The Cost Of Medicare At 60

If Medicare at 60 becomes reality, there are financial concerns that the country must address. Those who age in are eligible for Part A premium-free if theyve paid in while working for at least 40 quarters . The tax money goes to the Hospital Insurance Trust Fund. This fund pays for Part A, which is why it is premium-free for most.

A major concern is that the HI Trust Fund is at risk of insolvency. Meaning, there might not be sufficient revenue to cover Part A premiums in just a few years. The original prediction for when this would happen was 2026, but the pandemic is an additional strain on the fund and is speeding up the timeline.

The HI Trust Fund would need to be well-funded if Medicare at 60 becomes law. Millions more people would need to start receiving the coverage that theyve already paid into.

How Old Do You Have To Be To Get Medicare Part D

To enroll in Medicare Part D, you must be enrolled in Medicare Part A. Thus, the age requirement for Medicare Part A will inherently become the age requirement for Medicare Part D.

This means, you will need to be at least age 65 or qualify for Medicare Part A based on disability status to enroll in Medicare Part D.

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

Recommended Reading: Does Medicare Part B Cover Durable Medical Equipment

In General It’s 65 But You Might Be Eligible Sooner

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

When you think of Medicare, you probably assume that its for people of retirement age. Thats true, but the program covers more than just those who have worked all their life. You might be eligible right now and not know it. While most beneficiaries are people aged 65 or older, others receive these services at a younger age due to a qualifying disability.

When Will The Medicare Eligibility Age Lower

Now, with Democratic control of the Senate, its more likely that Medicare at 60 will go into effect in the coming years. Additionally, a majority of individuals on both sides of the political aisle support a Medicare buy-in plan for adults over 50.

Yet, there is opposition particularly from hospitals because of lower reimbursement rates. Thus, there could be pushback in the process.

Regardless of the outcome, the eligibility age for Medicare wont change overnight. Lowering the eligibility age is no longer part of the U.S. Governments budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

In the meantime, its crucial for beneficiaries to stay up-to-date with the latest information about potential changes to Medicare, including a reduced eligibility age. We will be updating this content as more information is available.

- Was this article helpful ?

Also Check: What Does Part A Of Medicare Pay For

The Challenges Of Changing Medicares Age Of Eligibility

First, there are the funding issues. If lowering the age to access increased the cost to administer the Medicare program, the chances of proposed changes passing will drop.

The Part A account that funds the hospitalization and related services faces insolvency by 2026. Insolvency means that Medicare wouldnt be able to fully reimburse hospitals, nursing homes, and home health agencies for promised benefits.

If this happens, Medicare patients would be hit hard. Theres no way around this. You cannot cut provider payments for medical services without impacting the beneficiaries of those services.

In response to the funding concerns, the Democrats who are sponsoring this bill say that Medicares funding wouldnt be touched under the proposed legislation since those buying the coverage would be required to pay the entire cost.

That means whatever the cost is to the government, would also be the cost to the individual.

Second, youre going to get lots of pushback from healthcare and health insurance companies. Theyll spend millions to lobby against this, which could impact the outcome of the law changes.

From the hospitals perspective, theyll be losing millions of Americans from their most profitable group of patients: Those who are 50 and up and covered by private healthcare. There is a big difference between the reimbursement rate between a Medicare patient and a patient with private health insurance.

How Do You Get Medicare At Age 65

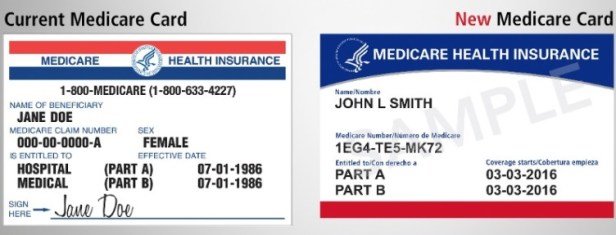

When youre eligible for Medicare at 65, you might be automatically enrolled in traditional Medicare, also called Original Medicare, Part A and Part B. Medicare for your spouse will happen later, when she or he turns 65.

If youre aging into Medicare at age 65, you can still help with Medicare planning for your spouse. Together, you can learn about Medicare. For example, find out when to apply for Medicare.

Read Also: How Do I Sign Up For Medicare In Massachusetts

If I Retire At 62 Is That My Medicare Eligibility Age

Most people don’t qualify for Medicare at age 62. Unless you qualify for Medicare based on a disability, you’ll need health insurance until you qualify for Medicare at age 65.

Retirement brings with it many questions, not the least of which is how youll handle health insurance. Medicare is for people age 65 or older or those with qualifying disabilities. If youre retiring at 62 and dont qualify for Medicare with a disability, youre not yet eligible for Medicare.

Read on to get answers to your questions about Medicare at an early age:

- What are the age requirements concerning becoming Medicare eligible?

- Whats the difference between two types of Social Security retirement benefits?

- Can I qualify for Medicare if I dont meet the traditional Medicare age requirement?

- What are insurance options for people that dont qualify for Medicare at age 62?

How Old Do You Have To Be To Get Medicare Part C Or Medicare Supplement

To get Medicare Part C or Medicare Supplement plans, you must be enrolled in Original Medicare. This means, you must be at least 65 years old or meet the Medicare criteria for enrolling under age 65. If you do not meet these criteria, you can get Medicare at age 65.

Medicare Part C and Medicare Supplement plans both act as a supplemental coverage to Original Medicare. However, you cannot have both plans. You are only able to enroll in Medigap OR Part C. If you enroll in Medicare Part C, the plan becomes your primary coverage over Original Medicare. If you enroll in a Medicare Supplement plan, it will pay secondary to Original Medicare. Because they require you to have Original Medicare, you cannot enroll in a plan without Medicare Part A and Part B.

Recommended Reading: How Long Does It Take To Get Medicare B

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Recommended Reading: When You Are On Medicare Do You Need Supplemental Insurance

What Do The Different Parts Cover

Medicare Part A covers hospital stays and care, while Part B covers physician fees and other costs associated with diagnosing and treating medical conditions. Medicare Part C, called Medicare Advantage, offers options for extra coverage that may include vision, dental, and wellness care. Medicare Advantage plans cover at a minimum what Medicare Part A and Part B cover . Most MA plans also provide prescription drug coverage. You can only apply for a Medicare Advantage plan if you’re already enrolled in both Part A and Part B. Medicare Part D covers prescription medications. If you have a Medicare Advantage plan with prescription drug coverage, you probably don’t need a separate Part D plan.

What Are The Differences Between Medicare And Medicaid

Medicare is a federal health insurance program open to Americans aged 65 and older, and those with specific disabilities who are under the age of 65. Medicaid, a combined state and federal program, is a state-specific health insurance program for low-income individuals with limited financial means, regardless of their age.

Medicare, generally speaking, offers the same benefits to all eligible participants. However, coverage is divided into Medicare Part A, Part B, and Part D. Medicare Part A is for hospice care, skilled nursing facility care, and inpatient hospital care. Medicare Part B is for outpatient care, durable medical equipment, and home health care. Part D is for prescription coverage. Not all persons will elect to have coverage in all three areas. In addition, some persons choose to get their Medicare benefits via Medicare Advantage plans, also called Medicare Part C. These plans are available via private insurance companies and include the same benefits as Medicare Part A and Part B, as well as some additional ones, such as dental, vision, and hearing. Many Medicare Advantage plans also include Medicare Part D.

Medicaid is more comprehensive in its coverage, but the benefits are specific to the age group. Children have different eligibility requirements and receive different benefits from low-income adults and from elderly or disabled persons.

Helpful Resources

Recommended Reading: What Is The Difference Between Medicare Advantage And Regular Medicare

Recommended Reading: How To Get Medicare Part D Deducted From Social Security

Can You Draw Social Security And State Retirement At The Same Time

When you retire, you will receive your public pension, but dont count on getting the full Social Security benefit. Under federal law, any Social Security benefits you earned will be reduced if you were a federal, state, or local government employee who earned a pension with wages not covered by Social Security.

What is the maximum amount of Social Security retirement you can draw?

What is the maximum of social security? The maximum that an individual filing for Social Security retirement benefits in 2021 can receive per month is: $ 3,895 for someone filing at age 70. $ 3,148 for someone presenting at full retirement age .

Will my retirement check affect my Social Security benefits?

We will reduce your Social Security benefits by two thirds of your government pension. In other words, if you get a monthly civil service pension of $ 600, two-thirds of that, or $ 400, must be deducted from your Social Security benefits.

Recommended Reading: How Do I Change Medicare Supplement Plans

Exceptions To Medicare Age Requirements

While you are typically not eligible for Medicare unless you are 65 and a U.S. citizen, there are some other ways that you can qualify.

If you have been receiving Social Security disability insurance for two years or more, you can be eligible for Medicare early.

You can also enroll if you have ALS or end-stage renal disease. In these circumstances, you are exempt from the requirement to have been on disability insurance for two years.

If you meet none of these requirements, you will have to wait until your standard eligibility period. According to AARP, your initial enrollment period will begin three months before the month of your 65th birthday.

Original Medicare is split into two parts, Part A and Part B. Unless you meet the above requirements, neither part is available to you early.

There is a third part, Part C, which is also known as Medicare Advantage. Private insurers provide Part C plans which offer expanded benefits and coverage like vision and dental.

Prepare for Medicare Open Enrollment

Don’t Miss: How Does Medicare Work With Other Insurance

How Much Does Ikea Pay Part

The hourly earnings for employees at IKEA vary greatly because of state and city minimum wage laws. However, we can give you a general idea of what the hourly pay is for each position.

Retail Sales Associate

Retail Sales Associates at IKEA usually earn between $14 and $20 per hour. The average hourly rate for this position is $16.

Retail Cashier and Customer Service

Retail Cashier and Customer Service associates at IKEA usually earn between $14 and $20 per hour. The average hourly rate for this position is $16.

Food Services Team Member

Food Service Team Members at IKEA can earn anywhere between $14 and $22 per hour. The average hourly rate for this position is $16.

Warehouse Worker

Entry-level Warehouse Workers at IKEA usually start at around $15 per hour. The average wage is $17 per hour.

Furniture Builder

IKEA Furniture Builders usually start at around $15 per hour. The average wage for this position is $17 per hour.

Proposed Changes To Allow People To Qualify For Medicare At 62

The most prominent proposal is the Medicare at 50 Act sponsored by Senator Sherrod Brown. Asking for the age to be lowered by 15 years may be too much of a stretch other proposals call for a more moderate age 60 or 62 as the age of eligibility.

The basic premise of all of these plans is simple: Instead of being able to access Medicare at 65, individuals would have the option of buying into Medicare at an earlier age.

Also Check: What Is The Best And Cheapest Medicare Supplement Insurance

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Medicare Eligibility Due To Specific Illnesses

In addition to the above ways to qualify for Medicare health insurance, you may also be eligible if you have one of the following diseases:

- End-stage renal disease. To qualify, you must need regular dialysis or a kidney transplant, and your coverage can begin shortly after your first dialysis treatment. If you receive a transplant and no longer require dialysis, youll lose Medicare eligibility.

- Amyotrophic lateral sclerosis. Also known as Lou Gehrigs Disease, patients diagnosed with this terminal disease gain immediate Medicare eligibility.

Read Also: What Is The Coinsurance For Medicare Part B

How Old Do You Have To Be To Get Original Medicare

The typical age to enroll in Original Medicare is 65 years or older. However, in certain cases, you may be eligible to enroll in Medicare at a younger age.

To be eligible for Medicare at age 65, you must be an American citizen for at least five years.

Are you wondering if you can get Medicare before age 65? You may be eligible for Medicare before age 65 if you receive Social Security Disability benefits or if you have specific diagnoses. To receive Original Medicare before age 65 you must meet one of the following qualifications:

- Receiving Social Security Disability Income for 24+ months

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Read Also: Can I Submit A Claim Directly To Medicare