How Do I Avoid A Penalty

The easiest way to avoid penalties is to sign up during your initial 7-month enrollment period. The exception is if you qualify for a special enrollment period — and have the documentation to prove it.

Generally, you qualify for a special enrollment period if you have other creditable health insurance coverage. If you or your spouse still works, that might be through an employer. Or it could be through a military health benefits program, if you or your spouse is an active-duty service member.

If you qualify for special enrollment, you can sign up while you’re still covered by your other group plan. For Parts A and B, you can also do it up to 8 months after either your job or your other health coverage ends, whichever comes first. But for Part D, you only have 63 days to enroll without penalty.

If you think you might qualify for special enrollment:

- Contact an administrator for your existing health plan. Find out how your insurance works with Medicare, and check whether you have “creditable” coverage for Parts B and D. Some employer plans require you to enroll in Part A and Part B for the best coverage.

- Keep the annual notice of creditable coverage for drug costs that employer health plans must send you.

What Is The Lep For Medicare Part B

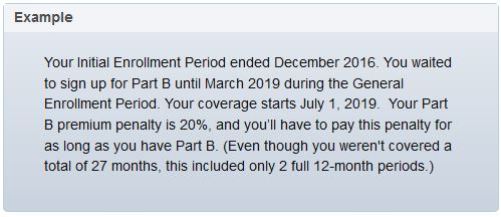

If you did not enroll in Medicare Part B when you were first eligible your monthly premium may go up 10% for each 12-month period you could have had Medicare Part B, but did were not enrolled. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay

In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Medicare Part B. So similar to the LEP for Medicare Part D, this is permanent for as long as you are enrolled in Medicare. And, the penalty increases the longer you go without Medicare Part B coverage.

How To Avoid Medicare Penalties

Most people avoid the penalties in two ways:

- Sign up for Medicare during your Initial Enrollment Period, a seven-month period around your 65th birthday.

- If you have employer-sponsored or other health coverage after age 65, sign up for Medicare as soon as it ends. Youll have a Special Enrollment Period of two months to do so.

Also Check: Does Medicare Cover Pill Pack

How Much Is The Part D Late Enrollment Penalty

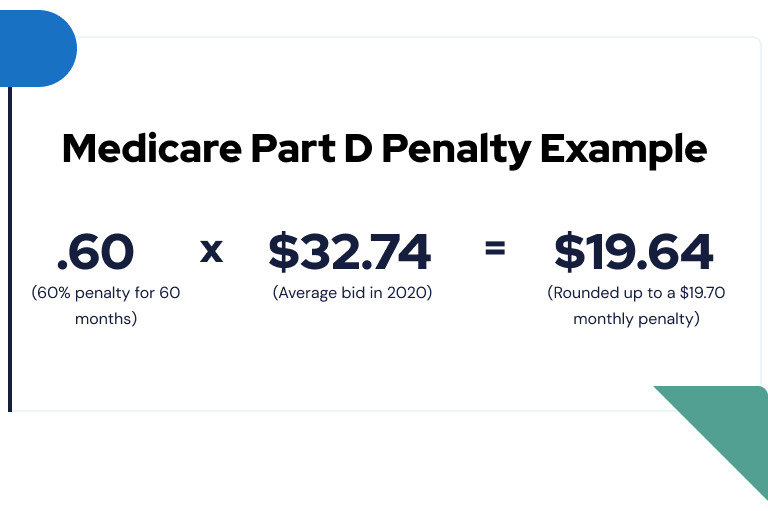

For each month you dont enroll or have creditable coverage, youll accrue a 1% penalty of the average monthly drug plan cost.

Lets assume you went four years without taking drug coverage. Youll receive a 1% penalty that compounds monthly. You would have a 48% penalty. The current average Part D premium is a little more than $33. Your Part D penalty would be about $14 a month.

No matter which drug plan you were to enroll in, you would pay an additional $14 a month on top of your plans premium for the rest of your life.

How Can I Avoid The Medicare Part B Penalty

If youre turning 65, you can enroll in Part B during your Initial Enrollment Period. Your IEP begins three months before your birth month and ends three months after your birth month. This means that if your 65th birthday is June 15th, you can enroll between March 1st and September 30th.

If you dont enroll in Part B during your IEP, you usually will have to wait for the General Enrollment Period before you will be allowed to sign up. General Enrollment runs from January 1st to March 31st each year.

If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have a sudden illness or injury. You can also apply for a Medicare Savings Program to avoid the Part B late enrollment penalty.

Don’t Miss: How Does Medicare Supplement Plan G Work

What Is The Lep For Medicare Part D

The LEP is an amount that is permanently added to your Medicare Part D Prescription Drug coverage premium.How does it happen? You might owe a late enrollment penalty if you go without a Medicare Part D Prescription Drug plan or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of your Initial Enrollment Period . For most people, this enrollment period is a few months before and after you turn 65.

Generally, your LEP is added to your monthly Medicare Part D Prescription Drug plan premium for as long as you have Medicare drug coverage, even if you change your Medicare plan. The late enrollment penalty amount changes each year. The cost of the late enrollment penalty depends on how long you went without a Medicare Part D Prescription Drug plan or other creditable prescription drug coverage.

How Can I Avoid The Late Enrollment Penalty

The easiest way to avoid paying these fees is to sign up during your seven-month IEP window. If that ship has sailed, your next best bet is qualifying for a Special Circumstance. If you had coverage through an employer, a spouses employer, or you experienced a significant life change such as moving, you may be able to take advantage of a Special Enrollment Period. Finally, if you qualify for Extra Help, you do not have to pay late penalties.

If you need to learn more about your Medicare options, call us toll-free at 855-350-8101. One of our licensed agents can answer your questions and explain your options.

HealthPlanOne is a licensed and certified representative of Medicare Advantage HMO, PPO and PPFS organizations and stand-alone prescription drug plans with a Medicare contract. Enrollment in any plan depends on contract renewal.

Medicare supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease. Medicare supplement plans are not connected with or endorsed by the U.S. government or federal Medicare program.

For a complete list of available plans please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Recommended Reading: What Is Medicare Part A And B

How Often Are These Decisions Changed Or Reversed

The CMS reports that 39,664 total reconsideration requests were closed in 2017. Of these, 17,629 of the original late enrollment penalty decisions were fully reversed and another 2,334 were partially reversed. Thats more than 50 percent.

Out of the remaining 19,701 reconsideration requests that were closed that year, 10,699 were upheld, 8,937 were dismissed, and the final 65 were withdrawn.

You can also contact your State Health Insurance Assistance Program for assistance with your appeal if youd like. If youre unsure of how to do this, visit their website, click on the SHIP Locator button, and youll find contact information for your local SHIP.

If you are assessed a penalty on your premiums for Part A or Part B, your only option is to request help from your state or to apply for a Medicare Savings Program to help cover the premiums.

The four Medicare Savings Programs currently being offered, as well as their income and resource limits , are:

| Program Name |

How To File A Medicare Part B Late Enrollment Penalty Appeal

If you disagree with a Medicare decision regarding your Part B coverage, you can appeal. If you decide to appeal Medicares decision, first ask your healthcare provider or insurance carrier for any information that can help your case.

Look at your Medicare Summary Notice . It will list all of your billed services and supplies for a 90-day period. Your MSN will show you what Medicare paid and what you still owe.

Circle any items you disagree with on your MSN. Then write down why you disagree with the items.

Fill out Medicare Redetermination Request Form and mail it to the address listed on your MSN. Be sure to include your MSN with your Medicare Redetermination Request Form.

Read Also: Does Medicare Cover Rides To The Doctor

What Can I Do About A Medicare Penalty

If you think Medicare was wrong to charge you a penalty, you can request a review. Generally, you have do this within 60 days of the date on the penalty letter Medicare sends you.

You fill out a Medicare reconsideration request form with evidence supporting your argument. This might include information about past creditable medical or drug coverage.

If you feel you need an experienced advocate to help with this process, contact an attorney, your State Health Insurance Assistance Program , or a Medicare aid organization. You’ll need to fill out Medicares Appointment of Representative form in this case.

Be prepared to provide a lot of evidence, says Tatiana Fassieux, a training specialist with California Health Advocates.

That doesnt mean just your own description of the situation. For example, you may need to contact your former employer for a statement of continuous coverage, she says.

And what are your chances of getting a penalty waived or lowered?

It depends on the situation, says Casey Schwarz, senior counsel of education and federal policy with the Medicare Rights Center.

Arguments like: this penalty shouldnt apply to me because its unfair because I didnt know about the enrollment because I had no drug expenses so I actually saved you money — tend not to be successful,” she says.

WebMD Feature

A Quick Note About Medicare Part A

The vast majority of Medicare beneficiaries don’t pay a monthly premium for Medicare Part A. That’s because they or their spouse worked and paid Medicare taxes for the required 10 years/40 quarters to qualify for premium-free Part A.

If you or your spouse did not pay the required Medicare taxes, you will pay up to $499 per month for Part A in 2022. And if you’re late enrolling, you may owe the Part A late fee, which is 10 percent for twice the number of years you could have had Part A but didn’t. So, one year equals two years paying the penalty, two years equals four, and so on.

Recommended Reading: What Is Medicare For All

What Is The Late Enrollment Penalty For Medicare Part B

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties. Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouses current job are exempt from this penalty, and can generally enroll in Part B without any delays.

However, people who delay Part B enrollment and didnt have current job-based health coverage can find themselves out of luck. They dont qualify for the Part B Special Enrollment Period and cant enroll in Part B until the next General Enrollment Period , which runs from January to March of each year, with Part B coverage beginning that July. The GEP for the current year may have passed by the time you discover you need Part B, potentially your Part B coverage effective date by an entire year.

Thoughts On Medicare Part B Late Enrollment Penalty

I am a retired federal employee and have FEHB through BCBS. If I keep FEHB and do not take Medicare B, will I be penalized? I have conflicting answers that I wont be penalized because I still have FEHB, and that I will be penalized because I am retired and not working. Which is correct? Where is this officially stated?

It seems that ignorance is expensive. Except for 4 years in the military, I worked for a municipal employer for 30 years that did not collect Social Security and Medicare taxes. I retired from that employer with a disability pension and health insurance that terminated at age 65. When I turned 65, my wife was 58 and we purchased insurance through the Affordable Care Act and continued with AFC insurance through this year. My wife applied for and received Medicare A and B when she turned 65 this year and I discovered that I could apply under her work record, which I did except that they only gave me Part A, with the option to enroll in Part B in January when Ill be 73. My question Why do they penalize those with quality AFC insurance?

Hi Bob we are sorry to hear about your situation. That is why we try to educate as many people about Medicare as possible. Health insurance through the Affordable Care Act is not creditable for Medicare, so those who enroll are vulnerable to penalties. Additionally, it is illegal for someone to try to sell a plan through the Marketplace to a Medicare beneficiary.

Don’t Miss: How To Sign Up For Medicare Online

More From Life Changes:

The government insurance program has roughly 63.3 million beneficiaries, the majority of whom are at least age 65. Most people pay no premium for Part A and pay a standard monthly premium for Part B .

The share of older people who aren’t auto-enrolled in Medicare has risen over time, according to a 2019 report from the Medicare Payment Advisory Commission. In 2016, 40% of individuals eligible for Medicare at age 65 had to actively enroll, compared with just 8% in 2002.

While there are no late-enrollment penalties related to Part A, the same can’t be said for signing up late for Part B. That penalty, which equates to 10% of the standard Part B premium for each 12 months that you should have been enrolled but were not, also can increase each year as the premium adjusts annually. And, the penalties are life-lasting.

Although the Part B penalty hits a small share of beneficiaries an estimated 776,200 in 2020 the average penalty increased their monthly premium by 27%, according to the Medicare Rights Center. Based on this year’s $170.10 premium, that would mean an additional $45.93 monthly, or $216.03 total.

Of course, you can appeal the charges, although your enrollment mistake must be due to someone in government providing you with inaccurate information.

When Should I Enroll In Medicare To Avoid All Penalties

Youll become eligible for Medicare when you reach age 65. The good news is that you have a generous seven-month window to sign up, which Medicare calls your Initial Enrollment Period . Your IEP is the month your 65th birthday falls in, plus the three months before and after.

Some people dont need to do anything to enroll in Medicare. If you claimed Social Security retirement benefits at ages 62, 63, or 64, the Social Security Administration will automatically enroll you in Medicare Parts A and Part B when you reach 65. You will receive a Medicare card in the mail shortly before your 65th birthday.

If you are not automatically enrolled in Medicare , you are responsible for enrolling yourself during the IEP. If you dont, you may be charged penalties.

For an overview of all the Medicare enrollment periods, see our Medicare Enrollment Periods Cheat Sheet.

Don’t Miss: When Does Medicare Start For Social Security Disability

How Can I Eliminate Medicare Late Enrollment Penalties

There are a few ways to try and get the penalty waived. You can contact Social Security to appeal the late enrollment penalty. If you have a low income, you can apply for the Extra Help program or the Medicare Savings Program.

If youre dual-eligible for Medicare & Medicaid, then you could be eligible for a Medicare Savings Program. These programs will waive or pay for any penalties you may have incurred.

Your penalities will also disappear if you accrued them when you were under 65 and on Medicare due to collecting SSDI for 24 months. When you turn 65, your penalties will reset.

Medicare To Waive Late Enrollment Penalties For Some

by Christian Worstell | Published April 26, 2021 | Reviewed by John Krahnert

Relief is on the way for potentially thousands of Medicare patients.

The federal government has ruled to issue a waiver for late-enrollment penalties that hit unsuspecting Medicare recipients who missed their enrollment deadline because they were already enrolled in another health insurance plan purchased on the individual marketplace.

Recommended Reading: Can I Enroll In Medicare Online

Statement About Healthplanonecom And Privacy

At HealthPlanOne.com, we understand that the process of selecting the right health care coverage for an individual or family member is a personal one. Our goal is protect your privacy while ensuring that you are offered useful and comprehensive information to help you make your decision.

At HealthPlanOne.com, we also understand that relationships are built on trust. So we want to make sure that we clearly disclose to you the kind of information our website may collect and what we do with that information.

Medicare Penalties You Should Know About

By Jon McKenna

The Medicare program is all about helping older Americans. But if you procrastinate about signing up, it could hit you in the pocketbook.

Medicare charges several late-enrollment penalties. They’re meant to discourage you from passing up coverage, then getting hit with costly medical bills. To avoid higher Medicare premiums, you need to know about these penalties and take steps to avoid them.

Recommended Reading: Can A 60 Year Old Get Medicare

Medicare Part B Enrollment Avoiding The Part B Penalty

There are a few situations when you may be able to delay Medicare Part B without paying a late-enrollment penalty. For example, if you were volunteering overseas or if you were living out of the country when you turned 65 and werent eligible for Social Security benefits, you may be eligible for a Special Enrollment Period when you return to the United States. The length of your SEP will depend on your situation. If you arent sure if you qualify for a Special Enrollment Period, call Medicare to confirm at 1-800-633-4227 , 24 hours a day, seven days a week.

Have more questions about Medicare coverage? You can talk to one of eHealths licensed insurance agents youll find contact information below.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!