Can You Have Employer Coverage And Part D

When it comes to Part D, you can delay enrollment if your employer group insurance has prescription coverage. This is similar to Part B. Always compare your group insurance to what the cost of Medicare + Medigap + Part D would cost. Its cheaper to leave group insurance and enroll in a Medicare Supplement plan and Part D plan.

How Do You Keep Your Card And Information Safe

If you dont want to carry the card with you when youre not going to the doctor, you should keep it in a safe place at home, such as a locked desk drawer or a fireproof safe.

Be sure to put it back in the same place every time once youre done using it. If you forget where you put it, you may need to get a replacement card.

Before 2018, Medicare cards used a subscribers Social Security number as their ID, which led to problems of identity theft. Now that your Medicare number is no longer your SSN, its less risky to lose the card. Nonetheless, you should still be careful about giving out your Medicare number to anyone other than a doctor, pharmacist, insurer or other healthcare professional. Protect it as you do your credit cards, since con artists are always trying to get Medicare beneficiaries personal information.8

Getting Help With Your Medicare Coverage After Divorce

Things can get messy after a divorce, and you may not know what your options are for Medicare. Also, Medicare and Social Security can be challenging to understand.

Some people worry about Medicare or Social Security running out of funds. But, the National Committee of preserving Social Security and Medicare wont let that happen.

And, when you have any questions about Medicare or your coverage options, were here to help you along.

Give us a call at the number above for more information on help with costs. Cant call? We get it, fill out our online rate form, and get your quote today.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Also Check: Does Costco Pharmacy Accept Medicare

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

A You Can Continue Working And Start Receiving Your Retirement Benefits

If you start your benefits before your full retirement age, your benefits are reduced a fraction of a percent for each month before your full retirement age.

You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced if you earn more than the yearly earnings limits.

After you reach your full retirement age, we will recalculate your benefit amount to give you credit for any months you did not receive a benefit because of your earnings. We will send you a letter that explains any increase in your benefit amount.

If you delay filing for your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. If you also continue to work, you will be able to receive your full retirement benefits and any increase resulting from your additional earnings when we recalculate your benefits. Once you reach full retirement age, your earnings do not affect your benefit amount.

If you start receiving retirement benefits before age 65, you are automatically enrolled in Original Medicare when you turn 65. If you or your spouse are still working and covered under an employer-provided group health plan, talk to the personnel office before signing up for Medicare Part B. To learn more, read our Medicare publication.

Read Also: Does Medicare Part B Cover Prolia Shots

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Read Also: Does Medicare Cover Full Body Scans

Does Medicare Send A 1095

Income tax forms related to healthcare can seem a little complicated, and when you first become eligible for Medicare, you may wonder what information you need when filing your annual tax return. Changes in healthcare have also contributed to some confusion regarding the forms you may receive. People must provide information about their income to the IRS, but understanding forms related to your Medicare coverage can help you keep track of important tax-related documents.

What Is The 1095-A Form?

In short, the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The form includes basic personal information, such as your name, address, and insurance provider. It also lists anyone covered on the insurance policy, such as you, your spouse, and any children. It gives a breakdown of each month of the previous year, noting which months you had coverage, the cost of your premium, and any tax credit advance. Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form.

What Form Can You Expect with Medicare Coverage?

What Should I Do with the Form?

Do you need to fill out any information on the 1095-B form? As a general rule, no. You shouldnt have to fill out the 1095-B form. If you receive one, it should come to you pre-filled by Medicare or your Medicare Advantage provider.

Related articles:

How Long Does It Take To Sign Up

That depends on the method you choose. It can take as little as 10 minutes to sign up online, a month or more by phone or, if you prefer to sign up in person, it will depend on how long it takes to get an appointment.

- Medicaid number, if applicable, with start and end dates.

- Start and end dates for group health insurance through your employer.

- Start and end dates of employment with the employer providing your group health plan.

Once your account is set up, you can start the Medicare application process here. Its unlikely that youll need to sign anything physically.

When youre finished applying online, youll get a confirmation number. Keep it handy and use it to check the status of your application through your My Social Security account. Social Security will let you know if more information is needed.4

You May Like: How Much Medicare Is Taken Out Of Social Security Check

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Sometimes Youre Automatically Enrolled In Medicare

Medicare enrollment may happen automatically if the following situations apply.

If you turn 65 years old

If youre already receiving Social Security or Railroad Retirement Board benefits, youll be automatically enrolled in Original Medicare, Part A and Part B, when you reach age 65. Your Medicare card should arrive about three months before your 65th birthday, and your Medicare coverage starts the first day of the month you turn 65.

If you retire before 65

You can apply for Social Security retirement benefits when youre 61 years and 9 months old or older see the agencys contact information below. However, in most cases, you dont qualify for Medicare until the age of 65 .,

If youre eligible for Railroad Retirement Board benefits, see the agencys for information about retiring before age 65, or call them at the number listed below.

If you qualify for Medicare because of disability

If you get Social Security or Railroad Retirement Board disability benefits, youll be automatically enrolled in Medicare after 24 months of collecting disability. Your Medicare card should arrive in the 25th month.

If you have amyotrophic lateral sclerosis

People with ALS, or Lou Gehrigs disease, are automatically enrolled in Medicare Part A and Part B the same month their disability benefits start.

Unless the situations above apply to you, youll need to manually enroll in Medicare. If thats you, heres how to get your Medicare card.

Don’t Miss: Does Medicare Pay For Mens Diapers

What Do You Need To Know About Your Medicare Card

Your red-white-and-blue paper Medicare card is similar to other health insurance cards you may have had in the past. It acts as proof that you have Medicare health insurance, and it provides the starting date of your coverage.

Did You Know?

A red-white-and-blue paper Medicare card is mailed to adults who are turning 65 and enrolled in Medicare.

Medicare Advantage Eligibility Requirements

While regular Medicare Advantage does not cover ESRD, you may qualify for a Medicare Special Needs Plan. SNPs are special types of Advantage plans specifically designed for a particular condition or financial situation.

You can keep your Medicare Advantage plan if you purchased it before developing ESRD. And you can buy an Advantage plan after being medically determined to no longer have ESRD usually from a successful kidney transplant.

Don’t Miss: Who Pays The Premium For Medicare Advantage Plans

How To Get $148 Back From Medicare

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Though not an official Medicare program, this benefit is offered by some Medicare Advantage plans and covers some or all of your Part B monthly premium .

While not all plans offer this benefit, it’s possible to find one where you’d pay a reduced premium amount up to $148. This can help maximize your savings while on Medicare, though there are a number of considerations when deciding if these plans are right for you. Read on to learn more about the giveback benefit and how you could qualify.

What is the Part B premium reduction benefit?

When you’re enrolled in Medicare Part B, you must pay a monthly premium of $148.50. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

Even though you’re paying less for the monthly premium, you don’t technically get money back. Instead, you just pay the reduced amount and are saving the amount you’d normally pay.

If your premium comes out of your Social Security check, your payment will reflect the lower amount. If you don’t pay that way, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you’d only pay the amount with the giveback benefit included.

How do I qualify for the giveback?

What Information Is On Your Medicare Card

Besides your full name, your Medicare card includes your Medicare number as well as important information about the health insurance coverage to which you are entitled. This includes:2

- Medicare numberThis is one of the most important pieces of information on your Medicare card. Its what the billing department will use when it submits for reimbursement from Medicare. Your Medicare number used to be your Social Security number , but now its a more secure, randomly generated combination of 11 numerals and capital letters. It is confidential and should only be shared with people you trust.3

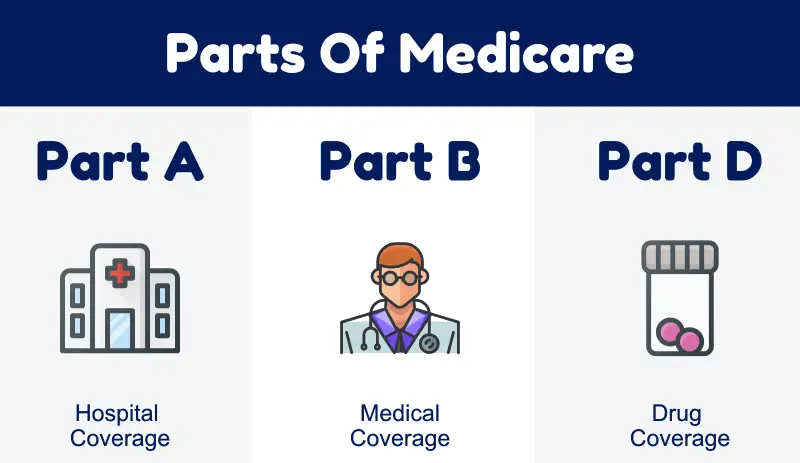

- Part AIf you have Part A, labeled HOSPITAL, you are entitled to care in a hospital or skilled nursing facility, hospice care and home healthcare. The date your coverage begins is also included.4

- Part BIf you have Part B, labeled MEDICAL, you are entitled to medical care and preventive services. Your coverage starting date for Part B is also included.5

If you are enrolled in a Medicare Advantage Plan, you will receive a separate ID card. If your plan covers prescription drugs, your MA card will include that information too. You should use your MA card as your primary Medicare card, but you should still keep your Medicare card in a safe place.

Good to Know

Your Medicare number is no longer your Social Security number, but a more secure combination of letters and numbers that helps protect you from identity theft.

Recommended Reading: Can Medicare Be Used Out Of State

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

Medicare Eligibility At 65 And Older

The year you turn 65, you can apply for Medicare starting three months before your birth month until three months after. You generally have to meet three eligibility requirements to qualify for full Medicare benefits when you turn 65.

The chief requirement is that you must be a U.S. citizen or permanent legal resident who has lived at least five years in the United States.

In addition, you have to meet one of the following other requirements:

- You or your spouse must have worked long enough to also be eligible for Social Security benefits or for railroad retirement benefits. This usually means youve worked for at least 10 years. You must also be eligible for Social Security benefits even if you are not yet receiving them.

- You or your spouse is either a government employee or retiree who did not pay into Social Security but did pay Medicare payroll taxes while working.

Paying Medicare payroll taxes for 10 full years means you wont have to pay premiums for Medicare Part A, which covers hospital care.

You dont need the work credits to qualify for Medicare Part B, which covers doctor visits or outpatient services, or Medicare Part D, which covers prescription drugs. But everyone has to pay premiums for both.

You can still get Medicare if you never worked but it may be more expensive depending on your spouse or total work history.

Prepare for Medicare Open Enrollment

Recommended Reading: Is Labcorp Covered By Medicare