Canceling Part B Because You Got A Job With Insurance

If you have had Part B for a while but no longer need it because youve rejoined the workforce with access to employer-sponsored health insurance, congratulations! But before you drop Part B, find out if your jobs coverage is primary or secondary to Medicare.

A primary payer health plan pays before Medicare. That means your employer-provided health plan will cover its share of your health care costs first, and if theres anything left over that Medicare covers, Medicare will pay what remains.

Conversely, a secondary payer health plan covers only costs left over after Medicare covers its share.

If your health plan at work is a primary payer, thats great. Feel free to drop your Part B coverage if you wish. The Part B premiums might not be worth any additional coverage you receive. But if you have secondary-payer insurance at work, its usually better to keep Part B, or you could get stuck paying Medicares share of your health care expenses.

Talk to your human resources department at work to find out if your employer-sponsored plan is primary or secondary to Medicare. Generally, businesses with 20 or fewer employees have secondary payer plans, while larger companies have primary payer plans.

What Does Medicare Part B Not Cover

Medicare Part B only covers specific services performed by medical professionals who accept Original Medicare Coverage.

Medicare Part B does not cover:

- Dental

- Hearing

- Prescription drug coverage

Further, it does not cover anything not considered medically necessary or preventive, nor any medical services provided by non-Medicare-participating providers. Finally, all inpatient services will be covered under Medicare Part A coverage.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

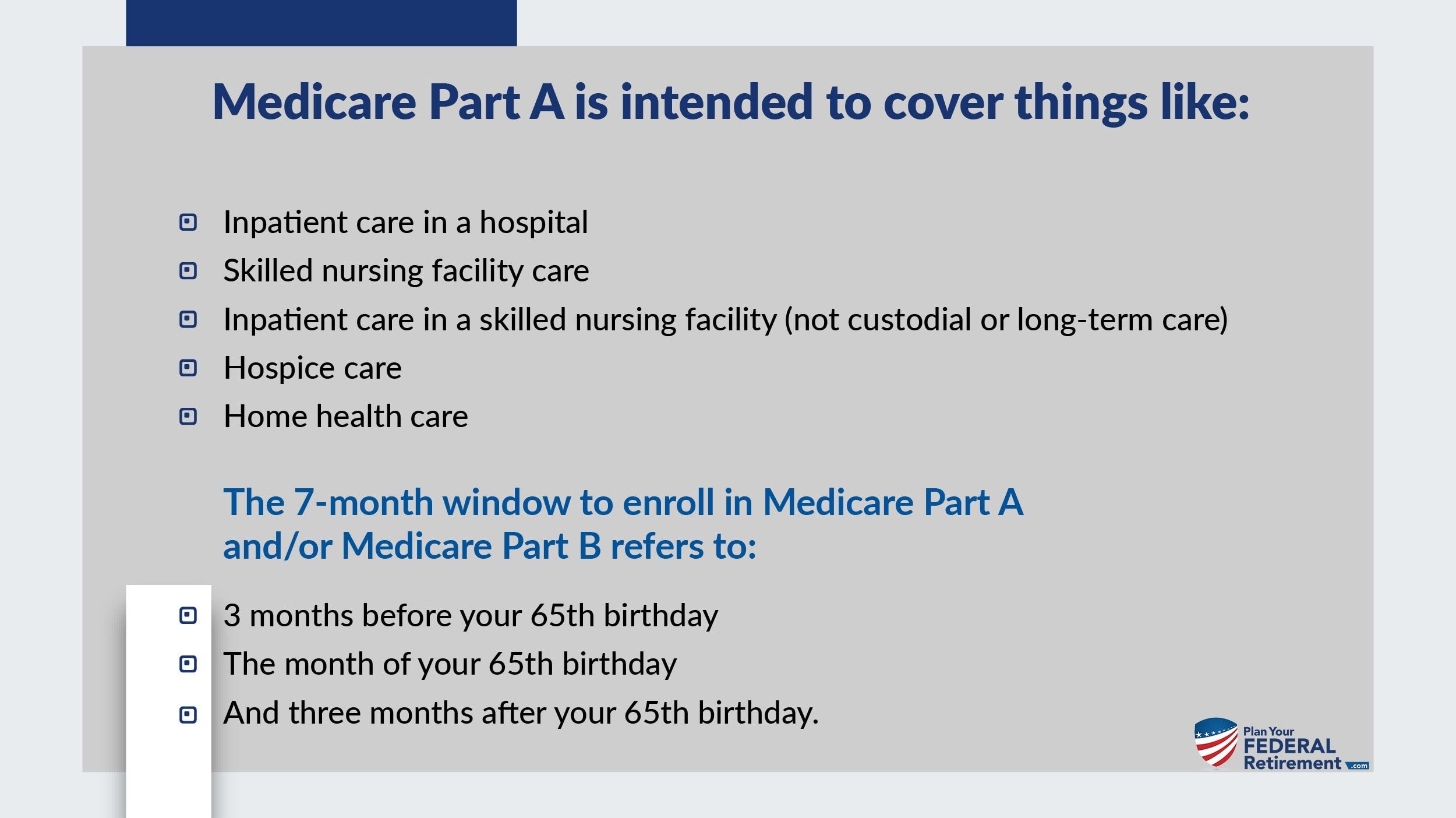

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Don’t Miss: How Long Do You Have To Sign Up For Medicare

Canceling Part B Because You Cant Afford The Premiums

If you dont have a job with creditable health care coverage but still dont want to pay Part B premiums, use caution. Without health insurance thats as good or better than Medicare, you could start racking up late-enrollment penalties the longer you go without coverage. If you decide to re-enroll in Part B later, these penalties could make your premiums even less affordable.

If you can’t afford your Part B premiums, consider other options before canceling your coverage. You can apply for Medicaid coverage if you’re in a low-income household or have few assets. Medicare also offers several savings programs, which help qualified individuals pay their Medicare expenses.

Medicare Part B Cost Example

You might be wondering, How much exactly will I pay out of pocket when I visit the doctor? The actual dollar amount of a service Medicare Part B will cover depends on whether your physician accepts the assignment. This means your doctor/provider agrees to accept the Medicare-approved amount as full payment for the service they render. Sometimes, this is referred to as participating in or with Medicare.

A non-participating provider may require you to pay the entire charge for a service at the time you receive it they can also charge you more than the Medicare-approved amount.

If your doctor has an agreement with Medicare to pay the Medicare-approved amount for the service, you will not be billed any more than the deductible and coinsurance.

For example, lets say you visit your Medicare-approved physician for an outpatient cardiovascular appointment on Jan. 12. This appointment falls under your Medicare Part B insurance, and the visit is $250.

This was your first medical appointment of the year, so you have not yet paid your annual Medicare Part B deductible. You are responsible for the 2022 deductible of $233 before Medicare begins paying for services.

This means you have to pay out of pocket for most of your doctors visit on Jan. 12. Of the $250 visit, youll pay $246.60. This covers your 2022 deductible and 20 percent of the remaining doctor visit balance.

You May Like: Does Medicare Cover Scooters For Seniors

What Is Creditable Coverage

The term creditable means that insurance coverage meets a minimum set of standards. Most group, individual and government-provided plans meet these qualifications. Even if you have creditable coverage, you will pay a penalty for delaying signing up for Medicare Part B for more than twelve months, if the coverage is not from an employer.

How Much Does Medicare Part B Cost

There is a monthly premium for both Medicare Part A and Medicare Part B. However, most people dont have to pay a Part A premium because they paid Medicare taxes while working. All enrollees, however, pay a monthly Part B premium, and the premium amount may depend upon your income.5 If you need assistance affording Part B premiums, there are federal and state programs that can help.6

Also Check: How Does Medicare Differ From Medicaid

How Can I Check On My Medicare Application

I applied for Medicare benefits last week. How can I check the status of my application?

You can check the status at our secure website, secure.ssa.gov/apps6z/IAPS/applicationStatus, but you must wait five days from the date you originally filed. You will need to enter your Social Security number and the confirmation number you received when you filed your application. Your application status also shows the date that we received your application, any requests for additional documents, the address of the office processing your application, and whether a decision has been made about your benefits. If you are unable to check your status online, you can call us at 1-800-772-1213 from 7 a.m. to 7 p.m. weekdays.

Changing From Employer Or Spouse Coverage

There are two forms that you will need in order to apply for Medicare Part B. Print these forms, get them filled out, and drop them off at your local Social Security office. The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application. Another important form is for your employer to show that you have had coverage since you were first eligible for Medicare at age 65. This is to ensure no penalty is added to your monthly Part B premiums. Here is the form needed for the employer coverage:

What do I need to do if I have Part A, but am losing my group plan coverage?

To sign up for Medicare Part B, you need to fill out application form CMS40B and take or mail it to your local Social Security office. You will also want to send your employer a CMS-L564E form to be filled out and sent in with your CMS40B application. There is an 8-month Special Enrollment Period that begins the month your group coverage ends or when the employment it is based on ends, whichever comes first.

Also Check: Is A Nursing Home Covered By Medicare

How Do You Get Help With This Application

- Phone: Call Social Security at 1-800-772-1213. TTY users should call 1-800-325-0778.

- En español: Llame a SSA gratis al 1-800-772-1213 y oprima el 2 si desea el servicio en español y espere a que le atienda un agente.

- In person: Your local Social Security office. For an office near you check www.ssa.gov.

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Recommended Reading: Can You Go On Medicare If You Are Still Working

How To Disenroll From Medicare Part B

Medicare Part B helps qualified Americans pay health care costs related to doctor visits, lab testing, preventative services, and more, but this coverage isn’t free, and not everyone needs it. Those who dont need Part B can disenrollbut its not a straightforward process.

The Centers for Medicare and Medicaid Services doesnt make it easy to drop this coverage, and you’ll need to speak with a representative to disenroll. If you cancel Part B, it could also impact your ability to afford coverage in the future, so read this entire article before you begin the process.

Signing Up For A Medicare Part D Plan

Medicare Part D drug coverage is optional and available to anyone with Medicare Part A and Part B.

Two Ways to Get Medicare Prescription Drug Coverage

In both cases, you must already be enrolled in Original Medicare.

You can explore and compare available Part D plans on the Medicare website.

You can also call your local State Health Insurance Assistance Program for free help.

Once you find a plan that meets your needs, there are a few ways to sign up.

Four Ways to Sign Up for a Part D Drug Plan

To sign up for a Medicare Part D plan, you will need your Medicare number and the date your Part A and Part B coverage started. You can find this information on your Medicare card or on MyMedicare.gov.

Other Information You Need to Provide

- Your primary mailing address

- Whether you had or have other drug coverage

- How you want to pay your premiums

Coverage usually begins the first day of the month after enrollment.

If you switch plans during the open enrollment period , your new coverage will start Jan. 1.

Also Check: Can You Change Medicare Plans After Open Enrollment

What Is The Difference Between Medicare Part A And Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. In terms of out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

How Can I Reenroll In Medicare Part B

An individual who wants to reenroll in Medicare Part B may have to pay a late enrollment penalty. Generally, the penalty cost is linked to the length of the gap in coverage.

The monthly premium also increases by 10% for each 12-month period an individual was eligible for, but did not have, Part B.

Advice is available from the SHIP about reenrolling in Part B and about penalties.

To reenroll in Medicare Part B, people need to complete an application form on the Social Security Administration website.

The application process requires supporting documentation. The exact documents required depends on an individualâs circumstances, such as if a person enrolled in an employerâs healthcare insurance plan.

Recommended Reading: How Do I Become A Medicare Insurance Agent

Step By Step Instructions For Filling Out This Application

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

Also Check: Does Medicare Pay For Teeth Implants

Mistake #: Not Signing Up For Part B Because You Have Retiree Coverage

COBRA and retiree health plan benefits aren’t based on current employment and therefore arent considered current employer health coverage. If you have either COBRA or retiree health plan benefits, you should still sign up for Medicare Part B when you first become eligible.

Check out our Medicare checklist for a step-by-step guide to enrollment.

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Recommended Reading: How Do I Submit Medical Bills To Medicare For Reimbursement

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

Enroll During An Enrollment Period

You can only enroll in Medicare Part B during an initial enrollment period, a general enrollment period, or a special enrollment period.

- Initial enrollment period : A seven-month period that starts three months before you turn 65 and ends three months after.

- General enrollment period: An annual enrollment period that runs from January 1 to March 31. Part B and Premium Part A coverage begin July 1 of that same year.

- Special enrollment period: An eight-month period that starts when employment or group health plan coverage ends.

If you dont enroll in premium Part B when first eligible, you may have to pay a late enrollment penalty of up to 10% for each full 12 months in the period that you couldve had Part B, but didnt enroll for as long as you have Medicare Part B.

You May Like: What Documents Do I Need To Apply For Medicare