Common Medicare Part D Expenses To Know

While prescription drugs costs under the majority of Medicare Part D plans are low, the amount youll pay will vary by the Part D provider. These are the most common expenses youll need to familiarize yourself with…

Premiums: This is the amount you pay each month to ensure your plan is active.

Annual deductible: The amount you pay before coverage begins. This amount is capped at $435 annually, but some Medicare Part D plans offer zero deductibles.

Copayments: This is the set amount youll pay each time you file a prescription.

Coinsurance: The percentage cost you have to cover.

Coverage gap costs: This applies once your Medicare Part D plan covers $4,020 in drugs. Of course, that also means youll have to cover higher out of pocket costs.

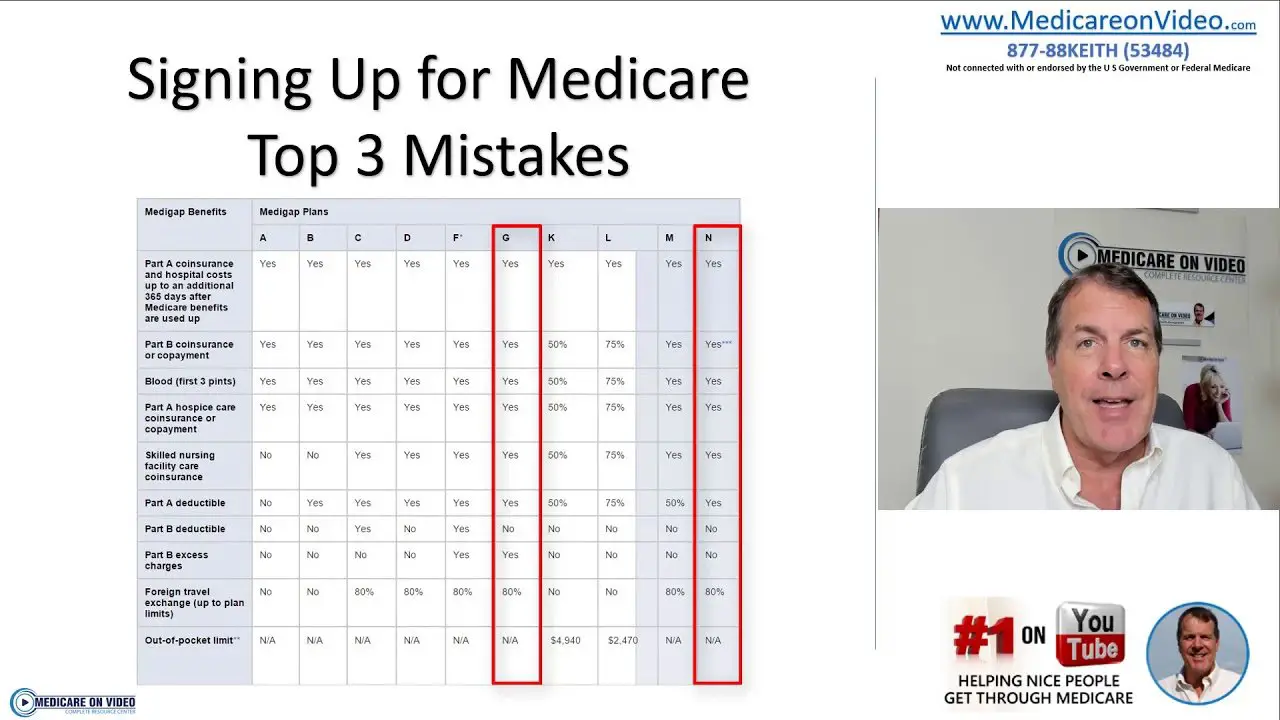

What Are The Best Medicare Supplement Plans Available In 2021

Find out how to choose the right Medicare Supplement plan for you.

Everyday Health may earn a portion of revenue from purchases of featured products.

Knowing how much money to set aside for your healthcare expenses can seem daunting without proper preparation and research. Medicare doesnt meet every coverage need for many people, but there are options available to fill those gaps. Depending on your health and budget needs, enrolling in a Medicare Supplement plan could be a viable option.

Does Medicare Part G Plan Cover Acupuncture Services

Medicare Supplement Plans do not pay for health services directly. Instead, they cover the left-over costs for Medicare-approved services that Part A or Part B did not pay in full. Original Medicare does cover acupuncture for chronic low back pain. If you meet the specific criteria for acupuncture services, Part G will cover the remaining costs. Medicare does not cover acupuncture for other indications.

Recommended Reading: Does Medicare Part B Cover Inpatient Hospital Services

How To Buy Medicare Supplement Insurance

Buying a Medigap policy is a straightforward process. Though the specific steps youll take may vary by insurance provider, here are the basic steps you should expect to go through when purchasing a policy:

- Compare each Medigap plan option available to you and consider which set of benefits best fits your needs.

- After you know which plan youre interested in, find a company licensed to offer this coverage in your state. You can find plans by reaching out to Benzingas recommended providers directly or by searching with Medicares Medigap search tool here.

- When you find a plan from a company you want to work with, complete your application.

Insurance companies are required to provide you with a clear and easy-to-understand statement of your benefits before you buy a Medigap policy. Be sure to read it thoroughly so you understand what is and isnt covered with your plan. If you have questions, contact an insurance agent to ask questions before you agree to a policy.

Pay Less Now And More As You Go With Plan N

Medigap Plan N premiums are the lowest of the top Medigap plans in 2022.

This plan is a top choice for those who:

- Are looking for a relatively low monthly premium

- Are okay with small copayments

- Are not concerned about excess charges

This plan requires you to pay small copayments when you receive certain services, such as $20 at the doctor and $50 for an emergency visit. However, if you visit one of your local urgent care facilities, you wont have any copays.

This particular plan doesnt cover the excess charges. However, Part B excess charges are prohibited in the following states: Connecticut, New York, Ohio, Massachusetts, Minnesota, Vermont, Rhode Island, and Pennsylvania. If youre comfortable with a few copayments in exchange for a lower premium, this could be the plan for you.

Even though Plan N isnt as popular as other letter plans, its one of the Medigap plans we enroll our clients in the most. The reason this plan makes this list is due to its lower premiums. The reason the monthly premiums are lower is because of the copays. In exchange for a lower monthly premium, you agree to pay a $20 copay at the doctors office and a $50 copay at the emergency room.

Recommended Reading: What Is Medicare Advantage Coverage

Top 10 Supplemental Medicare Insurance Companies In 2022

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Plan N coverage is also the same across the board, regardless of whether you go with Cigna, UnitedHealthcare, or any other company that offers the plan. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment which is the majority of doctors, coast-to-coast.

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what youll pay each month. Demographic information such as age, location, and tobacco use affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

Do You Need Medicare Supplement Insurance

If youre experiencing a gap in coverage from Medicare, then you may need to choose supplemental coverage. Explore your options when it comes to finding out what coverage youre lacking and if things like prescriptions, doctor visits, vision, and dental care are covered or if you need help paying for them. If youre not fully covered, then consider purchasing supplemental insurance.

Read Also: When Do I Enroll In Medicare Part B

Best Discounts For People New To Medicare: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

Rates do not increase based on age

-

Also offers Part D drug plans

-

No High-Deductible Plan F

-

Requires dues for AARP membership

UnitedHealth Group was founded in 1977, and its insurance arm, UnitedHealthcare, has been in partnership with AARP since 1997. Combining quality healthcare offerings with one of America’s largest advocacy groups for people over 50, AARP by UnitedHealthcare Medicare Supplement Plans are highly ranked. It offers Plan F, but not High-Deductible Plan F, in all states except for Massachusetts, Minnesota, and Wisconsin.

Enrollment in Medicare Supplement Plan F requires AARP membership, which is $16 unless signing up for automatic renewal, making it $12. Membership comes with added perks, including financial planning services, shopping discounts, and more. Once you are a member, you can reach out to UnitedHealthcare to sign up for Plan F and, if you’re interested, one of the company’s highly-rated Medicare Part D plans for prescription drug coverage.

Reach out to a representative seven days a week, or chat with an agent online at its website. The site is easy to use and provides a wealth of information about Medicare and Medicare Supplement Plans. The company did not provide a quote to us over the phone because we were not applying for a plan.

UnitedHealthcare offers several discounts, so be sure to ask for available discounts when you sign up to save even more on Plan F.

Does It Matter Which Insurance Company I Purchase My Medicare Supplement Plan From

While it is true that every insurance company must provide identical coverage under each standardized plan type, the prices each charged for that same coverage can vary. Once you identify the plan type that will work best for your specific needs, it is definitely in your best interests to do a bit of shopping around to find the coverage you want at the best possible price.

Also Check: What Preventive Services Are Covered By Medicare

Forget Copays Just Pay Your Premium With Plan F

Plan F is the all-inclusive Medigap plan. It leaves you with zero out-of-pocket costs. It covers the Part A and B deductible. You wont ever spend a dime on any medical services outside the premium. But, the legislation didnt like this. So, they proposed Medicare changes and discontinued Plan F to those newly eligible after 2020. Plan F is the most comprehensive policy you can purchase.

This plan is an excellent choice for those who:

- Frequent doctors offices and hospitals

- Live in a state that allows excess charges

- Often travels outside the U.S.

For those eligible, there is a value-added version of this plan. Plan F also comes with a high-deductible version.

Centene : Lowest Monthly Rates

Medicare stars: 3.6 out of 5

Avg. monthly cost: $32

Avg. Part D drug deductible: $365

NAIC Complaint Index: 0.15

With both HMO and PPO prescription drug plans available, Cetene and its subsidiary WellCare provide a broad selection of plan options.

The Medicare Part D plans are widely available and moderately well ranked. Rankings do vary by location, so check to see how your local plans score. Notably, WellCare’s prescription insurance has a very low rate of consumer complaints, only about one-sixth of the average rate.

Plans are affordable, averaging $32 per month, and there are no deductible requirements for generic drugs when with WellCare Value Script, WellCare Wellness Rx and WellCare Medicare Rx Select.

Don’t Miss: How Much Money Is Deducted From Social Security For Medicare

Compare Medicare Supplement Insurance Plans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that arent covered in Original Medicare. A Medicare Supplement Plan might cover copayments, coinsurance or deductibles you owe under Original Medicare.

Medicare Supplement Plans operate as additional not primary insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio .

Do All Doctors Accept Medicare Supplement Plan Insurance

Although most physicians do accept Medicare payments, there are some that do not. You must ask your health care provider about accepting Medicare assignment this means that they will be willing to accept the amount Medicare pays for services. There are many reasons a doctor may refuse to take Medicare, including low reimbursement rates, administrative paperwork that must be done, and more.

Also Check: How To Apply For Medicare In Hawaii

What Are My Options For The Best Medicare Supplement Plan

Its important to know that you can only use a Medigap plan if you have Original Medicare . As of 20201 there are eight different Medicare Supplement plans sold to new beneficiaries: A, B, D, G, K, L, M, and N. Each Medicare Supplement plan must include the same standardized benefits regardless of carrier and location.* However, different types of Medicare Supplement plans offer different levels of coverage. . Medigap policies are guaranteed renewable, which meansas long as you pay the premiumthey cant be canceled for health reasons.

Best User Experience: Humana

-

Some of the deductibles run higher than other plans

-

Lack of detailed educational information about each plan’s coverage

-

Not available in all 50 states

Humana’s website offers easy-to-use, self-explanatory content that makes the process of finding the best Medicare Supplement policy simple and straightforward. Each plans coverage details are clearly displayed by ZIP code, without needing to enter your personal information into the site. You can also request an in-person appointment with a Humana Medicare agent.

You can compare specific plans if you enter your personal data, and Humana also provides a PDF with detailed plan information by state. Deductibles for some Humana plans are a little higher than other carriers. Humana covers every state with the same basic plans, including Parts A, B, C, F, G, K, L, and N. Plan F has an additional high-deductible option.

Humana earns an A- with AM Best for financial health. The MyHumana app is available from both Google Play and Apple’s App Store.

Also Check: Does Medicare Medicaid Cover Dentures

Best Medicare Prescription Drug Plans

Choosing the right prescription drug plan can be as important as any of your other Medicare decisions. Especially when you consider the cost of drugs today.

COMING SOON: The Association hopes to make available an incredibly valuable free tool for consumers. It will allow you to easily enter your drug information and check if there is a better option available for you. This way you do not need to speak with an insurance agent who might try to sell you on a different plan. The automatic online system will be prominently featured on our website.

The American Association for Medicare Supplement Insurance is an independent organization that advocates for the importance of this protection. AAMSI organizes the Medigap industrys annual conference and make available the only independent national directory of agents. In addition, we have two sister organizations, the American Association for Long-Term Care Insurance and the American Association for Critical Illness Insurance.

We welcome hearing comments and feedback.

Cvs Health : Best Plan Features

Medicare stars: 3.75 out of 5

Avg. monthly cost: $35

Avg. Part D drug deductible: $250

NAIC Complaint Index: Variable based on subsidiary

CVS Health and its subsidiaries, Aetna and Silverscript, are very popular for prescription drug coverage, accounting for about 23% of all Medicare Part D enrollments.

Plans are affordably priced, and the SilverScript SmartRx plan costs just $7.15 per month. The strongest coverage is available with the SilverScript Plus plan, which has a $0 deductible across all drug tiers and additional gap coverage.

A key advantage of these plans is that members get access to the digital tools of CVS Caremark. This includes resources for prescription pricing, discounts, deductible tracking, spending summaries and more.

Note that CVS Caremark mail order pharmacy had the worst customer satisfaction of all pharmacies studied by J.D. Power. This reveals that even when plan coverage is strong, there could be frustrations when ordering medications via mail.

If you want to combine your prescription drug coverage with other types of Medicare, Aetna offers some of the cheapest Medicare Advantage plans on the market.

Read Also: When Is Medicare Supplement Open Enrollment

What Is Excluded From Health Insurance Coverage

Most types of health insurance exclude some types of coverage or expect you to pay some of the cost of your care.

Items that are and are not covered vary greatly among employer-based and individual health insurance plans. However, since the passage of the federal Affordable Care Act — often known as Obamacare — virtually all standard health insurance plans must cover a set of 10 categories of services.

These services – – known as “essential health benefits” — include things such as:

- Physician services

- Hearing aids and exams for fitting them

- Routine foot care

Medicare Advantage plans may cover some of those items. Otherwise, you will have to find separate coverage or pay for those services yourself.

What Is The Best Health Insurance For Seniors

For most people, senior health insurance plans basically boil down to Medicare. There are two main ways to get Medicare:

Original Medicare. Original Medicare provides coverage in two parts. Part A is hospital insurance Part B is medical insurance. Those who sign up for Original Medicare can use any hospital or doctor accepting Medicare.

People with Original Medicare also can sign up for additional coverage, such as Medicare prescription drug coverage and Medicare supplement insurance, also known as Medigap.

A Medicare Advantage Plan. Also known as Part C, this type of coverage is often described as an “all in one” package that combines coverage found in Parts A, B and D. Some of these plans, which private health insurance companies offer, have lower out-of-pocket expenses than Original Medicare.

However, unlike Part B coverage, those with Medicare Advantage coverage typically need to see physicians and other providers in the plans network and service area if they want the lowest health care costs.

Part C offers some benefits not found in Original Medicare, such as:

- Vision

Recommended Reading: What Is Part B Excess Charges In Medicare

How Much Do Medicare Part A And Part B Cost In 2022

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $499 per month in 2022.If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

- The standard Part B premium is $170.10 per month in 2022.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2022.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Top 10 Medicare Supplement Insurance Companies In 2022

Home / FAQs / Medigap Plans / Top Medicare Supplement Companies

When shopping around for the best Medigap policy available to you, its helpful to be familiar with the top 10 Medicare Supplement insurance companies in 2022. Whether youre new to Medicare or are now considering supplemental coverage a few years after enrolling, were here with the information you need to make the best decision!

For a company offering Medigap to be one of the best, we must consider several elements. These measures include consumer reports, AM Best rating, Standard and Poor rating, and the companys number of years in the market. Knowing about these carriers reputations will help when you compare Medigap rates to find the best plan for your budget.

Also Check: Does Medicare Pay For Prep