What Is The Medicare Deductible For 2022

The annual Part B deductible has increased to $233 which is $30 more than last year. The standard Part B premium is increasing to $170.10 monthly, which is $21.60 more per month than before.

Part A is free for most people. The Part A deductible increases annually. In 2022, the deductible will be $1,556 for each benefit period. That makes the increase $72 more than last year. But, those who buy into Medicare could pay a full Part A premium of $499 each month. And, those who paid 30-39 quarters could pay $274 per month.

The inpatient hospital benefit period costs are rising slightly for 2022. For days 1-60 beneficiaries will continue to pay $0 each day. Days 61-90 now cost $389 per day. Finally, for days 91 and beyond, youll pay $778 coinsurance for each day. Now, skilled nursing facility copayments also saw an increase days 21-100 cost $194.50 per day.

Medicare Part D And Calpers Medicare Health Plans

CalPERS participates in a Medicare Part D prescription drug plan for members enrolled in a CalPERS Medicare health plan.

The standard Part D premium is paid through your CalPERS health insurance premium. If your income exceeds a federal threshold as determined by the SSA, you may be subject to an additional Income Related Monthly Adjustment Amount for Part D prescription drug premiums. You’ll either receive an invoice for the additional amount, or it’ll be deducted from your Social Security benefits. Non-payment of the additional prescription drug premium will result in cancellation of your CalPERS health coverage.

If you enroll in a CalPERS-sponsored Medicare Advantage Plan that includes Part D prescription drug coverage in its benefit package and you are subject to an additional Medicare Part D premium, you must pay the additional Medicare Part D premium, or your health coverage will be canceled. If you re-enroll at a later date, you may incur a federal late enrollment penalty.

Do not enroll in a non-CalPERS Medicare Part D plan. If you do so, CMS will disenroll you from your CalPERS-sponsored Medicare Advantage Plan or Medicare Part D prescription drug plan resulting in cancellation of your CalPERS health coverage and you’ll be responsible for your prescription drug costs.

Unitedhealthcare And Humana Account For Nearly Half Of All Medicare Advantage Enrollees Nationwide In 2021

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 45 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates account for another 14 percent of enrollment in 2021. Four firms account for another 23 percent of enrollment in 2021.

Read Also: How To Calculate Medicare Tax

What Do Mbis Look Like

The MBIs are:

- Clearly different than the HICN and RRB number.

- 11-characters in length.

- Made up only of numbers and uppercase letters if you use lowercase letters, our system will convert them to uppercase letters.

The MBI doesnt use the letters S, L, O, I, B, and Z to avoid confusion between some letters and numbers . Learn about and use our MBI format specifications to make changes to your systems.

Do the MBI’s characters have any meaning?

Each MBI is unique, randomly generated, and the characters are “non-intelligent,” which means they don’t have any hidden or special meaning.

The Cost Of Medicare Supplement Plan G In New Mexico

Medicare supplement Plan G costs an average of $149.90 per month in New Mexico. Meanwhile, Humana, the cheapest provider, charges an average monthly premium of $105 for a 65-year-old, while Aetna, the most costly provider, charges an average monthly premium of $144.90. This demonstrates that through comparison shopping, you may save almost $40 per month.

However, the prices shown here are for a 65-year-old Medicare purchaser. Your actual Plan G costs will vary based on your age at the time of purchase, your current age, any discounts and underwriting factors.

Sort by Age:

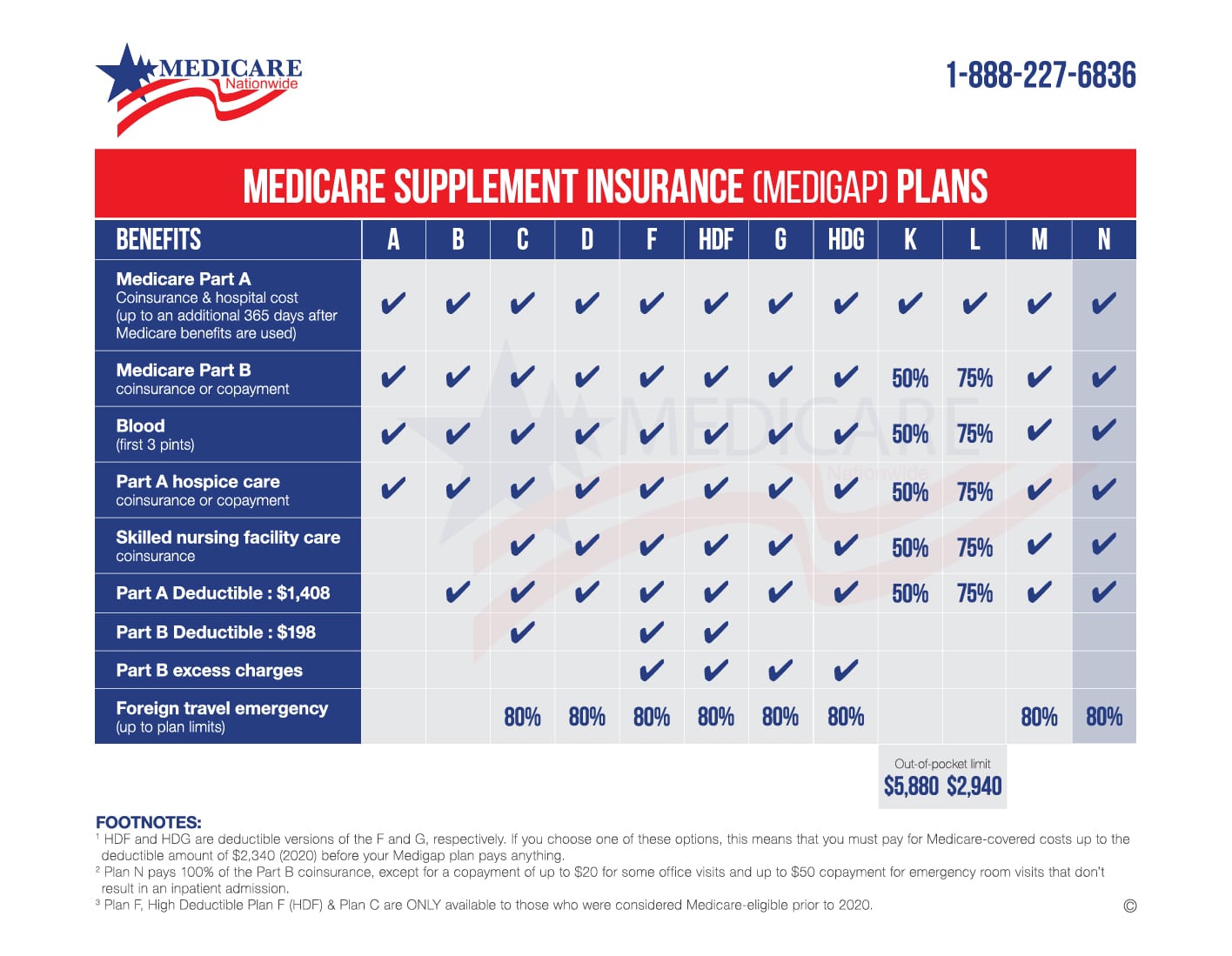

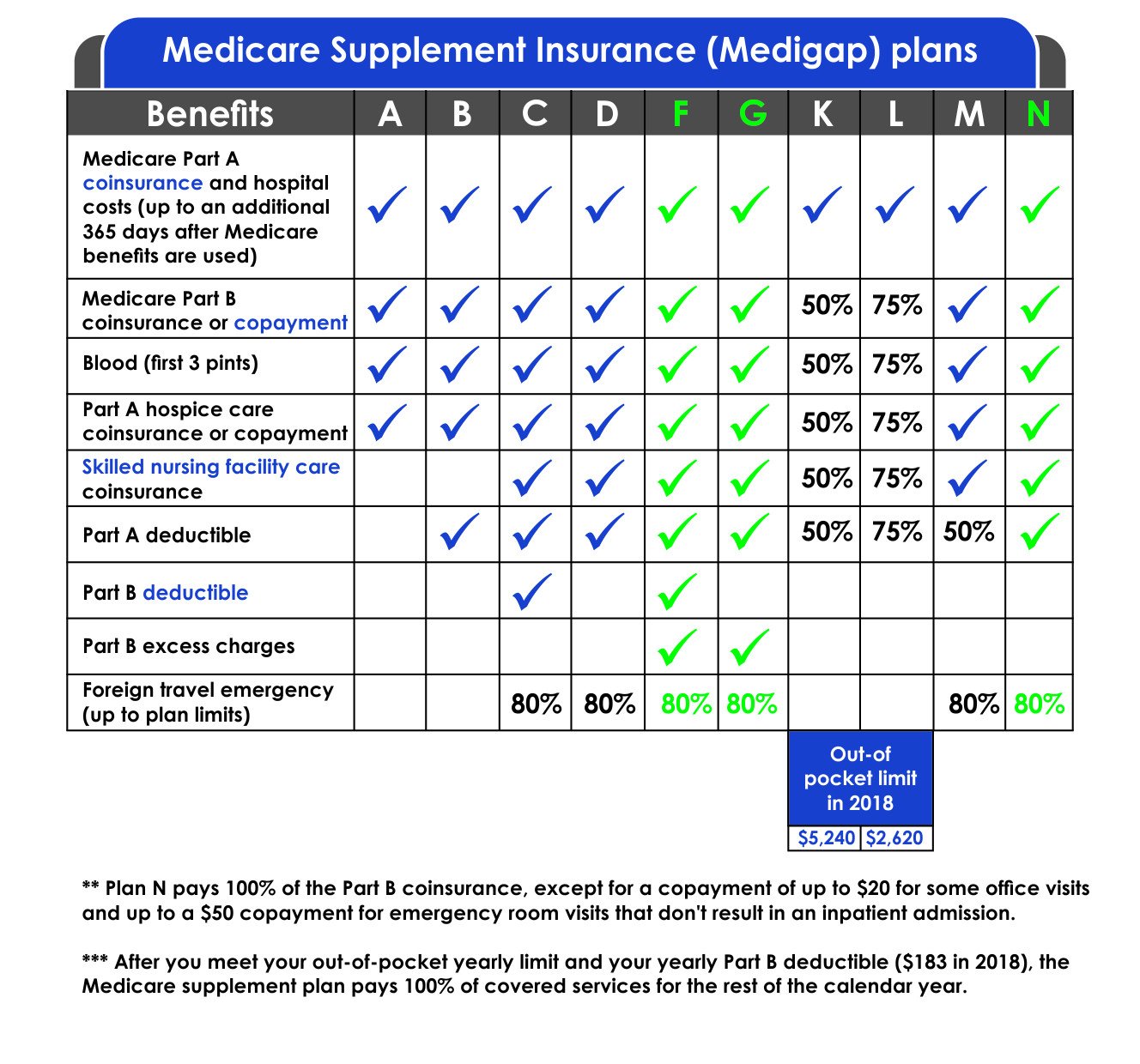

- Foreign travel exchange 80%

Also Check: When Do I Qualify For Medicare Insurance

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

How Is Medicare Part D Prescription Drug Coverage Changing For 2022

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021.

And the out-of-pocket threshold will increase to $7,050 in 2022, up from $6,550 in 2021. The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.95 for generics and $9.85 for brand-name drugs.

Some Medicare beneficiaries with Part D coverage will continue to have access to insulin with a copay of $35/month, and more insurers are participating in this program for 2022.

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a hole for brand-name or generic drugs: Enrollees in standard Part D plans pay 25% of the cost until they reach the catastrophic coverage threshold. Prior to 2010, enrollees paid their deductible, then 25% of the costs until they reached the donut hole, then they were responsible for 100% of the costs until they reached the catastrophic coverage threshold.

That amount gradually declined over the next several years, and the donut hole closed one year early in 2019, instead of 2020 for brand-name drugs.

The donut hole is still relevant, however, in terms of how drug costs are counted towards reaching the catastrophic coverage threshold, and in terms of who covers the costs of the drugs . Heres more about how that all works.

Also Check: How To Check Medicare Premium Payments

Do You Need A Medicare Supplement In New Jersey

| Should you consider a Medicare supplement? | |

Yes, if you:

|

No, if you:

|

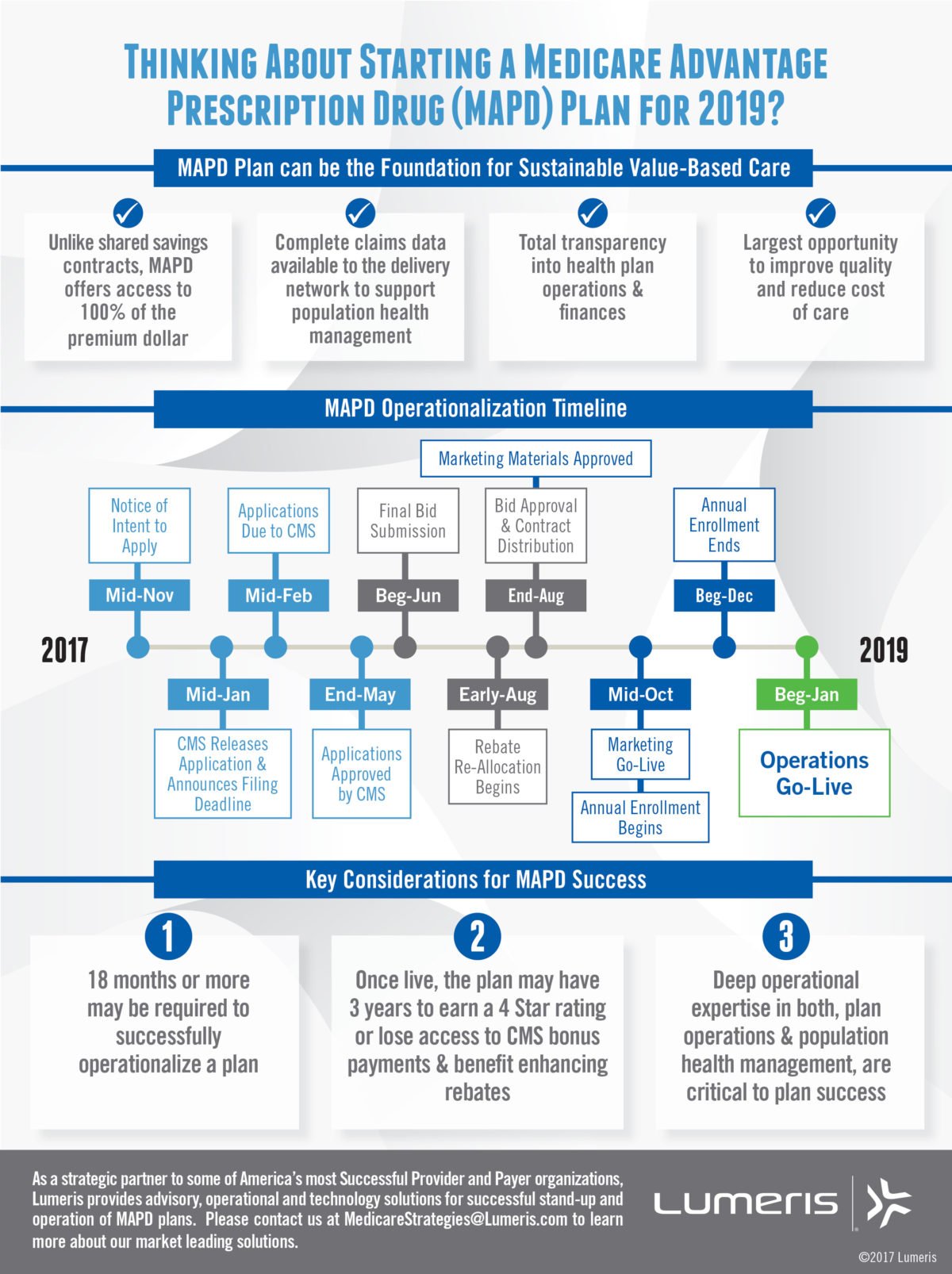

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Read Also: Is It Worth Getting Medicare Part D

All Part A Coinsurance And Deductibles Paid

Medicare Part B

- Part B coinsurance of 20%

- Any Part B excess charges

- Coinsurance for skilled nursing facilities

- Up to 3 pints of blood

With Medicare Plan G there are also emergency foreign travel benefits. This pays 80% of your emergency medical care after you pay a $250 deductible. There is a $ 50,000-lifetime max with this benefit.

To get started and see which plan is best for you, give us a call now!

New Jersey Medicare Supplement Plans Comparison Chart

In terms of coverage and availability, Medigap policies vary. Plan F and C, for example, provide the most extensive coverage but are not available to new enrollees. Your next best options are Plan G or Plan D.

You may compare Medicare Supplement plans in New Jersey shoulder to shoulder using MoneyGeek’s chart. It displays the differences in coverage as well as the average cost.

Medicare Supplement Comparison Chart

Read Also: Can You Get Medicare Advantage Without Part B

Wait Times And Access

Common complaints relate to access, usually to accessing family physicians , to elective surgery and diagnostic imaging. These have been the primary targets of health care reinvestment, and it appears that considerable progress has been made for certain services, although the implications for procedures not on the target list are unclear. Canadian physicians have been heavily involved, particularly in developing appropriateness criteria to ensure timely access for necessary care. It is estimated to have cost Canada’s economy$14.8 billion in 2007 to have patients waiting longer than needed for medical procedures, assuming all patients normally work, and cannot work while waiting.The Fraser Institute completed a study in October 2013, Waiting Your Turn: Wait Times for Health Care in Canada. The authors surveyed both private and publicly funded outpatient health care offices and estimated the amount of wait time between general practitioner and specialists for elective treatments such as getting breast implants. The Fraser Institute estimates that the wait times for elective treatments have increased 95 percent from 1993 to 2013.

The Cost Of Medicare Supplement Plans In New Jersey

The cost of Medicare Supplement Plans in New Jersey varies according to the plan you choose and the company. Horizon is the most cost-effective option in New Jersey for most of the plan options . Meanwhile, Aetna is the cheapest for Plans B, C, D and N, while UnitedHealthcare is the most cost-effective for Plan L.

Companies in New Jersey use the pricing styles described below to determine premiums:

- Attained-Age: This is the most popular pricing method used by New Jersey providers. Premiums are based on your current age . This implies that your rates will rise as you get older.

- Issue-Age: In New Jersey, this is the second most popular price plan. The premium is calculated according to your age at the time of purchase. Prices may grow due to causes other than age, such as inflation.

- Community-Rated: Providers of community-rated plans charge the same monthly cost regardless of age.

Average Cost of Medicare Supplement in New Jersey

Sort by Plan Letter:

- $132

You May Like: What Does Medicare Cover Australia

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

A Guide To New Brunswick Medicare Health Plan

Unfortunately, New Brunswickers feel like their healthcare needs arent met. The provincial health has many systemic challenges and numerous gaps that prevent it from improving the health of New Brunswick residents. According to a poll conducted by the NBMS , more than 44,000 residents dont have a family doctor. Many of them who dont have family doctors face lengthy wait times before being able to see one.

Right now, the government is working on a new system that would provide access to primary care to patients without a nurse practitioner or family doctor. Residents without a medical provider can register with Patient Connect NB. They will be assigned a provider on a first-come, first-serve basis.

Read on to learn more about NB Medicare Health Plan, the eligibility requirements, ways to obtain a health care card, and understand why additional health and dental coverage is important. If you are a permanent resident of New Brunswick, you should know how to take advantage of the provincial healthcare benefits.

Don’t Miss: How To Sign Up For Medicare Advantage

Is The Medicare Part A Deductible Increasing For 2022

Part A has a deductible that applies to each benefit period . The deductible generally increases each year, and is $1,556 in 2022, up from $1,484 in 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Under 65 Don’t Miss Your Initial Enrollment Period

Generally, you qualify for Medicare if you are 65 or older.

You can enroll in Medicare and other extra coverage up to 3 months before you turn 65, the month you turn 65, and the 3 months after you turn 65. This is called your Initial Enrollment Period.

If you donât qualify for full benefits you can still get Original Medicare you just have to pay a premium.

Read Also: Where Can I Go To Apply For Medicare

Nearly One In Five Medicare Advantage Enrollees Are In Group Plans Offered To Retirees By Employers And Unions In 2021

Nearly 4.9 million Medicare Advantage enrollees are in a group plan offered to retirees by an employer or union. While this is roughly the same share of enrollment since 2014 , the actual number has increased from 1.9 million in 2010 to 4.9 million in 2021 . With a group plan, an employer or union contracts with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare. For example, some states, such as Illinois and Pennsylvania, provide health insurance benefits to their Medicare-eligible retirees exclusively through Medicare Advantage plans. As with other Medicare Advantage plans, employer and union group plans often provide additional benefits and/or lower cost sharing than traditional Medicare. The employer or union may also pay an additional premium for these supplemental benefits. Group enrollees comprise a disproportionately large share of Medicare Advantage enrollees in eight states: Alaska , Michigan , Maryland , West Virginia , New Jersey , Wyoming , Illinois , and Kentucky .

Medicare Advantage Plan Benefits

Some Medicare Advantage plans include benefits like dental, vision, hearing and prescription drug coverage, none of which are covered by Original Medicare. Some plans may even offer coverage for gym memberships and fitness programs.

The additional benefits that are available with some Medicare Advantage plans could be one reason why over one-third of all Medicare beneficiaries are enrolled in one of the thousands of Medicare Advantage plans available nationwide.1

Before taking effect, any benefit packages for 2020 Medicare Advantage plans must first be approved by CMS. The list of approved benefits is expected to be released in the fall of 2019, when annual open enrollment begins.

You May Like: What Does Medicare Advantage Cover

What Is Original Medicare

In short, Original Medicare is a federally-funded health insurance program for those 65 and over, or otherwise qualify.

Hereâs what you need to know:

- There are two parts to Original Medicare: Part A and Part B

- Covers 80% of medical expenses after deductible is met

- Most people are automatically enrolled on their 65th birthday

Did you know that with Original Medicare there is no limit to how much you spend out of pocket each year? eHealth can help you find coverage that puts a yearly cap on your spending!

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

You May Like: What Medicare Supplement Plans Cover Hearing Aids

Medicare Changes To Fight The Coronavirus

As the coronavirus began to spread across the United States in March 2020, a number of changes were made to Medicare coverage to meet the needs of its enrollees.

These changes are still in effect for 2021 to ensure that costs to treat COVID-19 are covered under these plans. Currently, coverage includes:

- testing for coronavirus with no out-of-pocket costs

- all medically necessary hospitalizations related to coronavirus

- a vaccine for coronavirus, should one become available

- Medicare expansion of telehealth services and virtual visits to increase access and meet patient needs due to the Public Health Emergency created by COVID-19

- waiver of the requirement that patients have a 3-day hospital stay before entering a nursing home to clear hospital resources for more critically ill patients