Medicare Supplement Insurance Plan G

Summary:

Medicare Supplement Insurance Plan G offers more basic benefits than most Medicare Supplement insurance plans. Plan G may pay some of your Original Medicare costs â keep reading to learn more.

Is it Medicare Part G or Medicare Plan G?

Itâs neither one of those! Thereâs no Medicare Part G . And thereâs no Medicare Plan G. But thereâs Medicare Supplement Insurance Plan G, and weâll tell you all about it.

What is Medicare Supplement?

Medicare Supplement insurance is optional coverage you may be able to buy to work alongside your Original Medicare coverage. Original Medicare includes Part A and Part B .

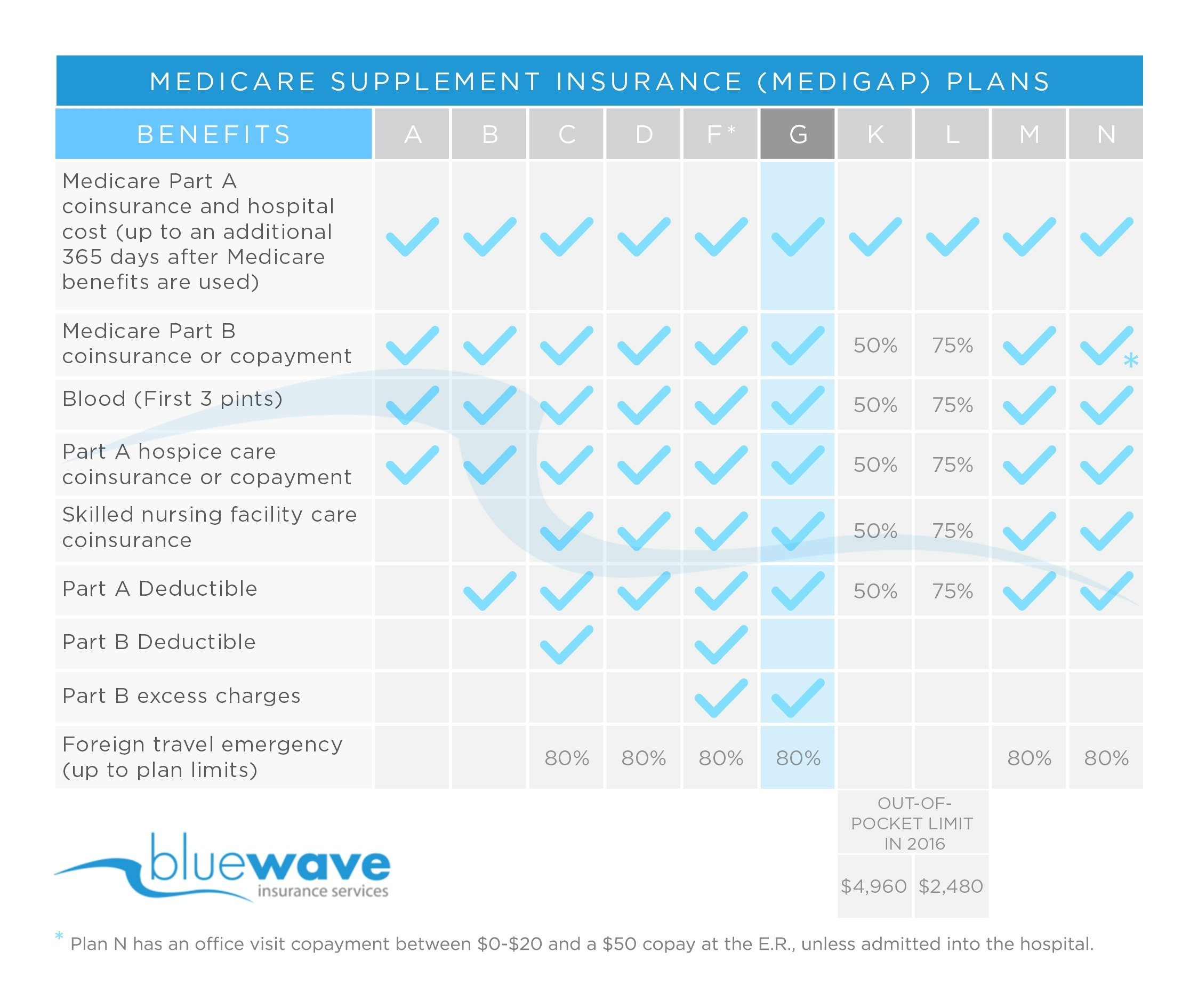

Medicare Supplement insurance plans are standardized in most states. They are named with letters, like Plan G. Every plan of the same name has the same basic benefits.

For example, although many different insurance companies sell Medicare Supplement Insurance Plan G in many states, every Plan G has the same set of basic benefits. Thatâs true of the other plans, like Medicare Supplement Insurance Plan A, Plan B, and so on.

Where Can I Buy Medicare Supplement Plan G

You can buy MedSup Plan G and every other MedSup plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

Remember, all Plan G policies must provide the same benefits or coverages. Just like all Plan F policies must provide the same benefits or coverages.

Insurers can and do charge different amounts for the MedSup Plan G policies they sell, though. Dont enroll in the first one you come across while shopping around. Compare the various costs associated with the plans sold in your area before you make your final decision.

Best For Easy Application: Mutual Of Omaha

Mutual_of_Omaha

Mutual of Omahas application process couldnt be simpler. The front page details each different Medicare Supplemental Plan it has available, and it never navigates away from that page during the comparison process.

-

Easy, clean website with reviews available on the same page

-

Simple comparison process that only requires gender, date of birth, and ZIP code

-

Household discount available

-

Multi-step process to pay online

-

Limited extra benefits other than the household discount

Mutual of Omaha prides itself on simplicity. It offers an easy-to-read chart for services covered under Medicare Supplement Plan G. It also allows you to create an account or apply as a guest, allowing faster comparisons. Applying with either type of account requires information from your Medicare card, your social security number, and your medications to allow for an accurate estimate. You also can save your application and return to it later, but you will have to create an account to do so.

Recommended Reading: Does Medicare Accept Pre Existing Conditions

Why Should I Choose Medicare Supplement Plan G Over Plan F

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees.

Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers cant sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

Dont worry, if youre already enrolled in Plan F, youll be able to keep it. If you dont have MedSup coverage and you want to buy Plan F now, though, you won’t be able to do so. The same is true if youre enrolled in a different MedSup plan and you want to switch to Plan F.

Long story short: if you want MedSup Plan F but can no longer enroll in it, Plan G may be the best Medicare Supplement policy for you.

How Does Medicare Plan G Work

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Plan G is a supplemental policy, meaning it’s not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits pay for health services you may need.

Once Medicare pays its share, Plan G pays for most remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,556 in 2022. If you don’t have Plan G, you pay that deductible out of pocket. But with Plan G coverage, your health insurer pays the entire deductible.

Read Also: Will Medicare Pay For A Power Lift Chair

Determine If You Are Eligible To Enroll In Medicare

Medicare enrollment eligibility begins three months before you turn 65 and extends for the three months after unless you’re eligible earlier due to disability. If you’re already in a Medicare Advantage Plan, you can switch plans during the Open Enrollment Period.

Otherwise, you can enroll during Open Enrollment, which runs from each year. After that, there’s no ability to enroll, only the option to adjust coverage you already are enrolled in. Changes in coverage begin in January. Every provider we look at has an eligibility check when providing you estimates, which will tell you if you’re eligible to enroll or not.

Does Medicare Pay For Inpatient Hospital

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay …

You May Like: What Is Medicare Supplement Part F

Is Plan G The Best Medicare Supplement Plan

It really depends on what you want. Suppose youre looking for a comprehensive basic Medicare Supplement plan. In that case, for coverage that fills in gaps not provided by Original Medicare, Plan G is a good option, especially if you recently became eligible for Medicare and cant sign up for Plan F.

However, if you want more bundled coverage, dental or vision coverage, or dont think youll need the benefits Plan G offers , another Medicare Plan might be better for you.

Does Medicare Part G Plan Cover Chiropractic Services

Medicare covers limited chiropractic services. Specifically, it covers spinal manipulation to correct a subluxation, an alignment issue of the spine that causes pain and/or functional impairments. Part B covers 80% of those costs and Part G will cover the remaining 20%. Other chiropractic services like X-rays or massage are not covered.

Don’t Miss: Do You Have To Pay A Premium For Medicare

How Much Does Medicare Part B Cost

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan which pays both the $20 coinsurance and the $15 excess charge in this example.

What Is Medicare Supplement Plan G

Find Cheap Medicare Plans in Your Area

Plan G is one of 10 Medicare supplement policies that fill the coverage gaps in Original Medicare. For this reason, many seniors purchase Plan G to reduce their out-of-pocket medical costs while enrolled in Medicare. Although Plan G is one of the most comprehensive policies available, the plan does not cover the Medicare Part B deductible.

You May Like: Does Medicare B Cover Prescriptions

Why Is Medicare Supplement G More Expensive Than Plan N

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars …

What Are The Differences Between Medicare Supplement Plan G And Plan F

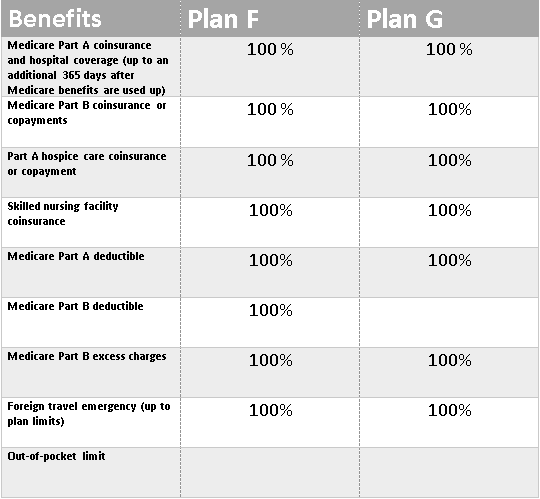

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesnt cover that cost.

Of course, the Part B deductible is just $198 this year, but a buck is a buck, right?

However, MedSup Plan G premiums tend to be cheaper than Plan F premiums. This means youll pay less per month to maintain Plan G coverage than you will to maintain Plan F coverage.

There’s only one way to figure out which plan will best fit your budget and your medical needs. Whip out your calculator and add up what youll pay for each one in the long run.

Dont be surprised, though, if you find MedSup Plan G to be the better deal.

You May Like: Does Quest Labs Accept Medicare

How Much Does Medicare Plan F Cost

This figure depends on a multitude of factors. Plan F premiums hinge heavily on where you reside, but gender, age and tobacco use all come into play as well as insurance providers determine their rates. Sometimes discounts are available for non-smokers, women or married people who have multiple policies. Meanwhile, companies that use medical underwriting might set higher premium rates depending on your health status.

People who are eligible for Plan F enrollment can expect to pay a monthly premium between $150 and $400 , with the average hovering around $230. Again, that number could vary significantly depending on the provider you pick and the personal factors mentioned above.

If you choose a high-deductible Plan F option, the annual deductible is $2,490.

Medicare Medical Serviceswhat Plan G Pays

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physicians services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an excess charge. Medicare puts a 15% limit on the extra amount a doctor can charge.

Also Check: Where Do You Apply For Medicare

Medicare Supplement Plan G: Benefits Costs And Coverage

- Medicare Supplement Plan G covers more benefits than most other Medigap plans, including the Medicare Part A deductible and coinsurance. Learn more about how Plan G compares to other Medicare Supplement Insurance plans.

Medicare Supplement Plan G may soon become the most popular Medicare Supplement Insurance plan for new Medicare beneficiaries. Plan G offers more Medigap benefits than any other type of Medicare Supplement plan other than Plan F.

While Medicare Plan F is currently the most popular Medigap plan, it is no longer available for beneficiaries who become eligible for Medicare after January 1, 2020. Beneficiaries who had Plan F before 2020 or who became eligible for Medicare before 2020 may still be able to sign up for Plan F or keep their plan.

This means that Plan G offers the most benefits out of any type of Medicare Supplement plan new Medicare beneficiaries can buy. In this guide, we detail the benefits and costs that Medicare Supplement Plan G can cover.

Medicare Hospital Serviceswhat Plan G Pays

Semi-private room and board, general nursing, and miscellaneous services and supplies.

Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital.

Pain relief, symptom management, and support services for the terminally ill. You must meet Medicares requirements, including a doctors certification of terminal illness.

Don’t Miss: Is Jakafi Covered By Medicare

Why Choose This Plan

Plan G is a standalone supplemental Medicare plan. It does not have copayments for physician services like most other Medigap plans. Instead, the plan covers the cost of prescription drugs up to the deductible amount, so you pay the total cost of your prescriptions until you hit that amount. Want to speak to a licensed advisor? click here.

Who Can Sign Up For High

The new high-deductible Plan G will be available to both current and newly-eligible Medicare beneficiaries beginning in 2020. If you become eligible for Medicare before January 1, 2020, or after, you will be eligible to apply for for high-deductible Plan G.

In order to apply for high-deductible Medicare Supplement Plan G, you must be enrolled in both Medicare Part A and Part B and live in an area that is serviced by a high-deductible Plan G option.

Don’t Miss: Do You Have To Take Medicare Part B

Why Is Medicare Plan F Being Discontinued

Medigap Plan F is being phased out as part of the Medicare Access and CHIP Reauthorization Act of 2015 , which prohibits the sale of Medicare Supplement plans that cover Medicare Part Bs annual deductible in full. By discontinuing these plans, all Medicare beneficiaries can expect some degree of out-of-pocket spending when using health care services.

Who Can Sign Up For Plan G

If you qualify for Original Medicare, you may be able to enroll in Plan G. American citizens and legal residents of at least five years can qualify for Medicare. Having worked 10 or more years is a requirement for getting Part A without a premium. If you have not worked 10 years in the US, you may still be eligible for Medicare but you have to pay the Part A premium. And in most cases, you should either be turning 65 or have a disability that qualifies for Social Security disability benefits.

The only exception to getting Medicare without the 2-year wait is amyotrophic lateral sclerosis . Cancer and other diseases e.g. some cases of breast cancer, early-onset Alzheimers disease, may be considered a disability if it meets the SSDI criteria and the 24-month waiting period applies.5

Don’t Miss: How To Report Suspected Medicare Fraud

What Are The Eligibility Requirements For Aarp Medicare Supplement Plan G

You must be enrolled in Medicare Part A and Part B before you can apply for Medicare Supplement Insurance Plan G. And you must be at least 65 years old to purchase Medigap in some but not all states. Lastly, you must live in the area that is serviced by the plan. While Medigap can be used anywhere that Original Medicare is accepted, it can only be purchased in the county or zip code in which you reside.

To apply for AARP Medicare Supplement Plan G or any other Medigap plan from AARP, you must be an AARP member. Memberships are $16 per year in 2021 and include a number of savings and discounts on travel, dining, shopping and more.

Medicare Part B Coinsurance And Copayment

Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care. Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

After you meet your deductible, Plan G pays the 20% coinsurance or copayment costs.

Read Also: Is Suboxone Covered By Medicare

How Medigap Plan G Works

Plan G helps fill in gaps in Original Medicare and is issued by Medicare-approved private insurance companies. Plan G will pay for costs that remain after Original Medicare pays its portion for services received. For instance, if you are hospitalized, you are charged a Part A deductible per benefit period. Plan G will cover that expense, plus hospital costs up to an additional 365 days after your Medicare benefits are used up.

Plan G pays for copays and coinsurance charges for Part B benefits. For instance, if you see your physician, Medicare pays for 80% of approved charges, and Plan G covers the rest. Plan G also pays for 80% of foreign travel emergency costs, which is not covered by Medicare.

If you have a high-deductible Plan G, you must pay for Medicare-covered costs up to the deductible amount of $2,490 in 2022 before your policy pays anything.

As long as you continue to pay your monthly premiums, your Plan G will remain in effect.

What Is The Plan G Deductible In 2021

There are two version of Medigap Plan G: a standard version and a high-deductible version.

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 that must be met before the plan coverage kicks in.

The tradeoff for the high-deductible version of Plan G is that it typically comes at a lower monthly premium than the standard version of the plan.

Also Check: How To Check Medicare Status Online

Where To Find Help Choosing A Medigap Plan

You can utilize the following resources to help you choose a Medigap plan:

- Online search tool.Compare Medigap plans using Medicares search tool.

- Call 800-633-4227 for any questions or concerns related to Medicare or Medigap.

- Contact your state insurance department.State insurance departments can help provide you with information on Medigap plans in your state.

- Contact your State Health Insurance Assistance Program .SHIPs help to provide information and advice to those enrolling or making changes to their coverage.

What Does Medicare Part B Cover

Part B services covered at 80% include outpatient care in an emergency room or hospital, and diagnostic tests such as X-rays. For many preventive services, the coinsurance and the deductible do not apply such as standard flu shots, mammograms, bone density tests, glaucoma tests, and many cancer screenings. Some preventive services have criteria you need to meet before getting the preventive service without the coinsurance and/or deductible. If you dont meet the criteria, the service will be covered under Part B but with the coinsurance and deductible.

Part B also covers doctors visits, ambulances, mental healthcare, outpatient surgeries, home health care, durable medical equipment such as blood sugar monitors and test strips, lancet devices, walkers, and wheelchairs. Home health care is also covered under Medicare Part A if certain conditions are met.

Don’t Miss: What Is The Best Medicare Supplement Insurance Plan