Medicare Part A Premium

Medicare Part A is hospital insurance, and it helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Most people do not pay a premium for Medicare Part A in 2022.

You must have worked and payed Medicare taxes for 40 quarters to qualify for premium-free Part A.

If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 permonth. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

How it changed from 2021The 2021 Part A premiums increased by $15 and $28, respectively, in 2022.

Average Medicare Part C Costs

There are some different costs associated with Medicare Part C plans. Your costs may look different depending on your coverage, plan type, and whether you receive any additional financial assistance.

Below is a small sample of Medicare Part C plan costs from major insurance providers in cities around the United States:

| Plan name |

|---|

Medicare Advantage Plans Include Out

A Medicare Advantage plan out-of-pocket spending limit represents an annual cap on your out-of-pocket spending for covered Part A and Part B health care costs.

Once you have reached this amount, your Part C plan will pay for 100 percent of the cost of all covered services and items for the remainder of the year.

The out-of-pocket limit can help protect you from Medicare out-of-pocket costs that can add up quickly as a result from a serious injury or illness that requires lengthy inpatient hospital stays.

Original Medicare does not feature an out-of-pocket limit, which can be one factor many beneficiaries may consider in joining a Medicare Advantage plan.

Also Check: How Do I Get Part A Medicare

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Medicare’s Annual Open Enrollment Period Offers A Chance To Reevaluate And Change Advantage Coverage

- Medicare Advantage plans must have medical loss ratios of at least 85%

- If you live in the designated service area of the specific Medicare Advantage plan, and have Part A and Part B , you may join the plan.

- You can switch back to Original Medicare during the annual open enrollment period or the Medicare Advantage open enrollment period.

Read Also: How To Get Medicare Advantage Plan

How Much Do Medicare Advantage Plans Cost

Even though Advantage enrollees have rights and protections under Medicare guidelines, the services offered and the fees charged by private insurers vary widely. A thorough understanding of how these plans work is key to the successful management of your personal health.

Advantage plans can charge monthly premiums in addition to the Part B premium, although 59% of 2022 Medicare Advantage plans with integrated Part D coverage are zero premium plans. This means that beneficiaries only pay the Part B premium .

But across all Medicare Advantage plans, the average premium is about $19/month for 2022. This average includes zero-premium plans and Medicare Advantage plans that dont include Part D coverage if we only look at plans that do have premiums and that do include Part D coverage, the average premium is higher.

Some Advantage plans have deductibles, others do not. But all Medicare Advantage plans must currently limit in-network maximum out-of-pocket to no more than $7,550. The out-of-pocket maximum had previously been $6,700 each year from 2011 through 2020, but it increased as of 2021, under new methodology that was finalized in 2018. CMS will continue to gradually change it over time, although its still $7,550 for 2022.

Copayments for doctors visits differ dramatically, as do the actual health care services and how often enrollees receive those services. Close attention to the details is necessary when assessing these plans.

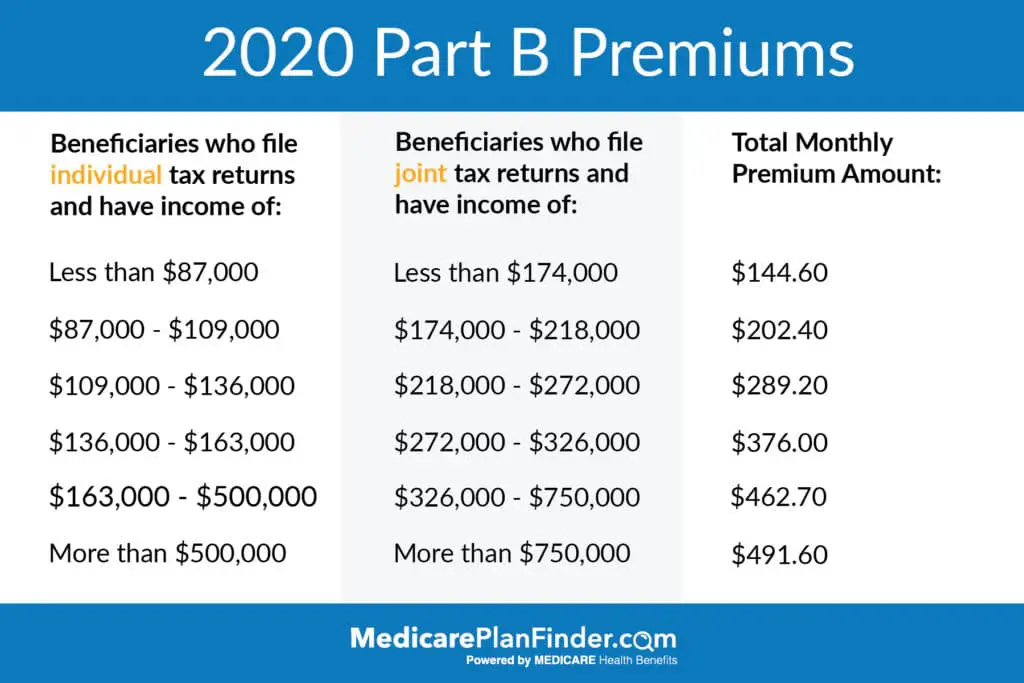

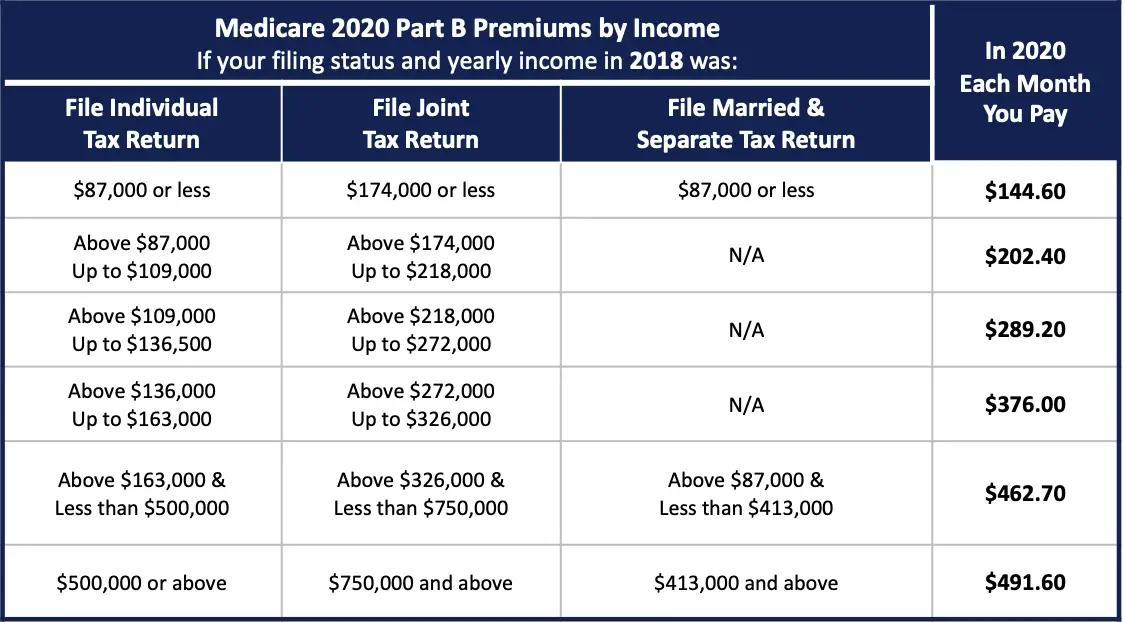

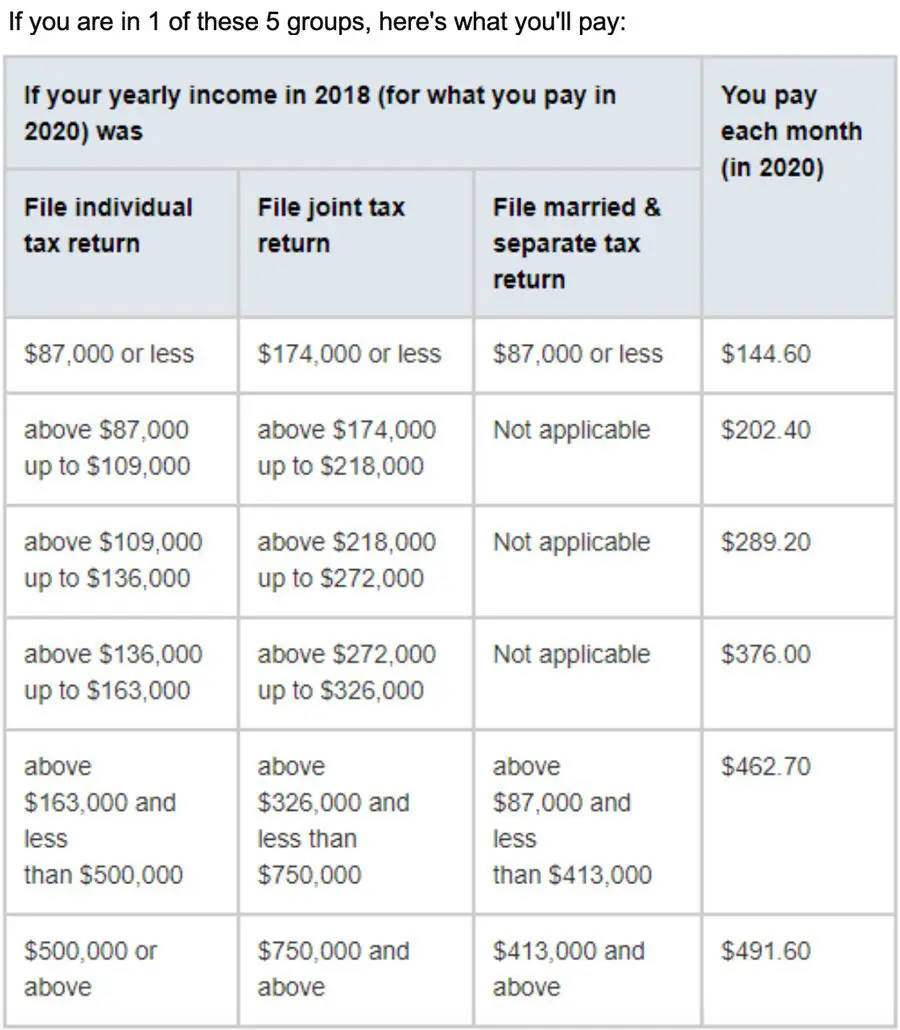

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2021 Medicare Part D enrollee would have pay for a premium.1

| 2019 Reported Income | 2021 Medicare Part D premium cost |

| $88,000 or less | |

| Plan premium + $77.10 |

You May Like: Is Ed Medication Covered By Medicare

What Does Medicare Part C Cover

A Medicare Part C plan will cover the same medical services as Original Medicare. That means plans will cover doctors, hospital care and many other types of health services. Coverage includes:

- Inpatient care

- Long-term care

- Lab tests, X-rays and diagnostics

Keep in mind that even though Part C coverage may be similar to Original Medicare, there are key differences that will affect your access to care and how much you pay for medical services.

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays.

Read Also: Does Medicare Cover Breast Prosthesis

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Recommended Reading: Does Medicare Cover Nursing Care At Home

Medicare Late Enrollment Penalties

Medicare Part A, Part B and Part D include late enrollment penalties that can be applied in certain situations.

- For Part A, the late enrollment penalty is applied to anyone who did not and must buy Medicare Part A coverage. The Part A late enrollment penalty is 10 percent of any owed premium, which must be paid for twice the number of years for which you were eligible but did not enroll.

- Part B beneficiaries may also have to pay a late enrollment penalty for every year they were eligible for Part B but did not sign up for it. The penalty is also 10 percent and is owed every year for as long as you continue to be enrolled in Medicare Part B.

- For Part D, the late enrollment penalty is dependent on how long you went without a Part D plan or other creditable prescription drug coverage .To calculate the Part D late enrollment penalty, Medicare multiples 1 percent of the national base beneficiary premium by the number of months you went without coverage. And because the national base beneficiary premium can increase each year, so too can the penalty.

Understanding Medicare Part C

With Original Medicare, you have Part A and Part B. Original Medicare is a federal insurance program, and most people dont pay a premium for Part A insurance if they paid Medicare taxes while working. However, you do have to pay a premium for Part B coverage. For 2021, the Centers for Medicare and Medicaid Services announced that the standard monthly premium for Medicare Part B enrollees is $148.50.

Medicare Part C works differently than Original Medicare. Medicare Advantage plans are offered by private companies approved by Medicare. They bundle your Part A and Part B coverage together, and usually include prescription drug coverage , as well.

Medicare Advantage plans cover all the services that Original Medicare covers. However, you may be able to get coverage with Medicare Part C that Original Medicare doesnt cover, such as vision, hearing, and dental care.

Medicare Advantage plans are a good option for people who want an alternative to Original Medicare. They tend to be convenient, all-in-one plans that offer more covered services.

When you enroll in a Medicare Advantage plan, you can choose a network type. You have the following managed-care health insurance options:

Read Also: Will Medicare Pay For A Dermatologist

Medicare Part C Premiums

As well as paying the Part B deductible, a person with Medicare Part C will pay a monthly premium. Some premiums are $0. The monthly premium varies based on the type of plan and the coverage offered.

For 2020, the average monthly premium cost for all Medicare Advantage plan types was $25, according to the Kaiser Family Foundation .

Different Medicare Advantage plan types are available. They vary by deductible, coinsurance, and out-of-pocket limits.

A person should look over their last year of healthcare costs to work out the cost effectiveness of a Medicare Part C plan. They should also consider how much they could afford to pay if they were to suddenly need significant medical care.

For targeted cost estimates based on a persons local services, they can visit the Medicare Part C search engine on Medicare.gov.

Factors That Affect Cost

There are a few different factors that can affect the cost of a Medicare Part C plan.

- CarrierMedicare Part C is sold by private insurance companies who are free to set their own prices according to market competition.

- LocationIts not uncommon for a Medicare Part C plan to cost more in a big city than in a rural area, just as the overall cost of living will often be different between the two locations.

- Coverage levelPlans that include stronger coverage and more benefits will typically come at a higher price than more basic plans.

- Cost-sharingPlans with higher deductibles and coinsurance or copayments may have a lower monthly premium as a tradeoff while plans with higher monthly premiums may come with lower deductibles and cost-sharing requirements.

- Plan typeMedicare Part C plans come in several different forms such as HMO or PPO. HMO plans generally have lower premiums due to having more restrictions about where the plan can be used.

Don’t Miss: Will Medicare Pay For A Patient Lift

Saving Money On Medicare

Despite some of the costs of Medicare, there are ways to save money and maximize your coverage.

46890-HM-0121

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Recommended Reading: Is Blood Pressure Monitor Covered By Medicare

How Medicare Part C Coverage Is Changing

Medicare vs. Medicare Part C

Medicare is a federal program that provides health insurance for persons age 65 or older or disabled persons under the prerequisite age. About 2/3, or 66%, of Americans 65 years old and older depend on Medicare. Original Medicare includes:

- Medicare Part A covers inpatient hospital stays, plus skilled nursing facility care, hospice care for patients with terminal illnesses and some home health care.

- Medicare Part B covers medical costs, including doctor visits, outpatient care, diagnostic services, medical equipment and non-emergency medical care.

- An optional Medicare Part D covers prescription drugs, but it must be purchased separately.

Medicare Part C, also called Medicare Advantage, is offered through private insurance companies approved by Medicare. Medicare C is a comprehensive alternative to Original Medicare that covers both Part A and Part B with the optional Part D usually available. Plus, it may cover extra benefits you wont get with traditional Medicare, such as dental, vision, hearing, health club and gym memberships, and a wealth of non-medical benefits that allow seniors to sustain their independence longer.

Changes in 2019

Starting in 2019, the Centers for Medicare & Medicaid Services approved new supplemental health care benefits available through Medicare Part C plans that have never been offered before. Some plans may cover:

- Transportation For Non-Emergency Medical Care

- Home Modifications

- Adult Day Care

- Nonmedical Home Care

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industry in general, including provisions for preventive care. In 2020, the ACA closed the Medicare donut hole however, that doesnt mean prescription drug coverage is free. Beneficiaries are still responsible for various costs.

But one of the major changes specific to Medicare Part C plans is that insurers are not allowed to charge plan members more than what Original Medicare would charge for certain services, such as chemotherapy. This could affect costs, depending on your plan. Only five factors can determine your monthly premium rates: age, location, tobacco use, individual vs. family enrollment, and plan category.

Read Also: Does Medicare Cover Mental Health Visits

What Does Medigap Plan C Cover

Plan C is very popular because of how comprehensive it is. Many Medicare cost-sharing fees are covered under the plan. In addition to coverage for the Part B deductible, Plan C covers:

- Medicare Part A coinsurance costs

- Medicare Part B coinsurance costs

- hospital coinsurance for up to 365 days

- the first 3 pints of blood needed for a procedure

- skilled nursing facility coinsurance

- hospice coinsurance

- emergency coverage in a foreign country

As you can see, nearly all costs that fall to Medicare beneficiaries are covered with Plan C. The only cost that isnt covered by Plan C is whats known as the Part B excess charges. Excess charges are an amount above the Medicare-approved cost billed by a healthcare provider for a service. Excess charges arent allowed in some states, making Plan C a great option.

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

Recommended Reading: Can I Use Medicare For Dental