you live in. This means your premiums are not set based on your individual age, but rather the relative age of the community as well as other factors.

Read Also: What Age Do You Draw Medicare

Moving Forward With Aarp Medicare Plans

AARP offers many options for Medicare health insurance:

-

Medigap plans supplement coverage under Part A and B. Consider combining an AARP endorsed Medigap plan with an AARP prescription drug plan.

-

Medicare Advantage plans are more affordable than Medigap, but still lower your exposure to high out-of-pocket costs.

As you get close to entering Medicare, consider reaching out to an independent professional as a part of your research process. Licensed medicare insurance agents can assist you with comparing quotes on AARP Medicare plans, finding out which plans are available in your area, and identifying the plan that best fits your needs.

Joseph Arroyo is a licensed Medicare insurance agent who lives in Hilton Head, South Carolina. Arroyo is certified to sell Medicare products including Medicare Supplement insurance, Medicare Advantage, and prescription drug plans.

Medicare Plus Medigap Supplemental Insurance Policies

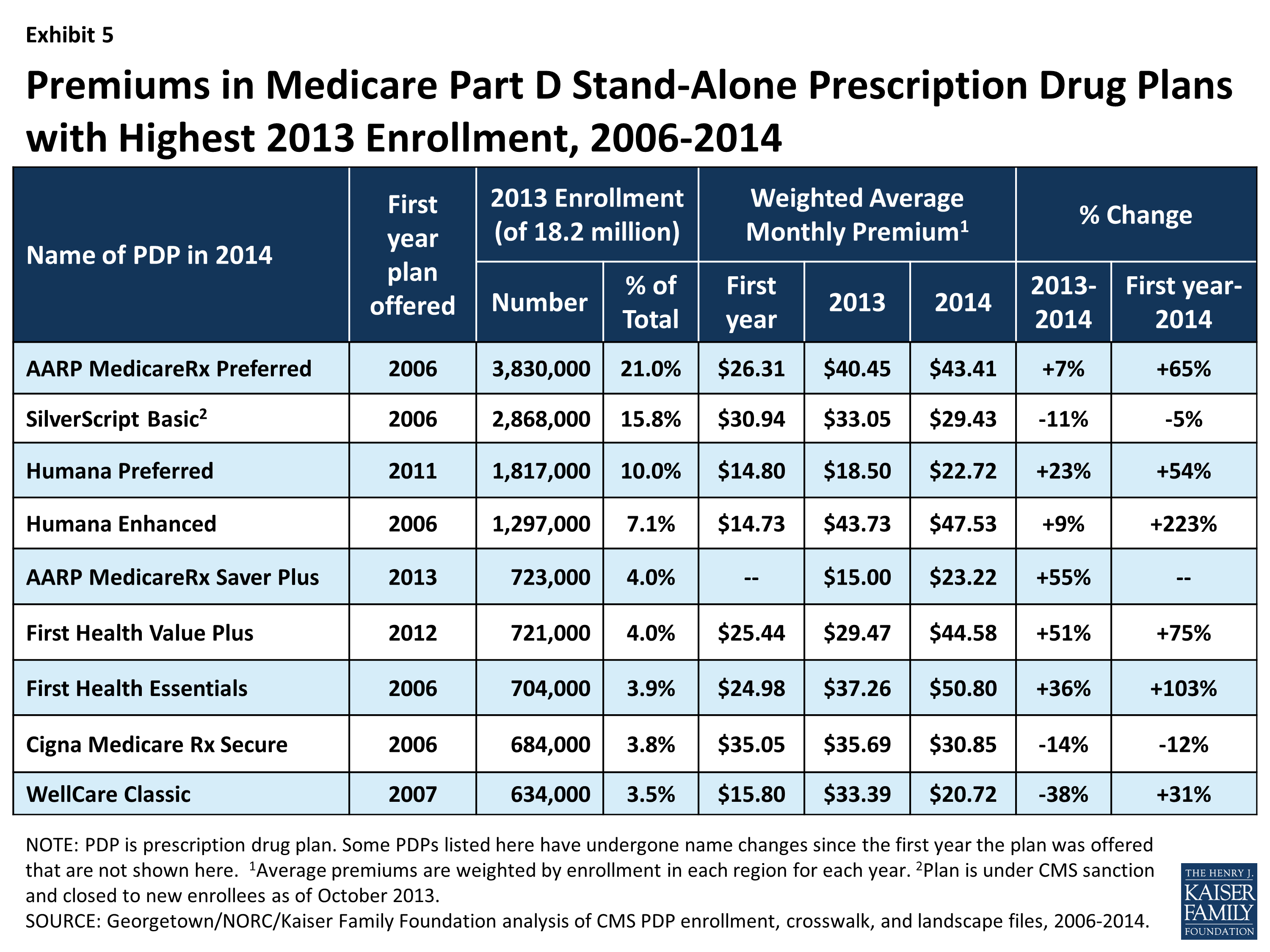

About two-thirds of the 61 million seniors and disabled Medicare beneficiaries choose Original Medicare, Parts A and B, which cover hospitals, doctors, and medical procedures. About 81% of these beneficiaries supplement their insurance with Medigap , Medicaid, or employer-sponsored insurance, and more than 25 million also pay for a stand-alone Medicare Part D prescription drug policy.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program.

While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare, and the great majority do. There is no need for prior authorization or a referral from a primary care doctor. Coverage includes the entire U.S., which may be important for anyone who travels frequently or spends part of the year in a different locale. This option is also attractive to those who have particular physicians and hospitals they want to use.

Don’t Miss: What Is The Best Medicare Advantage Plan In Washington State

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Theres A Lot To Juggle In A Medical Practice

Few clinicians pursued their career for love of paperwork.

Caring for patients is the top priority, but that can mean mountains of paperwork and thousands of hours on the phone with insurance companies every year.

What many practices donât know is that the choice of specialty pharmacy can dramatically add or reduce workload. Choose a specialty pharmacy that not only provides specialty medication and support, but can also help your office run more smoothly.

Read Also: When Does My Medicare Coverage Start

Expert Advice Right At Your Fingertips

If you have questions about the different plan options, are curious about plan benefits or just dont know where to start, thats OK. UnitedHealthcare is here and ready to help.

Call UnitedHealthcare today.

Our licensed insurance agents/producers are standing by to answer your questions or to help you set up an in-person appointment.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000.

Youll also be subject to an annual deductible, set at $203 for 2021. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Also Check: Does Medicare Medicaid Cover Assisted Living

How We Chose The Best Medicare Part D Companies

We began our search by looking into the biggest and most popular health insurance companies. We eliminated companies that didnt serve at least 40 states, to make sure as many people as possible would be able to use this information to their best benefit. Then, we looked at key considerations like Medicare Star Rating, pricing, AM Best financial health ratings, ease of use for their tools and website, the amount of information presented, any extra benefits they might offer, and more to give you the best understanding of which Medicare Part D plan is right for you.

Consider Talking To A Broker Or Consultant

Why wade through overwhelming information if you dont have to? Engaging with a broker or a health insurance consultant is free. Brokers sometimes have access to more plans or better pricing and can use their connections with insurance companies to help find the best plan and coverage for you.

State Health Insurance Assistance Programs can be an excellent resource to help you find all the information you might need if you look for further help with insurance.

You May Like: Do I Need Medicare If I Have Tricare

Aarp Medicarerx Preferred By Unitedhealthcare

AARP MedicareRx Preferred is a Enhanced Alternative 2021 Medicare Prescription Plan by UnitedHealthcare. Stand-alone plans offer additional prescription drug coverage only and are an option if you are on Original Medicare insurance or you have a Medicare health plan that does not include Part D coverage. The AARP MedicareRx Preferred plan has a monthly drug premium of $94.80 and a $0 drug deductible.

How Aarp Medigap Costs Compare To Other Insurance Companies

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation.In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs. For example, a 65-year-old woman may pay more for AARP Medicare Supplement than for a similar plan from Humana or BlueCross BlueShield. However, in this case, AARP plans have slower price increases. By age 85, AARP Medigap is cheaper than Humana, Cigna and BlueCross BlueShield.

To understand how aging will affect your costs, you can request multiple price quotes to discover the best deal now and for decades to come.

Read Also: Does Aetna Medicare Advantage Have Silver Sneakers

Additional Aarp Medicare Supplement Insurance Plans

In addition to the three plans highlighted above, AARP also offers Plan A, B, D, K, L and N. The only Medigap plan not sold by AARP is Plan M. Not every plan will necessarily be available in every location, so be sure to compare the AARP Medicare Supplement plans that are available where you live.

Every year, the Centers for Medicare and Medicaid Services evaluates Medicare Advantage and Medicare Part D based on a 5-star rating system. For 2021, UnitedHealthcare received an overall rating of 3.5 stars from Medicare.

UnitedHealthcare has been recognized as having an A rating or financial strength from A.M. Best and ranks number 7 on the Fortune 500 list.

Because AARP Medicare plans operate under the UnitedHealthcare brand, members enjoy access to one of the largest nationwide networks of doctors, pharmacies and other health care providers. You can use the UHC Find a Doctor tool to find out if your doctor, pharmacy, dentist or vision care provider will accept an AARP Medicare plan.

Find Cheap Medicare Plans In Your Area

Good for

- Those who want the security of an AARP endorsement.

- Those who want benefits for vision, dental and more.

- Those who want plans with discounted rates for in-network coverage.

Bad for

- Those who prefer top-tier customer service.

- Those who don’t want to become AARP members.

AARP Medicare Supplement Insurance provides strong coverage at a good value. Average costs are variable, and in addition to the standard benefits, plans provide discounted access to vision care, dental, hearing, fitness and more.

Also Check: When You Are On Medicare Do You Need Supplemental Insurance

Aarp Medicare Supplement Plan G

Plan G is also highly popular among Medicare beneficiaries and will only continue to grow in popularity, as the share of people eligible for Plan F will go down over time.

Plan G includes all of the same benefits as Plan F with the only exception being coverage for the Medicare Part B deductible. In 2021, the annual Part B deductible is $203. This means that once you meet your Part B deductible for the year and if you have Plan G, you will typically face little or no out-of-pocket Medicare costs for the remainder of the year .

Dual Special Needs Plans

For people who qualify, these combine the benefits of Medicare Parts A and B with your states Medicaid benefits, for as low as a $0 premium.

7 a.m. 11 p.m., ET, Monday – Friday 9 a.m. 5 p.m., ET, Saturday

* Medicare Advantage: April 2020 CMS and Internal Company Enrollment Data. Medicare Supplement: From a report prepared for UnitedHealthcare Insurance Company by Gongos, Inc., Substantiation of Advertising Claims Concerning AARP Medicare Supplement Insurance Plans, August 2020, www.uhcmedsupstats.com or call 1-800-272-2146 to request a copy of the full report.

** You must continue to pay your Medicare Part B premium if not otherwise paid for under Medicaid or by another party. Not all plans are available in all locations.

Read Also: Is Obamacare Medicaid Or Medicare

What Is Plan F 2020 High Deductible

High Deductible Plan F overview High Deductible Plan F includes the comprehensive benefits of regular Plan F, but you manage your health care costs until youve reached the calendar year deductible amount. After that, the plan functions like regular Plan F. Having a high deductible can reduce your monthly premiums.

Best In Broad Information: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No easily accessible price comparisons

-

Limited explanation on the difference between different levels of coverage

Blue Cross Blue Shield clearly takes patient education seriously. It wants to provide accurate information from the start, and its approach and website are different from most other companies. Instead of offering estimates based on your personal information, Blue Cross Blue Shield provides lots of general, up-front information about Medicare and all its different Parts, including Part D. It also offers a state-by-state breakdown of offerings and who to contact for more information. Its quote process is not the most straightforward if you visit your states Blue Cross Blue Shield website, you will be redirected to Anthem to begin a more detailed quote process.

You May Like: Does Medicare Pay For Mobility Scooters

Medicare Part D Open Enrollment Period Ends December 7th

- Make sure all the drugs you take are covered either by your Medicare Advantage plan or by a Part D plan. Taking a drug that isnt covered or isnt considered a preferred medication could mean youll pay more out of pocket.

- Copays differ among the plans, so be careful to look at what the 2022 costs will be.

- Check out whether your local drugstore is considered a preferred pharmacy in your plan if it is, you’ll pay less for your prescriptions there.

Join for $12 for your first year when you enroll in automatic renewal

- Access to hundreds of discounts and programs

- Subscription to “AARP The Magazine”

- Free second membership for any adult in your household

- Subscription to “AARP The Magazine”

- Free membership for your spouse or partner

Get the Most From Your Membership

- Hundreds of discounts, programs and services

- Subscription to “AARP The Magazine”

- Free membership for your spouse or partner

Continue Enjoying Your Member Benefits!

- Hundreds of discounts, programs and services

- Subscription to “AARP The Magazine”

- Free membership for your spouse or partner

Start Getting Your Member Benefits Today!

- Hundreds of discounts, programs and services

- Subscription to “AARP The Magazine”

- Free membership for your spouse or partner