Is Plan G The Best Medicare Supplement Plan

It really depends on what you want. Suppose youre looking for a comprehensive basic Medicare Supplement plan. In that case, for coverage that fills in gaps not provided by Original Medicare, Plan G is a good option, especially if you recently became eligible for Medicare and cant sign up for Plan F. However, if you want more bundled coverage or dental or vision coverage, or dont think youll need the benefits Plan G offers , another Medicare Plan might be better for you.

How Do I Decide Between Medicare Supplement Plan F And Plan G

Our clients often ask us for help comparing Medicare Plan F vs. Plan G. We understand it can be a tough decision to make. Well help you compare the plans so that you can feel confident in your choice. First, lets take a look at what benefits the two plans cover.

| Medigap Plan Benefits | |

|---|---|

| Part A coinsurance & hospital costs | Yes |

| Part B coinsurance or copayment | Yes |

| Part A hospice care coinsurance | Yes |

| Skilled nursing facility care coinsurance | Yes |

| Yes |

How Do I Enroll In A Medigap Plan G

In general, you will get the best price for Medicare Supplemental Insurance if you purchase a plan as soon as you are eligible for Medicare and enrolled in Parts A and B. Medigap Open Enrollment starts on the first day of the month that you turn 65 and are enrolled in both Parts A and B and lasts for six months. An insurance company is not allowed to use medical underwriting to decide whether to accept your application or change the price during this time.

To enroll in a Medigap Plan G, contact the insurance company to make sure you are in your open enrollment period or have guaranteed issue rights. Complete the application and determine when you want your policy to start.

Recommended Reading: How Much Money Can I Make On Medicare

What Is The Medicare Supplement Plan G

When you stay on Original Medicare, instead of going the Medicare Advantage route, you are going to need insurance to supplement your Medicare coverage.

If you have Original Medicare with no Supplement, you are left with 20% of all your medical bills, uncapped. While this might not seem like much, medical expenses add up quickly. 20% of a $100 bill is no big deal 20% of a $10,000 bill, or even a $100,000 bill, is.

Medicare Supplements were designed to cover the gaps of Original Medicare.

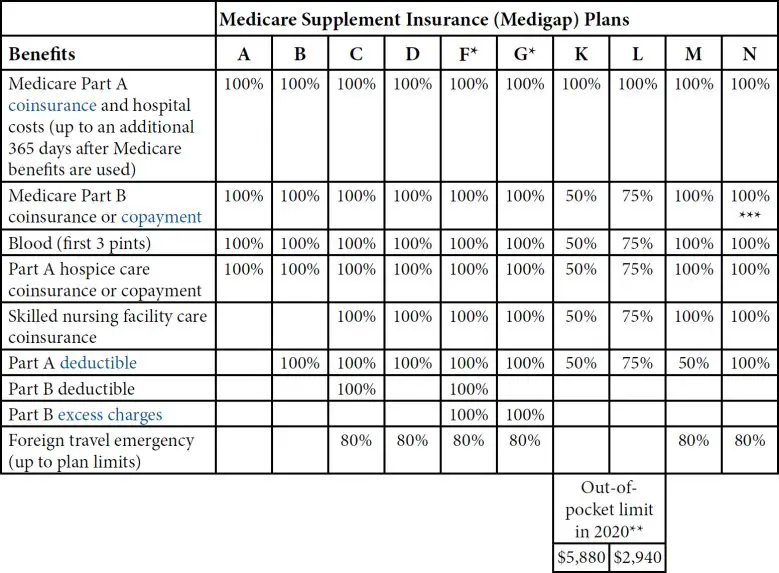

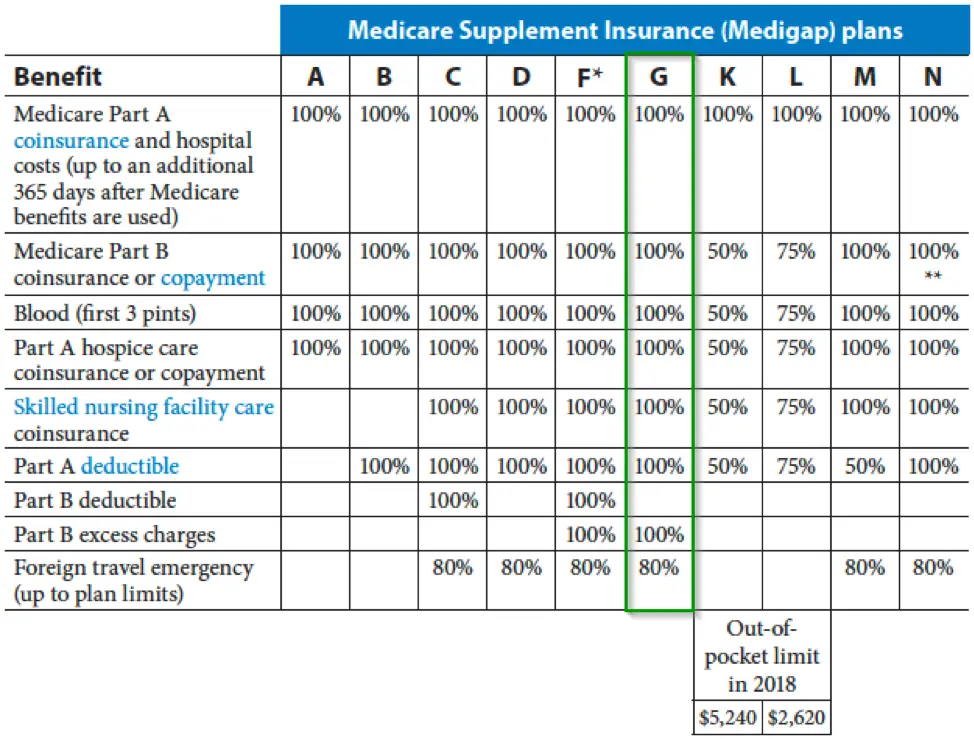

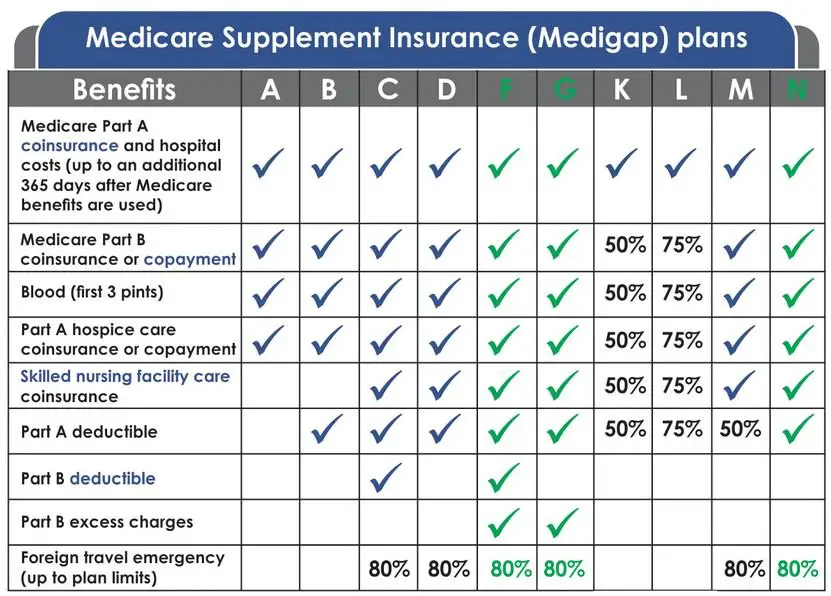

There are 10 different Medicare Supplement Plans, all named with letters: Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N. All these Plans differ in the type of coverage they offer, but they are standardized.

This means once you pick the Plan you want to go with, no matter who you purchase it from, you will receive the exact same coverage. This makes it easy to shop around, as all you need to compare is the price.

Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. Both policies will not cover the Part B deductible however, Plan N will not pay for expenses related to the Medicare Part B excess charges. Excess charges can occur when there is a difference between what is billed to Medicare for your treatment and what is actually paid by Medicare. This difference would be paid for you out of pocket if you had Plan N, for example.

However, since Plan N has less coverage, the monthly premium for the policy will be less than Plan G. For 2020, Plan N will cost between $149 and $289 per month.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Does Medicare Pay For Radiation Treatments

Who Is Eligible For A Medigap Plan G

Anyone who is eligible for Medicare and enrolled in Part A and Part B may be eligible to purchase Medigap Plan G. If you miss your Medigap Open Enrollment period, you may not be able to purchase a policy depending on your health condition. You cannot have a Medigap policy and a Medicare Advantage Plan at the same time.

Determine If You Are Eligible To Enroll In Medicare

Medicare enrollment eligibility begins three months before you turn 65 and extends for the three months after unless you’re eligible earlier due to disability. If you’re already in a Medicare Advantage Plan, you can switch plans during the Open Enrollment Period.

Otherwise, you can enroll during Open Enrollment, which runs from each year. After that, there’s no ability to enroll, only the option to adjust coverage you already are enrolled in. Changes in coverage begin in January. Every provider we look at has an eligibility check when providing you estimates, which will tell you if you’re eligible to enroll or not.

You May Like: Does Medicare Pay For A Portable Oxygen Concentrator

Medigap Plan G Costs And Availability

It is essential to understand that all of the benefits for Medicare Supplement Plan G are standardized and will be the same no matter which insurance company you purchase them from.

The only thing that isnt standardized is going to be the price which can vary from company to company.

We cant stress enough that you shouldnt get caught up on a companys name brand or familiarity when choosing to buy.

No matter which company you choose, a Plan G is a Plan G, so if you hear a company name that you might not be familiar with, but it has the lowest monthly rate, go for that plan.

Get An Expert Opinion

An insurance broker or consultant can be a valuable asset. They have more access and knowledge than the average person might, and they sometimes can negotiate better prices, or at the very least, provide additional guidance throughout the insurance-buying process. Plus, using a broker or consultant does not increase your costs, since they receive commissions from the insurance companies. Furthermore, an insurance broker has stringent rules set by the government to ensure the process is handled easily and fairly for you, the customer.

You May Like: How Old Do I Have To Be For Medicare

How To Shop And Compare Medicare Supplement Plan G

When you sign up for Medicare, or during Open Enrollment, you must first decide if you want to be on Original Medicare or Medicare Advantage. Original Medicare has a nationwide network of providers but has fixed benefits. Medicare Advantage plans are based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare Supplement Plan.

Is Medigap Plan C And Medicare Part C The Same

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplemental insurance to help cover costs if you have Original Medicare. Whereas Medicare Part C is an alternative to Original Medicare, combining Parts A, B and sometimes D. Medicare Part C plans may also include additional benefits like dental, vision and hearing.

Recommended Reading: What Age Does Medicare Eligibility Start

Don’t Miss: Are Spouses Eligible For Medicare

Can You Switch To Medicare Plan F Even Though Its Being Discontinued

It depends on your new to Medicare effective date. If you were eligible for Medicare prior to January 1, 2020, youre allowed to switch to Medicare Plan F. If youre currently on Plan F, you do not need to select a new plan if you dont want to.

If for some reason you fall under Guaranteed Issue Rights and your effective date for Medicare is prior to January 1, 2020, you can sign up for Plan F.

However, if you were newly eligible for Medicare on or after January 1, 2020, you cannot switch to Plan F. If you qualify for Guaranteed Issue Rights, you can sign up for Plan G.

Medicare Supplement Plan G Vs Plan F

Medicare Supplement Plan G 2022 is the most popular Plan among new enrollees .

Plan F held both of those titles for many years, as the best selling and most comprehensive Medicare Plan. It still holds a vast lead over any other plan in terms of total market share. Plan F currently has 49% of the Medigap market, with Plan G and Plan N lagging far behind.

However, as of 2020, Plan F are closed to newly-eligible Medicare recipients.

Only those eligible for Medicare Part A prior to January 1, 2020 can enroll in Plan F.

Comparing Medicare Supplement Plan G Coverage Chart

Read Also: How Will Bernie Sanders Pay For Medicare For All

Medicare Supplement Plan G The Top Plan

While there are actually ten different Medigap Plans people can choose from, most people only enroll in one of three plans. The most popular Plan by far is Medigap Plan G.

It has the most coverage, offering 100% coverage of all your medical bills after you pay a low deductible.

The most important thing to consider when it comes to any of the Medigap plans is that each company offers the exact same coverage. This means a Plan G from one company has the exact same benefits when offered by anyone else.

Each company charges different rates for the exact same coverage though!

You absolutely must work with an independent agency like us to help you shop the rates from all the carriers each year. First of all, its FREE. Secondly, not only can you get rates from each company on your own when youre just starting, but you will also get a rate increase every year regardless of the company.

That means youll have to shop every year, over and over again or you will end up overpaying.

Medicare containsparts that make up your coverage. They are:

- Medicare Part A Hospital coverage

- Medicare Part B Outpatient doctors services

- Medicare Part D Prescription drug plans

Part A and B are called Original Medicare, and they handle all your medical bills. They do not, however, cover everything. The bills they dont cover are called gaps. These gaps are expenses such as:

- Deductibles

- co-pays

- Coinsurance

How Much Does Plan G Cost

Plan premiums depend on many factors, including your age, sex, ZIP code, and smoking status. Premiums also vary by insurance company.

The chart below shows sample plan premiums for some of the most popular insurance companies. The premiums listed are for a 65-year-old female nonsmoker living in the midwest.

Read Also: Do You Have To Pay A Premium For Medicare

Plan G Coverage And Benefits

One of the most popular plans is Medigap Plan G, and its easy to understand why.

Remember all those out-of-pocket costs we talked about? Medigap Plan G will pay for all of those costs except the Part B deductible.

Plan G also has a foreign travel exchange benefit. If you need medical care during the first 60 days of a trip, Plan G will pay for up to $50,000 in benefits per lifetime. You will need to pay a $250 deductible, as well as 20% of the cost.

Which Is Better: Plan F Or Plan G

The most exhaustive Medicare supplement plan, or Medigap, is Medigap Plan F. This plan provides holistic coverage and supplements all gaps in Medicare. Coming in at No. 2 on the list of most comprehensive plans is Plan G, which is identical to Plan F, aside from not having the Medicare Part B deductible. Because of their comprehensive coverage, Plan F and Plan G tend to be the two most popular policies on the market.

However, it is important to note that if you are new to Medicare, you can no longer enroll in Plan F because the government has phased out the plan. If you were enrolled in Medicare and Plan F before January 1st, 2020, then you can still keep Plan F for your lifetime. But, again, Plan F is no longer accepting new enrollees.

Also Check: How Much Does Medicare Cover For Hospital Stay

How We Chose The Best Medicare Plan G Providers

Using the Medigap Find a Plan search engine, all companies offering Plan G and High-Deductible Plan G were considered. Subsidiaries of larger umbrella companies, e.g., Blue Cross Blue Shield, were taken as one entity rather than as separate companies. Of those carriers, the review was narrowed down to those offering plans in 40 states or more.

What It Will Cost You

Nationwide, the average premium for the most popular Medigap F plan costs roughly $326 a month. There is also a high-deductible F plan , and that premium averages about $68 a month. Premiums are based on three pricing systems and vary widely based on where you live.

- Community rated: The same monthly premium is charged to everyone who has this policy, regardless of age.

- Issue-age rated: This premium is based on your age when you first buy the policy. The younger you are, the lower the initial premium. Any premium increases in the future will not be based on your age.

- Attained-age rated: This premium is initially based on your current age but can rise as you get older.

Experts suggest that you ask a potential insurer which pricing system it uses before buying a Medigap policy. That way youll know whether to expect increases as you age.

Recommended Reading: How To Calculate Medicare Tax

Medicare Supplement Plan F Vs G Vs N

If you want free quotes or just want to talk with an independent agent, fill out our quote form, use our chat option, or give us a call and we will assist you.

Many seniors are surprised to learn that Medicare does not cover all health care expenses. There are deductibles, copays, coinsurance, and we havent even gotten to the cost of prescription drugs.

For this reason, many seniors often find themselves in a position of needing a supplemental medicare plan to cover the gaps, AKA Medigap.

This article will cover the most cost effective Medigap plans that are the most popular right now in 2022. These are Medicare Plan F, G, and N. We will go over the differences between each one and which one is the best for you.

Medicare Plan F

Medicare Plan F covers 100% of the gaps in Medicare and is the most comprehensive Medigap plan. You will never pay anything when you go to the hospital or doctor, as Medicare will pay for most of it and Plan F will cover the rest.

The only catch is this plan is only available to people who were eligible for Medicare prior to 2020. This basically means you must have been 65 before 2020 to be eligible for this plan.

Since Plan F is also the most comprehensive and covers 100% of the gaps in Medicare, it is also the most expensive.

Here is what is covered under Plan F

- Part A coinsurance and hospital costs

- Part B coinsurance/copayment

- Part B deductible

- Part B excess charges

Medicare Plan G

Medicare Plan N

Cheat Sheet

| Benefits |

|---|

What Does Medicare Plan G Cover

There are many out-of-pocket costs with Original Medicare . Depending on the care you need, you could pay:

- Part A deductible

- Part B deductible

- Part A daily coinsurance for hospital, skilled nursing facility, and hospice stays

- Part B coinsurance

- Part B excess charges

Medicare Plan G covers all of those out-of-pocket costs, except for the Part B deductible.

Also Check: How Does Medicare For All Work

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Opting Out Of Original Medicare With A Medicare Advantage Plan

- Medicare Advantage plans dont supplement Medicare. Enrollees have the option of joining a Medicare Advantage plan instead of Original Medicare. The federal government requires that all MA plans cover the same benefits as traditional Medicare, except for hospice care.

- Most MA plans offer additional health benefits and services as well, but because theyre sold by private insurance companies, they have different pricing structures and network stipulations. The benefits included in a Medicare Advantage plan and the cost of the policy can vary widely based on the private insurance company providing coverage.

- Companies that sell Medicare Advantage Plans set different rules for how beneficiaries get services. Each plan has different rules regarding where you can receive care, and whether you need a referral to see a specialist. Most Medicare Advantage plans have smaller networks than traditional Medicare.

Don’t Miss: How To Get A Power Wheelchair Through Medicare

Help Me Choose A Plan

Not sure what you need? Answer a few questions to help you decide. Get started

Now that youve picked a plan, its time to enroll.

File is in portable document format . To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at

You are leaving this website/app . This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. In addition, some sites may require you to agree to their terms of use and privacy policy.

Also Check: How To Find Out If I Have Medicare