Understanding The Additional Benefits Of A Medicare Advantage Plan

Its common for Medicare Advantage plans to include additional benefits such as dental, hearing, and vision coverage. At times, MA plans may provide benefits such as reduced gym memberships and transportation assistance as well. To learn more about the additional benefits included in your insurance plan, contact your insurance provider.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

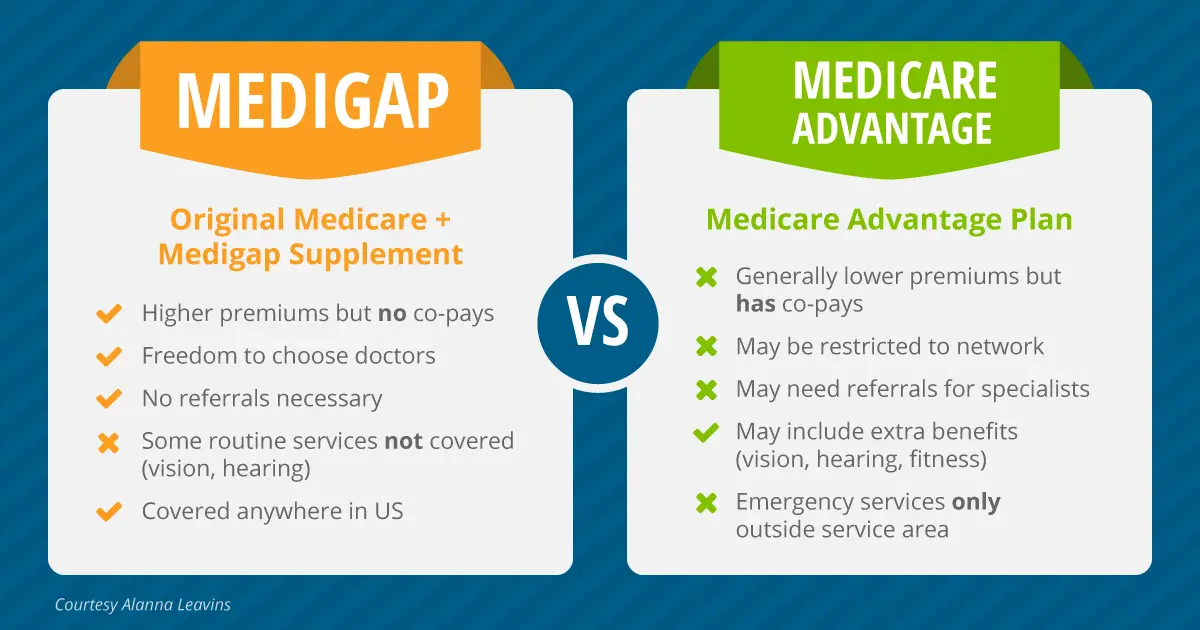

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur. If you decide that the Medicare Advantage Plan isn’t for you, you have the right under federal law to purchase any Medigap plan if you switch to Original Medicare within 12 months of the date that you joined a Medicare Advantage Plan for the first time.

You may also switch from your Medicare Advantage Plan to Original Medicare during the annual Open Enrollment Period or if you qualify for a Special Enrollment Period. However, you may not be able to purchase a Medigap policy . If you are able to do so, it may cost more than it would have when you first enrolled in Medicare.

Keep in mind that an employer only needs to provide Medigap insurance if you meet specific requirements regarding underwriting . The wait time for Medigap coverage can be avoided if you have what is called a “guaranteed issue right.”

A thorough breakdown of what is considered a “guaranteed issue right,” where an insurance company can’t refuse to sell you a Medigap policy, can be found on the Medicare website.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

You May Like: What Medicare Supplement Covers Hearing Aids

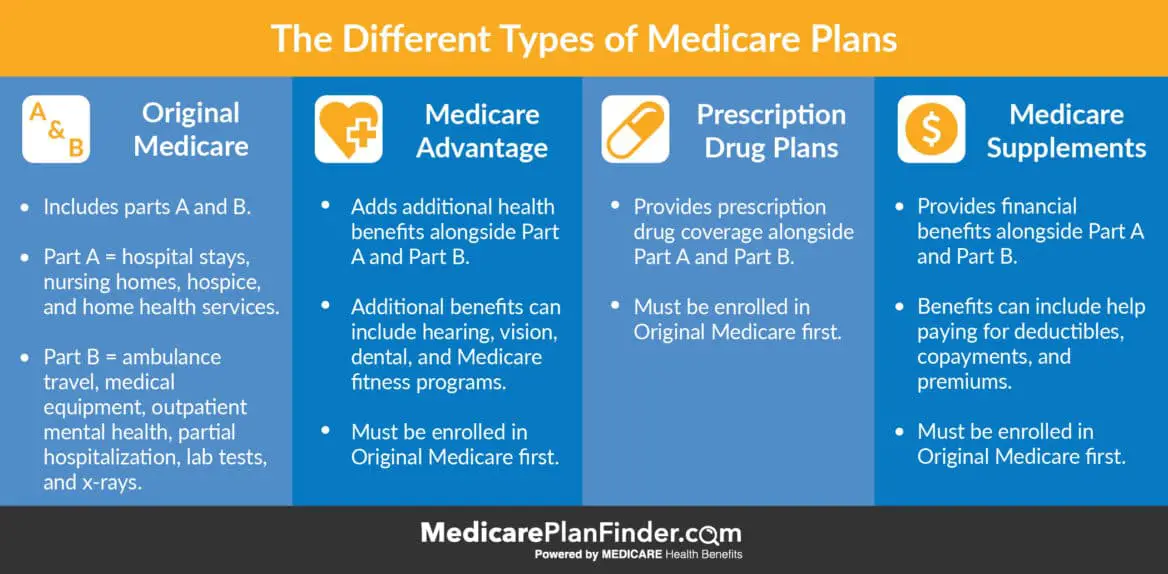

There Are Four Parts To Medicare

- Part Aâ Medicare Part A covers hospital care. You are protected during short-term stays in hospitals and for services like Hospice. You also get limited coverage for some in-home healthcare services and skilled nursing facility care.

- Medicare Part Bâ Medicare Part B covers doctorâs appointments, urgent care visits, preventative care, and medical equipment.

- Part Câ Medicare Part C is also known as Medicare Advantage. These plans combine the coverage of Parts A, B, and Part D into a single plan. Private insurance companies offer Medicare Advantage plans that are overseen by Medicare.

- PDP or Medicare Part Dâ Medicare offers drug coverage through Part D, AKA PDP . These are stand-alone plans that only cover your medications. Private insurance companies offer Part D plans, not the Federal Government.

Read Also: How To Get A Lift Chair From Medicare

The Difference Between Medicare Medigap And Medicare Advantage

Taking care of an aging family member is a job that can take a toll on your finances. This is why some 63 million Americans rely on Medicare to afford senior healthcare.

However, there is a lot of confusion associated with signing up for Medicare. What part of Medicare covers outpatient medical care? Should you use Medigap to supplement your Medicare plan, or should you just choose Medicare Advantage instead?

Understanding the answers to these questions and the advantages and disadvantages of each of these options can help you figure out how to handle the expenses that come with caregiving.

Recommended Reading: How To Find Out Your Medicare Number

Cons Of Original Medicare

When you enroll in Original Medicare, you are responsible for the Medicare Part B premium, Medicare Part A and Part B deductibles, and Medicare Part A and Part B coinsurances. With these costs, there is no out-of-pocket maximum for Original Medicare.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Alongside the out-of-pocket costs, another con is that Original Medicare does not provide additional benefits. These include dental, vision, hearing, and drug coverage. If you require this coverage, you will have to seek additional policies.

Who Runs Medicare And Medicaid

The federal government runs the Medicare program. Each state runs its own Medicaid program. Thats why Medicare is basically the same all over the country, but Medicaid programs differ from state to state.

The Centers for Medicare and Medicaid Services, part of the federal government, runs the Medicare program. It also oversees each states Medicaid program to make sure it meets minimum federal standards.

Although each state designs and runs its own Medicaid program, all Medicaid programs must meet standards set by the federal government in order to get federal funds .

In order to make significant adjustments to their Medicaid programs, states must seek permission from the federal government via a waiver process.

Read Also: Which One Is Better Medicare Or Medicaid

Original Medicare: A Quick Overview

The government health insurance program created in 1965 is called Original Medicare. Its made up of:

- Part A, which is hospital insurance and generally covers care at skilled nursing facilities and sometimes nursing homes

- Part B, which is medical insurance and generally covers preventive care, doctor visits, lab tests, durable medical equipment, and more.

Part A and Part B come with deductible amounts, coinsurance, and/or copayments for most services.

If youre automatically enrolled in Medicare, as many people are, youre usually enrolled in Part A and Part B. If youre already getting Social Security benefits when you turn 65 or qualify by disability, youre usually enrolled automatically.

Medicare Supplement Insurance Plan Benefits

There are 10 Medigap insurance plans available in most states, and each plan type is designed by a different letter . Coverage is standardized across each plan letter, which means youâll get the same basic benefits for Medicare Supplement coverage within the same letter category, no matter which insurance company you purchase from. However, even if basic benefits are the same across plans of the same letter category, premium costs may vary by insurance company and location. If you live in Massachusetts, Minnesota, or Wisconsin, keep in mind that these three states standardize their Medigap plans differently from the rest of the country.

Medigap plans cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some plans may help pay for other benefits Original Medicare doesnât cover, such as emergency health coverage outside of the country or the first three pints of blood. Medigap plans donât include prescription drug benefits. If you donât already have creditable prescription drug coverage , you should consider buying a separate stand-alone Medicare Part D Prescription Drug Plan to cover the costs of your prescription medications. Also, Medicare Supplement insurance plans generally donât offer extra benefits like routine dental, vision, or hearing coverage beyond whatâs already covered by Medicare.

Read Also: When Can You Get Medicare At What Age

Premiums Paid By Medicare Advantage Enrollees Have Declined Since 2015

In 2022, the average enrollment weighted MA-PD premium, including among those who do not pay a premium, is $18 per month. However, average MA-PD premiums vary by plan type, ranging from $16 per month for HMOs to $20 per month for local PPOs and $49 per month for regional PPOs. Nearly 6 in 10 Medicare Advantage enrollees are in HMOs , 38% are in local PPOs, and 3% are in regional PPOs in 2022. Regional PPOs were established to provide rural beneficiaries with greater access to Medicare Advantage plans.

Average MA-PD premiums have declined from $36 per month in 2015 to $18 per month in 2022. The reduction is driven in part by the decline in premiums for local PPOs and HMOs, that account for a rising share of enrollment over this time period. Since 2015, a rising share of plans are bidding below the benchmark, which enables them to offer coverage without charging an additional premium. More plans are bidding below the benchmark partly because Medicare Advantage benchmarks relative to traditional Medicare have increased over time, and when benchmarks increase, plans are able to keep more for Part A and B services as well as for extra benefits. Further, rebates paid to plans have increased over time, and plans are allocating some of those rebate dollars to lower the part D portion of the MA-PD premium. Together, these trends contribute to greater availability of zero-premium plans, which brings down average premiums.

Medicare Advantage Vs Medicare Supplement: Plan Costs

It may seem obvious that many people would want either a Medicare Advantage plan or a Medicare Supplement insurance plan for the added benefits and the protection from out-of-pocket costs. However, both these types of plans may come with additional costs. You may have to spend money to save money, which is how most types of insurance generally work.

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium.

Most Medicare Supplement insurance plans also have monthly premiums. The premium you pay generally depends on the plan you select and your location.

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Donât Miss: How Much Medicare Is Taken Out Of Social Security Check

Also Check: How Old To Get Medicare Part B

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

Some potential benefits of having a Medicare Advantage plan include:

- All Medicare Advantage plans have an annual out-of-pocket spending max, which Original Medicare does not offer.

- Some Medicare Advantage plans offer $0 premiums.

- Many Medicare Advantage plans offer prescription drug benefits and some of the additional benefits listed above, which are not covered by Original Medicare.

Some potential downsides of a Medicare Advantage plan can include:

- Certain types of Medicare Advantage plans may limit you to a provider network. If so, youll be required to visit health care providers who are in the plan network for your care to be covered.

- The provider networks in some Medicare Advantage plans may be small limited to a certain geographic region. This could be an issue if you travel frequently or live in different parts of the country during certain times of the year.

Whether or not a Medicare Advantage plan is a good fit for you will depend on your personal health care and budget needs.

Medicare Advantage Vs Traditional Medicare: How Do Beneficiaries Characteristics And Experiences Differ

-

Enrollment in private Medicare Advantage plans is projected to overtake traditional Medicare enrollment over the next decade. How do these plans compare to traditional Medicare?

-

Beneficiaries in traditional Medicare and Medicare Advantage have similar demographics, report comparable levels of chronic illness, and experience the same monthlong wait times for medical care

-

Enrollment in private Medicare Advantage plans is projected to overtake traditional Medicare enrollment over the next decade. How do these plans compare to traditional Medicare?

-

Beneficiaries in traditional Medicare and Medicare Advantage have similar demographics, report comparable levels of chronic illness, and experience the same monthlong wait times for medical care

Don’t Miss: Are All Plan G Medicare Supplements The Same

Which Is Better Original Medicare Or Medicare Advantage

There is no solid answer to this question. The best medicare plan is a personal decision based on each individualâs needs and the options that might be available to them. Sometimes the best plan for you might not meet the needs of your spouse, friends, or family. Thatâs why it is important to research, compare benefit options, cost and networkâ and consider key factors such as :

- Your work history and thus qualifications for Medicare benefits

- Your tax deductibles that can be applied to Medicare

- Your health

- Your living and traveling requirements

- The healthcare providers in each planâs network

- If you want your health care to focus on problems and/or prevention

Regardless there is good news you can change your plan annually during enrollment from Oct. 15- Dec. 7 so if your life circumstances change, you move, or you have better options available there is time to update!

Also Check: Does Medicare Cover Bed Rails

Why Choose Medicare Advantage

Medicare Advantage plans must offer benefits comparable to original Medicare. The government regulates these plans, ensuring that they meet certain basic care requirements. The costs and copays for various services, however, may be different. For some people, Medicare Advantage is a better choice. You might choose Medicare advantage because:

- There are more options. In 2018, the average Medicare beneficiary could choose from 21 plans, though some regions offered even more choices.

- Premiums may be lower on some plans. Some even offer $0 premiums, though this usually means you’ll pay higher copays.

- There is usually prescription drug coverage. Original Medicare does not cover prescription drugs unless you enroll in Part D. In 2019, 90% of Medicare Advantage policies offered prescription drug coverage.

- You may pay less for expensive services. Medicare Advantage plans are legally required to limit your out-of-pocket maximum costs. With original Medicare, you keep paying costs no matter how much you spend. In 2020, the out-of-pocket maximum for most Medicare Advantage costs was $6,700.

- There is often coverage for services original Medicare will not fund. Each plan is different, so it is important to compare and review plan documents. However, many Medicare Advantage plans offer dental or vision coverage. Original Medicare, by contrast, covers only medical and hospital care.

You May Like: What Is The Average Cost Of A Medicare Advantage Plan

What Is Thedifferencebetween A Medicare Advantage Plan And A Medigap Plan

You will notice that the first bullet point says that Medicare Advantage plans are not a kind of Medigap plan. This can be confusing since both are a way to handle the lack of coverage that Medicare Parts A and B come with. Luckily, the difference isnt as hard as it may seem. To put it simply, Medicare Advantage plans are another way to get traditional Medicare . On the other hand, Medigap works with your traditional Medicare coverage. There are plenty more differences when it comes to the benefits, costs, and how they work but this is just the basic difference.

Costs With Original Medicare Include:

- The Part B premium

- A low-cost or $0 plan premium

- A plan deductible

- Copays for covered health services and items

A note about financial protection: A really great benefit with a Medicare Advantage plan though is there is a limit on your out-of-pocket costs . This can really help keep your Medicare costs under control. Original Medicare does not provide any financial protection like this.

Don’t Miss: Is Medicare Automatically Deducted From Social Security

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage Plans, you can do so once a year, either during Medicares fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. Insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage Plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Original Medicare Vs Medicare Advantage: Which Is Best

Medicare coverage is a personal decision unique to the individual. What works best for your neighbor, or even your spouse, may not be best for you. The good news is that all Medicare plans are individual plans, which means you and your spouse can enroll in different plans.

You should think about your health-care needs, budget, and lifestyle when deciding whether Original Medicare or Medicare Advantage is right for you. The table below lists things to consider before you make the final decision:

Also Check: How To Change Mailing Address For Medicare

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2022 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $432 per enrollee annually for non-Medicare supplemental benefits, a 24% increase over 2021. The rise in rebate payments to plans is due in part to incentives for plans to document additional diagnoses that raise risk scores, which in turn, generate higher rebate amounts that make it possible for plans to provide extra benefits. Plans can also charge additional premiums for such benefits, but most do not do this. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.