Can I Delay Medicare Part D

Medicare Part D covers prescription drugs. Like Medicare Part B, it is recommended you apply as soon as you reach Medicare Part D eligibility.

Even if you do not take any prescription medications, delaying Medicare Part D could cost you a large penalty in the long run. The Medicare Part D penalty is 1% of the average Part D premium for every month you delay enrollment. This amount is added to the premium your prescription drug insurance company sets.

Here are three ways to avoid the Medicare Part D late enrollment penalty:

- Enroll in Medicare drug coverage when youâre first eligible

- Enroll in Medicare drug coverage if you lose other creditable coverage

- Keep records handy proving when you had creditable drug coverage

Additionally, it is essential to know that your Medicare Part D late penalty never goes away. Thus, if you have Part D drug coverage, you must pay the penalty.

I Didnt Sign Up For Part B When I First Became Eligible But Want To Sign Up Now I Know There Is A Penalty For Late Enrollment Is There Any Way To Avoid The Penalty

Generally, no. In most cases, if you missed your Part B enrollment window, which runs from the three months before the month of your 65th birthday through the three months after the month of your 65th birthday, you will face a late enrollment penalty once you do enroll, which will be added to your premium costs for the remainder of your enrollment. The penalty equals 10% of the standard monthly premium for each 12-month period that you delayed enrollment.

If you did not enroll for Part B during your initial enrollment period, you may qualify for a Special Enrollment Period to sign up for Part B anytime as long as you or a spouse is working and youre covered by a group health plan through that employment. For people age 65 or over who have coverage through a group health plan, there is also an 8-month SEP which starts the month after the employment ends or the group health plan coverage ends. If you sign up during an SEP, the late enrollment penalty will not apply.

I Am Receiving Social Security Disability Benefits

You will be enrolled in Original Medicare automatically when you become eligible for Medicare due to disability. Youll get your Medicare card in the mail. Coverage usually starts the first day of the 25th month you receive disability benefits.

You may delay Part B and postpone paying the premium if you have other creditable coverage. Youll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

Youll need to inform Medicare of your decision before your Part B coverage starts. Follow the directions on the back of your Medicare card.

Also Check: How Much Is Medicare B Deductible

Who Should Delay Medicare Coverage

There are several situations in which you may think about delaying Medicare coverage. One of the most common situations is whether or not to delay Medicare Part B and keep their current coverage through work. For most people the answer is simple: if you are going to be working past age 65, and are happy with your current employer plan, then you can keep it. Special restrictions apply for things like COBRA plans, insurance under a spouse, and other conditions, and well discuss these below.

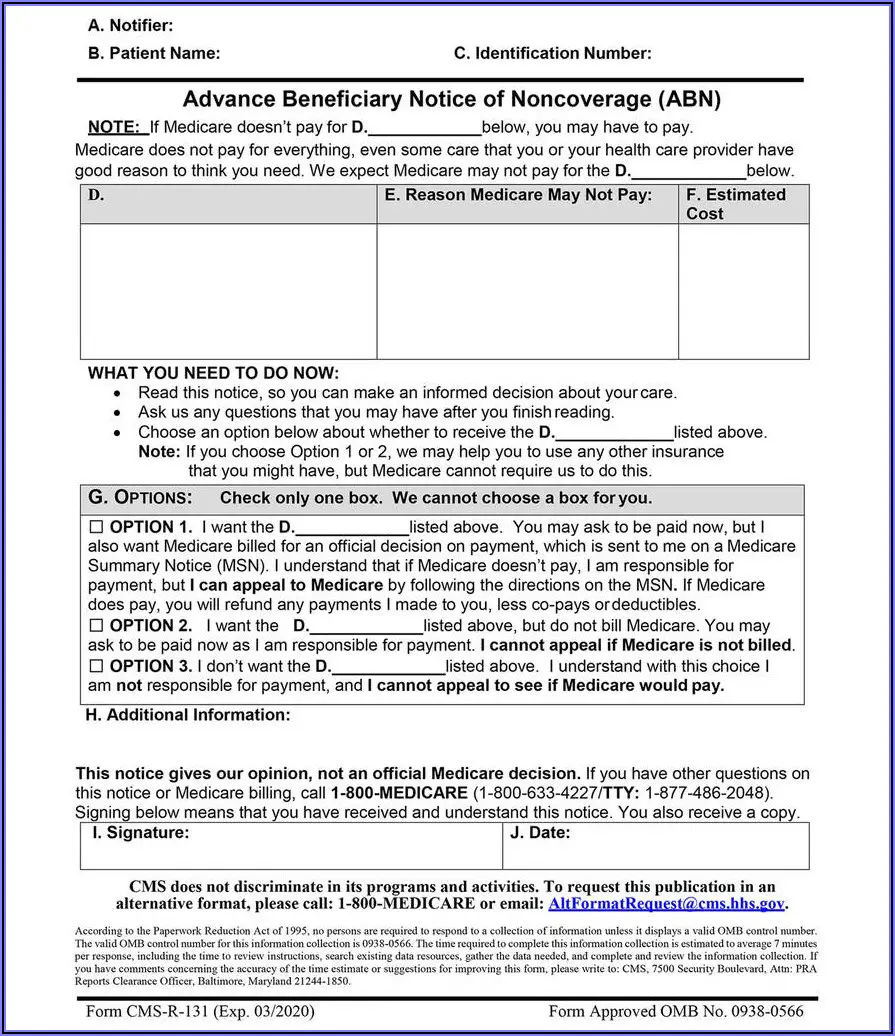

How Do I Appeal The Medicare Part B Penalty

If you feel that the Medicare Part B penalty should not apply, you may request a review. Medicare has reconsideration request forms to file an appeal.

Unfortunately, you will still pay the Medicare Part B penalty while waiting for your appeal to process. Additionally, there is no timeline by which Medicare must abide when processing your appeal.

- Was this article helpful ?

Don’t Miss: When Can I Be On Medicare

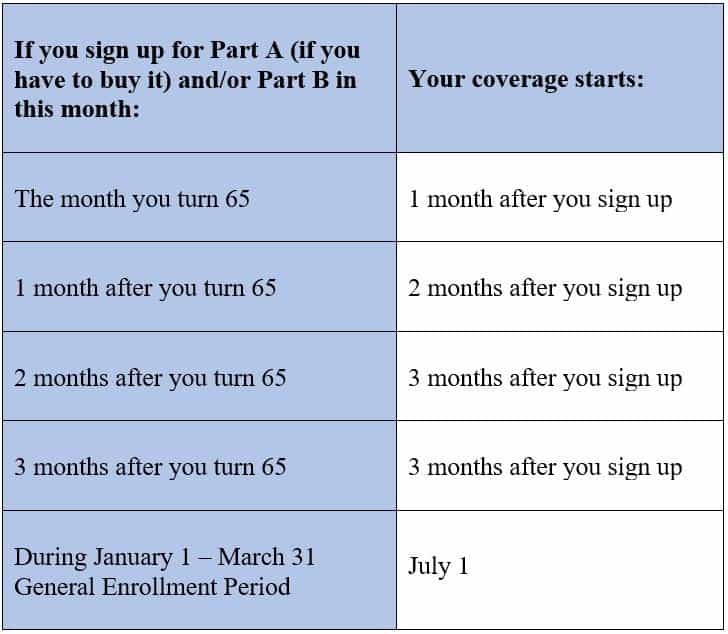

When Do I Have To Sign Up For Medicare When Can I Add Prescription Drug Coverage

If you delay enrollment in Medicare Part A, Part B, and/or Part D, you might not be able to enroll just anytime. You might have a Special Enrollment Period, which varies depending on your situation. Learn more about Medicare enrollment periods.

Enrollment in a plan may be limited to certain times of the year unless you qualify for a special enrollment period or you are in your Medicare Initial Election Period.

Ready to get started? Find a plan that fits your budget and covers your doctor and prescriptions now

Do I Have To Sign Up For Medicare When I Turn 65

It depends. Most people whove worked and paid taxes are eligible for premium-free

, on the other hand, requires that you pay a monthly premium , so if you feel you dont want it or need it, you may assume you can just delay your enrollment.

But depending on your circumstances, it may be in your best interest to to avoid any late enrollment penalties.

Also Check: How Early Can You Sign Up For Medicare

How Do I Avoid Medicare Part B Penalty

If you dont qualify to delay Part B, youll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Can Medicare penalties be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government for example by Social Security or 1-800-MEDICARE to delay Part B. Asking for the correction is known as requesting equitable relief.

A Late Enrollment Penalty

- Some people have to buy Part A because they don’t qualify for premium-free Part A.

- If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%.

- You’ll have to pay the penalty for twice the number of years you didn’t sign up.

Example:

You May Like: Does Medicare Cover Full Body Scans

What Is The Penalty For Not Taking Medicare Part B

The Medicare Part B penalty increases your monthly Medicare Part B premium by 10% for each full 12-month period you did not have creditable coverage. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay.

For example, if you pay a higher Medicare Part B premium based on your previous tax returns, your penalty will only be 10% of the base Medicare Part B premium. The penalty will not be 10% of your Income-Related Monthly Adjustment Amount premium.

For most, the Medicare Part B penalty never goes away. You must pay the additional premium cost as long as you have Medicare Part B. The only time the penalty goes away is if you are eligible for Medicare Part B prior to age 65 and pay the penalty before turning 65. Once you turn 65, the penalty is reset, and you will no longer be responsible for the additional premium.

Medicare Late Enrollment Penalties: How A New Bill May Help

A bipartisan bill introduced in the Senate in March 2022 hopes to help eliminate Medicare Part B penalties for late enrollment for Americans. If passed, the bill would require the federal government to notify people about Medicare enrollment rules starting at age 60. Generally, when someone signs up to start receiving their Social Security retirement benefits, they automatically enroll in Medicare Parts A and B. Medicare has roughly 63.3 million beneficiaries, with most aged 65 or older. Through this government-sponsored insurance program, most people don’t pay a premium for Part A but pay a standard monthly premium for Part B, which covers outpatient care. There are no late-enrollment penalties for Part A. However, Part B has a 10% premium penalty for each month of the twelve months of missed enrollment. To avoid the penalty, Americans must sign up for Medicare Parts A and B three months before they turn age 65 until three months after the month they turn age 65.Now, with more people working past age 65, they delay Social Security, risk missing their Medicare Part A and B enrollment period, and face a 10% premium penalty. According to the Medicare Rights Center, in 2020, the average Medicare Part B penalty increased the premium by 27% for those who enrolled late, costing them $45.93 each month.

A financial professional can help.

Are you approaching age 60 and have questions about Medicare or Social Security Retirement Benefits? We can help. Call us today!

Also Check: Does Medicare Pay For Chair Lifts For Seniors

What Is Medicare Part B Coverage And What Does It Cover

Medicare Part B, along with Part A, constitutes what is known as original Medicare. It is estimated that in 2016, 67 percent of individuals using Medicare were enlisted in Original Medicare.

Part B protects a wide range of medically necessary outpatient services. A service is considered medically necessary if required to diagnose or treat a medical condition effectively.

Part B services include the following:

- emergency ambulance transportation

- complementary health services such as acupuncture and massage

- If you want prescription coverage, you can buy Part D plans. Medicare Part D programs are provided by private insurance organizations and cover most prescription drugs.

Furthermore, Medicare Part C programs include all benefits covered under traditional Medicare services and some additional services such as vision, dental, and even fitness plans. If you think youll need these medical services, consider a Part C program.

Donât Miss: Does Medicare Pay For Private Duty Nursing

Medigap Late Enrollment Penalty

Late enrollment for Medigap doesnt cause you to incur a penalty. However, in order to get the best rates for your Medigap plan, youll need to enroll during your open enrollment period.

This period starts on the first day of the month you turn 65 and lasts for 6 months from that date.

If you miss open enrollment, you may pay a much higher premium for Medigap. You may also be refused a Medigap plan after open enrollment ends if you have health problems.

If you wish to defer Medicare enrollment, you dont need to inform Medicare. Simply dont sign up when you become eligible.

To avoid penalties when you do decide to enroll, you should:

- have alternative during the time youre eligible for Medicare

- make sure to enroll during the 8-month period when your current coverage ends, known as a special enrollment period

If you decline Medicare coverage and never enroll, you wont receive Social Security benefits or Railroad Retirement Board benefits. Youll also need to return any payments youve already received through these programs.

Read Also: Does Medicare Change From State To State

How Can I Delay Medicare Part B

Some people may want to delay Part B coverage but enroll in Part A. If this is your choice, there are a few things to keep in mind as you near your 65th birthday. This will help make sure you delay Part B coverage properly.

If you have been receiving Social Security benefits for four months or longer when you turn 65, then you will be enrolled in both Part A and Part B automatically. If you dont want to enroll in Part B coverage, then contact Social Security as soon as you can and let them know you dont want this coverage. You will find instructions in the package you receive from Medicare a few months before you turn 65.

If you arent receiving Social Security benefits for four months by your 65th birthday, then you will need to directly contact Social Security to enroll for Part A. You can do this through their website, ssa.gov or by calling them directly and notifying them that you want to enroll for Part A only.

Remember, if you are covered under a group plan and delay Part B, you will not have to pay penalty fees when you enroll in Part B later on. You will have 8 months to enroll in Medicare penalty-free after you stop working, or once your employer insurance ceases, whichever comes first.

What Are The Exceptions To The Medicare Part B Eligibility Rules

To get Medicare Part B coverage, its not necessary that you must be age 65 or above.

- You qualify for Part B coverage if you are under 65 and have received railroad retirement disability benefits or Social Security disability benefits for at least 24 months.

- People of any age who have ESRD or ALS are eligible for Medicare Part B.

Read Also: How Much Does Medicare Supplemental Health Insurance Cost

How Is The Part B Late

You generally need to sign up for Medicare parts A and B during your initial enrollment period , which begins three months before the month you turn age 65 and ends three months after the month you turn 65.

You may be able to delay enrolling in Medicare if you or your spouse is still working and you have health insurance through either of your employers. But after losing your job-based coverage, you have to sign up during the special enrollment period while youre working or within eight months of losing your health insurance.

If you dont sign up during your IEP or a special enrollment period, you will face two consequences:

Since Part B premiums usually rise each year, your late-enrollment penalty will rise, as well. The penalty lasts for as long as you have Medicare Part B, whether you have coverage through original Medicare or a Medicare Advantage plan.

Avoiding Penalties For Not Signing Up For Medicare With Special Enrollment Periods

There are some situations where you might be able to delay enrollment in Medicare without having to pay a late enrollment penalty. You might qualify for a Medicare Special Enrollment Period. For example, if youâre still covered under an employer or union plan, or your spouseâs plan, you may be able to switch to Medicare coverage after your Medicare Initial Enrollment Period without a penalty. Generally thereâs a time limit on making this transition, so if your other coverage is coming to an end, you might want to talk to your plan administrator about switching over to Medicare. You can also ask a eHealth licensed insurance agent.

You May Like: Are Hearing Aids Covered By Medicare Australia

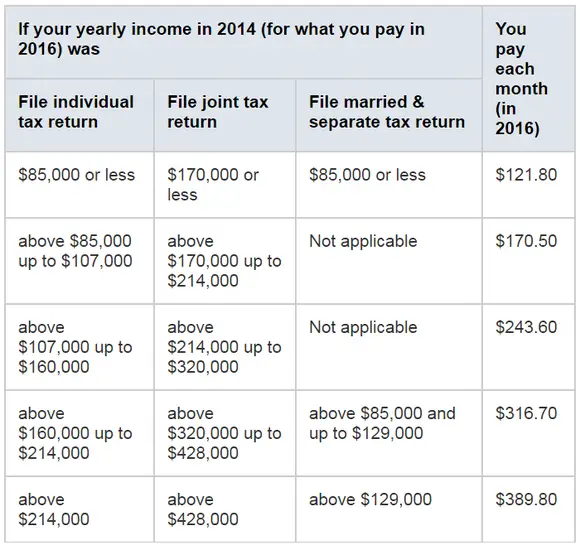

Medicare Part B Part D Irmaa Premium Brackets

September 14, 2021Keywords: AGI, health insurance, Medicare

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits arent included in the income for determining IRMAA.

* The last bracket on the far right isnt displayed in the chart.

Reduce Or Eliminate The Part B Lifetime Late Enrollment Penalty

Erroneously delaying Medicare Part B can have significant consequencesincluding a lifetime premium penalty. Designed to encourage enrollment when first eligible, this late enrollment penalty is also imposed on those who simply make a mistake. For as long as they have Medicare, these individuals will pay the regular monthly Part B premium plus an additional 10 percent for each year they delayed signing up. While it is important that a penalty appropriately deter anyone who might actively seek to avoid Medicare enrollment, it must not punish those who make honest mistakes. Congress should enact policies to reduce or eliminate lifetime premium penalties for beneficiaries who were misinformed or uninformed about Medicare enrollment rules.

Recommended Reading: What Is Part D For Medicare

I Have Va Health Care Benefits

VA benefits cover care you receive in a VA facility. Medicare covers care you receive in a non-VA facility. With both VA benefits and Medicare, youll have options for getting the care you need.

Its usually a good idea to . VA health care benefits do not qualify as creditable coverage. You may have to pay a penalty if you delay Part B enrollment, unless you have other creditable coverage such as through an employer.

How Will I Know How Much My Medicare Part B Premium Will Be

The Social Security Administration or the Railroad Retirement Board, if that applies to you will tell you how much your Part B premium will be. Heres a table that may help you to know what to expect, particularly if your income is above a certain level.

If your income falls into one of four higher-income categories based on your 2019 tax return, in most cases youll pay more than the standard Medicare Part B premium. The amounts listed below reflect the Income Related Monthly Adjustment Amount, or IRMAA. To determine your Part B premium, the Social Security administration looks to your income tax returns from two years ago .

Here is a chart of Medicare Part B premiums for 2021, including IRMAA amounts, if applicable. Please note that your actual premium may be different depending on your individual circumstances.

| Your reported tax income in 2019 | Your 2021 Part B premium |

Read Also: What License Do You Need To Sell Medicare Supplements