Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrigs disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If youre eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you dont sign up for Part B when you are first eligible, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didnt enroll.

However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicares website to find out more.

You May Like: When Can I Apply For Medicare In California

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

Recommended Reading: Is A Walk In Tub Covered By Medicare

Find Cheap Medicare Plans In Your Area

For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing. Keep in mind that what you pay for a Medicare Part C plan will be on top of the cost of Original Medicare.

Which Benefits Do I Need

Think about the benefits you would use under each plan and your potential savings.

- Do you anticipate needing regular treatment or services? If so, how much are you paying for each visit?

- Would you use an out-of-network doctor, and if so, what is the added cost?

- Is there prescription drug coverage, or do you need to purchase a separate Medicare Plan D? Note: If you enroll in an HMO or PPO that does not have drug coverage, you cannot purchase a separate Part D plan.

- If youre taking regular medications, what are your prescriptions costs under each plan?

- Do you see a dentist regularly? What does it cost for routine cleanings under each plan?

- If youre unlikely to use a benefit, such as a fitness membership or non-emergency transportation, is there a plan without the benefit that may be cheaper?

Recommended Reading: Is A Chiropractor Covered By Medicare

Medicare Part C Vs Original Medicare

Under Part A and B, there are no provider networks so, you can go to any doctor or hospital you want, so long as they accept Medicare.

Private insurance companies offer Part C through HMOs and PPOs. For each, theres a list of in-network healthcare providers.

If you go to a provider out of the network, your claim may not have coverage, or youll pay more for services.

By comparing Medicare Advantage vs. Medicare Supplement side by side, you can figure out which you prefer.

Worries About How Much Medicare Costs

If youre concerned about Medicare costs rising, youre not alone. An eHealth study in 2019 found that 43% of survey participants worry that they might not be able to afford Medicare coverage costs going up in the future. Most participants also worried about future Medicare benefits being scaled back.

While its always good to keep an eye on your Medicare costs, heres some good news. Another eHealth study reported that Medicare Advantage premiums went down between 2019 and 2020, and held steady in 2021.*

The Kaiser Family Foundation reported that the government increased Medicare spending by 1.7% per year on average from 2010 to 2018. But Medicare expects to increase spending by an average of 5.1% per year from 2018-2028. This increase is because of growing Medicare enrollment, higher use of services and intensity of care, and rising health-care costs.

Also Check: Is Medicare The Same As Ahcccs

Extra Help For Medicare Part D

Extra Help is an assistance program that helps lower income individuals more easily afford Medicare Part D. Extra Help helps pay for Part D premiums, deductibles and copayments/coinsurance.

Learn more about Medicare Part D Extra Help, including how to qualify, where Extra Help is offered and how to find other assistance programs designed to help cover Part D prescription drug costs.

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Recommended Reading: How Do I Get Dental And Vision Coverage With Medicare

What Is The 2022 Medicare Part B Deductible

The rate for the 2022 Part B deductible is $233 per year . This is an increase of $30 per year from the 2021 Part B deductible

Premiums for Medicare Part C and Medicare Part D are on an opposite trajectory. While Medicare Part A and Part B premiums have historically gone up nearly every year, premiums for private Medicare plans have been dropping in recent years. In 2022, the average Medicare Advantage premium is $62.66 per month, though many Medicare Advantage plans feature $0 monthly premiums.

Standalone Part D plans have an average monthly premium of $47.59 per month in 2022.

What Is The Best Supplemental Medicare Plan

Theres no single supplemental health insurance plan for seniors that fits everyone. But there is most likely a plan that will fit your specific needs. HealthMarkets can make finding a plan easy. Get a quote for supplemental health insurance for seniors, at no cost to you. You can also call to speak to a licensed insurance agent.

48203-HM-1221

Read Also: When Is Medicare Supplement Open Enrollment

Read Also: Can You Get Medicare If You Work Full Time

Medicare Part D Prescription Drug Coverage

What it covers:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

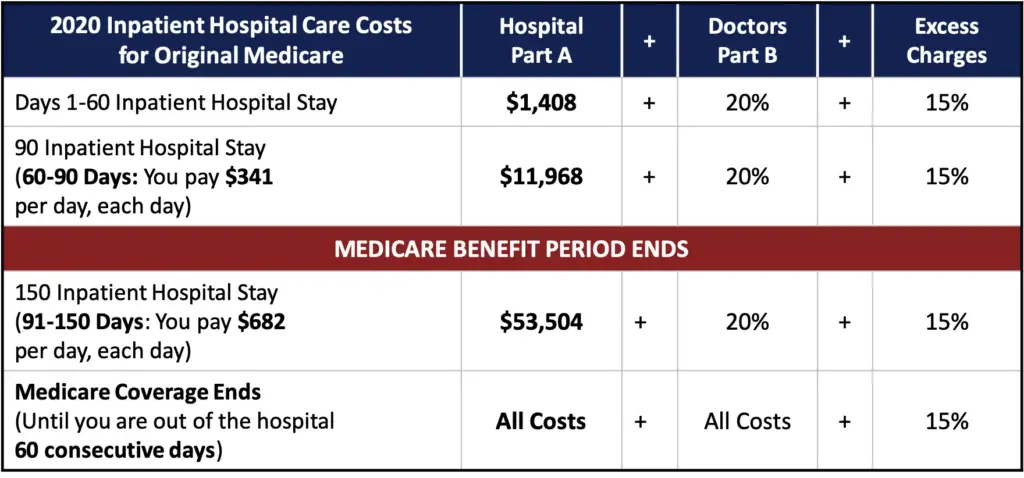

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

Recommended Reading: How To Determine Medicare Eligibility

How Is Medicare Part D Funded

About 73% of the $105.8 billion in Medicare D spending is derived from general revenue. An additional 15% is generated by beneficiary premiums, while another 11% in funding comes from payments from the state for dual eligible beneficiaries who qualify for both Medicare and Medicaid because of having a low income.

Medicare Part D is an optional benefit that helps beneficiaries enrolled in Original Medicare pay for prescription drug coverage. Private insurance companies administer Part D prescription drug plans, charging beneficiaries premiums, deductibles and copays as part of the policies coverage of prescription drugs.

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2021, the Plan A deductible increased from 2020:

- Medicare Part A deductible 2020: $1,408

- Medicare Part A deductible 2021: $1,484

Recommended Reading: When Am I Eligible For Medicare Benefits

Total 2022 Monthly Medicare Costs

When we total up all of your monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B â

- Get a quoteâ¯for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Much Is Medicare Supplement Plan F

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

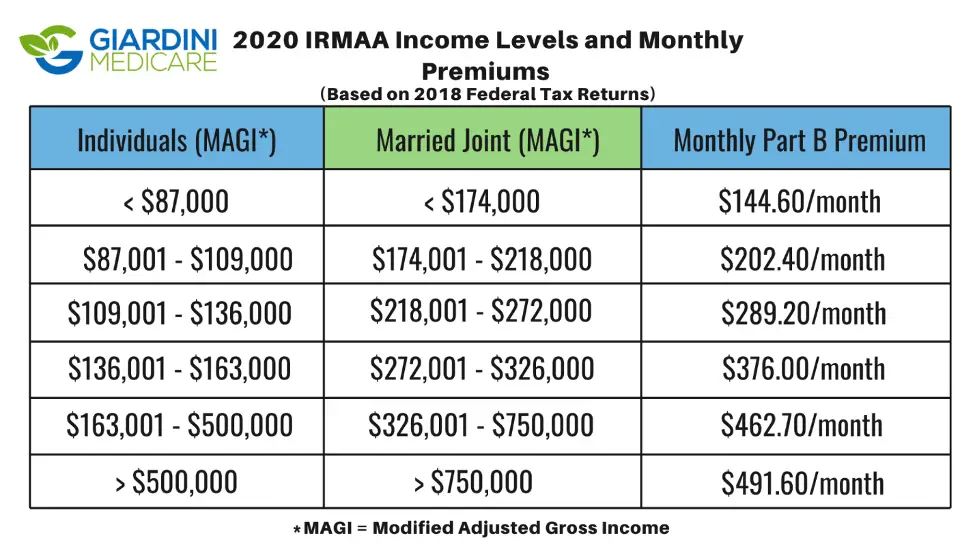

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

Recommended Reading: Does Medicare Pay For Visiting Nurses

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

What Is Part C

Before getting into Part C costs, its important to understand what Part C is. Part C, also known as Medicare Advantage, is a way of getting your Medicare benefits through a health insurance plan from a private insurance company. Unlike other parts of Medicare, Part C doesnt refer to a specific type of care. Medicare Part A covers inpatient care, and Part B covers outpatient care, but Part C will cover both of these, as well as prescription drugs in some cases.

Although Medicare Part C plans are heavily regulated by the government, they will essentially function the same way that other private insurance plans do. You will have a provider network, the plan can change each year, and the cost will vary depending on coverage and other conditions.

All Part C plans have to cover at least the same things that Original Medicare cover. This means that Part C plans will cover inpatient services like hospital stays and hospice care, but also outpatient services like doctor visits and medical equipment. If a specific service is covered under Original Medicare, it will be covered by Part C plans as well.

This coverage can be limited by provider networks. On the other hand, most Medicare Advantage plans will offer more than Original Medicare does. This can include things like dental and vision plans, as well as specialized care for specific health conditions, fitness plans, and more.

Don’t Miss: How Much Do Medicare Plans Cost