Types Of Medicare Prescription Drug Coverage

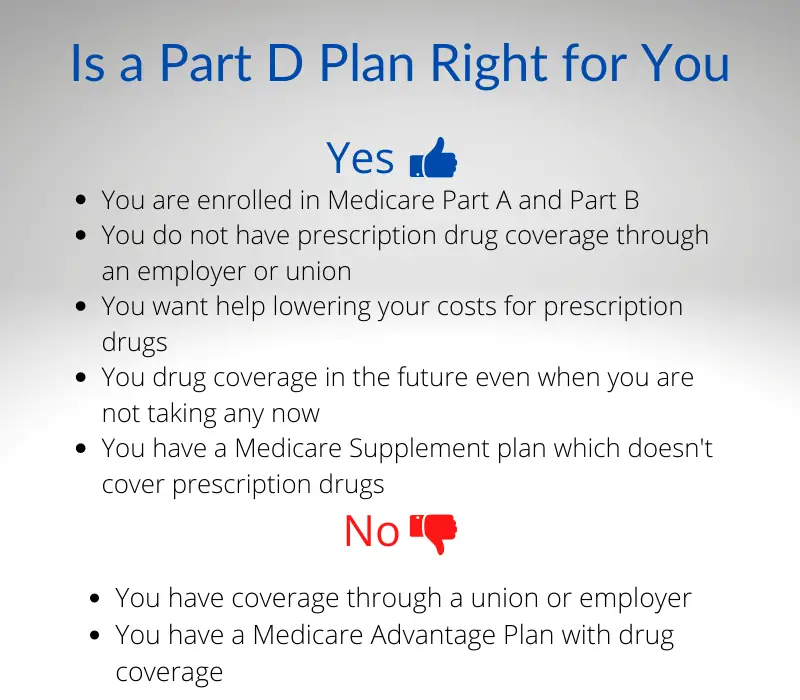

Although Part D is usually what people associate with drug coverage, there are other ways to get this coverage as well.

Medicare Advantage plans, also known as Medicare Part C plans, can sometimes offer prescription drug coverage as well. These plans will not function as standalone plans but will be bundled with regular insurance plans that are offered by private health insurance companies under Medicare Advantage.

Because these plans are bundled, it can sometimes be hard to find a plan that offers a perfect mix of ordinary coverage and drug coverage. If you have a Part C drug plan, you wont be able to get a standalone drug plan as well. For those who do find a plan that works, it can be a very convenient way to ensure full coverage.

Medigap Policy Without Creditable Drug Coverage

You’ll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn’t include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you’ll pay a higher monthly premium than if you joined when you were first eligible.

Your penalty amount increases for each month you wait to join a Medicare drug plan. In general, you’ll have to pay this penalty for as long as you have a Medicare drug plan. Learn more about the Part D late enrollment penalty.

Eligibility For Part D

Anyone with Medicare is eligible to enroll in a Part D plan. To enroll in a PDP, the individual must have Part A OR Part B. To enroll in an MA-PD, the individual must have Part A AND Part B.

Enrollees must live in their plans service area. In the case of homeless persons, the following may be used as a permanent residence: a Post Office box, the address of a shelter or clinic, or the address where the person receives mail such as Social Security checks.

PDPs are usually national plans, but MA-PDs have delineated regions, sometimes by state, sometimes by counties within states ). For this reason, MA-PDs may not be appropriate for those who travel a great deal or who maintain summer and winter residences in different areas of the country. NOTE: Some MA-PDs offer passport plans that allow members to obtain benefits outside their normal service areas.

Individuals who reside outside the United States* are not eligible to enroll, but may do so upon their return to the country. Incarcerated individuals may not enroll in Part D, but they may enroll upon release from prison. Prior to 2021, people with end-stage-renal-disease could not enroll in an MA-PD. Starting in 2021, people with ESRD can enroll in Medicare Advantage plans during the annual Open Enrollment Period.

There are no other eligibility restrictions or requirements for Part D.

Recommended Reading: When Can You Sign Up For Medicare Part D

How Much Will I Have To Pay For Medications

In Medicare Part d in 2023, your costs will vary according to the unique plan that you choose. It is possible that you may have to pay a premium, a set deductible, copayments on certain drugs, and even coinsurance costs.

To determine how much you will have to pay, visit the following website now to compare plans: Medicare.gov/plan-compare

What Do Medicare Part D Plans Cover

Medicare prescription drug plans cover the following:

- Types of drugs most commonly prescribed for Medicare beneficiaries as determined by federal standards

- Specific brand name drugs and generic drugs included in the plan’s formulary

- Commercially available vaccines not covered by Part B

It is important to note that while Medicare Part D plans are required to cover certain common types of drugs, the specific generic and brand-name drugs they include on their formulary varies by plan. You will need to review a plan’s formulary to see if the drugs you need are covered.

Recommended Reading: Are Medicare Advantage Plans Hmos

Medicare Prescription Drug Coverage

What do you need to know about prescription drug coverage? Let’s unpack what you need to know. According to a 2016 study from the CDC 40% of people over the age of 65 take five or more medications a day. Medicare can help you pay for it. A Medicare prescription drug plan is also known as Medicare Part D. To get Medicare drug coverage you must join a plan run by an insurance company or a private company approved by Medicare. There are two ways you can sign up. The first, buy a stand-alone Medicare Part D plan. The second, purchase a Medicare Advantage plan that includes prescription drug coverage. And remember, you can only get these through private insurance companies. Keep in mind each plan has a list of prescription drugs that it covers on a list called a formulary. The formulary has information like which tier the drug is on. Tiers help determine how much you’ll pay for your medicine. The formulary also tells you about any special rules including whether there are quantity limits. You can get the most out of the Part D plan by checking different ways to save like reduced pricing at preferred pharmacies, extra benefits, or 90-day drug prescriptions. Don’t forget. If you don’t sign up when you’re first eligible, you could pay more in the form of a late enrollment penalty. Got more questions? Learn more at AetnaMedicare.com.

Forty-one percent of those over 65 take five or more medications a day.1

Medication Therapy Management Programs For Complex Health Needs

Plans with Medicare drug coverage must offer free Medication Therapy Management services if you meet certain requirements or are in a program to help members use their opioids safely. This program helps you and your doctor make sure that your medications are working to improve your health.

Through the MTM you’ll get:

- A comprehensive review of your medications and the reasons why you take them.

- A written summary of your medication review with your doctor or pharmacist.

- An action plan to help you make the best use of your medications

A pharmacist or other health professional will talk with you about:

- Whether your medications have side effects

- If there might be interactions between the drugs you’re taking

- Whether your costs can be lowered

- How to safely dispose of unused medications

Its a good idea to schedule your medication review before your yearly wellness visit, so you can talk to your doctor about your action plan and medication list. Bring your action plan and medication list with you to your visit or anytime you talk with your doctors, pharmacists, and other health care providers. Also, take your medication list with you if you go to the hospital or emergency room.

If you take many medications for more than one chronic health condition, contact your drug plan to see if you’re eligible for a Medication Therapy Management program.

Read Also: When Do Medicare Benefits Kick In

Consider All Your Drug Coverage Choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs , the Indian Health Service, or a Medicare Supplement Insurance policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

D Does Not Cover Over

Medicare Part D does not pay for nonprescription drugs like antacids and cold medicines that you find at a pharmacy. Nor does it cover drugs for erectile dysfunction, hair loss or weight control, even if a doctor prescribes them.

You can use money from a health savings account tax free to pay for over-the-counter medications. You cant contribute to an HSA after you enroll in Medicare, but you can withdraw money for eligible expenses at any time without paying taxes.

Don’t Miss: Does Medicare Pay For Lung Cancer Screening

Can I Get Automatic Prescription Refills In The Mail

Some people with Medicare get their drugs through an automatic refill service that automatically delivers prescription drugs before they run out. To make sure you still need a prescription before they send you a refill, drug plans may offer a voluntary auto-ship program. Contact your plan for more information.

| Note |

|---|

|

Be sure to give your pharmacy the best way to reach you, so you don’t miss the refill confirmation call or other communication. |

If you have both Medicare and

or qualify for

, also bring proof of your enrollment in Medicaid or proof that you qualify for Extra Help.

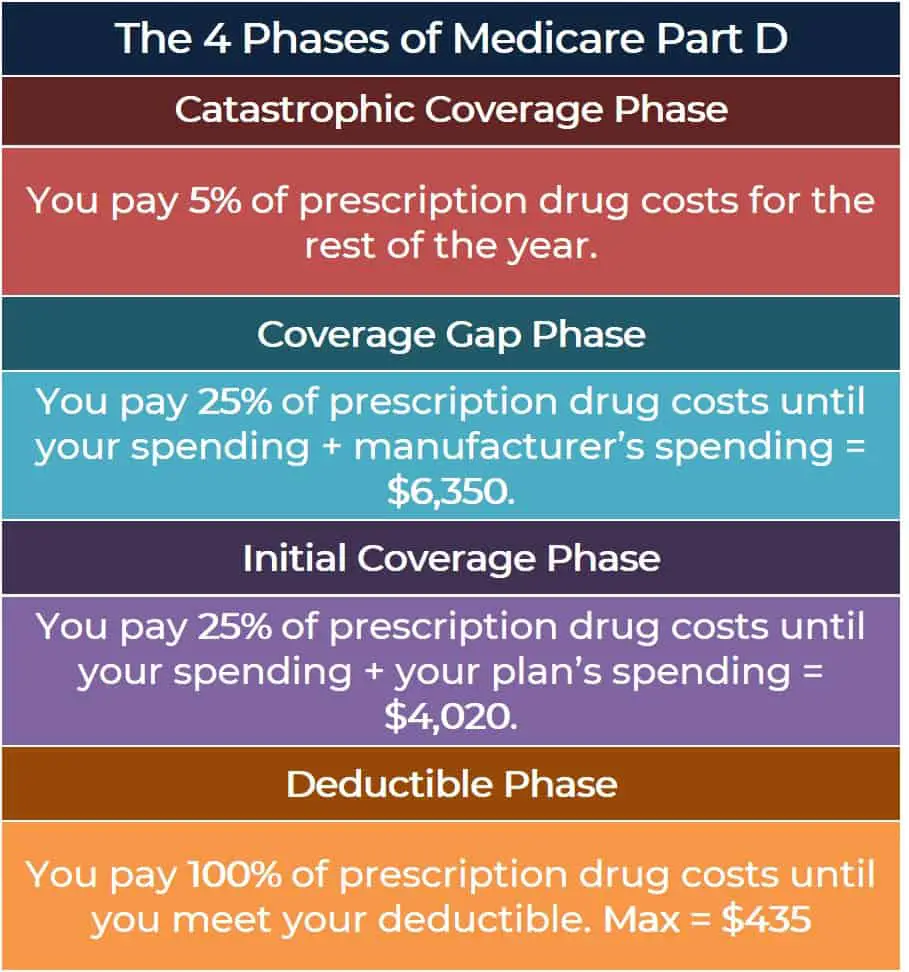

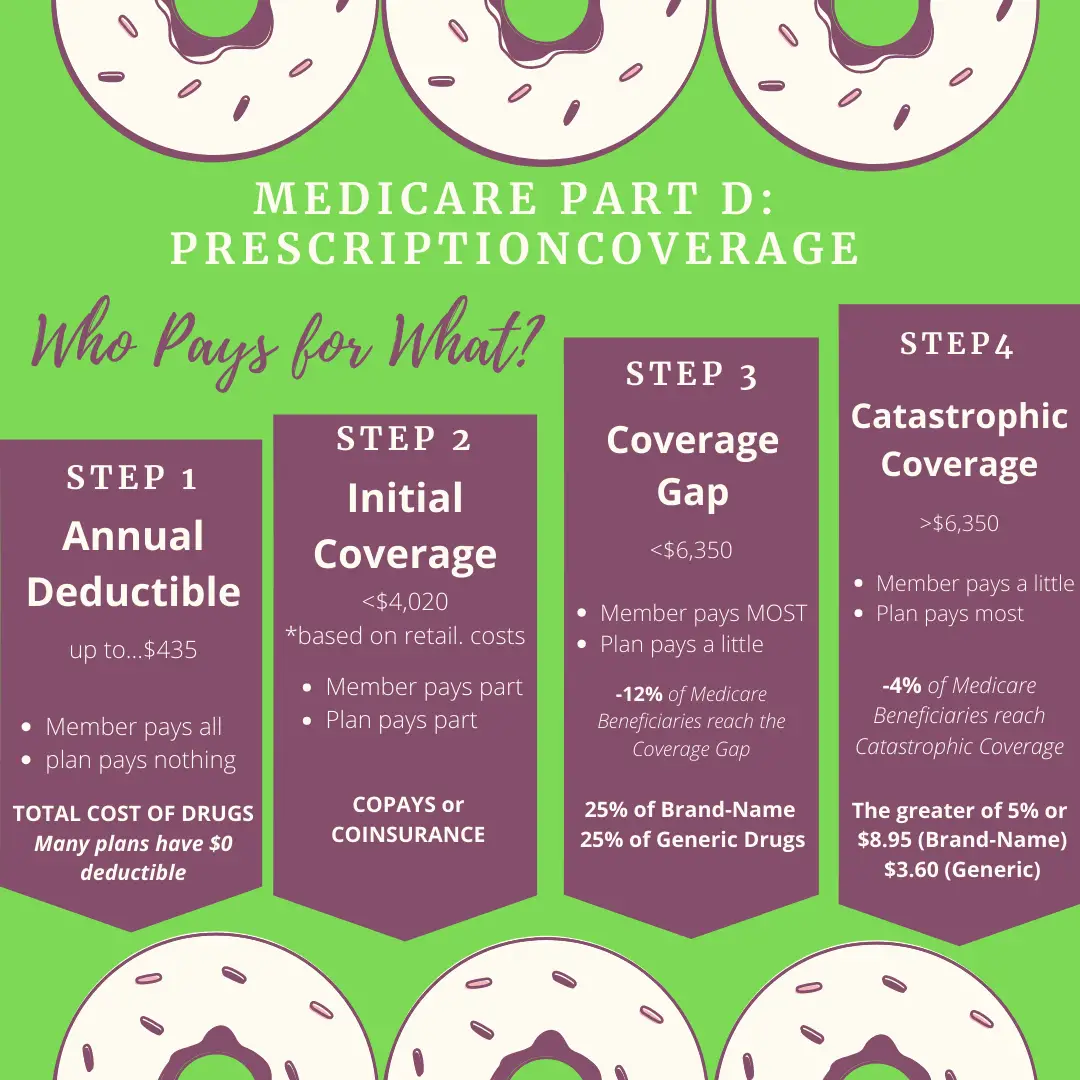

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and it’s important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay for your drugs until you reach your plan’s deductible

If your plan doesn’t have a deductible, your coverage starts with the first prescription you fill.

Initial Coverage

You pay a small copay or coinsurance amount.

You stay in this stage for the rest of the plan year.

- Total drug costs: the amount you and your plan pay for your covered prescription drugs. Your plan premium payments arenot included in this amount.

- Out-of-pocket costs: The amount you pay for your covered prescription drugs plus the amount of the discount that drug manufacturers provide on brand-name drugs when youre in the third coverage stage — the coverage gap . Your plan premiums are not included in this amount.

*If you get Extra Help from Medicare, the coverage gap doesn’t apply to you.

Don’t Miss: What Is The Best Medicare Advantage Plan In Arizona

How Do I Choose A Medicare Part D Plan

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. Its important to comparison shop to find the one thats right for you. In addition to monthly premiums and deductibles, you should definitely compare plan formularies, especially if you take daily medications.

Some plans use a pharmacy network. If you have a pharmacy you really like, make sure its part of the plans network. Look for other benefits, such as mail-order pharmacies, that can help save money out-of-pocket.

Prescription Drugs Not Covered By Medicare Part D

Over-the-counter medications generally arent covered by Part D plans, which includes:

- cosmetic and weight loss medications

Prescription drugs not covered by Medicare Part D include:

- your plan doesnt offer Part D services

- you want to switch to a plan with a higher star rating

You can also change plans during each year.

Also Check: How Do I Get A Medicare Explanation Of Benefits

What Is The Best Time To Enroll In Medicare Part D

Ideally, the time to enroll in Medicare Part D is when one gets enrolled in Medicare A and B.

Further, if you enroll at the same time you start your Part A & B benefits, you will avoid a Late Enrollment Penalty when you do decide to elect a Part D plan.

Otherwise, yearly enrollment periods provide opportunities to revise and change coverage options for Part D.

First, Annual Enrollment, the yearly time to add or change Medicare Advantage or Plan D plans runs from October 15 through December 7.

Next, the Medicare Advantage Open Enrollment, takes place at the beginning of each year, from January 1st through March 31st. In particular, this enrollment period applies if a person is already enrolled in a Medicare Advantage.

Regardless of whether their current Medicare Advantage plan includes prescription drug coverage, a person could switch plans.

Accordingly, members can replace their current Medicare Advantage plan with any other Medicare Advantage plan.

Alternatively, a person could drop their Medicare Advantage plan to join a stand-alone Medicare Part D Prescription Drug Plan .

Consequently, dropping a Medicare Advantage plan for a PDP means the person returns to Original Medicares Part A and Part B coverage and network.

What Medications Are Covered By Medicare Part D

Each Medicare Part D plan has a list of prescription drugs and medications that are covered. This list is called a formulary, and is usually formatted by drug category. Drug categories are classified based on medications that are intended to treat the same types of illnesses by targeting similar symptoms or by having similar effects on ones body.

All Medicare part D plans are required by law to include coverage for at least two drugs from most categories, and all drugs that fall under the following categories:

- HIV/AIDS treatment

- Anticonvulsants and medications intended for seizure disorders

- Immunosuppressants

Also Check: When Does My Medicare Coverage Start

Medicare Part D Enrollment

There are three periods during which you can enroll for Medicare Part D plans.

1) Initial Enrollment Period

You can enroll for Medicare Part D when you first become eligible for Medicare. This is the period that runs from three months before your 65th birthday month to the three months after. If you enroll in the three months prior to your 65th birthday, your Part D coverage will begin on the first day of the fourth month.

It is best to enroll in Part D coverage during the initial enrollment period, but if you miss the IEP, other enrollment options are available.

2) Annual Election Period

You have the option to enroll for Part D coverage during the annual election period, which runs from October 15th to December 7th each year. If you enroll during this period, your coverage will take effect on the 1st of January the following year. Note that you also have the option to switch from one Plan D coverage plan to another during this period.

3) Special Enrollment Period

In special circumstances, you may be eligible to enroll for Part D during the Special Enrollment Period. You may qualify for special enrollment in various circumstances, including:

- You move outside of your plans service area

- You qualify for Extra Help

- Your plan is discontinued by Medicare

- You are no longer eligible for Medicaid

- You have recently been released from jail

Get Help Managing Your Medications

If youre taking a number of medications prescribed by more than 1 doctor, you may be eligible to take advantage of . Through this program, you can meet 1-on-1 with a doctor or pharmacist to learn more about your medicines and how they work, ask questions about side effects or interactions with other medications and look for opportunities to lower your costs.

You May Like: How Much Is Taken Out Of Social Security For Medicare

What Is Medicare Part D Prescription Drug Coverage

Medicare Part D helps cover the cost of prescription drugs. Part D is optional and only provided through private insurance companies approved by the federal government. However, Part D is offered to everyone who qualifies for Medicare. Costs and coverage may vary from plan to plan. Read on to learn more about Medicare Part D prescription drug coverage, how to get it and what it covers.

Drugs Covered Under Medicare Part D

Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans cover all commercially available vaccine drugs when medically necessary to prevent illness. Otherwise, the plan decides which drugs to cover, which drugs not to cover, and under which tier to cover them.

Before enrolling in a Medicare Prescription Drug Plan or Medicare Advantage plan that includes drug coverage, you should review the planâs formulary to see which drugs it covers.

Also Check: Is Medicare Through The State

How Medicare Part D Works With Other Insurance

If you want to keep your prescription drug coverage from an employer or union, it must be whats called creditable prescription drug coverage to avoid the Medicare Part D premium penalty in the future. Your plan is required to notify you annually as to whether or not your coverage is creditable. If you dont receive word, contact the plan or your employee benefits department directly to find out.

Be aware that if you sign up for Medicare Part D and your spouse or dependents receive prescription drug coverage from your employer or union prescription drug plan, they may lose their coverage.

The following types of government-sponsored insurance are considered creditable coverage. If you have coverage from one of these sources, it may make sense to continue with it.

-

Federal Employees Health Benefits.

Does Medicare Part D Cover Generic Drugs

All Part D plans cover generic and brand name medications using the formulary tier system. Tier 1 generics are generally preferred since the plan and copays are usually the lowest.

Keep in mind each plan has different generics on their tier formulary, so its important to be sure the medications you take are on the list. If a medication isnt on the formulary list, ask your pharmacy how much it would cost to buy that medication without Part D.

Also, plans can change the medications they offer in their tiers. Its important to check every year during annual open enrollment before you sign up for a Part D plan to be sure your plan still covers the medications you take.

Read Also: Does Medicare Cover Hearing Aids In 2020

Which Prescription Drugs Are Covered

Though a plans formulary, or list of drugs covered by Medicare Part D, varies from plan to plan, every therapeutic category of prescription drug must be covered under Part D.

These categories include:

- Immunosuppressants

Additionally, Medicare Part D formularies must also cover at least two drugs in most prescription drug categories.

It should also be noted that, in the event that a noncovered drug is deemed medically necessary for you, every Medicare Part D plan is required to allow a process for its members to request exception to their plans formulary. This can also be applied to other areas of the plan, such as quantity limits.