What Is The Difference Between Medicare Plan G And Plan F

Plan G is essentially Plan F without coverage for the Part B deductible. In 2015, Congress signed the Medicare Reauthorization Act, which included a rule eliminating Medigap plans that paid the Part B deductible. The rule applied to all new plans sold on or after January 1, 2020.

Plan F, which is the most popular Medigap plan among all Medicare beneficiaries, is no longer available to anyone who first became eligible for Medicare after December 31, 2019. If you had Plan F before January 1, 2020, you can keep your plan. If youre new to Medicare, Plan G gives you the same comprehensive coverage minus the Part B deductible.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

The 10 Standard Medicare Supplement Insurance Plans

There are 10 Medicare supplement insurance plans. Each plan is labeled with a letter of the alphabet and has a different combination of benefits. Plan F has a high-deductible option. Plans K, L, M, and N have a different cost-sharing component.

Every company must offer Plan A. If they offer other plans, they must offer Plan C or Plan F.

You May Like: What Medicare Plans Do I Need

How Is Medsup Plan G Different From Other Medsup Plans

Medicare Supplement Plan G and Plan F are very similar. The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesnt.

Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different. For example:

- MedSup Plan C is like Plan F but doesnt pay your Medicare Part B excess charges.

- Plan N, on the other hand, doesnt pay your Part B deductible or excess charges.

Other MedSup plans pay just a portion of costs, like your Part A deductible or your Part B copay or coinsurance fees. Some come with yearly out-of-pocket limits, too.

Why Should You Choose Medicare Supplement Plan G

Medicare Supplement Plan G is among the highest-rated and most popular Medicare Supplement plans. Whether you are new to Medicare or looking for a policy to better fit your budget or healthcare needs, Medigap Plan G may be the right fit.

Medigap Plan G covers 100% of your costs after the Medicare Part B deductible. So, you will see that by enrolling in this plan, you could save thousands of dollars per year on healthcare.

Recommended Reading: What’s The Number For Medicare

Original Medicare And The Gaps

Basically, they cover the big stuff like hospital visits and medical insurance . Medicare beneficiaries often find themselves with additional mounting out-of-pocket expenses. Handling those unplanned for expenses on a fixed budget creates a hardship.

Enter Medigap plans, also referred to as Medicare Supplements. These plans are distributed through individual carriers. Their purpose is to fill in the gap of what Original Medicare does not cover.

Medicare Supplement Plan G: What Are The Facts

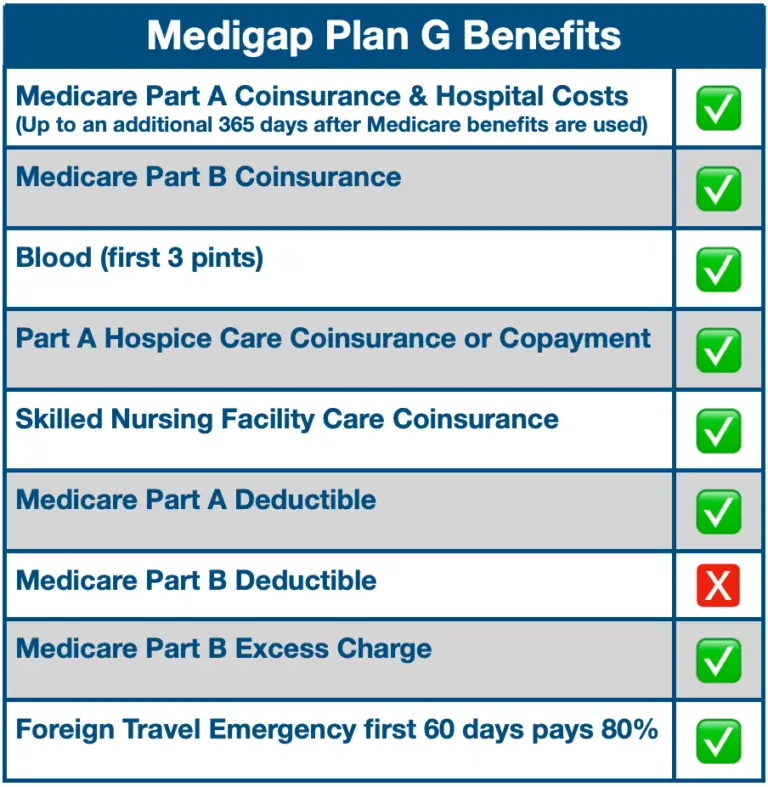

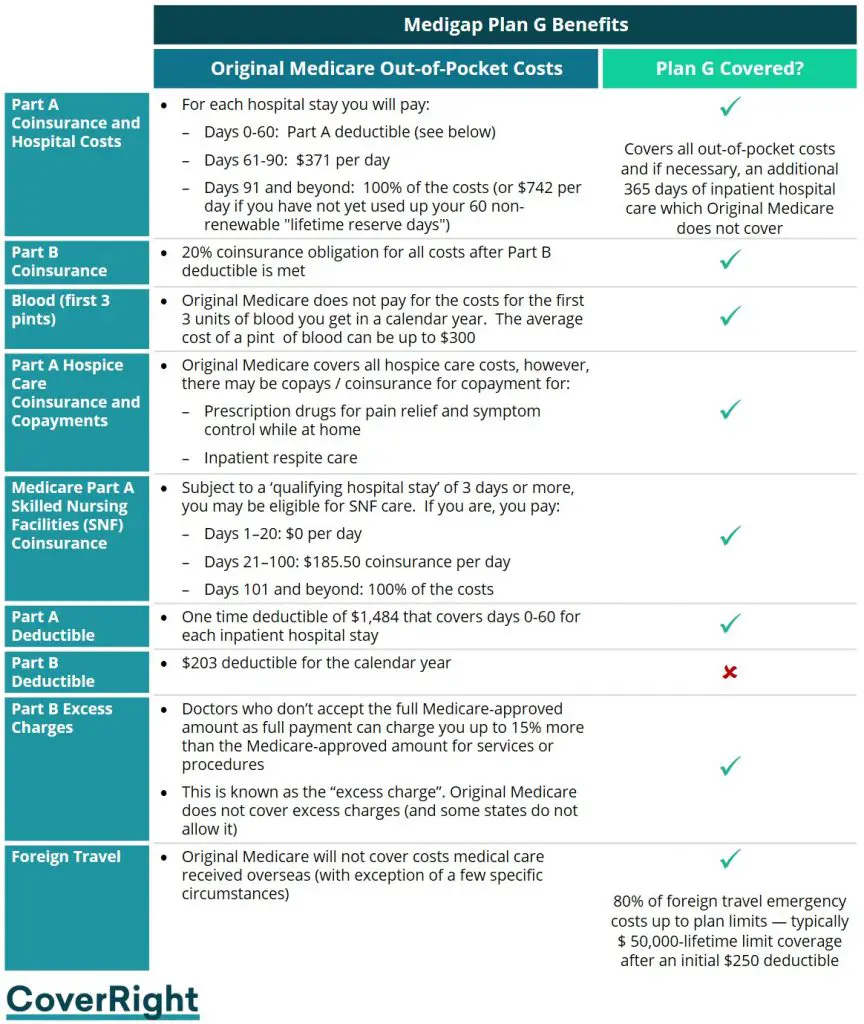

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency

You May Like: Can You Have Kaiser And Medicare

Ultimate Guide To Medicare Supplement Plan G In 2021

If you are already familiar with Medicare Plan F, youll notice that Plan G has many similarities to the former plan. It offers substantial value for beneficiaries who are able and willing to pay a relatively small annual deductible. Medicare Part G provides full coverage for gaps in Medicare. It will pay for coinsurance, copays and hospital deductibles.

If you arent familiar with Plan F, we can share some information about it for you. Keep in mind that Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with end-stage renal disease.

Part A is what covers some home health care, inpatient hospital stays, hospice care, and skilled nursing facility care. Part B is used to cover certain services from doctors, outpatient care, preventive services and medical supplies. Part D adds on prescription drug coverage to several Medicare plans.

Medicare Plan F is a comprehensive supplement plan that covers Medicare copays, coinsurance and deductibles without any out-of-pocket costs. Unlike Plan F, Plan G has a deductible on a calendar year basis that will need to be paid. Its also important to be aware that the amount of the deductible increases each year. As an example, it may be $183 for 2018, $185 for 2019, and increase from that point.

Below, well go into more depth about what Plan G Supplemental Medicare can offer you when it comes to healthcare.

What Does Plan G Cover

Plan F is considered the top-of-the-line Medigap policy. It covers 100% of the gaps in Medicare. Plan Gs coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $233 in 2022. Even with paying the Part B deductible, many Medicare enrollees find Plan G more cost-effective than Plan F when considering their respective premiums.

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you wont pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Like Medigap Plan F, Plan G also covers excess charges. Doctors who dont accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures. This is known as the excess charge.3 Most doctors accept the Medicare-approved payment and cannot bill you the extra amount. Since 2016, excess charges are illegal in these states: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont.

Top Coverage

Plan G offers top coverage for preventive visits, emergency care or chronic conditions.

Recommended Reading: How To Know If I Have Medicare

Where To Find Help Choosing A Medigap Plan

You can utilize the following resources to help you choose a Medigap plan:

- Online search tool.Compare Medigap plans using Medicares search tool.

- Call 800-633-4227 for any questions or concerns related to Medicare or Medigap.

- Contact your state insurance department.State insurance departments can help provide you with information on Medigap plans in your state.

- Contact your State Health Insurance Assistance Program .SHIPs help to provide information and advice to those enrolling or making changes to their coverage.

Why Consider Plan G

Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare. Depending on where you live in the country, it can range from $99 per month to $476 per month for the plan premium, which is $1,188 to $5,712 per year. For the premium, which is higher than for other Medigap policies, youll get more comprehensive coverage.

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance.

If you dont need that level of coverage, though, you might want a plan with less coverage.

You May Like: What Is Medicare Gap Insurance

Medigap Plan G: Everything You Need To Know

Original Medicare covers many different services, including hospital stays and doctorâs visits. But the cost of deductibles, coinsurance, and copays can still be high. Medigap policies, also known as Medicare Supplement, help fill in these coverage gapsâand sometimes offer additional services as well. Medigap Plan G offers a wider range of coverage than all Medigap plans except for Medigap Plan F.

What Is The Difference Between Medicare Plan F And G

The primary difference between Medicare Plan F and G is that Plan F will cover the Medicare Part B deductible, but Plan G does not. Medicare Part A will only begin to pay a share of the healthcare costs after beneficiaries meet a $1,484 deductible for the 2021 benefit period. Medicare.gov explains that all Medigap policies are required to follow federal and state laws for your protection and must be identified as Medicare Supplement Insurance.

Don’t Miss: Does Medicare Take Care Of Dental

What Is The Medicare Part B Premium For 2021

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What Does Medicare Part A Cover:

- Inpatient care in semi-private hospital room

- Skilled nursing facility care following a hospital stay of three or more days

- Inpatient care in a skilled nursing facility not custodial or long-term care

- Part-time home health care, i.e., occupational, physical, speech therapy, illness counseling. It does not include custodial, personal care or homemaker services.

- Blood for transfusions, after the first three pints

Don’t Miss: Does Medicare Advantage Have A Donut Hole

What Does Medicare Part G Cover

Medigap policies supplement original Medicare benefits, and plans must follow standardized Medicare rules.

To have a Medicare Plan G policy, a person must have original Medicare parts A and B. One Medigap plan covers one person only. Additional beneficiaries must have a Medigap policy of their own.

Medigap Plan G covers:

It may be beneficial for a person to think about their current healthcare needs when researching plan options.

Keeping Your Coverage If You Move

If you are moving to another county or state, make sure your Medicare plan will still be in effect after you move.

If you have original Medicare, federal rules usually allow you to keep your Medicare supplement policy. There are exceptions to this if you have a Medicare Select plan or if you have a plan that includes added benefits, such as vision coverage or discounts that were available only where you bought the plan.

If you have a Medicare Advantage plan, ask the plan whether its available in your new ZIP code. If the plan isnt available, youll have to get a new one. You can switch to another Medicare Advantage plan in your new area or to original Medicare.

Don’t Miss: What Is A Medicare Supplement Insurance Plan

What Are Part B Excess Charges

Medicare Part B excess charges happen when theres a difference between what Medicare will pay for medical services and what your doctor decides to charge for that same service.

Medicare sets approved payment amounts for covered medical services. Some doctors accept this rate for full payment, whereas others dont.

If your doctor doesnt accept the rate in the Medicare fee schedule as full payment, they are allowed under federal law to charge up to 15 percent more than the approved rate. The amount above the Medicare-approved rate is the excess charge.

With Medicare, you are responsible for paying any excess charges. Some people choose Medigap Plan G to assure that these fees are covered and avoid any unexpected costs after receiving medical care.

What Doesnt Medicare Part G Cover

Although MedSup Plan G helps you pay most of the healthcare costs Original Medicare, or Medicare Part A and Part B, doesnt cover, it doesnt help you pay all of them.

For example, MedSup Plan G doesnt cover the Medicare Part B deductible. Youll pay for all medical services or supplies until your out-of-pocket costs reach that amount if you enroll in Plan G.

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, youll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy.

Also, Plan G usually doesnt cover prescription drugs. Some MedSup policies used to, but thats no longer the case. For that, you need to enroll in Medicare Part D.

Finally, Medicare Supplement Plan G also wont cover any of these costs:

- Private-duty nursing.

Read Also: What Age Do You Register For Medicare

What Are Other Options

There are nine other plans for beneficiaries to consider, but Plans F, G and N are the most popular.

Plan F has for many years had the highest number of enrollees, covering more than half of policyholders from 2014 to 2017. Plans C, G and N have been popular choices, with G and N gaining popularity for the same time period.8

In 2020, Medigap Plans C and F arent available to those newly eligible for Medicare.9 If youre already a Medicare member, you can still choose Plan F or C.

Plan F and Plan N are often chosen instead of Plan G. Plan F is the most comprehensive Medigap plan since it covers 100% of the gaps in Medicare coverage, so costs more than Plan G or N. This means co-pays for Medicare-covered services and items under Medicare Part A or Part B will be $0 co-pay for those with Plan F. Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Plan N is the least expensive of these three plans but youll have more out-of-pocket costs with it. With Plan N you are responsible to pay these three items that Plan F covers in full:

- Maximum of $20 for doctor visits and $50 for ER visits

- Part B deductible of $233

If youre more focused on preventive care like doctors visits, and dont expect to have more serious medical needs, then Plan N could save you money.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Recommended Reading: Is Estring Covered By Medicare

Where Can I Get Medicare Supplement Plan G

Private insurance firms sell Medigap policies. To get an idea of which plans are available in your area, visit Medicares search tool.

To discover available plans, enter your ZIP code and choose your county. Each Plan will have a monthly premium range and other possible charges.

You can also look at the companies that provide each Plan and how they manage the monthly premiums. Because the cost of Medigap coverage varies depending on the company, its critical to examine different Medigap policies before deciding.

You can visit our website NewMedicare.com to learn more.

Does Plan G Pay For Prescription Drugs

Medicare Supplement plans only pay for covered expenses under Part A and Part B. Original Medicare doesnt typically cover prescription drugs, and you dont get any additional coverage with Medicare Plan G.

Plan G cant be used to cover prescription drug costs under Part D. The good news is that most companies that sell Plan G also sell Part D plans, so you can still get all your Medicare coverage in one place.

You May Like: Does Medicare Cover Counseling For Depression

Should I Change From Plan F To Plan G

If you’re considering switching from your grandfathered Medicare Plan F to Plan G, it can feel like a constant game of tug-of-war. Some Medicare Supplement plans are guaranteed issue, which means you cant be refused for pre-existing conditions. But, its important to note that you might be required to undergo underwriting when switching Medicare Supplement plans. That means a plan carrier can increase your rate based on age and health factors or decide not to sell you the plan at all.

What Does Mutual Of Omaha Part G Cover

If you are looking for supplemental coverage your original Medicare doesnt cover, you have options. In fact, most states offer 10 different standardized Medicare Supplement, or Medigap, insurance plans. Those looking for a broad level of coverage may find that Medicare Part G is an excellent choice for having access to the medical coverage you need for the lifestyle you lead.

Medicare supplement plans are designed to fill in the gaps that Medicare leaves behind. There are several different plans to choose from, each of which is named by a letter. These Medigap plans range from Plan A all the way to Plan N.

Don’t Miss: Does Medicare Cover New Patient Visit