Which Popular Medigap Plans Offer Lower Monthly Premiums

A high-deductible plan option is an excellent way to say money on monthly premiums. For example, a high deductible Plan G has a lower premium than standard Plan G.

Those eligible for Medicare before 2020 may find a High-deductible Plan F makes the most sense.

The word high-deductible can seem intimidating however, these plans cover the full amount of many preventive and wellness services. These plans are sensible if you have the money to cover the deductible in a worst-case scenario but want to save monthly.

Wellcare Health Plans Medicare: Good Choice Of Plans

WellCare Health is a government-sponsored healthcare plan specialist, and so is a great resource for weighing up which Medicare Part D plan might be suitable for any potential customer.

Since these types of plan are definitely the focus, the customer service agents are equipped to give detailed and specialist knowledge, putting the company in a relatively good position compared to many of the peers in the marketplace.

WellCare has an excellent spectrum of available plans, ranging from very affordable entry-level, basic plans to good value, comprehensive plans for customers with extensive medication needs. Pricing is also nicely varied meaning there should be something for everyone.

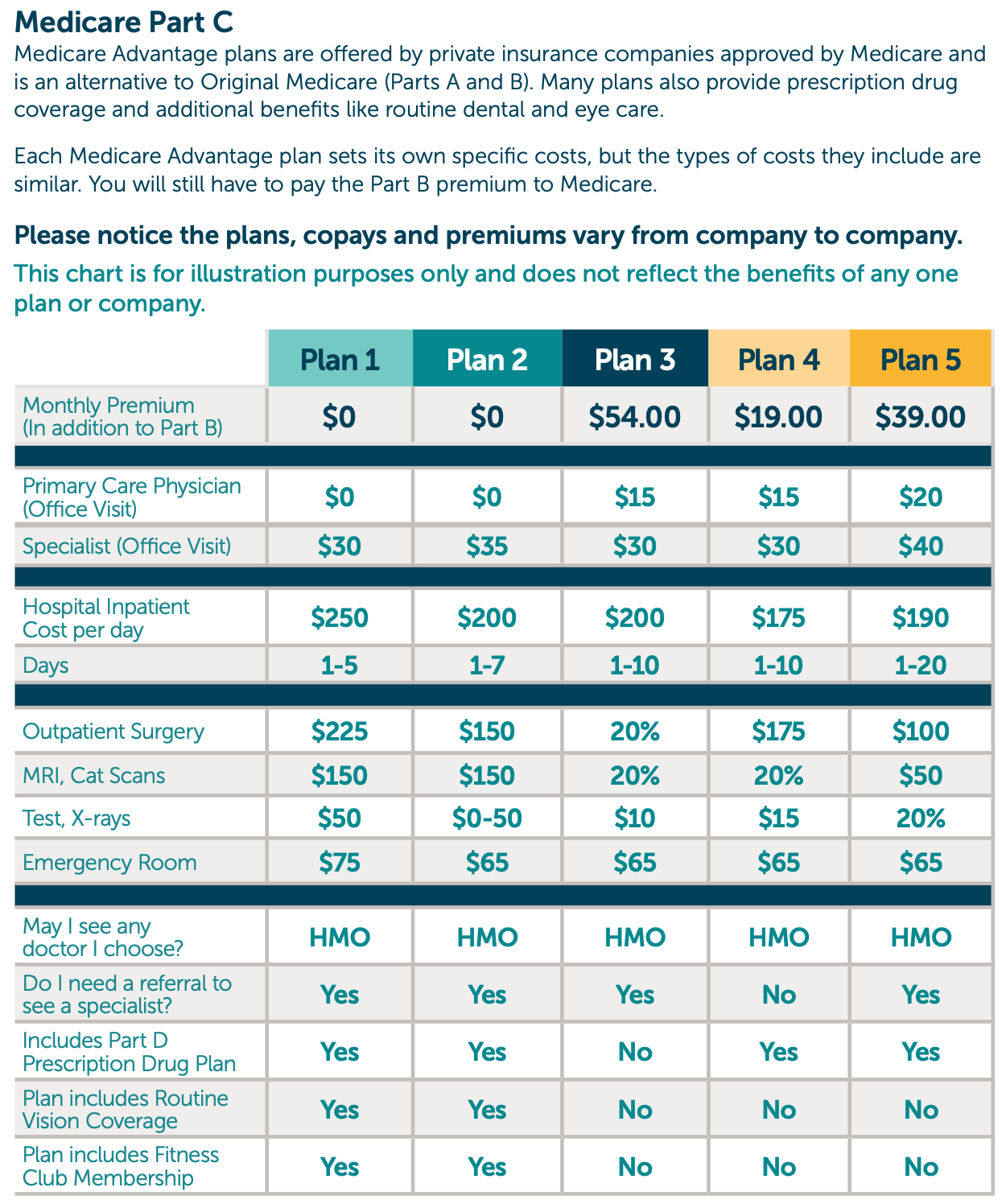

Does A Plan Cover Doctors Facilities Other Providers I Want

Most Medicare Advantage plans have provider networks, so youll need to find out whether the doctors, hospitals and outpatient clinics you want to use are covered. The Plan Details page in Plan Finder may include a link to the plans provider network. If so, search or scroll down to Provider Costs.

In many cases, that link goes to the plans website, where you may find a searchable provider database. After you narrow the possibilities, you should call a plans customer service number and ask your doctors whether they participate in the plan or plans youre interested in to reconfirm what you saw online.

Be sure to ask about a specific plan by name. Some Medicare Advantage insurers offer several plans with different provider networks.

Also find out how your Medicare Advantage plan will treat your use of an out-of-network provider:

- Some health maintenance organizations pay nothing for out-of-network providers except for emergencies.

- Some preferred provider organizations cover out-of-network providers, but charge higher copayments and have higher out-of-pocket spending limits for out-of-network care.

This is important to know if you end up wanting to see a specialist thats not in the plans network or if you travel and need to go to a doctor while away from home. The Benefits & Costs section for each plan on Plan Finder lists the in-network copayments for each type of care and the out-of-network copayments if covered.

Don’t Miss: When Can I Apply For Medicare In California

What Is The Difference Between Medicare Part D And Medicare Advantage For Prescription Costs

On average, prescriptions will be less expensive with a Medicare Advantage plan, and you have a better chance of having your medication covered. Medicare Advantage offers lower plan maximums and in some cases, lower monthly premiums, but Medicare Advantage does have extrassome of which you may not actually need if you just want prescription drugs and nothing else. Part D medications can be more expensive since theyre not bundled the same way Medicare Advantage is, but thats not always the case. Prices vary drastically with both plans depending on the medicine in question, so its worth investigating both options to determine what will be best for your situation.

How Does A Plan Cover My Typical Care Big Medical Issues

The Plan Finder can show you copayments for various services. Click on Plan Details and scroll down to Benefits & Costs or click the Benefits & Costs tab to do the same thing to see copayments for primary doctor and specialist visits, lab services, X-rays, diagnostic radiology services such as MRIs, emergency care, inpatient and outpatient hospital coverage, physical therapy and other services.

Also look at the plans out-of-pocket spending limit. In 2022, the maximum out-of-pocket spending limit, which includes copayments and deductibles for medical care but not premiums or drug costs, must be $7,550 or less for in-network care, and $11,300 for covered in-network and out-of-network care. Some plans have lower limits.

You May Like: When Is The Earliest You Can Apply For Medicare

Initial Coverage Level In 2023

Per Medicare.gov, the initial coverage level amount will raise to $4660 in 2023. The coverage gap is a coverage gap that is reached when the retail cost of your medications reaches $4660 during the year.

When that occurs, you are required to pay 25% of the plans negotiated retail prices until the catastrophic amount is reached.

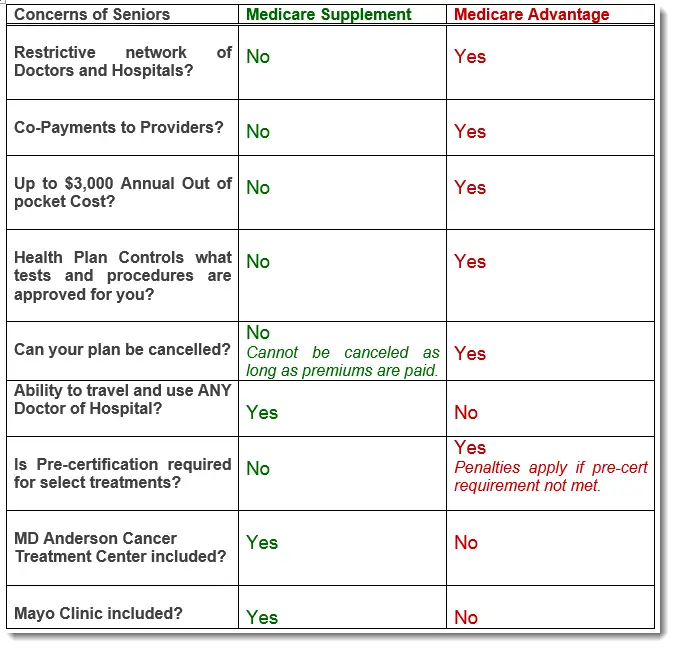

What Is The Downside To Medicare Advantage

While Original Medicare enables you to go to any doctor and visit any hospital as long as they accept Medicare, Medicare Advantage plans often require you to use in-network providers to get the lowest costs. Further, you may need a referral to see a specialist with an MA plan while Original Medicare often doesnt require one.

The way your plan works depends on the type of MA plan you have. For example, HMOs restrict you to the doctors, healthcare providers, and hospitals in your plans network for non-emergency care. You also typically need to choose a primary care doctor and get referrals to see specialists. If you get care from a provider outside of the HMOs network, you may have to pay the full cost of care.

PPOs are more flexible, but theyre still more restrictive than Original Medicare. They also come with networks of doctors, healthcare providers, and hospitals. Staying in-network offers the best pricing, but you can usually get out-of-network care without paying the full cost.

When youre limited to a plans network of doctors and service providers, it can be harder to get care when and where you need it. Additionally, if you prefer to go to a specialist without needing a referral from your primary care doctor, you should consider an MA PPO plan.

Recommended Reading: Is Spaceoar Covered By Medicare

If Retirement Means A Permanent Move

- If you make a permanent move, youll be able to sign up for a different Medicare plan in your new area.

Planning to do some globetrotting? Learn about the best Medicare plans for people who spend time in different countries.

If you want to change your plan because youre moving, you can tell your plan starting the month before the month you move, and for up to two months after you move. You can also enroll in a 5-star rated plan at any time.

Best For Size Of Dental Network: Unitedhealthcare

Average Medicare star rating: 4.2 out of 5.

Service area: Available in 50 states and Washington, D.C.

Standout feature: UnitedHealthcare has the largest network of dental providers of all Medicare Advantage companies, with approximately 100,000 providers.

UnitedHealthcare is the biggest provider of Medicare Advantage plans in the U.S., with a presence in all 50 states and plans available in almost three-quarters of U.S. counties. UnitedHealthcare also partners with AARP and insures Medicare products with the AARP name. Many of UHCs members are in plans with high star ratings.

Pros:

-

UHC offers the largest Medicare dental network, with approximately 100,000 providers.

-

UHC plans with comprehensive dental coverage include an average of six services per plan.

-

Three-quarters of UHC Medicare Advantage members are in highly rated plans.

Cons:

-

Only 75% of UHC plans offer comprehensive dental coverage, one of the lowest among the major Medicare Advantage providers.

-

UHC tied for sixth out of nine providers on J.D. Powers latest Medicare Advantage study, which measured member satisfaction.

You May Like: What Is The Best Medicare Supplement Insurance Company

Humana Medicare Part D Overall Review

Offering $0 copayments for many generic drugs on all their plans, Humana is a great option for someone who primarily uses generics. All three plans have a $480 deductible that you can quickly meet if you take higher-tier drugs. With an option for everyone, Humana Medicare Part D plans could potentially save you the most money in 2022.

As Medicare Deadline Nears Pick The Plan That’s Best For You

As 2023 quickly approaches, many Hoosiers may start to consider their New Years resolutions.

If exercising more, eating healthier, losing weight and living more economically are on your list, youre not alone. In fact, a survey found those were among the top five resolutions for 2022.

For those 65 or older or individuals eligible for Medicare as a result of disability, it may be easier than you think to choose a health care plan that aligns with these goals, as many Medicare Advantage plans provide coverage and benefits to help you live a healthy, active life.

While selecting a Medicare plan that suits your individual needs can feel overwhelming, its an important task since the plan you select by the Dec. 7 Medicare Advantage and Prescription Drug Plan deadline is the plan youll likely have for all of the coming year.

Whether you are new to Medicare or reevaluating your plan options, I urge anyone eligible to enroll to conduct a personal assessment to identify the type of plan thats best suited for your unique health needs.

This can include checking to see whether your doctors and hospitals are in network, as well as whether dental, vision and hearing coverage is included.

Its also important to make a list of your current medications so you can compare estimated prescription costs as you evaluate plan options. Some plans even offer $0 copays for certain prescriptions, which can result in a significant savings if you take several medications.

Read Also: When Can I Enroll For Medicare Part B

Humana Medicare Part D

Humana’s Part D plans are typically a good deal. The cost for generic drugs is usually under $5, and preferred brand-name drugs cost around $45 with the company’s more expensive plan. However, Humana’s coverage for non-preferred drugs is not great, and you could have very high costs if you need these medications.

Pros

Other companies to consider:Best Medicare Part D plans

Legalities Of Part C Plans

CMS sets guidelines and regulates what Medicare Advantage plans can offer in terms of pricing, providers and marketing practices. Insurers that violate CMS policies can be fined or have their plans suspended or terminated. You have the right to be treated fairly and have your privacy protected. You can file a claim if you feel your rights have been violated use the Claims and Appeal tab on Medicare.gov.

You May Like: Which Drugs Are Covered By Medicare Part D

Humana Medicare Part D Plans

- Walmart Value Rx Plan

| $78.60 | Take multiple brand-name or high-tier drugs |

Humana is number two on our list of the top 5 best Medicare Part D plans for 2022. The Humana Walmart Value Rx Plan is excellent for someone with very few generic medications or certain name-brand medications.

The Basic plan is best for those taking a few more maintenance medications that are both generic and name-brand. On the other hand, the Premier Plan is best for those who take higher-tier drugs for which they need a higher level of coverage.

Which Company Has The Best Medicare Advantage Plan

The answer to this question depends on what you define as best. Are you looking for the lowest monthly premium or the lowest cost-sharing plan? Maybe the best Medicare Advantage plan to you means the highest overall customer satisfaction rating or the plan with the most benefits. Below, we listed the best Medicare Advantage carriers based on company ratings, coverage options, and benefits.

Don’t Miss: What Does Part G Cover In Medicare

Best In Education: Aarp

AARP offers three well-rounded plans to its customers, with information written clearly at a level that anyone can understand. AARP even offers suggestions to match you with a plan, for example if you are looking for basic coverage or something more comprehensive. AARP also lists all of its different Medicare options available in your location if you want to look into them.

-

Information is easy to follow

-

Ability to review all different Parts of Medicare available in your area

-

Lots of educational materials on the website, including general Medicare information, AARPs Medicare Plans, as well as enrollment questions

-

Must enter at least some of your medications to get an accurate personalized estimate of your costs

-

Higher deductibles

-

Cannot split payments over multiple methods

AARP was founded in 1958, and was a trailblazer for the insurance of older people, especially since Medicare itself didnt even exist until 1965. As such, AARPs focus is 100% on patient understanding and comfort, and all of the information is written with you in mind. There are free Medicare guides available for download on its website, and its easy to compare plans or connect with an associate for more detailed information and assistance. AARP provides all the tools you need for a well-rounded understanding of Medicare.

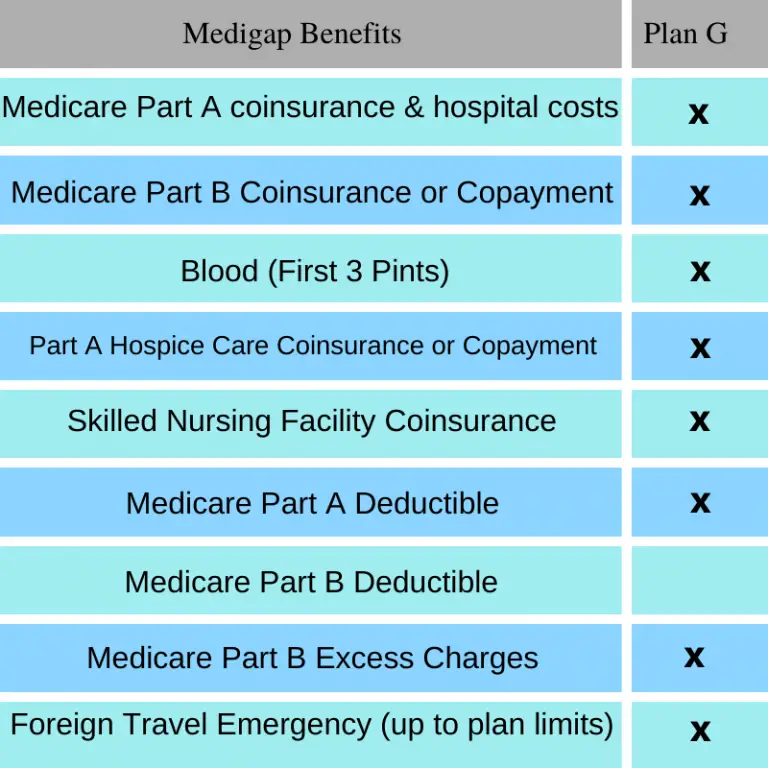

Mutual Of Omaha Medigap

The cost for a Plan G from Mutual of Omaha is often similar to what you’d pay for a plan from AARP/UnitedHealthcare, and if you qualify for Mutual of Omaha’s household discount of 7% to 12%, the plan could be one of the cheapest options available.

Pros

| $36 | 3.5 |

Cost is the national monthly average for Part D plans, and ratings are the average Medicare.gov star rating for prescription drug plans. Note that star ratings for Part D plans tend to be lower, and 89% of enrollees have a plan with 3.5 or 4 stars.

Find Cheap Medicare Plans in Your Area

What you pay for cancer medications largely depends on their tier classification. For example, generic drugs are usually cheaper than new, experimental or specialty drugs.

Additionally, each insurance company sets its own formulary about the drugs it covers. While all companies will provide broad coverage across all types of medication, choosing the best prescription plan usually means matching your list of prescriptions to a drug plan’s formulary.

When managing your cancer treatment, remember that with all Medicare prescription plans, you can request an exception to the list of covered drugs in your plan’s formulary or a drug’s tier classification. To do this, your doctor must say that a particular medication is required for treatment and there are no cheaper options available. While this process can require more paperwork, it’s a useful way to make sure your cancer medications are affordable and accessible.

Read Also: How To Apply For Medicare Card Replacement

Mutual Of Omaha Medicare Supplement

Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur. They have a lot of experience, offer discounts for things like being a non-smoker, and they are available in most states.

What we like: They offer international travel coverage with some of their plans. Theyve been working with Medicare since 1966, so they know what theyre doing. Their international coverage option is great for active seniors.

Flaws: Some of their high end plans are pretty expensive. Also, they do not offer plans C and D.

Medicare Part D: Prescription Drug Coverage

This component of Medicare helps cover the cost of prescription drugs, including many recommended vaccines. You can get a Medicare drug plan in two ways: by joining a Part D plan in addition to Original Medicare or by enrolling in a Medicare Advantage Plan with drug coverage.

Medicare Part D is only offered through private insurance companies.

According to Dr. Anderson, the biggest recent change to Medicare has been the passage of certain drug provisions in the federal governments 2022 Inflation Reduction Act, as reported by the Centers for Medicare and Medicaid Services. This will allow Medicare to negotiate drug prices for certain drugs, penalize drug companies that raise prices, and prevent any Medicare beneficiary with Part D coverage from paying more than $2,000 out-of-pocket, he says.

Don’t Miss: Does Medicare Cover Hiv Testing

The Best Medicare Part D Plans Resources To Consult

Although SHIP counselors are not allowed to recommend one specific Medicare Part D plan, by asking these questions and evaluating which plans formularies best suit a persons needs, theyre able to narrow down the choices significantly.

Walker estimates that consumers who follow his staffs advice save an average of $2,100 a year. And since the services are free, you can call your states SHIP any time throughout the year, especially during every open enrollment period, when you need to decide whether to keep your current plan or switch to a new one.

We always recommend SHIPs as a resource for people who want more-personalized help with sorting through their Medicare plan options, Purvis says.

You can find your states SHIP website in this drop-down menu .

There are few things more important than your health. That’s why MedicarePlan.com is designed to find the best Medicare Part D insurance plans designed for you and your family. Start your search today.

Most Popular Medicare Supplement Plans

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsMedigap

The Medicare Supplement insurance plan letters with the highest percentage of enrollments nationwide are Plan F, Plan G, and Plan N. But, the best insurance policy for you is going to have a fair price with adequate coverage. Since Original Medicare has deductibles and coinsurances, its beneficial to have a supplemental policy. Below well discuss the most popular Medigap plans and explain how to choose the best option for you.

Recommended Reading: How Does Medicare D Work

Q: Can I Get A Medicare Supplement Plan If I Have A Pre

A: During the open enrollment period we discussed earlier, you have what are known as guarantee issue rights . Guarantee issue rights ensure you cannot be turned down for a Medicare supplement plan, even if you have a pre-existing condition. Also, the insurer cannot charge a higher premium because of the pre-existing condition. What the provider can do in that case is impose a waiting period of up to six months before coverage begins.