Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

- Medicare Advantage will cover at least basic cataract surgery and lens implants along with a pair of eyeglasses or contact lenses.

- The estimated total cost of cataract surgery performed in a surgical center is $1,777.

- Your estimated out-of-pocket expenses are estimated to be between $355 and $557, but these costs could vary.

Cataracts and cataract surgery are extremely common . The thought of having to pay for cataract surgery out-of-pocket can be overwhelming.

So, does Medicare Advantage cover cataract surgery? What will your out-of-pocket expenses be after Medicare covers their share? Well answer these questions below.

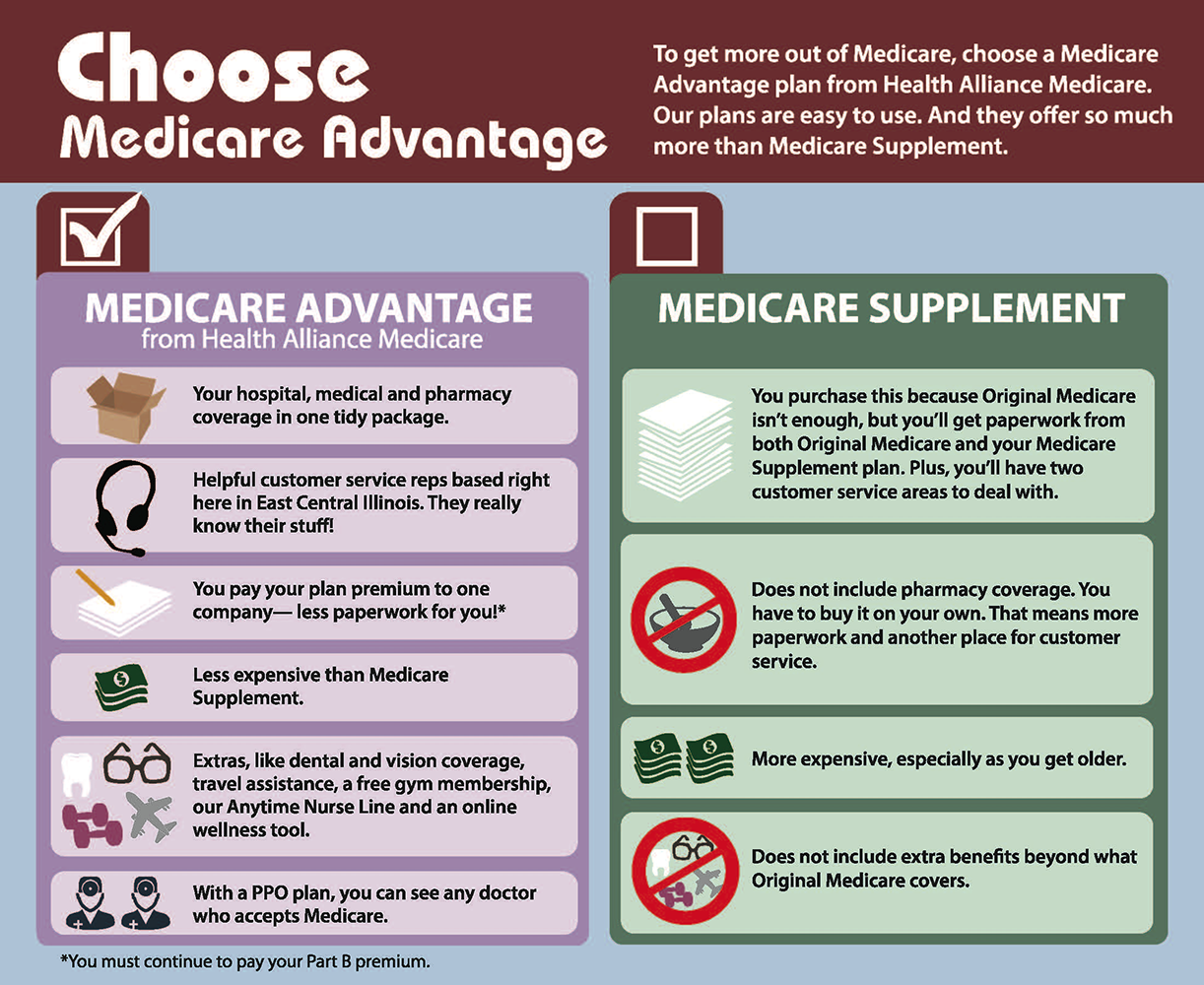

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

What Is The Price Of A Flexitouch Pump

New Medicare guidelines will restrict access to Tactile Medicals pneumatic compression pump, so the company is preparing. The Flexitouch technology from Tactile Medicals is used to self-manage lymphedema and non-healing venous leg ulcers. Depending on the model, it costs anywhere from $1,200 to $5,000 .

Read Also: How Much Does Medicare Pay For Knee Replacement

How Do Medicare Advantage Plans Work

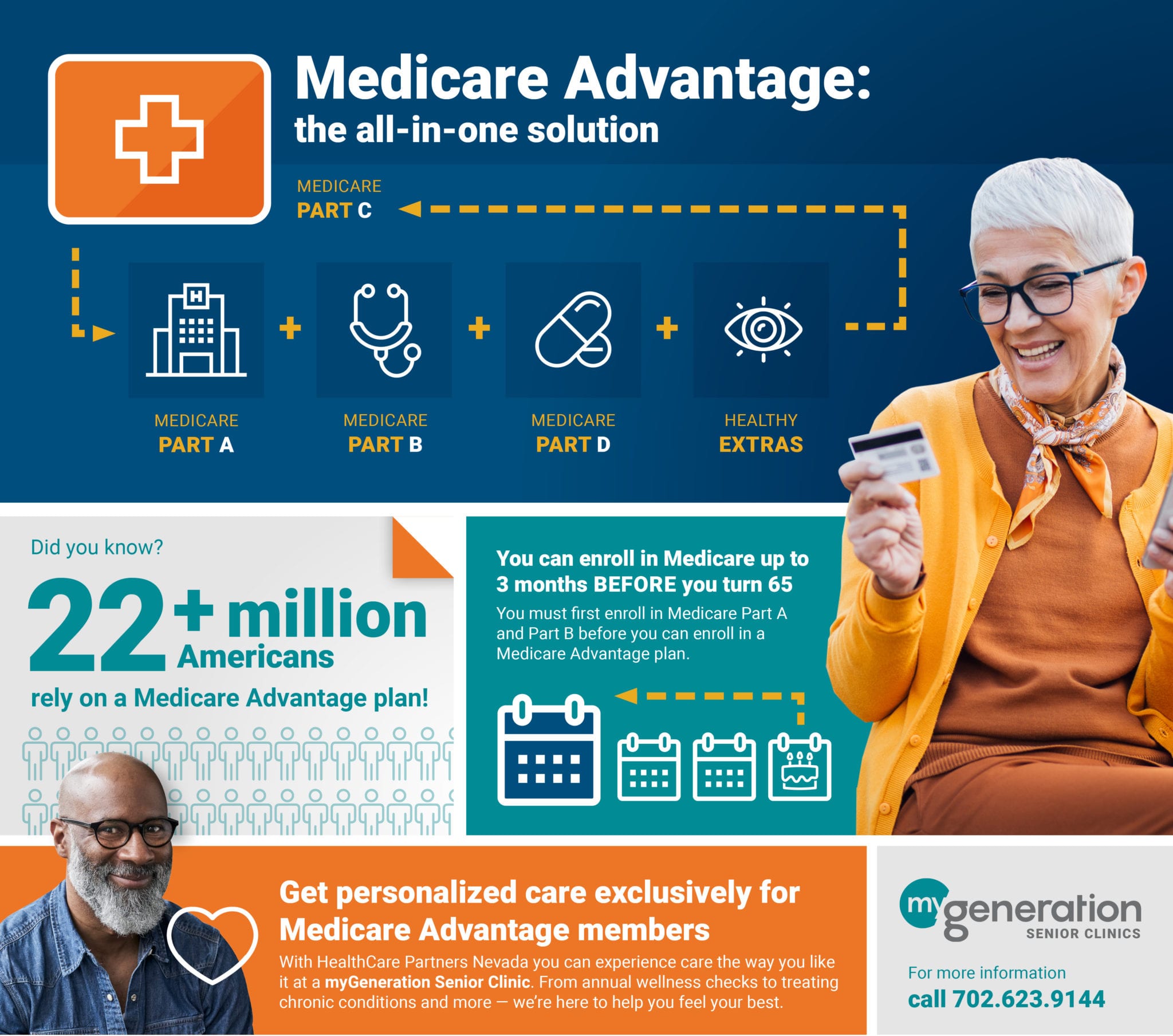

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Medicare Advantage Changes For 2022

Before getting into some of the most complex topics involved in Medicare Advantage, you may find it helpful to get a quick update on recent changes to both Medicare and Medicare Advantage.

Part B Premium ChangesMost seniors who use Medicare Advantage will owe Part B premiums. Part B costs vary from person to person, but a standard rate applies to the majority of seniors. Between 2020 and 2021 the standard rate increased about $5 per month. The standard rate is now about $148.50 per month for Part B.

In 2021, the number of available Medicare Advantage plans increased by 13 percent. 402 individual plans were added to the market. The addition of new companies and new plans to the market helped to increase the number of options each consumer has. In 2021, the average senior now has five more Medicare Advantage plans to choose from than he or she had in 2020, and that number is expected to continue to rise heading into 2022.

Higher Out-of-Pocket CostsAll Medicare Advantage plans have an out-of-pocket maximum, or a maximum amount a plan beneficiary will have to pay for their medical costs for the year. For the last several year, the maximum has been $6,700. In 2021, the Medicare Advantage out-of-pocket maximum is $7,550, an increase of $850 per year. However, plans are able to set an out-of-pocket limit below the federally-mandated maximum, so you may find a plan with lower out-of-pocket costs.

Recommended Reading: How Do I Change Medicare Supplement Plans

Medicare Advantage Enrollment Periods

There are six different time periods for joining a Medicare Advantage plan after youve enrolled in Parts A and B. Theres also a designated time during which you cant join a Medicare Advantage plan for the first time but you can switch between plans if already in a Medicare Advantage plan.

Open Enrollment PeriodsAnyone who has Original Medicare or Medicare Advantage can use the first open enrollment period. But the second open enrollment period only allows changes for people who are already using a Medicare Advantage plan. The designations of first and second are names that we have applied for the sake of clarity. These designations are not used in Medicares own literature.

| Open Enrollment Periods for Medicare Advantage and Other Health Plans | |||

|

Switch From OM* to MA |

Revert to OM |

Drop One MA Plan and Join Another |

Timeframe for Making Changes |

*OM = Original Medicare. Those who have Original Medicare get all A and B services from Medicare itself. See the coverage section of this article for more information.

Enrollment Periods Based on Individual Circumstances If youre unable to utilize one of the open enrollment periods, or if youd like to enroll before or after those periods, chances are good that youll qualify for one of the five other Medicare Advantage enrollment periods below.

What Types Of Medicare Advantage Plans Are There

Coordinated Care Plans

Most Medicare Advantage plans are coordinated care plans. Coordinated care plans have a network of doctors and providers. If you use the plan’s network doctors and providers, you generally pay less out-of-pocket for care.

Health Maintenance Organization plans

HMO plans use a network primary care provider to help coordinate care. HMO plans usually only pay for doctors and providers in the plan network.

Point of Service plans

POS plans have the benefits of an HMO, but with more flexible doctor/provider choice. Costs are generally lower for using in-network doctors/providers.

Preferred Provider Organization plans

PPO plans cover doctors and providers both in and out of network. These plans pay a portion of the cost for using an out-of-network doctor or provider.

Special Needs Plans

Special Needs Plans have benefits that cover special health care or financial needs. All SNPs include prescription drug coverage.

- Dual-Eligible Special Needs Plans for people who have both Medicare and Medicaid

- Chronic Special Needs Plans for people living with severe or disabling chronic conditions

- Institutional Special Needs Plans for people who live in a skilled nursing facility

- Institutional-Equivalent Special Needs Plans for people who live in a contracted assisted living facility and need the same kind of care as those who live in a skilled nursing facility

Recommended Reading: What Is Medicare Plan C

S For Using The Plan Finder Tool

To check which plans are in your area, you can use the Medicare Health Plan Finder. If you wish, you can create an account, log in, and return to saved plan searches later if youre not able to make your selection in one day.

Step 1: Select Search PreferencesTo begin your search for a plan, either create an account or click log in as a guest. Next, select Medicare Advantage from the menu provided, enter your zip code in the box that pops up, and click continue. Now youll be asked if you get help with your costs from one of several programs select not sure if necessary. Youll then be given the option to see the costs of specific drugs on different plans. This will be useful to you if you have regular prescriptions. The drug costs question is the final prompt youll receive before youll be shown a list of local Medicare Advantage plans.

Step 2: Examine Coverage DetailsWhen you first look at the plans, you may just want to scroll through them all to see the range of costs and types in your area. Once you have a sense of whats available, begin looking at the coverage offered in individual plans by clicking plan details. Here you can evaluate the copays/coinsurance of specific tests, office visits, and hospital stays, including for extra services like drug coverage, dental coverage, and more. Youll also find contact information for the plan in this section.

Enrollment Periods For Medicare Advantage

As with most Medicare coverage options, the first time most seniors can enroll in an MA plan is during their Initial Enrollment Period .

This seven-month period begins on the first day of the month, three months before an enrollees 65th birthday, and it ends on the last day of the month, three months after the birthday.

Thus, a senior whose 65th birthday is on May 11 can first sign up for a Part C plan on February 1 and may still apply without penalties as late as August 31 of the same year.

In addition to the initial enrollment window, Medicare beneficiaries have two annual windows for making changes to their coverage. These two different enrollment periods run from January 1 to March 31 and from October 15 to December 7 of each year, respectively.

- During Medicare Advantage Open Enrollment Period from Jan. 1March 31, existing MA beneficiaries may switch their coverage to another Part C plan or go back to Original Medicare. Original Medicare beneficiaries may not change from Original Medicare to Medicare Advantage during this window.

- During the fall Medicare Open Enrollment Period for Medicare Advantage and prescription drug plans from Oct. 15Dec.7, enrollees have the option to make plan changes to their Part C coverage, as well as to switch into a Part C plan from Original Medicare.

In most states, seniors can test their new Part C coverage during a month-long try-out period, and then switch back without incurring a penalty rate.

Also Check: What Age Do You Apply For Medicare

What Isn’t Covered By Medicare Part C

Medicare Advantage plans must provide at least the same amount of coverage as Original Medicare. Once a plan meets the minimum requirements, its up to the insurer to determine if additional services are covered.

Depending on the plan selected, Medicare Part C may not cover prescription medications. If it doesnt, you must have other prescription drug coverage. If you have a HMO or PPO, you are not allowed to purchase a separate Part D prescription drug plan. Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care.

If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary. A private room is medically necessary if putting you in a semi-private room would endanger your health or the health of someone else. For example, if you have an infectious disease, Medicare Part C will cover a private room to ensure you remain isolated and prevent the disease from spreading to other patients.

What Is The Premium For A Medicare Advantage Plan

Medicare Advantage plans are sold by private insurance companies, and their coverage, premiums, and out-of-pocket costs vary widely depending on the carrier and plan features.

It is possible to find a Medicare Advantage plan that does not charge an additional monthly premium beyond your Part B premium. You must continue to pay your Part B premium directly to Medicare, even if you are on a Medicare Advantage plan.

Medicare Advantage plans must offer at least the same benefits as Original Medicare, and most also offer prescription drug coverage. In some cases there may be an additional premium for benefits that arent offered by Original Medicare, such as routine vision, hearing, and dental coverage.

In addition to any monthly premiums, you may have to meet a deductible and pay copayments or coinsurance for doctor visits and other medical services.

Check your plans Evidence of Coverage and Annual Notice of Change for specific information about costs.

Don’t Miss: Do You Have To Buy Medicare Part B

Will I Pay Coinsurance With Medicare Advantage

Cost vary widely among Medicare Advantage plans, and you may need to pay coinsurance, depending on which plan you choose. Even if basic medical and hospital care is 100% covered, you may have to pay coinsurance for other specific services such as outpatient surgery, durable medical equipment, cancer treatments, and prescription drugs.

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam-dunk choice for some people, they’re not right for everyone.

Pros:

-

Additional benefits, which may include some cost savings or subsidies toward hearing, dental and vision care.

-

Potentially lower premiums for coverage.

-

Limits on how much you may have to pay out of pocket for hospital and medical coverage. This limit is determined by the Centers for Medicare & Medicaid Services, and in 2021 it is $7,550.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

-

The potential for the plan to end, either by the insurer or by the network and its included medical providers.

Don’t Miss: Where Can I Go To Sign Up For Medicare

Does Medicare Cover Cataract Surgery

- 80% of the cost of cataract surgery is covered under Part B.

- Coverage is the same whether or not laser technology is used.

- Most Medicare Advantage plans will cover cataract surgery.

Simply put, Medicare does cover cataract surgery. However, there are multiple types of cataract surgery, and Medicare only covers one very specific set of procedures.

- Lens implants

- One set of eyeglasses or contact lenses

Most cataract surgery isnt any more complex than the items included above, but there are a few special circumstances where your surgery may not be fully covered. We will discuss these special circumstances in more detail later on. Its important to emphasize that Medicare will cover one set of eyeglasses or contact lenses after your surgery, even though Medicare does not usually offer this coverage.

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Read Also: Which Is Better Original Medicare Or Medicare Advantage Plan

Medicare Advantage Vs Original Medicare

Medicare Advantage plans may have provider networks that limit your choices. If you go outside the network, your care may not be covered or may cost significantly more than if you stay in-network. With Original Medicare, you generally can use any doctor or medical facility that accepts Medicare assignment.

In exchange for less freedom, though, you often pay less. You would still be required to pay a monthly premium for Part B, but the additional cost for a Medicare Advantage plan may be less than for a Medigap plan. Sometimes the Medicare Advantage plan may have a $0 premium.

Medicare Advantage plans may also have a maximum out-of-pocket limit for covered care. That caps the amount youll be expected to pay in addition to your premiums. In 2021, that cap is $7,550.

How To Enroll In Part B

A person becomes eligible for Medicare Part B when they reach 65 years of age.

However, people with specific disabilities qualify for Medicare Part B earlier, including those with end stage renal disease and individuals with amyotrophic lateral sclerosis , also known as Lou Gehrigs disease.

If a person receives benefits from Social Security or the Railroad Retirement Board, these organizations will automatically enroll them in Parts A and B.

Some people may choose to delay enrollment in Part B because other sources provide coverage, such as insurance for which their employer or their spouses employer pays.

If a person cannot pay the Medicare Part B premium, they can apply for Extra Help or Medicaid, which helps individuals with a low-income access and pay for insurance.

Recommended Reading: Does Medicare Cover A1c Test

How To Find A Medicare Advantage Plan

Seniors interested in a Part C plan can find a list of Medicare Advantage plans and their plan details by comparing plans online or calling to speak with a licensed insurance agent.

Beneficiaries who are eligible for Medicare can also browse insurance providers websites for plans, compare costs at their states health exchange website or speak with a Medicare planner about options available locally. Seniors can also call a plan representative or broker and ask about Medicare Advantage plans.

Does Medicare Advantage Cover Cataract Surgery

Medicare Advantage, also known as Part C, offers you a way to receive your Medicare benefits through a private insurance company. Because of this, the plans tend to vary a lot throughout the country, both in price and in coverage. However, many Part C plans will cover cataract surgery. As some plans may cover more than Original Medicare, it is worthwhile to research each in detail if you already have a Part C plan.

Recommended Reading: How Much For Part B Medicare