What Is The Part B Deductible In 2023

The Part B deductible is $233 for 2022 and will be $226 in 2023. The Part B deductible hasnt decreased since 2012.

If you enroll in a Medicare Advantage plan rather than traditional Medicare, you are still responsible for paying the Part B cost. To be enrolled in a Medicare Advantage plan , you must enroll in Part B and pay the applicable premium. Additionally, you might have to pay a premium for the Medicare Advantage plan itself.

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

Do Medicare Benefits Run Out

If you are admitted for inpatient care at a hospital or another inpatient facility, your MedicarePart A benefits will help pay for some of your hospital costs.

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs.

- For the first 60 days of a qualified inpatient hospital stay, you dont have to pay any Part A coinsurance. You are responsible for paying your Part A deductible, however. In 2022, the Medicare Part A deductible is $1,556 per benefit period.

- During days 61-90, you must pay a $389 per day coinsurance cost after you meet your Part A deductible.

- Beginning on day 91 of your stay, you will begin using your Medicare lifetime reserve days. Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $778 per day in 2022.

You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year. If you have a hospital stay that lasts longer than 90 days after your lifetime reserve days are exhausted, you will be responsible for all costs beginning on day 91.

Don’t Miss: Does Medicare Pay For Sleep Apnea

To 2016 Medicare Part B Premiums

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase. The 2013 to 2015 premiums started at $104.90 per month and increased for single or married individuals who filed separately with MAGIs over $85,000 and married taxpayers who filed jointly with MAGIs over $170,000.

In 2016, the premium rate of $104.90 from the previous three years applied to about 70% of beneficiaries due to COLA. The other 30% paid a Medicare Part B premium that was not based on COLA. The premium was $121.80 in 2016, which was a 16% increase from the $104.90 paid in 2015.

A Late Enrollment Penalty

- Some people have to buy Part A because they don’t qualify for premium-free Part A.

- If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%.

- You’ll have to pay the penalty for twice the number of years you didn’t sign up.

Example:

Recommended Reading: Does Medicare Cover Medical Expenses Abroad

Medicare Recipients Will See A Reduction In Their Medicare Part B Premiums For 2023

The Centers for Medicare and Medicaid Services adjusts coinsurance, deductible, and premium amounts for Medicare Parts A and B each year. For many years, including in recent years, the premium and deductible for Medicare Part B have increased. Recently, CMS released the premium and deductible amounts for Part B for 2023.

What Is The Part B Premium In 2023

Part B is the main component of original Medicare that covers doctors visits and many other types of non-hospital care. Every beneficiary in Part B pays a premium, while lower-income beneficiaries may be eligible for help.

The Part B premium increased by 14.5% to $170.10 between 2021 and 2022. There were various reasons for the increase, but $10 of the $22 increase was added to create a reserve for potential reimbursement of the brand-new Alzheimers medication Adulhelm at the time. Subsequently, the pharmaceutical company decreased the price of the medication, and the Centers for Medicare and Medicaid opted to restrict coverage for the medication.

The base Part B Medicare cost in 2023 will be $164.90, a $5.20 decrease from the $170.10 monthly premium in 2022.

Recommended Reading: Does Medicare Cover Caregiver Services

B Deductible Also Decreased For 2023

Medicare B also has a deductible, which is , down from $233 in 2022. As is the case for Part B premiums, this is the first time in a decade that the Part B deductible decreased.

The Medicare Part B deductible only has to be paid once per year, unlike the Part A deductible, which has to be paid once per benefit period.

After the Part B deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services for the remainder of the year. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

B Late Enrollment Penalty

- Generally, you wont have to pay a Part B penalty if you qualify for a Special Enrollment Period. Learn more about Special Enrollment Periods.

- Youll pay an extra 10% for each year you could have signed up for Part B, but didnt.

- You may also pay a higher premium depending on your income.

Example:

$170.10 + $34.00

$204.10 will be your Part B monthly premium for 2022. . This amount is rounded to the nearest $.10 and includes the late enrollment penalty.

Also Check: How Do I Get A Second Opinion With Medicare

Medicare Part B Premium In 2023

Each year the Medicare Part B premium amount changes to reflect inflation and the economic status of the U.S. The standard Medicare Part B premium in 2023 is $164.90 per month and can be as high as $560.50 monthly for high-earning beneficiaries. The standard Medicare Part B Premium in 2023 is $5.20 lower than the previous year.

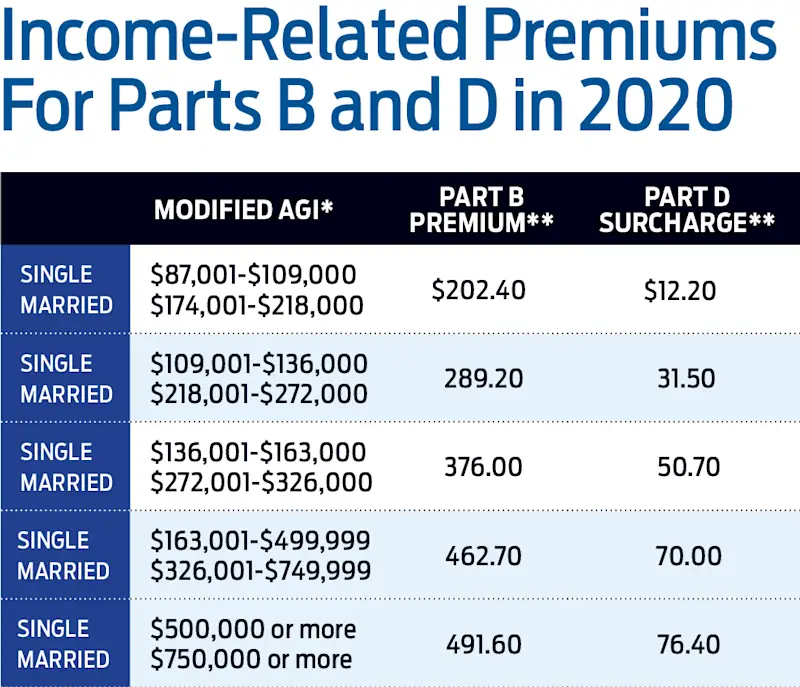

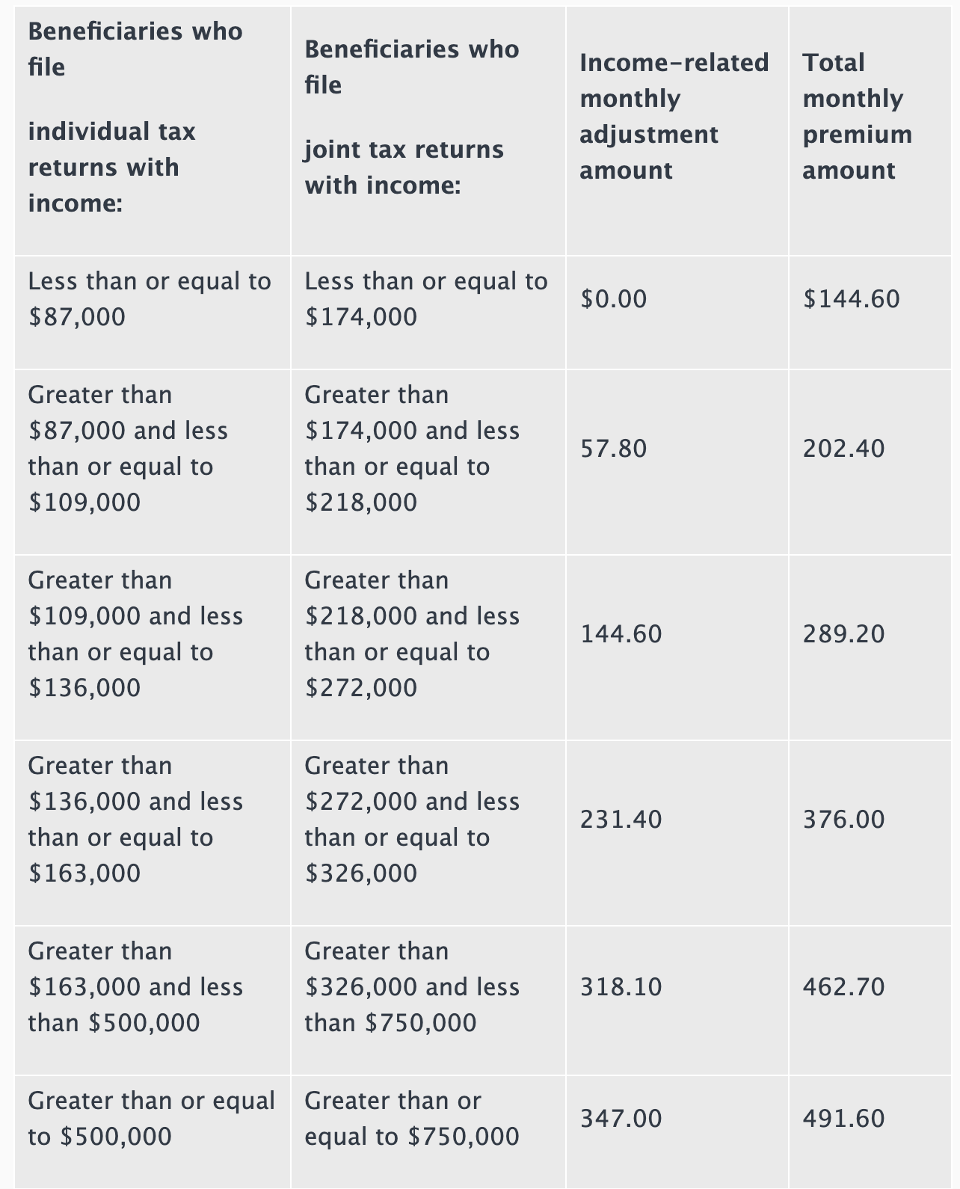

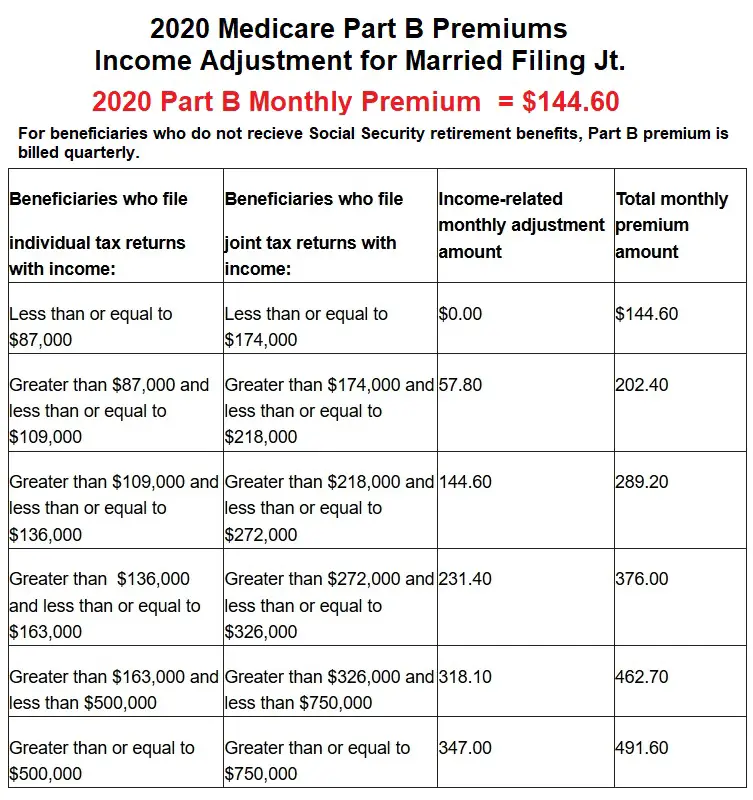

If your income falls above a certain threshold, you will be subject to paying an Income-Related Monthly Adjustment Amount. This additional charge is on top of the standard monthly Medicare Part B premium to balance the cost between high and lower-earning beneficiaries.

You will pay the standard Medicare Part B premium in 2023 regardless of income if:

- You enroll in Medicare Part B for the first time in 2023

- You are billed directly for your Medicare Part B premium

- You do not receive Social Security benefits

- You have Medicare and Medicaid

When Do The Changes To Medicare Part B Premiums Take Effect

Although CMS has announced the new rates, people will not see changes in their premiums or deductibles until January 2023. The new premium and deductible will be in place for all of 2023. However, Medicare Open Enrollment begins October 15 and ends December 7, 2022. People who have Medicare Advantage are also affected by the change in Part B premiums and should check the premium and cost-sharing information that Medicare Advantage plan providers release ahead of open enrollment.

You May Like: Does Medicare Pay For New Shingles Vaccine

Find Medicare Advantage Plans Where You Live

If you have any questions about the Medicare Advantage plans that are available near you and the network coverage they offer, you can call to speak with a licensed insurance agent.

A licensed agent can help you find out if your doctor is part of plan networks available near you, and they can also help you see if your prescriptions drugs are covered by any available plans.

Supplemental Security Income Benefits

SSI is a cash benefit paid by Social Security to people with limited income and resources who are blind, 65 or older, or have a disability. SSI benefits arent the same as Social Security retirement benefits. You may be able to get both SSI benefits and Social Security benefits at the same time if your Social Security benefit is less than the SSI benefit amount, due to a limited work history, a history of low-wage work, or both. If youre eligible for SSI, you automatically qualify for Extra Help, and are usually eligible for Medicaid.

You May Like: Does Humana Medicare Cover Hearing Aids

Medicare Provider Utilization & Payment Data: Physician & Other Supplier Look

The Physician and Other Supplier Look-up Tool is a searchable database that lets you to look up a provider by:

- National Provider Identifier .

When you use the look-up tool, youll get information on:

- Services and procedures given to Medicare beneficiaries, including utilization information.

- Payment amounts .

- Submitted charges organized by Healthcare Common Procedure Coding System code.

The data covers calendar year 2012 and contains 100% final-action physician/supplier Part B non-institutional line items for the Medicare fee-for-service population .

Avoid Late Enrollment Penalties

Its important to sign up for Medicare coverage during your Initial Enrollment Period, unless you have other coverage thats similar in value to Medicare . If you dont, you may have to pay an extra amount, called a late enrollment penalty.

Late enrollment penalties:

- Are added to your monthly premium.

- Are not a one-time late fee.

- Are usually charged for as long as you have that type of coverage . The Part A penalty is different.

- Go up the longer you wait to sign up theyre based on how long you go without coverage similar to Medicare. Find out when you should sign up to avoid penalties.

Also Check: How To Apply For Medicare In Alabama

To 2019 Medicare Part B Premiums

Medicare Part B premiums for tax year 2019 started at $135.50 and increased to up to $460.50, depending on your income. The rate of $135.50 was for single or married individuals who filed separately with MAGIs of $85,000 or less, and for married taxpayers who filed jointly with MAGIs of $170,000 or less.

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration’s cost-of-living adjustments .

Medicare has a “hold harmless” provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. While this keeps seniors from paying more than they should, you’ll have to pay the increased premiums if your COLA is higher than the increase.

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Recommended Reading: Does Medicare Pay For Yearly Physicals

Premium Surcharge Is Based On 2021 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2021 tax returns were filed in 2022, so those are the most current returns available when income-related premium adjustments are determined for 2023.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

What Do Medicare Parts A And B Cover

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation and some home health care services.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

Medicare Part D helps cover prescription drug costs.

For more information, here’s what to know about signing up for an Affordable Care Act plan.

Get the So Money by CNET newsletter

Also Check: Does Medicare Pay For Life Line Screening

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 was the largest year-over-year dollar increase in the programs history. But the decrease for 2023 was the first time the deductible has declined in over a decade. Heres an historical summary of Part deductibles over the last several years :

How Much Does Medicare Part C Cost

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or plus a variety of coverages and benefits not offered by Original Medicare .

Recommended Reading: How To Calculate Medicare Wages

What Is The Cost Of Medicare Part A Coinsurance In 2023

The Part A deductible pays for the first 60 inpatient days of an enrollees coverage period. There is a daily coinsurance charge if the person requires extra inpatient coverage during the same benefit period. Inpatient treatment will cost $400 per day from the 61st to the 90th day in 2023 . The lifetime reserve days coinsurance will increase to $800 per day in 2022 from $778 per day in 2022.

The first 20 days of care in skilled nursing facilities are covered by the Part A deductible paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility. However, coinsurance applies to days 21 through 100 in a skilled nursing facility. It will increase to $200 per day in 2023 from $194.50 in 2022.

Can I Still Purchase Medigap Plans C And F

MACRA prohibits individuals who become newly eligible for Medicare on or after January 1, 2020, from purchasing Medigap plans C and F . People who became Medicare-eligible before 2020 can keep their current Plan C or F or apply for those plans later, including coverage beginning in 2023.

The Part B deductible is entirely covered by Medigap Plans C and F. However, some Medigap coverage demands that participants cover their own Part B deductible. The change is intended to reduce misuse of services by asking members to pay at least a fraction of the cost of outpatient care rather than having all expenses covered by a combination of Medicare Part B and a Medigap plan.

There is a high-deductible Plan G available in its place because the high-deductible Plan F was eliminated for newly eligible members beginning in 2020.

Read Also: Does Medicare Supplemental Insurance Cover Hearing Aids

What Are Medicare Income Limits

Medicare income limits ensure that beneficiaries with the means to do so are required to pay a larger share of the cost of their coverage.

Our guide to financial assistance for Medicare enrollees includes information about HCBS, Medicaid spend-down, Medicaid for the aged, blind and disabled and more.

Medicare Extra Help 2023 Income Limits

Medicare Extra Help 2023 income limits are not yet available but are due to be released soon.

Income limits for 2022 are $20,385 for an individual or $27,465 for a married couple living together. There also are limits on your other financial resources: Your combined savings, investments and real estate can’t be worth more than $15,510 if you’re single or $30,950 if you are married and live with your spouse. You must meet each of these requirements to qualify for Extra Help.

| 2022 income limit |

|---|

|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

The Medicare Extra Help program assists with monthly Part D costs including monthly premiums, annual drug deductibles and prescription copayments. In 2023, youâll pay a maximum of $4.15 for each generic or $10.35 for each brand-name prescription. Extra Help is estimated to save enrollees about $425 every month.

You can apply for Medicare Extra Help online, at your local Social Security office or over the phone by calling 800-772-1213 .

Extra Help is only available if you’re on Original Medicare and a separate Part D prescription plan. You can’t use Extra Help to reduce drug costs on a Medicare Advantage plan.

Don’t Miss: Does Medicare Cover Medical Emergencies In Foreign Countries