Does Medicare Part D Cover Every Prescription Drug

Every Part D plan covers a different group of drugs, called a formulary. The drug lists might change with time, but your plan will always give you notification of these changes. When deciding a plan, it is important to look through the formulary and determine which plan offers the best coverage for your needs. If a drug is unavailable to you, and your healthcare provider is adamant that you need it, it is possible to file for an exemption.

In 2019 Around 1 In 10 Low

Figure 10: Weighted Average Monthly Premiums for Low-Income Subsidy Enrollees, 2006-2019

In 2019, 1.0 million LIS beneficiaries pay a premium for Part D coverage, even though they may be able to obtain coverage without paying a premium by enrolling in a benchmark PDP. This total includes 0.7 million PDP enrollees who are not enrolled in benchmark PDPs, and more than 0.3 million enrollees in MA-PDs that charge a premium. MA-PDs are not designated as benchmark plans by CMS, although most of the LIS enrollees in MA-PDs are currently enrolled in zero-premium plans. On average, the 1.0 million LIS beneficiaries paying Part D premiums in 2019 pay nearly $24 per month, or nearly $300 per year. This amount is down 7 percent from 2018, but is 2.6 times the amount in 2006.

| Data and Methods This analysis uses data from the Centers for Medicare & Medicaid services Part D Enrollment, Benefit, Landscape, and Low Income Subsidy files for the respective year, with enrollment data from March of each year. The analysis excludes plans with small enrollment counts in estimates that are plan-enrollment weighted. For analysis of cost sharing for formulary tiers in PDPs and MA-PDs, we did not analyze which drugs are on what tier under each type of plan and whether this has changed over time, factors which would also influence enrollees out-of-pocket costs. |

Is Every Medicare Part D Plan The Same

No. Medicare Part D monthly premiums, copayments and deductibles vary from one insurer to the next. You will be able to tell if what youre taking is covered by checking the Priority Health formulary, which includes a list of approved drugs. If your prescription drugs are not included on this list, Part D may not be the right choice for you financially.

You May Like: Do I Need Medicare Part B If I Have Medicaid

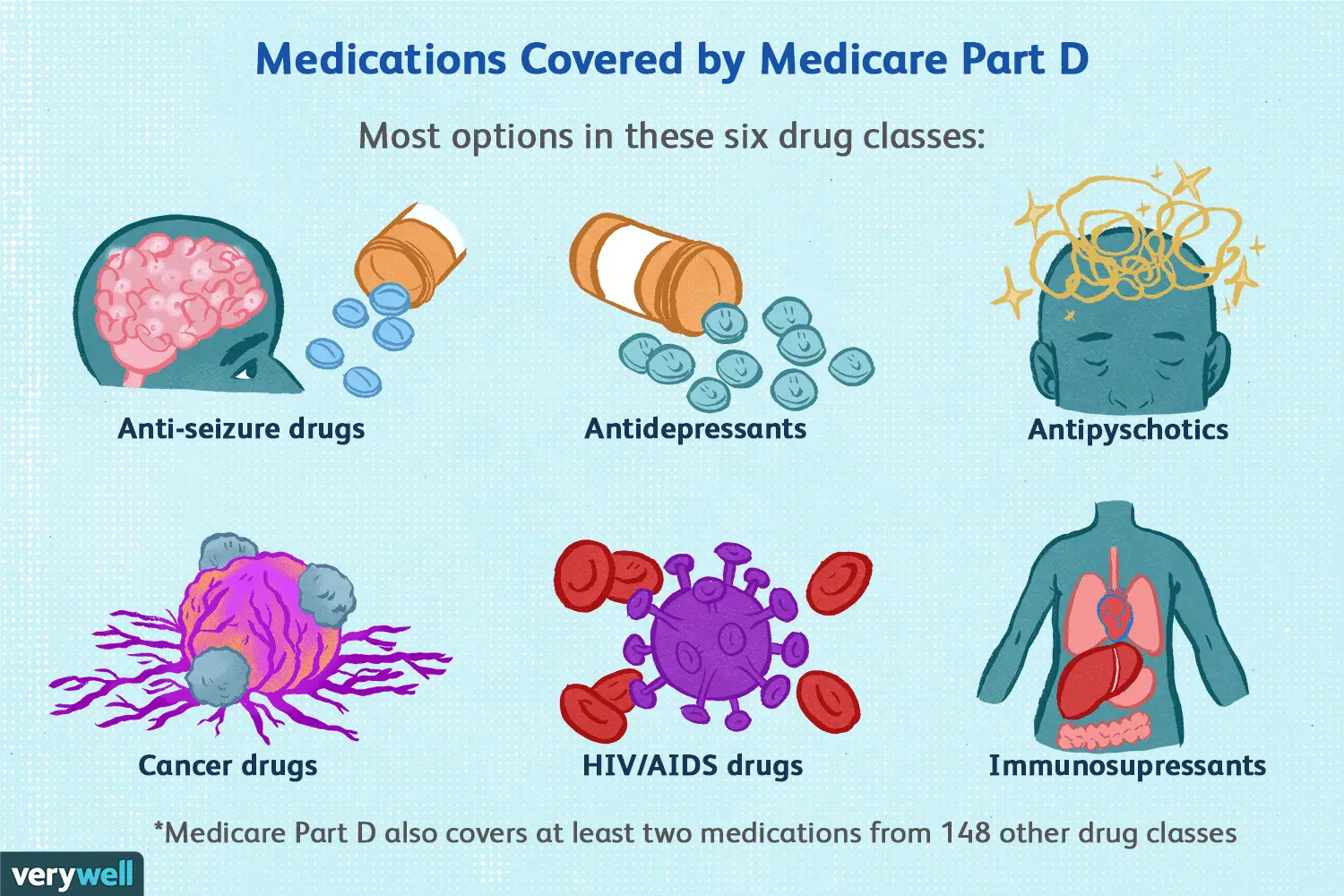

Medicare Part D Covered Medications

Medicare Part D plans vary in coverage somewhat, but they all group covered prescriptions into five main categories, or tiers. A Medicare drug plans tiers and coverage details are listed in the plans drug formulary and typically include the following drug tiers:

- Tier 1, Preferred GenericThis is the least expensive tier of prescription drugs Medicare plans can cover. Generic drugs in this class have expired patents and can be bought in bulk from preferred providers, lowering per-unit costs.

- Tier 2, Generic Generic, non-preferred drugs are sometimes a little more expensive than preferred generics, though they may not be. Prices for Tier 2 drugs vary by location and by plan.

- Tier 3, Preferred Brand-NameTier 3 brand-name drugs are new enough to still be covered by a manufacturers patent, and so they tend to be more expensive than equivalent generics. Medications in this tier are still supplied by preferred providers, which may result in a discount rate.

- Tier 4, Non-Preferred BrandNew and unusual drugs from non-preferred providers are in Tier 4. Prices can be high in this category, and not all plans cover every drug.

- Tier 5, Specialty and ExperimentalSpecialty tier is an unofficial categorization for very new, experimental or otherwise difficult to administer drugs. Medications in this tier may be unproven, or they may require close monitoring to safely administer.

How Do I Compare Medicare Part D Prescription Drug Plans

You should look at all three out-of-pocket expenses when you compare plans: Your Medicare Part D premiums, deductible, and copayment or coinsurance amounts. A plan with a higher deductible may have lower monthly premiums. If you dont use a lot of prescription medications, that may be the most cost-effective option for you. On the other hand, if you take daily medications, a lower deductible may be more important so you get help with your medications with less out-of-pocket expense.

If you take daily medications, its very important to look at each plans formulary. A formulary is simply the list of covered medications and your costs for each. Check to make sure the plans covers all your daily medications. Also remember a Medicare Supplement Insurance Plan doesnt cover any costs associated with Medicare Part D coverage.

Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and its not in a plans network, you may be happier with a different plan. With many plans, you can save on your copayments and out-of-pocket costs by using the plans mail order pharmacy for medications you take regularly. If a plan offers this option, you may actually come out ahead even if the plan has a higher deductible or monthly premium, depending on the medications you use.

Limitations, copayments, and restrictions may apply. Premiums and/or copayments/co-insurance may change on January 1 of each year.

New To Medicare?

Don’t Miss: Does Medicare Pay For Tummy Tuck

Definition Of Medicare Part D

Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system. For this reason, different plans include different prescription drugs and have different associated costs. Its important to review multiple plans before deciding which plan to buyor if youll buy one at all.

You can buy Medicare Part D only if you also have either Medicare Part A and/or Medicare Part B.

To join a Medicare Advantage plan that offers prescription drug coverage, you must have both Part A and Part B. Not all Medicare Advantage plans offer drug coverage.

Medication Therapy Management Programs For Complex Health Needs

Plans with Medicare drug coverage must offer free Medication Therapy Management services if you meet certain requirements or are in a program to help members use their opioids safely. This program helps you and your doctor make sure that your medications are working to improve your health.

Through the MTM you’ll get:

- A comprehensive review of your medications and the reasons why you take them.

- A written summary of your medication review with your doctor or pharmacist.

- An action plan to help you make the best use of your medications

A pharmacist or other health professional will talk with you about:

- Whether your medications have side effects

- If there might be interactions between the drugs you’re taking

- Whether your costs can be lowered

- How to safely dispose of unused medications

Its a good idea to schedule your medication review before your yearly wellness visit, so you can talk to your doctor about your action plan and medication list. Bring your action plan and medication list with you to your visit or anytime you talk with your doctors, pharmacists, and other health care providers. Also, take your medication list with you if you go to the hospital or emergency room.

If you take many medications for more than one chronic health condition, contact your drug plan to see if you’re eligible for a Medication Therapy Management program.

You May Like: How Do You Pay For Medicare Advantage Plans

How To Get Medigap Plan D4

Medigap plans are only sold through private insurance companies. The best time to get Medigap Plan D is during your Medigap Open Enrollment Period because you wont have to go through medical underwriting.

- Your Medigap OEP last for six months and begins the month you turn 65 and are enrolled in Part B.

- You can get any plan thats available in your area regardless of your health if you enroll during your OEP.

- If you enroll outside of your OEP, you may be denied a policy because of your health unless you have guaranteed issue rights.

Learn more about buying a Medicare Supplement plan that fits your needs.

What Else Should I Know About Medicare Part D

Either way you decide to get Medicare Part D coverage, there are a few things to keep in mind:

- Not every plan will cover every prescription drug. If youre on medications, you might want to make sure your Medicare prescription drug plan covers them. Each plan has its own formulary thats a list of prescription drugs the plan covers.

- Even if you find a plan that covers your prescriptions, know that a plan may change its formulary anytime. Your plan will notify you when necessary.

- Every fall, your plan will send you Annual Notice of Change and Evidence of Coverage documents. Check to see how your coverage may be changing next year, including if any of your medications will be dropped from the formulary, or if your costs are going up.

- You dont have to sign up for prescription drug coverage under Medicare Part D. But if you decide to sign up after your Medicare Initial Enrollment Period, you could face a Part D late enrollment penalty.

Don’t Miss: When Can You Start Medicare

Signing Up For Part D

Seniors who become eligible for Medicare may have the option to enroll in a Part D plan immediately after their benefits become active.

The initial enrollment period for Part D plans begins at the same time as a beneficiarys initial enrollment period for Medicare Part A and/or Part B coverage. This is a 7-month period that begins on the first day of the month, three months before a beneficiarys 65th birthday. The enrollment period closes on the last day of the third month after.

Thus, a senior who turns 65 on June 10 has an initial enrollment period that starts on March 1 of that year and ends on September 30. Seniors who enroll in Medicare Part D plans are encouraged to do so as early in this window as possible, as there can be a 3-month delay in benefits after a switch, and late enrollment could result in a coverage gap.

Enrolling in a Part D plan outside of your initial enrollment periods can potentially result in a lifetime late-enrollment penalty fee.

Seniors who need Part D coverage may be able to sign up during the fall Medicare Open Enrollment Period for Medicare Advantage and Prescription Drug plans, also called the Annual Enrollment Period . Medicare AEP begins on October 15 of each year and ends on December 7.

During AEP, beneficiaries can join a Medicare Part D plan, switch from one Part D plan to another or join a Medicare Advantage plan that includes prescription drug coverage. These plans are often called Medicare Advantage Prescription Drug Plans .

Medigap Changes: How Will Plan D Be Affected

Medicare Supplement Plans C and F will not be sold to anyone eligible for Medicare on or after January 1, 2020.5 But the good news is Plan D is a suitable Plan C replacement. Why? Medigap Plans C and D offer the same benefits, except that Plan C covers the Part B deductible and Plan D does not.1

Why should this matter to you? If youre eligible for Medicare before 2020, you may want to consider getting Plan C. If you do, you will be grandfathered in, which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

If coverage for the Part B deductible isnt a priority, you can buy Medigap Supplement Plan D now or whenever you become eligible for Medicare. Your monthly premium for Plan D may be less since it does not cover your Part B deductible. The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $196-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida.6

Recommended Reading: What Age Do You Qualify For Medicare

Low Income Subsidy Questions

No. The “extra help” is a subsidy that people with Medicare and Medicaid automatically qualify for without having to complete an application.

If you do not have Medicaid, but Medicaid pays your Medicare Part B premium, you automatically qualify for “extra help” and you don’t need to apply.

You may still be eligible for “extra help” to pay for the Medicare prescription drug plan premiums. To apply for extra help, you should visit or call your local Social Security Administration office or apply on line at

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

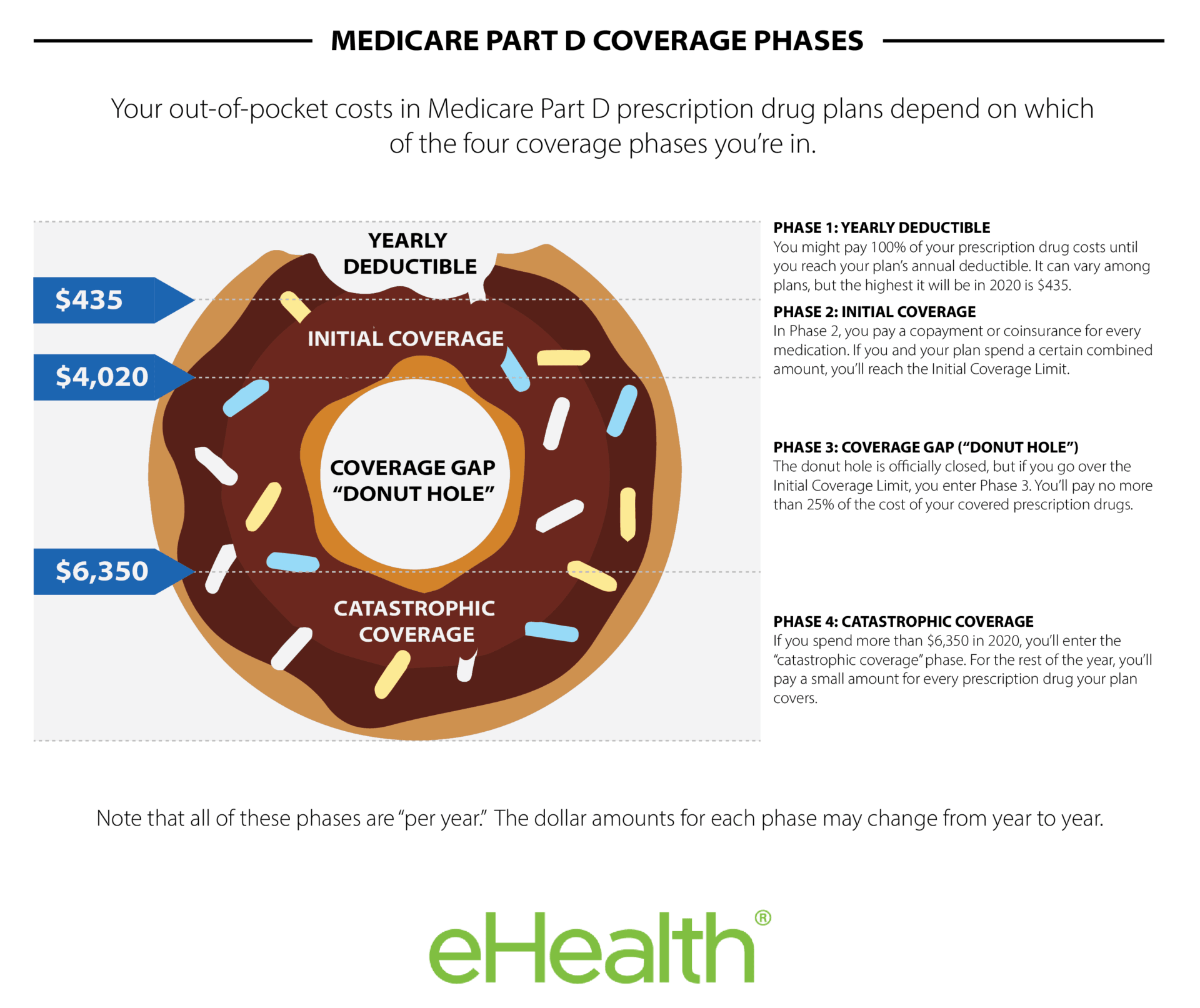

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

Also Check: What Preventive Care Is Covered By Medicare

What Else Should I Know About Medicare Part C

- Even though you get Medicare Advantage plans through private insurance companies, youre still in the Medicare program through Medicare Part C.

- You still need to keep paying your Medicare Part B premium, along with any premium the plan may charge.

- You have to have Medicare Part A and Part B to qualify for benefits under Medicare Part C. You also have to live within the plans service area.

- Theres one benefit you still get directly through Medicare Part A, instead of through the Medicare Advantage plan: hospice benefits.

- Some Medicare Advantage plans have provider networks. You might be limited to providers in the plans network. In some cases, you can see out-of-network providers, but you might have to pay a higher copayment or coinsurance.

- Medicare Advantage plans have annual maximum out-of-pocket spending limits. If you pay up to that limit within a calendar year, the plan generally pays for your covered medical expenses for the rest of that year. This spending limit may vary from plan to plan and from year to year.

How Can I Apply For Medicare Part C And Part D

As with Original Medicare, Part D is available during your Initial Enrollment Period .

After that, the Annual Enrollment Period , which occurs from October 15-December 7 each year, is when you can change your coverage for Part D or Part C.

Part C is also available during IEP, the Open Enrollment Period and Medicare Advantage Open Enrollment Period , but you must already be enrolled in both Part A and Part B before applying.

Related: Save the Date for These Medicare Deadlines

Recommended Reading: When Can I Change Medicare Advantage Plans

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.17

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

How Do I Get The Specific Information I Need To Choose A Plan

In October, you will begin to receive specific information about the options available to you. First, you will receive the Medicare & You handbook, which will include all of the plans available in your area. Second, in October, the plans will begin releasing specific plan information, including plan costs, the list of covered drugs , and the list of network pharmacies. Information will also be available at www.medicare.gov, the Medicare website.

Read Also: Do I Need A Primary Care Physician With Medicare